|

시장보고서

상품코드

1685690

자동차용 연료전지 시스템 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Automotive Fuel Cell System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

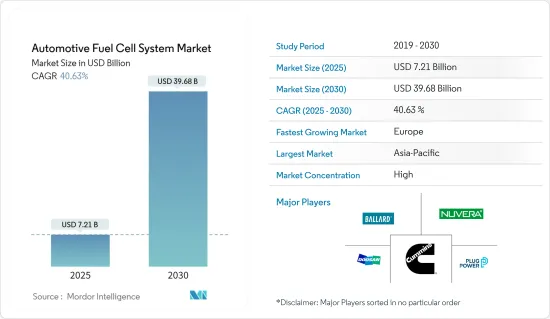

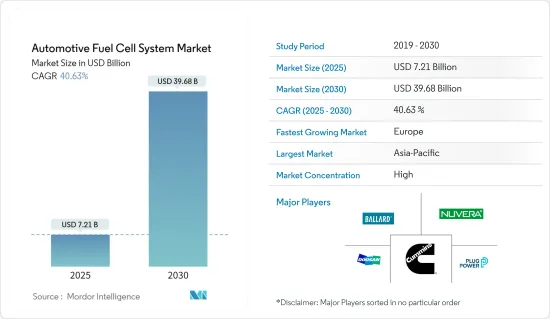

자동차용 연료전지 시스템 시장 규모는 2025년에 72억 1,000만 달러로 추정되고, 예측 기간인 2025-2030년 CAGR 40.63%로 성장할 전망이며, 2030년에는 396억 8,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- COVID-19 팬데믹은 다른 자동차 분야만큼 심각한 영향을 시장에 주지 않았습니다. 봉쇄 기간 중에는 수요가 감소한 반면, 2021년에는 시장이 기세를 늘리고 예측 기간을 통해 고성장이 계속될 것으로 예상되었습니다.

- 환경 문제에 대한 관심이 높아짐에 따라 정부와 환경기관은 엄격한 배출가스 규제와 법률을 제정하고 있으며, 향후 수년간 저연비 디젤엔진의 제조 비용이 상승할 것으로 예상됩니다. 그 결과, 신형 상용차용 디젤 엔진 분야는 단기적으로는 뻗어나갈 것으로 예상됩니다.

- 게다가 기존의 화석 연료를 동력원으로 하는 상용차, 특히 트럭과 버스는 운송기관의 배출가스를 증가시키는 원인이 되고 있습니다. 저배출 가스차 또는 제로 배출 차량으로 사용되는 연료전지 상용차의 등장은 대형 상용차에서 배출되는 차량 배출가스를 삭감할 것으로 예상됩니다.

- 또한 운송 공해를 억제하기 위해 녹색 에너지 이동성을 선택하는 세계 정부 기관의 이니셔티브는 가까운 미래에 연료전지 시스템 시장을 견인할 것으로 예상되는 중요한 요소입니다.

자동차용 연료전지 시스템 시장 동향

청정 에너지에 대한 정부의 이니셔티브가 수소 연료 수요 견인

- 가까운 미래에 연료전지 상용차 시장을 밀어 올릴 것으로 예상되는 중요한 요소는 교통 공해를 제한하고 줄이기 위해 녹색 에너지 이동성을 선택하는 세계 정부의 이니셔티브입니다. 일부 정부는 이미 전 세계적으로 연료전지 전기자동차(FCEV)의 길거리 주행을 장려할 계획을 세우고 있으며, 이는 자동차 연료전지 산업의 성장을 뒷받침하고 있습니다.

- 2022년 2월 일본 환경부는 수소비즈니스 컨소시엄의 설립에 있어서 지방자치단체나 기업을 지원한다고 발표했습니다. 동성은 저탄소 수소를 제조하고 지역에서 활용하는 수소 공급망 플랫폼을 특정 기업 및 지자체와 공동으로 실시했습니다. 2030년경까지 일본 전국에서 실증 실험을 실시해 수소 공급망 플랫폼의 실현을 목표로 하고 있습니다.

- 2022년 2월, 인도의 신재생 에너지부는 수소를 이용한 운송과 연료전지 개발 등 신재생 에너지의 다양한 측면에서 연구를 지원하는 '신재생 에너지 연구개발' 프로그램을 실시한다고 발표했습니다. 이 성은 몇 가지 주요 개발을 언급했습니다. 인도과학연구소(IISc)는 바이오매스 가스화에 의한 고순도 수소 제조 플랜트를 설립했습니다. 국제분말 야금 및신소재 첨단연구센터(ARCI) 연료전지 기술센터는 20kW의 PEM 연료전지 스택을 제조하기 위한 통합 자동 제조 라인을 설치합니다.

- 2022년 1월 독일 정부는 수소 트럭용 CryoTRUCK 프로젝트에 대한 지원을 발표했습니다. 시험 전문가인 IABG와 뮌헨 공과대학은 공동으로 장거리 수송 트럭을 위한 연료 공급 시스템을 갖춘 CRYOGAS 수소 가스 탱크를 개발했습니다. 총 예산 2,500만 유로를 넘는 3년 반의 CryoTRUCK 프로젝트는 대형 연료전지 트럭에 있어서 극저온 압축 수소 가스(CRYOGAS) 저장 및 보급 시스템의 제1세대 기술의 개발과 검증을 실시합니다.

- 이러한 노력은 연료전지 수송의 보급을 촉진하고 시장을 전진시키고 있습니다. 그러나 세계 시장에서 광범위한 연료전지 차량의 도입에 대한 주요 장애물은 수소 인프라 부족입니다. 세계의 수소 공급 스테이션이 적은 요인은 고액의 투자와 기존의 수소 제조 방법이 관여하고 있기 때문에 배출 수준이 높아져 엄격한 에너지 정책법에 따르기가 어려워지고 있다는 것입니다.

- 새로운 수소 연료 공급 인프라를 확립하는 것은 매우 비용이 많이 듭니다(그러나 메탄올과 에탄올의 인프라를 확립하는 것보다는 비용이 적게 듭니다). 천연가스에서 생산되는 수소는 가솔린보다 저렴할 수 있습니다. 물과 전기로부터 가수분해에 의해 제조되는 수소는 저비용의 오프 피크 전력을 사용하거나 태양전지판을 사용하지 않는 한, 기존 방법으로는 가솔린보다 비쌉니다.

고성장이 기대되는 유럽

- 유럽연합(EU)은 운송부문에서 온실가스(GHG) 배출을 크게 줄일 계획입니다. 그 결과 유럽의 일부 국가들은 이러한 목표를 달성하기 위한 수단으로 연료전지(주로 PEMFC)와 같은 혁신적인 기술의 도입을 들고 있습니다. 이것은 가까운 미래에 이 시장과 관련된 연료전지 제조업체에 큰 기회를 가져올 것으로 기대됩니다.

- 유럽은 전 세계적으로 제안된 수소 투자의 30% 이상(약 760억 달러)을 차지하고 있고, 총 314건 가까이 프로젝트가 제안되었으며, 268건이 2030년까지 전면적 또는 부분적인 시운전을 목표로 하고 있습니다.

- 유럽 연합(EU)은 전 세계에서 가장 엄격한 배출 기준을 제안하고 있으며, 이 지역에서 기존 연료 차량의 사용을 줄이고 대체 연료 차량의 사용을 장려하기 위해 노력하고 있습니다. 이러한 배기 가스 규제는 시장과 자동차 제조업체를 제로 방출 차량으로 밀어 올릴 것으로 예상됩니다.

- 자동차 배출 가스 문제에 대한 해결책을 모색하고 개발하기 위해 여러 프로젝트가 시작되었습니다. 예를 들어, 현재 진행중인 EC 지원 이니셔티브에는 1,000대의 수소버스 및 인프라를 배치하는 H2BusEurope 계획과 유럽의 22개 도시에서 약 300대의 연료전지 전기버스(FCEB)를 운행시키는 JIVE 및 JIVE 2 프로젝트가 있으며, 유럽연합(EU)의 연구 및 혁신 프레임워크 프로그램 'Hori 200만 유로의 보조금'에 의해 일부 지원될 예정입니다. 프로젝트 컨소시엄은 7개국 22개 회원으로 구성되어 있습니다.

- 또한, 시장에서 사업을 전개하는 기업은 시장에서의 지위를 유지하기 위해 신제품 개척, 공동 개발, 계약 및 협정 등의 전략을 채택하고 있습니다. 예를 들면

- 2022년 9월 현대자동차와 이베코 그룹은 하노버에서 개최된 IAA Transportation 2022에서 최초의 IVECO eDAILYFuel Cell Electric Vehicle을 발표했습니다. 양사는 7월 초 현대 자동차 연료전지 시스템을 탑재한 수소 구동 IVECO BUS 차량을 발표했습니다. eDAILY 연료전지 전기자동차(FCEV)는 IVECO의 베스트셀러와 롱런 대형 밴의 미래 가능성을 보여줍니다.

- 또한, 이 지역에서 수소 기술의 개발은 시장 확대에 도움이 될 것으로 보입니다.

- 예를 들어, 2022년 3월, 커민스는 독일 헤르텐에 있는 새로운 수소 연료전지 시스템 생산 센터를 성공적으로 운영했다고 발표했습니다. 이 중요한 개발은 대체 전력 솔루션의 확대에서 회사의 노력을 강화하고 유럽 전역에서 수소 기술의 보급을 촉진할 것으로 기대됩니다. 이 시설은 연료전지 시스템의 엔지니어링 및 조립을 위해 연간 10MW의 초기 생산 능력을 자랑합니다.

- 이 지역에서 활동하는 기업들은 끊임없이 신소재 및 새로운 연료전지 기술을 개발하기 위해 노력하고 있습니다. 또한 시설의 확장에도 힘을 쏟고 있습니다. 향후 투자를 발표하고 연료전지 기술에 주력하는 기업도 있기 때문에 이러한 동향은 앞으로도 계속될 것으로 예상됩니다.

자동차용 연료전지 시스템 산업 개요

- 자동차용 연료전지 시스템 시장은 Ballard Power Systems Inc., Doosan Fuel Cell, Hydrogenics, Nedstack Fuel Cell Technology BV와 같은 기업이 독점하고 있습니다. 이러한 기업들은 경쟁사보다 우위를 차지하기 때문에 새롭고 혁신적인 기술을 활용하여 사업을 확대하고 있습니다.

- 2023년 2월 두산연료전지는 남호주 정부 및 두산물산의 자회사인 HyAxiom과 협력 성명에 서명했습니다. 이 협정에 따라 남호주와 두산연료전지는 '그린 수소 및 유도품 제조를 위한 설비와 경험교환', '수소수출의 세계적 경쟁력을 달성하기 위한 전략과 제휴 구축', '수소제조 모범 사례 공유'를 약속했습니다.

- 2022년 7월 이베코 그룹은 브랜드인 IVECO BUS를 통해 HTWO와 제휴하여 미래의 유럽제 수소 버스에 세계 최첨단 연료전지 시스템을 탑재한다고 발표했습니다. HTWO는 현대자동차그룹의 연료전지시스템 기반의 수소사업 브랜드로서 수소경제에 대한 현대자동차의 강한 헌신과 함께 2020년 12월에 처음 발표되었습니다. 현대자동차 FCEV에서 활용되고 있는 입증된 연료전지 기술을 통해 HTWO는 다른 자동차 OEM 및 비자동차 분야에도 연료전지 기술의 제공을 확대하여 모든 분야에서 수소를 이용할 수 있도록 하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 시장 성장을 지원하는 정부의 이니셔티브

- 시장 성장 억제요인

- 인프라 부족이 시장 성장의 과제

- 산업의 매력-Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 전해질 유형별

- 폴리머 전자막 연료전지

- 직접 메탄올형 연료전지

- 알칼리 연료전지

- 인산형 연료전지

- 차량 유형별

- 승용차

- 상용차

- 연료 유형별

- 수소

- 메탄올

- 출력별

- 100KW 미만

- 100-200KW

- 200KW 이상

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 스페인

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 한국

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- BorgWarner Inc.

- Nuvera Fuel Cells LLC

- Ballard Power Systems Inc.

- Hydrogenics(Cummins Inc.)

- Nedstack Fuel Cell Technology BV

- Oorja Corporation

- Plug Power Inc.

- SFC Energy AG

- Watt Fuel Cell Corporation

- Doosan Fuel Cell Co. Ltd

제7장 시장 기회 및 향후 동향

- 신재생 에너지 통합 증가

The Automotive Fuel Cell System Market size is estimated at USD 7.21 billion in 2025, and is expected to reach USD 39.68 billion by 2030, at a CAGR of 40.63% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 pandemic did not impact the market as severely as it had affected other automotive segments. While the demand experienced a decline during the lockdown, it was expected that the market would gain momentum in 2021, with high growth continuing throughout the forecast period.

- With the growing environmental concerns, governments and environmental agencies are enacting stringent emission norms and laws, which are expected to increase the manufacturing cost of fuel-efficient diesel engines in the coming years. As a result, the new commercial vehicle diesel engines segment is expected to register a sluggish growth rate during the short term.

- Additionally, conventional fossil fuel-powered commercial vehicles, especially trucks, and buses, are responsible for increasing transportation emissions. The advent of fuel-cell commercial vehicles, which are considered low or zero-emission vehicles, is anticipated to reduce vehicular emissions emitted by heavy commercial vehicles.

- Moreover, initiatives by government bodies around the world to opt for green energy mobility in order to curtail and curb transportation pollution is a key factor that is projected to drive the fuel cell system market in the near future.

Automotive Fuel Cell System Market Trends

Government Initiatives for Clean Energy is Driving the Hydrogen Fuel Demand

- Government initiatives throughout the world to choose green energy mobility in order to restrict and reduce transportation pollution is a crucial driver that is expected to boost the fuel cell commercial vehicle market in the near future. Several governments are already laying out plans throughout the world to encourage fuel-cell electric vehicles (FCEVs) on the road will also help the automotive fuel-cell industry grow.

- In February 2022, Japan's Ministry of the Environment announced that it would support local governments and companies in the establishment of a hydrogen business consortium. The ministry has been jointly implementing a hydrogen supply chain platform that generates low-carbon hydrogen and utilizes it in the region with certain companies and local governments. It aims to realize the hydrogen supply chain platform after conducting demonstrations across Japan by around 2030.

- In February 2022, the Indian Ministry of New and Renewable Energy announced that it implemented the 'Renewable Energy Research and Technology Development' program to support research in various aspects of renewable energy, including inter-alia hydrogen-based transportation and fuel cell development. The ministry listed some of its major development. The Indian Institute of Science (IISc) established a production plant for high-purity hydrogen generation through biomass gasification. International Advanced Research Centre for Powder Metallurgy and New Materials (ARCI) Center for Fuel Cell Technologies is setting up an integrated automated manufacturing line for producing 20 kW PEM fuel cell stacks.

- In January 2022, the German government announced support for the CryoTRUCK project for hydrogen trucks. The testing specialist IABG and the Technical University of Munich are jointly developing a CRYOGAS hydrogen gas tank with a refueling system for hydrogen trucks in long-distance transport. The three-and-a-half-year CryoTRUCK project, with a total budget of more than EUR 25 million, will develop and validate a first-generation technology for cryogenic compressed hydrogen gas (CRYOGAS) storage and refueling systems in heavy-duty fuel cell trucks.

- Such initiatives are driving the market forward by increasing the adoption of fuel-cell transportation. However, the major obstacle to the introduction of a wide range of fuel cell vehicles in the global market is the lack of hydrogen infrastructure. Factors for fewer hydrogen refueling stations around the world are the involvement of high investment and conventional production methods of hydrogen, which is leading to high emission levels and making it difficult to be in line with the stringent Energy Policy Act.

- Establishing a new hydrogen refueling infrastructure is extremely costly (but not any costlier than establishing a methanol or ethanol infrastructure). Hydrogen that is produced from natural gas can be cheaper than gasoline. Hydrogen produced from water and electricity via hydrolysis is more expensive than gasoline using conventional methods unless low-cost off-peak electricity is used or solar panels are employed.

Europe Expected to Witness High Growth Rate

- The European Union plans to reduce greenhouse gas (GHG) emissions from the transportation sector significantly. As a result, several countries in Europe have identified the implementation of innovative technologies, such as fuel cells (primarily PEMFC), as a way to meet these objectives. This, in turn, is expected to provide a significant opportunity for the fuel cell manufacturers involved in the market in the near future.

- Europe is home to over 30% of proposed hydrogen investments globally (about USD 76 billion), with nearly 314 project proposals in total and 268 aiming for full or partial commissioning through 2030.

- The European Union (EU) has proposed some of the most stringent emission standards in the world in order to reduce the usage of conventional fuel vehicles and encourage the use of alternative fuel vehicles in the region. These emission standards are projected to push the market and vehicle manufacturers toward zero-emission vehicles.

- Several projects have been initiated to explore and develop acceptable solutions to the problem of automobile emissions. For instance, ongoing EC-supported initiatives include the H2BusEurope scheme that involves the deployment of 1,000 hydrogen buses and infrastructure and the JIVE and JIVE 2 projects that involve putting into operation nearly 300 fuel cell electric buses (FCEBs) in 22 cities across Europe and will be supported in part by a 32 million euro grant from the FCH JU (Fuel Cells and Hydrogen Joint Undertaking) within the European Union's Horizon 2020 framework program for research and innovation. The project consortium consists of 22 members from seven different countries.

- Furthermore, companies operating in the market are adopting strategies such as new product developments, collaborations, contracts, and agreements to sustain their market position. For instance,

- In September 2022, Hyundai Motor Company and Iveco Group at IAA Transportation 2022 in Hannover unveiled the first IVECO eDAILYFuel Cell Electric Vehicle. The two companies announced hydrogen-powered IVECO BUS vehicles with Hyundai's fuel cell system earlier in July. The eDAILYFuel Cell Electric Vehicle (FCEV) exemplifies IVECO's best-selling and longest-running large van's future potential.

- In addition, the development of hydrogen technology in the region will help in the expansion of the market.

- For instance, in March 2022, Cummins Inc. announced the successful operation of its new Hydrogen fuel cell systems production center in Herten, Germany. This significant development is expected to bolster the company's efforts in scaling up alternative power solutions and promote the widespread adoption of hydrogen technologies throughout Europe. The facility boasts an initial production capacity of 10MW per year for fuel cell system engineering and assembly.

- The companies active in the region are constantly working on new materials and new fuel cell technologies. They are also spending on the expansion of their facilities. These trends are expected to continue in the coming years, as some companies have indicated their focus on fuel cell technology by announcing their upcoming investments.

Automotive Fuel Cell System Industry Overview

- The automotive fuel cell system market is dominated by players such as Ballard Power Systems Inc., Doosan Fuel Cell Co. Ltd, Hydrogenics, and Nedstack Fuel Cell Technology BV. These companies have been expanding their businesses using new and innovative technologies to have an advantage over their competitors.

- In February 2023, Doosan Fuel Cell signed a statement of cooperation with the South Australian government and HyAxiom, a subsidiary of Doosan Corporation. In accordance with the agreement, South Australia and Doosan Fuel Cell committed to "exchange equipment and experience for the production of eco-friendly hydrogen and derivatives, to "create strategies and alliances to achieve worldwide competitiveness in hydrogen exports," and to "share best practices for hydrogen production.

- In July 2022, Iveco Group, through its brand IVECO BUS, announced that it would partner with HTWO to equip its future European hydrogen-powered buses with world-leading fuel cell systems. HTWO, as a fuel cell system-based hydrogen business brand of Hyundai Motor Group, was first released in December 2020 with Hyundai's strong commitment to a hydrogen economy. With its proven fuel cell technology utilized in Hyundai FCEVs, HTWO is expanding the provision of fuel cell technology to other automobile OEMs and non-automobile sectors to make hydrogen available for everything.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Government Initiatives to Support The Market Growth

- 4.2 Market Restraints

- 4.2.1 Lack of Infrastructure poses a Challenge For The Growth of The Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Electrolyte Type

- 5.1.1 Polymer Electronic Membrane Fuel Cell

- 5.1.2 Direct Methanol Fuel Cell

- 5.1.3 Alkaline Fuel Cell

- 5.1.4 Phosphoric Acid Fuel Cell

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Fuel Type

- 5.3.1 Hydrogen

- 5.3.2 Methanol

- 5.4 Power Output

- 5.4.1 Below 100 KW

- 5.4.2 100-200 KW

- 5.4.3 Above 200 KW

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BorgWarner Inc.

- 6.2.2 Nuvera Fuel Cells LLC

- 6.2.3 Ballard Power Systems Inc.

- 6.2.4 Hydrogenics (Cummins Inc.)

- 6.2.5 Nedstack Fuel Cell Technology BV

- 6.2.6 Oorja Corporation

- 6.2.7 Plug Power Inc.

- 6.2.8 SFC Energy AG

- 6.2.9 Watt Fuel Cell Corporation

- 6.2.10 Doosan Fuel Cell Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Renewable Energy Integration

샘플 요청 목록