|

시장보고서

상품코드

1716708

중고차 시장 기회, 성장 촉진요인, 산업 동향 분석예측(2025-2034년)Used Cars Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

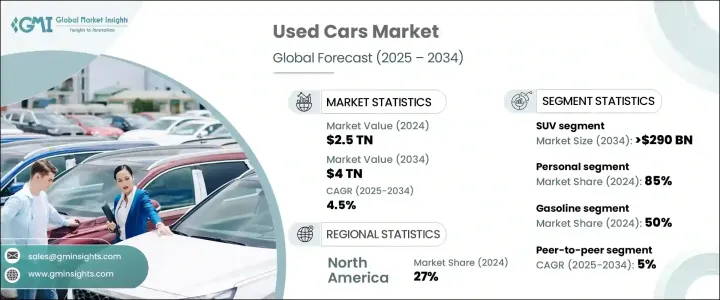

세계 중고차 시장은 2024년에 2조 5,000억 달러로 평가되었으며, 2025년부터 2034년에 걸쳐 CAGR 4.5%로 성장할 것으로 예상됩니다.

중고차 수요 증가는 신차에 비해 저렴한 가격에 기인하고 있으며, 예산 중시의 구매자에게 매력적인 선택지가 되고 있습니다. 신차는 감가상각이 빠르기 때문에 소비자는 비교적 새로운 모델을 원래 가격의 몇 분의 1로 얻을 수 있습니다. 이 가격경감은 처음으로 자동차를 구입하는 사람, 중간 소득층의 가족, 큰 경제적 부담을주지 않고 차량을 확대하고 싶은 기업 수요를 뒷받침하고 있습니다.

경제 불확실성과 인플레이션 압력은 중고차 시장의 매력을 더욱 높여주고 있습니다. 오늘날의 소비자는 지금보다 더 가치를 중시하고 장기적인 신뢰성과 재판매 가치를 제공하는 자동차를 선택하고 있습니다. 고차(CPO) 프로그램도 인기를 끌고 있으며, 연장 보증과 품질 보증을 제공함으로써 소비자 시장에 대한 신뢰감을 높여줍니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작금액 | 2조 5,000억 달러 |

| 예측 금액 | 4조 달러 |

| CAGR | 4.5% |

많은 고소득자들은 라이프스타일과 편의를 위해 자가용차의 소유를 계속 선호하고 있습니다. 중고차에는 다양한 모델이 있어, 소비자의 기호를 채우고 있습니다. 또, 라이드 헤일링이나 리스 프로그램 등의 공유 모빌리티 서비스의 확대도 시장의 성장에 기여하고 있습니다.

시장은 해치백, 세단, SUV, 기타 등 차종별로 세분화되고 있습니다. 이유는 그 안전성의 높이, 재판매 가치의 높이, 도로 상황의 변화에의 적응성에 있습니다.예측 불가능한 날씨 패턴이 늘어나고 있기 때문에 구입자의 기호는 내구성이 높고 고성능인 차로 시프트하고 있습니다. 컴팩트 SUV와 미드 사이즈 SUV는 특히 인기가 높아, 시장을 재형성해, 자동차

중고차 시장은 최종 용도에 근거하여 개인용 부문상업용 부문으로 나뉘어져 있습니다. 효과적인 소유 경험을 제공하여 초기 비용 절감, 보험료 절감, 매력적인 대출 옵션에 대한 액세스를 제공합니다.

북미의 중고차 시장은 2024년에 5,830억 달러의 수, 미국이 자동차 보유 대수로 리드하고 있습니다. 교환의 혜택을 받고 있으며, 다양한 중고차 셀렉션을 쉽게 입수할 수 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 원재료 공급자

- 부품 공급자

- 제조업체

- 기술 제공업체

- 최종 용도

- 이익률 분석

- 공급자의 상황

- 기술과 혁신의 전망

- 특허 분석

- 규제 상황

- 가격 동향

- 영향요인

- 성장 촉진요인

- 합리적인 가격과 비용 절감

- 가처분소득 증가와 도시화

- 신차의 감가상각비 상승

- 온라인 플랫폼의 성장과 디지털화

- 대출 및 대출 옵션의 가용성

- 업계의 잠재적 위험 및 과제

- 표준화와 품질 보증의 부족

- 신차 판매나 리스 모델과의 경쟁 격화

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추정 및 예측 : 자동차별, 2021년-2034년

- 주요 동향

- 해치백

- 세단

- SUV

- 기타

제6장 시장 추정 및 예측 : 연료별, 2021년-2034년

- 주요 동향

- 가솔린

- 디젤

- 하이브리드

- 전기

- 기타

제7장 시장 추정 및 예측 : 판매 채널별, 2021년-2034년

- 주요 동향

- 피어 투 피어

- 프랜차이즈 딜러

- 독립계 딜러

제8장 시장 추정 및 예측 : 최종 용도별, 2021년-2034년

- 주요 동향

- 개인

- 상업

제9장 시장 추정 및 예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- UAE

- 남아프리카

- 사우디아라비아

제10장 기업 프로파일

- Alibaba

- Asbury Automotive Group

- AUDI

- AutoNation

- Avis Budget Group

- CarMax

- CARS24

- Carvana

- eBay

- Group 1 Automotive

- Hendrick Automotive Group

- Hertz Global Holdings

- Lithia Motors

- Mahindra First Choice Wheels

- Maruti Suzuki True Value

- Penske Automotive Group

- Scout24 AG

- Sonic Automotive

- TrueCar

- Van Tuyl Group

The Global Used Car Market was valued at USD 2.5 trillion in 2024 and is projected to grow at a CAGR of 4.5% between 2025 and 2034. The rising demand for pre-owned vehicles stems from their affordability compared to new cars, making them an attractive option for budget-conscious buyers. As new vehicles depreciate rapidly, consumers can acquire relatively recent models at a fraction of the original price. This affordability factor drives demand among first-time buyers, middle-income families, and businesses looking to expand their fleets without a substantial financial burden.

Economic uncertainty and inflationary pressures have further strengthened the appeal of the used car market. With the cost of new vehicles rising due to supply chain disruptions, semiconductor shortages, and higher manufacturing expenses, pre-owned cars offer a cost-effective alternative without compromising on quality. Consumers today are more value-conscious than ever, opting for vehicles that provide long-term reliability and resale value. Certified pre-owned (CPO) programs backed by automakers and dealerships are also gaining traction, offering extended warranties and quality assurance, boosting consumer confidence in the market. Additionally, the growing adoption of digital platforms has made it easier for buyers to research, compare, and purchase used cars online, streamlining the entire buying experience. The integration of AI-powered pricing tools and vehicle history reports ensures transparency, further driving the market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Trillion |

| Forecast Value | $4 Trillion |

| CAGR | 4.5% |

Many high-income individuals continue to favor private vehicle ownership for lifestyle and convenience. Beyond financial savings, used cars cater to the increasing need for mobility, especially in urban areas where public transportation may not always be reliable. The wide variety of available pre-owned models meets diverse consumer preferences, from fuel-efficient compact cars to feature-packed SUVs and luxury vehicles. The expansion of shared mobility services, such as ride-hailing and leasing programs, has also contributed to the market's growth, as these services regularly refresh their fleets, supplying a steady stream of well-maintained used cars.

The market is segmented by vehicle type, including hatchbacks, sedans, SUVs, and others. The SUV segment is expected to generate USD 290 billion by 2034, driven by its strong build, spacious interiors, and versatility for both urban and off-road driving. Consumers favor SUVs due to their perceived safety, higher resale value, and adaptability to changing road conditions. With increasingly unpredictable weather patterns, buyers are shifting preferences toward durable and high-performing vehicles. Compact and mid-size SUVs are particularly popular, reshaping the market and influencing automakers' strategies.

Based on end-use, the used car market is divided into personal and commercial segments. The personal segment dominated in 2024, accounting for 85% of the market share. Used cars provide consumers with a practical and cost-effective ownership experience, offering lower initial costs, reduced insurance premiums, and access to attractive financing options. Competitive interest rates and flexible installment plans make pre-owned vehicles more accessible, fueling demand in this segment.

North America Used Car Market generated USD 583 billion in 2024, with the U.S. leading in vehicle ownership. Millions of registered vehicles on American roads create a high turnover, ensuring a steady supply of pre-owned cars. This dynamic market benefits from continuous vehicle replacements, making a diverse selection of used cars readily available. Digital marketplaces, dealership networks, and CPO programs further support industry expansion, reinforcing North America's position as a key player in the global used car market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material suppliers

- 3.1.1.2 Component suppliers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 End Use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Price trends

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Affordability and cost savings

- 3.6.1.2 Rising disposable income and urbanization

- 3.6.1.3 High depreciation of new cars

- 3.6.1.4 Growth of online platforms and digitalization

- 3.6.1.5 Availability of financing and loan options

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Lack of standardization and quality assurance

- 3.6.2.2 Rising competition from new car sales and leasing models

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hatchback

- 5.3 Sedan

- 5.4 SUV

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Hybrid

- 6.5 Electric

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Peer-to-peer

- 7.3 Franchised dealers

- 7.4 Independent dealers

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Personal

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Alibaba

- 10.2 Asbury Automotive Group

- 10.3 AUDI

- 10.4 AutoNation

- 10.5 Avis Budget Group

- 10.6 CarMax

- 10.7 CARS24

- 10.8 Carvana

- 10.9 eBay

- 10.10 Group 1 Automotive

- 10.11 Hendrick Automotive Group

- 10.12 Hertz Global Holdings

- 10.13 Lithia Motors

- 10.14 Mahindra First Choice Wheels

- 10.15 Maruti Suzuki True Value

- 10.16 Penske Automotive Group

- 10.17 Scout24 AG

- 10.18 Sonic Automotive

- 10.19 TrueCar

- 10.20 Van Tuyl Group