|

시장보고서

상품코드

1766363

자동차 엔지니어링 서비스 아웃소싱(ESO) 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Automotive Engineering Services Outsourcing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

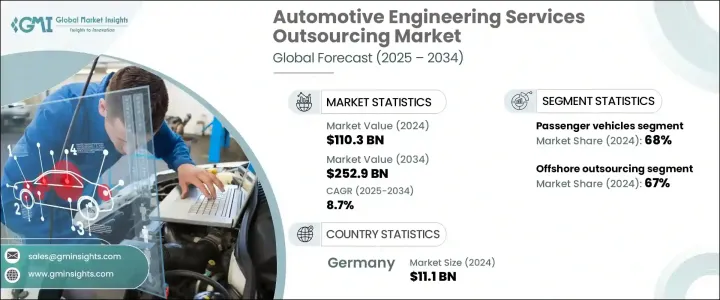

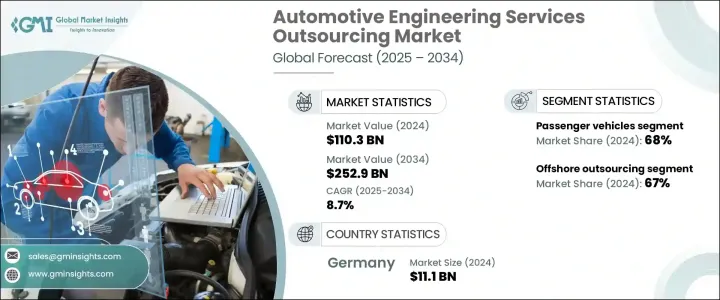

세계의 자동차 엔지니어링 서비스 아웃소싱 시장 규모는 2024년에는 1,103억 달러로 평가되었고, CAGR 8.7%로 성장할 전망이며, 2034년에는 2,529억 달러에 이를 것으로 예측됩니다.

이 성장의 주요 요인은 전기자동차에 대한 수요 증가이며, 이것이 차량 아키텍처의 근본적인 전환에 불을 붙였습니다. EV 개발에는 열 제어, 전기 추진, 배터리 시스템, 충전 인프라 등의 분야에서 고도의 엔지니어링이 필요하며, 많은 OEM들은 사내 역량이 부족하여 ESO 기업과 연계하여 전문적인 지원을 필요로 합니다. 이와 병행해 커넥티드카 기술의 통합이 진행되면서 현대차는 데이터가 풍부한 디지털 플랫폼으로 변모하고 있습니다. 자동차 제조업체는 선진적인 소프트웨어 기능, 텔레매틱스, 실시간 차량 통신 시스템의 개발에 각축을 벌이는 가운데, 엔드 투 엔드의 엔지니어링 지원, 신속한 전개, 확장성을 요구해 ESO 프로바이더를 이용하는 케이스가 증가하고 있습니다. 커넥티드, 개인화, 소프트웨어 주도의 차량 내 체험에 대한 수요는 세계 동향을 계속 견인하고 있습니다.

승용차 부문은 2024년에 68%의 점유율을 차지했으며, 2034년까지 9%의 연평균 복합 성장률(CAGR)로 성장할 전망입니다. 이 부문은 생산량이 많고, 스마트 기능, 전동화, 자동화에 대한 연구개발 수요가 높아져 ESO 분야에서 최대 규모를 유지하고 있습니다. 자동차 제조업체는 제품 혁신을 가속화하고 시장 출시 시간을 단축하며 첨단 안전, 사용자 경험 및 성능에 대한 소비자의 진화하는 요구에 부응하기 위해 승용차 엔지니어링 업무를 아웃소싱합니다. 전문 서비스 제공업체는 확장 가능한 엔지니어링 인력과 전문 분야에 대한 액세스를 제공함으로써 OEM이 차세대 자동차 모델을 지역 횡단적으로 제공할 때 비용 효율성을 높입니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 1,103억 달러 |

| 예측 금액 | 2,529억 달러 |

| CAGR | 8.7% |

해외 아웃소싱 분야는 2024년에 67%의 점유율을 차지했으며, 2034년까지 CAGR 9.1%로 성장할 것으로 예측됩니다. 이 모델은 OEM에 큰 비용 이점과 동유럽, 중국, 인도 등 지역의 숙련된 인력 풀에 대한 액세스를 제공합니다. 오프쇼어 벤더는 현재 CAD/CAE 개발, 임베디드 시스템 엔지니어링, 소프트웨어 통합에 필수적인 파트너가 되고 있습니다. 세계의 시간대를 달리해 지속적인 엔지니어링 지원을 제공할 수 있기 때문에 프로젝트의 완료가 빨라집니다. 자동차가 소프트웨어와 일렉트로닉스에 의존함에 따라 이러한 지역은 국제 표준과 품질 벤치마크를 준수하면서 경쟁을 유지하는 데 필요한 유연성과 비용 효율성을 OEM에 제공합니다.

독일 자동차 엔지니어링 서비스 아웃소싱 2024년 점유율은 29%로 평가되었고, 시장 규모는 111억 달러였습니다. 자동차 생산과 기술 혁신의 주요 국가로서 독일은 유럽의 ESO 시장을 계속 이끌고 있습니다. 이 나라의 기존 OEM 및 Tier 1 공급업체는 자율주행, 전기화, 디지털 이동성 플랫폼을 추진하기 위해 외부 엔지니어링 파트너와 적극적으로 협력하고 있습니다. 규제 압력과 탁월한 기술 추진으로 시뮬레이션, 차량 규정 준수 및 테스트 프로세스에서 아웃소싱 요구가 증가하고 있습니다. 독일 시장은 첨단 연구개발 문화 및 정책 중심의 혁신으로 번창하고 있으며, 개발 파이프라인 전체에서 ESO 통합을 더욱 강화하고 있습니다.

세계의 자동차 엔지니어링 서비스 아웃소싱 시장을 형성하는 주요 기업은 Ricardo, Tata Technologies, AVL, Capgemini, Bertrandt, Tech Mahindra, HCL Technologies, IAV, Wipro, L&T Technology Services 등이 있습니다. ESO 시장의 주요 기업은 발판을 굳히기 위해 EV 시스템, ADAS, 차량 커넥티비티 등 주요 분야에서 분야별 서비스 포트폴리오를 확충하고 있습니다.

각 회사는 인재 기술 향상, 해외 배달 센터 설립, OEM 및 Tier1 공급업체와의 전략적 파트너십 형성에 투자하고 있습니다. 몇몇 기업은 AI, ML, 디지털 트윈 테크놀로지를 엔지니어링 워크플로우에 통합하여 보다 신속하고 스마트한 개발 사이클을 제공하고자 합니다. 각사는 또, 컴플리언스에 대한 대응에 주력해, 각 지역에서 진화하는 규제 기준에 자사의 능력을 맞추고 있습니다. 공동 혁신 모델과 애자일 협업을 통해 ESO 기업은 비용 효율을 개선하면서 고객의 시장 투입까지의 시간을 단축하고 있습니다.

목차

제1장 조사 방법

- 시장의 범위 및 정의

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 데이터 마이닝 소스

- 세계

- 지역 및 국가

- 기본 추정 및 계산

- 기준 연도 계산

- 시장 예측의 주요 동향

- 1차 조사 및 검증

- 1차 정보

- 예측 모델

- 조사의 전제와 한계

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 자동차 공학의 복잡화

- 전기자동차 보급 증가

- 자동차 소프트웨어의 급속한 진보

- 커넥티드카 기술의 통합

- 업계의 잠재적 위험 및 과제

- 데이터 보안 및 지적 재산에 대한 우려

- 통합 및 커뮤니케이션의 갭

- 시장 기회

- 전기자동차(EV) 개발의 급증

- 디지털 엔지니어링 서비스 수요 증가

- 애프터마켓 엔지니어링 및 개조 서비스

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 기술 및 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 사례 연구

- 이용 사례

- 코스트 내역 분석

- 특허 분석

- 지속가능성 및 환경 측면

- 지속가능한 관행

- 폐기물 삭감 전략

- 생산에서 에너지 효율

- 환경 친화적인 노력

- 카본 풋 프린트의 고려

제4장 경쟁 구도

- 서문

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카 항공

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병 및 인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획 및 자금조달

제5장 시장 추계 및 예측 : 서비스별(2021-2034년)

- 주요 동향

- 설계 및 엔지니어링

- 프로토타이핑

- 테스트 및 검증

- 제조 엔지니어링

- 기타

제6장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 바디 및 외장

- 파워트레인 및 드라이브트레인

- 인포테인먼트 및 텔레매틱스

- ADAS 및 안전 시스템

- 기타

제7장 시장 추계 및 예측 : 차량별(2021-2034년)

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV

- 상용차

- 소형 상용차(LCV)

- 중형 상용차(MCV)

- 대형 상용차(HCV)

제8장 시장 추계 및 예측 : 로케이션별(2021-2034년)

- 주요 동향

- 온쇼어 아웃소싱

- 오프쇼어 아웃소싱

제9장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- OEM

- Tier 1 공급업체

- Tier 2 및 Tier 3 공급자

- 애프터마켓 기업

제10장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주 및 뉴질랜드

- 동남아시아

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

제11장 기업 프로파일

- AKKA Technologies

- Altran

- ASAP Holding

- AVL

- Bertrandt

- Capgemini

- Contrio

- ESG Mobility

- FEV Group

- HCL Technologies

- IAV

- Infosys

- KPIT Technologies

- L&T Technology Services

- Luxoft

- Ricardo

- Semcon

- Tata Technologies

- Tech Mahindra

- Wipro

The Global Automotive Engineering Services Outsourcing Market was valued at USD 110.3 billion in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 252.9 billion by 2034. A major contributor to this growth is the rising demand for electric vehicles, which has sparked a fundamental shift in vehicle architecture. EV development calls for advanced engineering in areas like thermal regulation, electric propulsion, battery systems, and charging infrastructure-disciplines where many OEMs lack internal capacity, prompting collaboration with ESO firms for specialized support. In parallel, the growing integration of connected car technologies has transformed modern vehicles into data-rich digital platforms. As automakers race to develop advanced software features, telematics, and real-time vehicle communication systems, they increasingly turn to ESO providers for end-to-end engineering assistance, rapid deployment, and scalability. The demand for connected, personalized, and software-driven experiences inside vehicles continues to drive this trend on a global scale.

Passenger vehicles segment accounted for 68% share in 2024 and is projected to grow at a 9% CAGR through 2034. This segment remains the largest within the ESO space due to high production volumes and mounting R&D demands for smart features, electrification, and automation. Automakers are outsourcing engineering tasks for passenger vehicles to accelerate product innovation, reduce time to market, and meet evolving consumer demands for advanced safety, user experience, and performance. Specialized service providers offer scalable engineering talent and access to domain expertise, making it cost-efficient for OEMs to deliver next-generation vehicle models across regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $110.3 Billion |

| Forecast Value | $252.9 Billion |

| CAGR | 8.7% |

Offshore outsourcing segment held 67% share in 2024 and is estimated to grow at a CAGR of 9.1% through 2034. This model offers OEMs significant cost benefits and access to skilled talent pools in regions such as Eastern Europe, China, and India. Offshore vendors are now essential partners for CAD/CAE development, embedded systems engineering, and software integration. Their ability to provide continuous engineering support through staggered global time zones allows for quicker project completion. As cars become more dependent on software and electronics, these regions provide OEMs with the flexibility and cost-efficiency required to stay competitive while adhering to international standards and quality benchmarks.

Germany Automotive Engineering Services Outsourcing Market held a 29% share in 2024 and generated USD 11.1 billion. As a powerhouse of automotive production and innovation, Germany continues to lead the ESO landscape in Europe. The country's established OEMs and Tier 1 suppliers are actively collaborating with external engineering partners to advance autonomous, electric, and digital mobility platforms. Regulatory pressures and the push for technological excellence have intensified outsourcing needs in simulation, vehicle compliance, and testing processes. The German market thrives on advanced R&D culture and policy-driven innovation, which further strengthens ESO integration across the development pipeline.

Key players shaping the Global Automotive Engineering Services Outsourcing Market include Ricardo, Tata Technologies, AVL, Capgemini, Bertrandt, Tech Mahindra, HCL Technologies, IAV, Wipro, and L&T Technology Services. To strengthen their foothold, leading companies in the ESO market are expanding domain-specific service portfolios in key areas such as EV systems, ADAS, and vehicle connectivity.

They are investing in upskilling talent pools, establishing offshore delivery centers, and forming strategic partnerships with OEMs and Tier 1 suppliers. Several players are integrating AI, ML, and digital twin technologies into their engineering workflows to offer faster, smarter development cycles. Companies are also focusing on compliance readiness and aligning their capabilities with evolving regulatory standards across regions. Through co-innovation models and agile collaboration, ESO firms are shortening time-to-market for clients while improving cost efficiency.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Services

- 2.2.3 Application

- 2.2.4 Vehicle

- 2.2.5 Location

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing complexity in automotive engineering

- 3.2.1.2 Rising adoption of electric vehicles

- 3.2.1.3 Rapid advancement in automotive software

- 3.2.1.4 Integration of connected car technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data security and IP concerns

- 3.2.2.2 Integration and communication gaps

- 3.2.3 Market opportunities

- 3.2.3.1 Surge in electric vehicle (EV) development

- 3.2.3.2 Increasing demand for digital engineering services

- 3.2.3.3 Aftermarket engineering and retrofit services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Case studies

- 3.9 Use cases

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Services, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Design and engineering

- 5.3 Prototyping

- 5.4 Testing and validation

- 5.5 Manufacturing engineering

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Body and exterior

- 6.3 Powertrain and drivetrain

- 6.4 Infotainment and telematics

- 6.5 ADAS and safety system

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Location, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Onshore outsourcing

- 8.3 Offshore outsourcing

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 OEMs

- 9.3 Tier 1 suppliers

- 9.4 Tier 2 and tier 3 suppliers

- 9.5 Aftermarket companies

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.4.7 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

- 10.6.4 Rest of MEA

Chapter 11 Company Profiles

- 11.1 AKKA Technologies

- 11.2 Altran

- 11.3 ASAP Holding

- 11.4 AVL

- 11.5 Bertrandt

- 11.6 Capgemini

- 11.7 Contrio

- 11.8 ESG Mobility

- 11.9 FEV Group

- 11.10 HCL Technologies

- 11.11 IAV

- 11.12 Infosys

- 11.13 KPIT Technologies

- 11.14 L&T Technology Services

- 11.15 Luxoft

- 11.16 Ricardo

- 11.17 Semcon

- 11.18 Tata Technologies

- 11.19 Tech Mahindra

- 11.20 Wipro