|

시장보고서

상품코드

1698338

수소 연료전지 자동차 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Hydrogen Fuel Cell Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

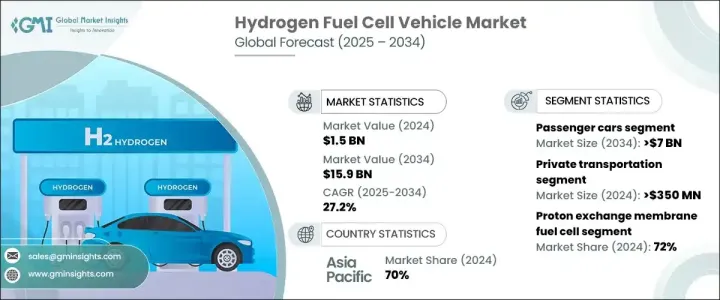

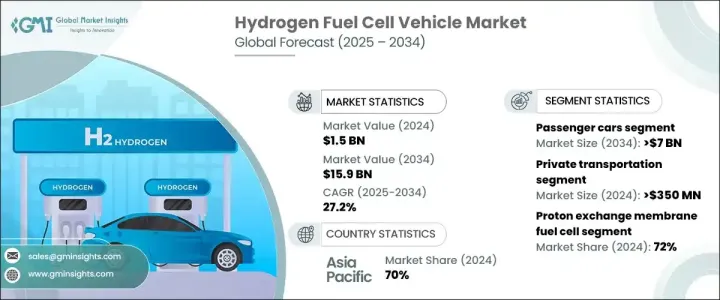

세계의 수소 연료전지 자동차 시장은 2024년 15억 달러에 이르렀고, 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 27.2%를 나타내 견조하게 확대될 것으로 예측됩니다.

청정 에너지 솔루션에 대한 수요 증가와 수소 연료 보급 인프라 투자 증가가 시장 확대를 뒷받침하고 있습니다. 액세서리를 확보하고 수소자동차의 보급을 촉진하기 위해 많은 돈을 투입하고 있습니다.

세계의 자동차 제조업체가 제로·에미션 차에 중점을 옮기는 가운데, 수소 연료전지 기술은 종래의 내연 기관이나 배터리식 전기자동차를 대신하는 유력한 선택지로서 지지를 모으고 있습니다. 거리 주행 성능과 급속한 연료 보급 시간을 겸비하는 독특한 이점이 있으며, 충전 시간의 길이 등 배터리 전기자동차와 관련된 주요 우려에 대처하고 있습니다. 미를 지원하는 정부의 정책과 함께 소비자의 관심을 높여 보급률을 가속시키고 있습니다. 또한, 연료전지 기술의 진보에 의해 수소를 동력원으로 하는 모빌리티의 비용 효율과 효율이 향상하고 있어, 장래의 운송 수단에 있어서의 수소 연료전지의 지위는 한층 더 견고한 것이 되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 15억 달러 |

| 예측 금액 | 159억 달러 |

| CAGR | 27.2% |

수소 연료전지 자동차 시장은 승용차, 상용차, 특수차량 등 차량유형별로 구분됩니다. 소비자는 배터리식 전기자동차에 따른 장시간 충전 없이 장거리 주행이 가능한 수소자동차를 선호하는 경향이 강해지고 있습니다.

기술 측면에서 시장은 양성자 교환 막(PEM) 연료전지, 고체 산화물 연료전지, 알칼리 연료전지, 인산 연료전지 및 기타 변형으로 분류됩니다. 이러한 특성으로 인해 PEM 연료전지는 수소자동차에 적합한 선택이 되고 있습니다.

아시아태평양은 수소 연료전지 자동차 시장의 주요 지역이 되어 2024년에는 70%의 점유율을 획득했습니다. 아태 지역 국가들은 장기 에너지 전략에 수소를 적극적으로 도입하고 있으며, 차량 도입을 가속화하기 위해 상당한 재정적 인센티브를 제공하고 있습니다.

목차

제1장 조사 방법과 조사 범위

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 기본 추정과 계산

- 기준연도의 산출

- 시장추계의 주요 동향

- 예측 모델

- 1차 조사와 검증

- 1차 정보

- 데이터 마이닝 소스

- 시장 범위와 정의

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 원재료 공급업체

- 부품 공급업체

- 제조업체

- 기술 제공업체

- 최종 용도

- 공급업체의 상황

- 이익률 분석

- 기술과 혁신의 전망

- 특허 분석

- 주요 뉴스와 대처

- 규제 상황

- 가격 동향

- 코스트 내역 분석

- 영향요인

- 성장 촉진요인

- 수소 연료전지 자동차 도입에 대한 정부의 인센티브와 보조금 증가

- 수소 연료 보급 인프라 확대

- 그린 수소 제조에 대한 투자 증가

- 무공해 상업용 운송에 대한 수요 증가

- 업계의 잠재적 위험 및 과제

- 높은 제조 비용과 연료 보급 비용

- 한정된 수소 보급 인프라

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추계·예측 : 자동차별(2021-2034년)

- 주요 동향

- 승용차

- 세단

- 해치백

- SUV차

- 상용차

- 경 상용차(LCV)

- 대형 상용차(HCV)

- 특수 차량

- 산업 차량

- 군용 차량

제6장 시장 추계·예측 : 기술별(2021-2034년)

- 주요 동향

- 양성자 교환막 연료전지(PEMFC)

- 고체 산화물 연료전지(SOFC)

- 알칼리성 연료전지

- 인산 연료전지

- 기타

제7장 시장 추계·예측 : 범위별(2021-2034년)

- 주요 동향

- 단거리(0-250마일)

- 중거리(251-500마일)

- 장거리(500마일 이상)

제8장 시장 추계·예측 : 출력 범위별(2021-2034년)

- 주요 동향

- 150kW 미만

- 150-250kW 미만

- 250kW 이상

제9장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 개인 교통

- 대중 교통

- 산업

- 군사 및 방위

제10장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- UAE

- 남아프리카

- 사우디아라비아

제11장 기업 프로파일

- BMW

- FAW Group

- Ford

- General Motors

- Great Wall Motor

- Honda

- Hyundai

- Hyzon Motors

- Iveco Group

- MAN Energy Solutions

- Mercedes-Benz

- Nikola Corporation

- Porsche

- Renault

- Riversimple

- SAIC

- Stellantis

- Toyota

- Volkswagen

- Volvo

The Global Hydrogen Fuel Cell Vehicle Market reached USD 1.5 billion in 2024 and is projected to expand at a robust CAGR of 27.2% between 2025 and 2034. The surging demand for clean energy solutions, in line with increasing investments in hydrogen refueling infrastructure, is propelling market expansion. Governments worldwide are making substantial financial commitments to build an extensive hydrogen refueling network, ensuring accessibility and encouraging widespread adoption of hydrogen-powered vehicles. These efforts are crucial as nations strive to meet stringent emissions targets and transition toward sustainable transportation solutions.

As global automotive manufacturers shift focus toward zero-emission vehicles, hydrogen fuel cell technology is gaining traction as a viable alternative to conventional internal combustion engines and battery electric vehicles. Hydrogen-powered vehicles offer a unique advantage by combining long-range capabilities with rapid refueling times, addressing key concerns associated with battery electric vehicles, such as lengthy charging durations. This advantage, along with government policies supporting clean energy initiatives, is fueling consumer interest and accelerating adoption rates. Leading automotive companies are ramping up production to cater to the rising demand, with several manufacturers unveiling new hydrogen fuel cell models in response to market needs. Additionally, ongoing advancements in fuel cell technology are making hydrogen-powered mobility more cost-effective and efficient, further solidifying its position in the future of transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $15.9 Billion |

| CAGR | 27.2% |

The hydrogen fuel cell vehicle market is segmented by vehicle type, including passenger cars, commercial vehicles, and specialized vehicles. In 2024, the passenger car segment held a dominant 50% market share and is expected to generate USD 7 billion by 2034. The increasing push for zero-emission transportation is compelling automakers to develop hydrogen-powered passenger cars that integrate fuel cell technology with battery systems to enhance driving range and efficiency. Consumers are showing a growing preference for hydrogen vehicles due to their ability to travel long distances without the extended charging times associated with battery electric vehicles. This shift in consumer sentiment is driving automakers to invest in hydrogen technology, further boosting market growth.

In terms of technology, the market is categorized into proton exchange membrane (PEM) fuel cells, solid oxide fuel cells, alkaline fuel cells, phosphoric acid fuel cells, and other variants. In 2024, PEM fuel cells dominated the market, holding a 72% share due to their superior efficiency, lightweight structure, and rapid start-up capability. These characteristics make PEM fuel cells the preferred choice for hydrogen-powered vehicles. Continuous advancements in membrane materials and fuel cell stack design are driving performance improvements while reducing production costs, making the technology more accessible for mass adoption.

Asia Pacific emerged as the leading region in the hydrogen fuel cell vehicle market, capturing a significant 70% share in 2024. This growth is driven by extensive government investments in hydrogen refueling infrastructure and large-scale hydrogen production initiatives. Countries across the region are actively incorporating hydrogen into their long-term energy strategies, providing substantial financial incentives to accelerate vehicle adoption. As automakers scale up production to meet growing demand, hydrogen-powered mobility is gaining momentum, reinforcing the region's position as a dominant player in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Component suppliers

- 3.1.3 Manufacturers

- 3.1.4 Technology providers

- 3.1.5 End Use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Price trends

- 3.9 Cost breakdown analysis

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising government incentives and subsidies for adoption of hydrogen fuel cell vehicles

- 3.10.1.2 Expanding hydrogen refueling infrastructure

- 3.10.1.3 Increasing investments in green hydrogen production

- 3.10.1.4 Growing demand for zero-emission commercial transport

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High production and refueling costs

- 3.10.2.2 Limited hydrogen refueling infrastructure

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger cars

- 5.2.1 Sedans

- 5.2.2 Hatchbacks

- 5.2.3 SUVs

- 5.3 Commercial vehicles

- 5.3.1 Light Commercial Vehicles (LCV)

- 5.3.2 Heavy Commercial Vehicles (HCV)

- 5.4 Specialized Vehicles

- 5.4.1 Industrial vehicles

- 5.4.2 Military vehicles

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Proton Exchange Membrane Fuel Cells (PEMFCs)

- 6.3 Solid Oxide Fuel Cells (SOFCs)

- 6.4 Alkaline fuel cell

- 6.5 Phosphoric acid fuel cell

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Range, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Short range (0-250 Miles)

- 7.3 Medium range (251-500 Miles)

- 7.4 Long range (Above 500 Miles)

Chapter 8 Market Estimates & Forecast, By Power Range, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Less than 150kW

- 8.3 150-250kW

- 8.4 Above 250kW

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Private transportation

- 9.3 Public transportation

- 9.4 Industrial

- 9.5 Military & defense

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 BMW

- 11.2 FAW Group

- 11.3 Ford

- 11.4 General Motors

- 11.5 Great Wall Motor

- 11.6 Honda

- 11.7 Hyundai

- 11.8 Hyzon Motors

- 11.9 Iveco Group

- 11.10 MAN Energy Solutions

- 11.11 Mercedes-Benz

- 11.12 Nikola Corporation

- 11.13 Porsche

- 11.14 Renault

- 11.15 Riversimple

- 11.16 SAIC

- 11.17 Stellantis

- 11.18 Toyota

- 11.19 Volkswagen

- 11.20 Volvo