|

시장보고서

상품코드

1782041

에이전트 AI 시장 예측(-2032년) : 소프트웨어별, 에이전트의 역할별, 용도별Agentic AI Market by Software (Computational Agents, Robotic Agents), Agent Role (Marketing, Sales, Operations & Supply Chain, ITSM), Application (Workflow Automation, Planning & Decision Support, Navigation & Mobility) - Global Forecast to 2032 |

||||||

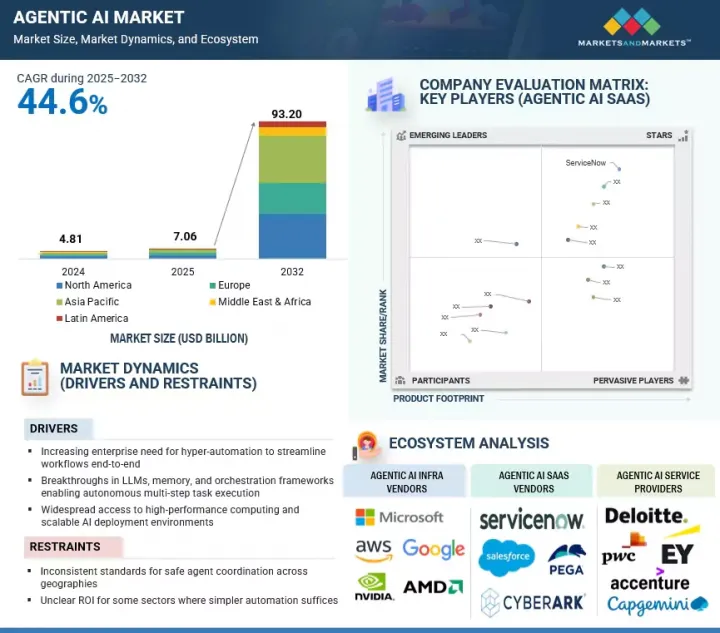

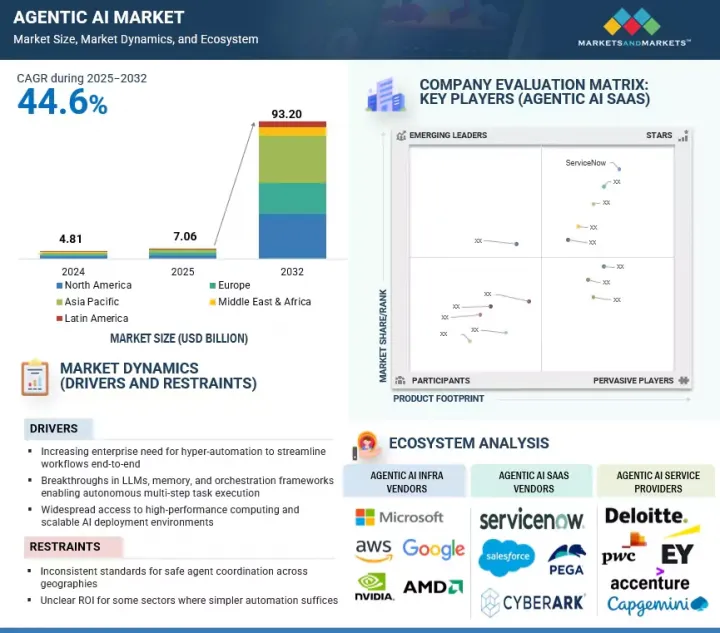

세계의 에이전트 AI 시장 규모는 2025년 70억 6,000만 달러에서 2032년까지 932억 달러에 달할 것으로 예측되며, 2025-2032년에 CAGR로 44.6%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2022-2032년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 단위 | 10억 달러 |

| 부문 | 제공, 에이전트의 역할, 기술, 용도, 최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

에이전트 AI 시장은 에이전트 AI 플랫폼이 도메인별 인간 피드백을 통한 강화학습(RLHF), 사고연쇄추론(CoT), 행동 데이터세트를 기반으로 에이전트를 미세 조정하는 지원을 늘리고 있다는 점, 코드 인터프리터 에이전트가 복잡한 작업을 완료하기 위해 코드를 작성하고, 테스트하고, 디버깅하고, 테스트하고, 디버깅하여 에이전트가 자신의 방법을 개선할 수 있다는 점 코드 인터프리터 에이전트가 복잡한 작업을 완료하기 위해 코드를 작성, 테스트, 디버깅, 실행함으로써 에이전트가 반복적으로 그 방법을 개선할 수 있는 코드 인터프리터, 샌드박스(특히 에이전트 AI 솔루션의 신뢰성을 높이는 데 도움이 되는 미션 크리티컬한 용도에서) 에지 케이스에서 에이전트 AI 솔루션의 신뢰성을 높이는 데 도움이 되는 미션 크리티컬한 용도에서) 에이전트의 행동을 미세 조정하는 데 도움이 된다는 점 등이 그 요인으로 작용하고 있습니다. 그러나 여러 가지 억제요인도 있습니다. 대부분의 에이전트 AI 플랫폼은 코어 리즈너로 상용 LLM(GPT-4, Claude 등)에 의존하고 있습니다. 이 때문에 벤더 종속성, 비용 확장성 문제, API가 고장나거나 변경될 경우 운영상의 리스크가 발생합니다. 또한 통일된 기억 표준이 없으면 에이전트는 효과적으로 협력하거나 조직화된 지식을 확실하게 유지할 수 없습니다.

"이용 사례별로는 수직적 이용 사례가 예측 기간 중 가장 빠른 성장세를 기록할 것으로 예측됩니다. "

조직이 점점 더 일반적인 자동화에서 부서별 과제를 해결하는 첨단 상황별, 산업별 전문화된 에이전트 활용으로 전환함에 따라 수직적 이용 사례는 에이전트 AI 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. BFSI, 의료, 제조, 물류, 자동차 등의 부문에서는 자율형 AI 에이전트를 핵심 업무에 적극적으로 도입하여 부문별 추론과 실시간 의사결정이 필요한 업무를 자동화하고 있습니다. 예를 들어 은행은 부정행위 감지, 실시간 컴플라이언스 모니터링, 자율적 리스크 평가에 에이전트 AI를 활용하고, 제조업체는 스마트 팩토리 운영, 예지보전, 공급망 최적화를 위해 에이전트 시스템을 구축하고 있습니다. 이러한 수직적 집중은 ROI를 가속화할 뿐만 아니라 안전성, 효율성, 규제 준수와 같은 중요한 성과를 지원합니다. 정부 기관과 국방 기관은 에이전트를 통한 모니터링과 재난 대응 계획을 빠르게 시범 도입하고 있으며, 에너지 관련 기업은 그리드 최적화 및 누수 감지를 위해 자율 에이전트를 활용하고 있습니다. 더 많은 업계 진입자들이 광범위한 플랫폼보다 미리 구축되고 도메인에 맞게 조정된 에이전트 모듈을 선호하고 있으며, 수직적 이용 사례에 대한 의욕이 커지고 있습니다. 벤더들은 맞춤형 제품, 플러그 앤 플레이 통합, 매니지드 서비스 등으로 대응하고 있으며, 규제가 까다롭고 복잡한 부문에서의 채택을 용이하게 하고 있습니다. 이러한 요인으로 인해 수직적 이용 사례는 에이전트 AI의 잠재력을 구체적인 산업 KPI와 딥 트랜스포메이션 로드맵에 직접적으로 부합시켜 가장 강력한 성장 동력으로 작용하고 있습니다.

세계의 에이전트 AI 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 제공하고 있습니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 중요한 인사이트

- 에이전트 AI 시장에서의 매력적인 기회

- 에이전트 AI 시장 : 상위 3개 수평 사용 사례

- 북미의 에이전트 AI 시장 : 제공별, 수평 사용 사례별

- 에이전트 AI 시장 : 지역별

제5장 시장 개요와 산업 동향

- 서론

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 에이전트 AI의 진화

- 공급망 분석

- 에코시스템 분석

- 에이전트 AI 프레임워크 프로바이더

- 에이전트 AI 플랫폼 프로바이더

- 에이전트 AI SaaS 프로바이더

- 에이전트 AI 서비스 프로바이더

- 기업용 전략 로드맵

- 조직 준비 상황의 평가

- 통합 전략

- 변경 관리와 인재 전략

- 거버넌스와 컨트롤

- 벤더, 파트너 평가 프레임워크

- 시장 참여에 대한 영향

- 성공 지표와 ROI 측정

- 향후 전망

- 슈퍼 에이전트 시스템에 대한 진화

- 장기적인 사회와 노동력에 대한 영향

- 잠재적리스크와 실존적 우려

- 시나리오 플래닝

- 투자와 혁신 기회

- 다음 최첨단 연구 분야

- 2025년 미국 관세의 영향 - 에이전트 AI 시장

- 서론

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종 용도 산업에 대한 영향

- 투자와 자금조달 시나리오

- 사례 연구 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 규제

- 특허 분석

- 조사 방법

- 특허 출원 건수 : 서류 유형별

- 혁신과 특허 출원

- 가격결정의 분석

- 제공의 평균 판매 가격 : 주요 기업별(2025년)

- 수평 사용 사례의 평균 판매 가격(2025년)

- 주요 컨퍼런스와 이벤트(2025-2026년)

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 고객 비즈니스에 영향을 미치는 동향/혼란

제6장 에이전트 AI 시장 : 제공별

- 서론

- 에이전트 AI 인프라

- 에이전트 AI 플랫폼

- 에이전트 AI SaaS

- 에이전트 AI 서비스

제7장 에이전트 AI 시장 : 수평 사용 사례별

- 서론

- 재무·회계

- 직장 체험

- 세일즈

- 데이터 애널리틱스·BI

- 마케팅

- 보안 오퍼레이션

- 고객 경험

- 데이터 취득

- 코딩·테스트

- 규제 준수

제8장 에이전트 AI 시장 : 수직 사용 사례별

- 서론

- BFSI

- 소매·E-Commerce

- 전문 서비스

- 의료·생명과학

- 통신

- 소프트웨어·기술 프로바이더

- 미디어·엔터테인먼트

- 물류·운송

- 정부·방위

- 자동차

- 에너지·유틸리티

- 제조

제9장 에이전트 AI 시장 : 최종사용자별

- 서론

- 개인 사용자

- 기업

제10장 에이전트 AI 시장 : 지역별

- 서론

- 북미

- 북미의 에이전트 AI 시장 촉진요인

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 에이전트 AI 시장 촉진요인

- 유럽의 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 기타 유럽

- 아시아태평양

- 아시아태평양의 에이전트 AI 시장 촉진요인

- 아시아태평양의 거시경제 전망

- 중국

- 인도

- 일본

- 한국

- 싱가포르

- 호주·뉴질랜드

- 기타 아시아태평양

- 중동 및 아프리카

- 중동 및 아프리카의 에이전트 AI 시장 촉진요인

- 중동 및 아프리카의 거시경제 전망

- 사우디아라비아

- 아랍에미리트

- 카타르

- 튀르키예

- 기타 중동

- 남아프리카공화국

- 라틴아메리카

- 라틴아메리카의 에이전트 AI 시장 촉진요인

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

제11장 경쟁 구도

- 개요

- 주요 참여 기업의 전략(2022-2025년)

- 매출 분석(2022-2024년)

- 시장 점유율 분석(2024년)

- 제품 비교 분석

- 제품 비교 분석 : 에이전트 AI 인프라 프로바이더

- 제품 비교 분석 : 에이전트 AI 플랫폼 프로바이더

- 제품 비교 분석 : 에이전트 AI SaaS 프로바이더

- 주요 벤더의 기업의 평가와 재무 지표

- 기업 평가 매트릭스 : 주요 기업(에이전트 AI 인프라 벤더)

- 기업 평가 매트릭스 : 주요 기업(에이전트 AI 플랫폼 벤더)

- 기업 평가 매트릭스 : 주요 기업(에이전트 AI SaaS 벤더)

- 기업 평가 매트릭스 : 주요 기업(에이전트 AI 서비스 프로바이더)

- 경쟁 시나리오

제12장 기업 개요

- 서론

- AI 인프라/프레임워크 프로바이더

- MICROSOFT

- NVIDIA

- AWS

- AMD

- 에이전트 AI 플랫폼 프로바이더

- OPENAI

- UIPATH

- SNOWFLAKE

- AISERA

- APPIAN

- NEWGEN

- AMDOCS

- HEXAWARE

- ADEPT AI

- RELEVANCE AI

- 에이전트 AI 서비스 프로바이더

- ACCENTURE

- COGNIZANT

- NTT DATA

- DELOITTE

- EY

- WIPRO

- CAPGEMINI

- HCL TECH

- TCS

- PWC

- DATAMATICS

- 에이전트 AI SaaS 프로바이더

- SAP

- IBM

- SALESFORCE

- SERVICENOW

- CISCO

- ALTAIR

- PEGA

- CYBERARK

- ZYCUS

- ORACLE

- SAS INSTITUTE

- AVANADE

- ERICSSON

- VALUELABS

- REWIND AI

- EMA

- ORBY AI

- EXA

- ARTISAN AI

- DEXA AI

- SIMULAR

제13장 인접 시장과 관련 시장

- 서론

- AI 에이전트 시장 - 세계 예측(-2030년)

- 시장 정의

- 시장 개요

- AI 시장 - 세계 예측(-2032년)

- 시장 정의

- 시장 개요

제14장 부록

KSA 25.08.11The agentic AI market is projected to grow from USD 7.06 billion in 2025 to USD 93.20 billion in 2032, with a CAGR of 44.6% during 2025-2032.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | USD (Billion) |

| Segments | Offering, Agent Role, Technology, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The agentic AI market is growing fast, driven by increasing support from agentic AI platforms for fine-tuning agents on domain-specific reinforcement learning from human feedback (RLHF), chain of thought reasoning (CoT), and behavior datasets, code-interpreter agents write, test, debug, and execute code to complete complex tasks, allowing agents to iteratively refine their methods, and sandboxes help fine-tune agent behavior under edge cases, especially for mission-critical applications which helps grow confidence in the agentic AI solutions. However, there are also some restraints. Most agentic AI platforms rely on commercial LLMs (e.g., GPT-4, Claude) as core reasoners. This creates vendor lock-in, cost scalability issues, and operational risks if APIs fail or change, and without unified memory standards, agents cannot collaborate effectively or retain institutional knowledge reliably.

"By use case, vertical use cases expected to register the fastest growth during the forecast period."

Vertical use cases are set to record the highest CAGR in the agentic AI market as organizations increasingly shift from generic automation to highly contextual, industry-specific agentic applications that solve unique sector challenges. Sectors like BFSI, healthcare, manufacturing, logistics, and automotive are actively embedding autonomous AI agents into core operations to automate tasks that require domain-specific reasoning and real-time decision-making. For instance, banks are using agentic AI for fraud detection, real-time compliance monitoring, and autonomous risk assessment, while manufacturers deploy agentic systems for smart factory operations, predictive maintenance, and supply chain optimization. This vertical focus not only drives faster ROI but also supports critical outcomes like safety, efficiency, and regulatory adherence. Governments and defense bodies are rapidly piloting agentic surveillance and disaster response planning, while energy players tap autonomous agents for grid optimization and leak detection. With more industry players favoring pre-built, domain-adapted agentic modules over broad platforms, the appetite for vertical use cases is expanding. Vendors are responding with tailored offerings, plug-and-play integrations, and managed services, making adoption easier for regulated and complex sectors. These factors together position vertical use cases as the strongest growth lever, aligning Agentic AI's promise directly with tangible industry KPIs and deep transformation roadmaps.

"By end user, professional service providers expected to account for the largest market share during the forecast period."

Professional service providers are poised to capture the largest market share in the agentic AI market as enterprises increasingly rely on their specialized expertise to navigate the complexity of deploying autonomous AI agents at scale. Major consulting and IT service firms such as Accenture, Deloitte, TCS, Wipro, and Capgemini are expanding their agentic AI portfolios by combining advisory, design, integration, and managed services under one roof. This end-to-end model allows clients in sectors like BFSI, manufacturing, telecom, and government to implement advanced agentic solutions without needing in-house AI engineering teams or deep AI governance capabilities. Professional services firms also play a critical role in customizing agentic AI to align with industry-specific regulations, security standards, and legacy infrastructure. Additionally, many providers now build and maintain partnerships with technology vendors to deliver tailored, plug-and-play agentic AI frameworks, accelerating time-to-value for clients. Their strong global delivery networks, industry-certified talent pools, and proven track records in driving enterprise digital transformation further strengthen their position. As enterprises look for trusted partners to manage risk, handle large-scale deployments, and deliver measurable ROI from agentic AI, professional service providers are naturally emerging as the largest revenue contributors in this evolving market.

"North America to hold the largest market share in 2025, and Asia Pacific is slated to grow at the highest rate during the forecast period."

North America is expected to hold the largest market share in the agentic AI market during the forecast period, driven by early adoption, strong cloud infrastructure, and the presence of key innovators such as OpenAI, Google, Microsoft, and AWS. The region benefits from a mature AI ecosystem, government-backed R&D (e.g., DARPA and NSF initiatives), and enterprise readiness to implement autonomous, agent-driven workflows across sectors like defense, finance, and software. In contrast, the Asia Pacific region is projected to grow at the highest CAGR, fueled by aggressive digital transformation efforts, rising investments in AI research from countries like China, Japan, South Korea, and Singapore, and a rapidly expanding base of AI startups. Governments in the region are also rolling out strategic frameworks and sandboxes to accelerate agent-based automation in manufacturing, public services, and telecom sectors. This dual dynamic reflects North America's current technological leadership and Asia Pacific's growing momentum in scalable agentic AI deployment.

Breakdown of primaries

In-depth interviews were conducted with innovation and technology directors, system integrators, and executives from various key organizations operating in the agentic AI market.

- By Company: Tier I - 29%, Tier II - 42%, and Tier III - 29%

- By Designation: Directors - 27%, Managers - 39%, and others - 34%

- By Region: North America - 41%, Europe - 27%, Asia Pacific - 24%, Middle East & Africa - 3%, and Latin America - 5%

The report includes the study of key players offering agentic AI solutions. It profiles major vendors in the agentic AI market. The major players in the agentic AI market include Aisera (US), Avanade (US), PwC (UK), Wipro (India), HCL Tech (India), Cognizant (US), Cisco (US), Ericsson (Sweden), NTT Data (Japan), SAS (US), Capgemini (France), Appian (US), IBM (US), ServiceNow (US), Accenture (Ireland), EY (UK), Salesforce (US), Pega (US), SAP (Germany), Snowflake (US), Altair (US), CyberArk (Israel), Zycus (US), Oracle (US), OpenAI (US), UiPath (US), Deloitte (UK), AWS (US), Microsoft (US), NVIDIA (US), Google (US), Newgen (India), Hexaware (India), AMD (US), Amdocs (US), ValueLabs (India), TCS (India), Datamatics (US), Rewind AI (US), Ema (US), Exa (US), Orby AI (US), Artisan AI (US), Dexa AI (US), Simular (US), relevance AI (US), and Adept AI (US).

Research coverage

This research report categorizes the agentic AI market by Offering (Agentic AI Infrastructure, Agentic AI Platforms, Agentic AI SaaS, and Agentic AI Services), Use Case (Vertical Use Case, and Horizontal Use Case [Finance & Accounting, Workplace Experience, Sales, Data Analytics & BI, Marketing, Security Ops, Customer Experience, Data Retrieval, Coding & Testing, and Regulatory Compliance]), End User (Individual Users, and Enterprise), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the agentic AI market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, product & service launches, mergers and acquisitions, and recent developments associated with the agentic AI market. Competitive analysis of upcoming startups in the agentic AI market ecosystem is covered in this report.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall agentic AI market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Increasing enterprise need for hyper-automation to streamline workflows end-to-end, Breakthroughs in LLMs, memory, and orchestration frameworks enable autonomous multi-step task execution, Widespread access to high-performance computing and scalable AI deployment environments, and Growing maturity of digital twins with agentic orchestration for real-world simulation), restraints (Inconsistent standards for safe agent coordination across geographies, and Unclear ROI for some sectors where simpler automation suffices), opportunities (New orchestration engines for multiple autonomous agents working collaboratively, Scaling autonomous agents across BFSI, telecom, and manufacturing for digital transformation, and Emerging AI regulations are unlocking new markets for complaint autonomy), and challenges (Fragmented autonomy stacks and missing interoperability standards restrict system integration, and Legal and ethical gaps around autonomous actions are delaying adoption in regulated sectors).

Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the agentic AI market.

Market Development: Comprehensive information about lucrative markets - the report analyzes the agentic AI market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the agentic AI market.

Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Aisera (US), Avanade (US), PwC (UK), Wipro (India), HCL Tech (India), Cognizant (US), Cisco (US), Ericsson (Sweden), NTT Data (Japan), SAS (US), Capgemini (France), Appian (US), IBM (US), ServiceNow (US), Accenture (Ireland), EY (UK), Salesforce (US), Pega (US), SAP (Germany), Snowflake (US), Altair (US), CyberArk (Israel), Zycus (US), Oracle (US), OpenAI (US), UiPath (US), Deloitte (UK), AWS (US), Microsoft (US), NVIDIA (US), Google (US), Newgen (India), Hexaware (India), AMD (US), Amdocs (US), ValueLabs (India), TCS (India), Datamatics (US), Rewind AI (US), EMA (US), Exa (US), Orby AI (US), Artisan AI (US), Dexa AI (US), Simular (US), relevance AI (US), and Adept AI (US), among others in the agentic AI market. The report also helps stakeholders understand the pulse of the agentic AI market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 THE DAWN OF AGENTIC AI

- 3.2 UNDERSTANDING AGENTIC AI: DEFINING THE NEXT WAVE OF AUTONOMY

- 3.2.1 AGENTIC AI VS. AI AGENTS: A CRITICAL DISTINCTION

- 3.2.2 THE CORE DIFFERENTIATOR: AUTONOMY AND GOAL-ORIENTATION

- 3.3 CORE CHARACTERISTICS OF HIGH-AUTONOMY AGENTIC SYSTEMS

- 3.3.1 DEFINING FEATURES

- 3.3.2 OPERATIONAL LOOP AND PROACTIVE BEHAVIOR

- 3.3.3 PROBABILISTIC AND ADAPTABLE DECISION-MAKING

- 3.3.4 ADVANCED INTEGRATION AND TOOL USE

- 3.3.5 LEVELS OF AI AUTONOMY: FRAMEWORK FOR STRATEGIC DESIGN

- 3.4 REDEFINING WORK AND ORGANIZATIONAL STRUCTURES

- 3.4.1 SHIFTING HUMAN ROLES AND SKILL REQUIREMENTS

- 3.4.2 ENHANCING PRODUCTIVITY AND INNOVATION CYCLES

- 3.4.3 HUMAN-AI PARTNERSHIP PARADIGM

- 3.5 STRATEGIC IMPERATIVES FOR DECISION-MAKERS

- 3.6 VENDOR LANDSCAPE AND MARKET TRENDS

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN AGENTIC AI MARKET

- 4.2 AGENTIC AI MARKET: TOP THREE HORIZONTAL USE CASES

- 4.3 NORTH AMERICA: AGENTIC AI MARKET, BY OFFERING AND HORIZONTAL USE CASE

- 4.4 AGENTIC AI MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing enterprise need for hyper-automation to streamline workflows end-to-end

- 5.2.1.2 Breakthroughs in LLMs, memory, and orchestration frameworks enabling autonomous multi-step task execution

- 5.2.1.3 Widespread access to high-performance computing and scalable AI deployment environments

- 5.2.1.4 Growing integration of digital twins with agentic orchestration for real-world simulation

- 5.2.2 RESTRAINTS

- 5.2.2.1 Inconsistent standards for safe agent coordination across geographies

- 5.2.2.2 Unclear ROI for some sectors where simpler automation suffices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 New orchestration engines for multiple autonomous agents working collaboratively

- 5.2.3.2 Scaling autonomous agents across BFSI, telecom, and manufacturing for digital transformation

- 5.2.3.3 Emerging AI regulations unlocking new markets for compliant autonomy

- 5.2.4 CHALLENGES

- 5.2.4.1 Fragmented autonomy stacks and missing interoperability standards restricting system integration

- 5.2.4.2 Legal and ethical gaps around autonomous actions delaying adoption in regulated sectors

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF AGENTIC AI

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 AGENTIC AI FRAMEWORK PROVIDERS

- 5.5.2 AGENTIC AI PLATFORM PROVIDERS

- 5.5.3 AGENTIC AI SAAS PROVIDERS

- 5.5.4 AGENTIC AI SERVICE PROVIDERS

- 5.6 STRATEGIC ROADMAP FOR ENTERPRISES

- 5.6.1 ORGANIZATIONAL READINESS ASSESSMENT

- 5.6.2 INTEGRATION STRATEGIES

- 5.6.3 CHANGE MANAGEMENT AND TALENT STRATEGY

- 5.6.4 GOVERNANCE AND CONTROL

- 5.6.5 VENDOR AND PARTNER EVALUATION FRAMEWORK

- 5.6.6 GO-TO-MARKET IMPLICATIONS

- 5.6.7 SUCCESS METRICS AND ROI MEASUREMENT

- 5.7 FUTURE OUTLOOK

- 5.7.1 EVOLUTION TOWARD SUPER-AGENTIC SYSTEMS

- 5.7.2 LONG-TERM SOCIETAL AND WORKFORCE IMPACT

- 5.7.3 POTENTIAL RISKS AND EXISTENTIAL CONCERNS

- 5.7.4 SCENARIO PLANNING

- 5.7.5 INVESTMENT AND INNOVATION OPPORTUNITIES

- 5.7.6 NEXT FRONTIER RESEARCH AREAS

- 5.8 IMPACT OF 2025 US TARIFF - AGENTIC AI MARKET

- 5.8.1 INTRODUCTION

- 5.8.2 KEY TARIFF RATES

- 5.8.3 PRICE IMPACT ANALYSIS

- 5.8.3.1 Strategic shifts and emerging trends

- 5.8.4 IMPACT ON COUNTRY/REGION

- 5.8.4.1 US

- 5.8.4.2 China

- 5.8.4.3 Europe

- 5.8.4.4 Asia Pacific (excluding China)

- 5.8.5 IMPACT ON END-USE INDUSTRIES

- 5.8.5.1 BFSI

- 5.8.5.2 Telecommunications

- 5.8.5.3 Government & public sector

- 5.8.5.4 Healthcare & life sciences

- 5.8.5.5 Manufacturing

- 5.8.5.6 Media & entertainment

- 5.8.5.7 Retail & e-commerce

- 5.8.5.8 Software & technology providers

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 CENCORA REALIZED 4X FASTER TURNAROUND THROUGH INFINITUS' VOISE AI AGENTS

- 5.10.2 TEVA PHARMACEUTICALS DEPLOYS CONVERSATIONAL AI AGENT "MEDI" TO ENHANCE MEDICATION INFORMATION ACCESS AND SAFETY

- 5.10.3 AISERA AND CITY AND COUNTY OF DENVER - AUTOMATING CITIZEN SERVICES WITH AGENTIC AI

- 5.10.4 EZCATER ELEVATES COMPLEX CUSTOMER SERVICE OPERATIONS WITH LEVEL AI'S AUTONOMOUS AGENT SOLUTIONS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Reinforcement learning (RL)

- 5.11.1.2 Multi-agent systems (MAS)

- 5.11.1.3 Continual learning

- 5.11.1.4 Symbolic planning & decision-making

- 5.11.1.5 Contextual memory & retrieval mechanisms

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Large language models (LLMs)

- 5.11.2.2 Natural language understanding (NLU)

- 5.11.2.3 Generative AI

- 5.11.2.4 Computer vision

- 5.11.2.5 Vector embedding & similarity search

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 AIOps

- 5.11.3.2 Computer Vision

- 5.11.3.3 Explainable AI (XAI)

- 5.11.3.4 Blockchain

- 5.11.3.5 Natural Language Understanding (NLU)

- 5.11.1 KEY TECHNOLOGIES

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATIONS

- 5.12.2.1 North America

- 5.12.2.1.1 SCR 17: Artificial Intelligence Bill (California)

- 5.12.2.1.2 S1103: Artificial Intelligence Automated Decision Bill (Connecticut)

- 5.12.2.1.3 National Artificial Intelligence Initiative Act (NAIIA) (US)

- 5.12.2.1.4 Artificial Intelligence and Data Act (AIDA) (Canada)

- 5.12.2.2 Europe

- 5.12.2.2.1 European Union (EU) - Artificial Intelligence Act (AIA)

- 5.12.2.2.2 General Data Protection Regulation (Europe)

- 5.12.2.3 Asia Pacific

- 5.12.2.3.1 Interim Administrative Measures for Generative Artificial Intelligence Services (China)

- 5.12.2.3.2 National AI Strategy (Singapore)

- 5.12.2.3.3 Hiroshima AI Process Comprehensive Policy Framework (Japan)

- 5.12.2.4 Middle East & Africa

- 5.12.2.4.1 National Strategy for Artificial Intelligence (UAE)

- 5.12.2.4.2 National Artificial Intelligence Strategy (Qatar)

- 5.12.2.4.3 AI Ethics Principles and Guidelines (Dubai)

- 5.12.2.5 Latin America

- 5.12.2.5.1 Santiago Declaration (Chile)

- 5.12.2.5.2 Brazilian Artificial Intelligence Strategy (EBIA)

- 5.12.2.1 North America

- 5.13 PATENT ANALYSIS

- 5.13.1 METHODOLOGY

- 5.13.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.13.3 INNOVATION AND PATENT APPLICATIONS

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE OF OFFERINGS, BY KEY PLAYER, 2025

- 5.14.2 AVERAGE SELLING PRICE OF HORIZONTAL USE CASES, 2025

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 PORTER'S FIVE FORCES ANALYSIS

- 5.16.1 THREAT OF NEW ENTRANTS

- 5.16.2 THREAT OF SUBSTITUTES

- 5.16.3 BARGAINING POWER OF SUPPLIERS

- 5.16.4 BARGAINING POWER OF BUYERS

- 5.16.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.17 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6 AGENTIC AI MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 DRIVERS: AGENTIC AI MARKET, BY OFFERING

- 6.2 AGENTIC AI INFRASTRUCTURE

- 6.2.1 INNOVATIONS IN MEMORY-AUGMENTED AGENTS AND TASK-CHAINING ENABLE COMPLEX PERFORMANCE AND AUTONOMOUS FUNCTIONS

- 6.3 AGENTIC AI PLATFORMS

- 6.3.1 TASK-CHAINING AND CONTEXTUAL MEMORY DRIVE NEW FRONTIERS FOR ENTERPRISE-GRADE AUTONOMY

- 6.4 AGENTIC AI SAAS

- 6.4.1 AUTONOMOUS BEHAVIOR EMBEDDED IN SAAS UNLOCKS REAL-WORLD PROCESS OPTIMIZATION

- 6.5 AGENTIC AI SERVICES

- 6.5.1 END-TO-END AGENTIC AI SERVICES ANCHOR ADOPTION AND TRUST IN AGENTIC DEPLOYMENTS

7 AGENTIC AI MARKET, BY HORIZONTAL USE CASE

- 7.1 INTRODUCTION

- 7.1.1 DRIVERS: AGENTIC AI MARKET, BY HORIZONTAL USE CASE

- 7.2 FINANCE & ACCOUNTING

- 7.2.1 AUTONOMOUS AGENTS RESHAPE COMPLEX FINANCE & ACCOUNTING WORKFLOWS

- 7.3 WORKPLACE EXPERIENCE

- 7.3.1 ELEVATING EMPLOYEE EXPERIENCE THROUGH CONTEXT-AWARE AUTONOMOUS AGENTS

- 7.4 SALES

- 7.4.1 AUTONOMOUS AGENTS UNLOCK ALWAYS-ON SALES INTELLIGENCE AND DEAL ACCELERATION

- 7.5 DATA ANALYTICS & BI

- 7.5.1 AUTONOMOUS ORCHESTRATION AMPLIFIES DATA ANALYTICS AND BUSINESS INSIGHTS

- 7.6 MARKETING

- 7.6.1 AGENTIC AI DRIVES PRECISION, PERSONALIZATION, AND CAMPAIGN AUTONOMY IN MARKETING

- 7.7 SECURITY OPS

- 7.7.1 AUTONOMOUS AGENTS REINVENT THREAT DETECTION AND RESPONSE CYCLES IN SECURITY OPS

- 7.8 CUSTOMER EXPERIENCE

- 7.8.1 ORCHESTRATED AGENTS ELEVATE CUSTOMER SERVICE WITH ADAPTIVE, PROACTIVE SUPPORT

- 7.9 DATA RETRIEVAL

- 7.9.1 AGENTIC ORCHESTRATION TRANSFORMS ENTERPRISE DATA RETRIEVAL INTO CONTEXTUAL INTELLIGENCE

- 7.10 CODING & TESTING

- 7.10.1 AUTONOMOUS AGENTS BOOST DEVELOPER VELOCITY AND SOFTWARE RELIABILITY

- 7.11 REGULATORY COMPLIANCE

- 7.11.1 AGENTIC AI ELEVATES COMPLIANCE MONITORING AND CONTINUOUS RISK MITIGATION

8 AGENTIC AI MARKET, BY VERTICAL USE CASE

- 8.1 INTRODUCTION

- 8.1.1 DRIVERS: AGENTIC AI MARKET, BY VERTICAL USE CASE

- 8.2 BFSI

- 8.2.1 AGENTIC AI REVOLUTIONIZES CORE BANKING WORKFLOWS WITH ADAPTIVE RISK CONTROLS AND INTELLIGENT PROCESS AUTOMATION

- 8.2.2 FRAUD DETECTION

- 8.2.3 AUTOMATED CREDIT UNDERWRITING

- 8.2.4 AUTONOMOUS CLAIMS PROCESSING

- 8.2.5 PORTFOLIO RISK SIMULATION

- 8.2.6 COMPLIANCE MONITORING

- 8.2.7 OTHER BFSI VERTICAL USE CASES

- 8.3 RETAIL & E-COMMERCE

- 8.3.1 AGENTIC AI POWERS INTELLIGENT MERCHANDISING, PRICING PRECISION, AND SEAMLESS OMNICHANNEL RETAIL OPERATIONS

- 8.3.2 DYNAMIC PRICING OPTIMIZATION

- 8.3.3 INTELLIGENT INVENTORY MANAGEMENT

- 8.3.4 CHECKOUT FRAUD PREVENTION

- 8.3.5 LAST-MILE ROUTE OPTIMIZATION

- 8.3.6 PERSONALIZED MERCHANDISING LAYOUTS

- 8.3.7 OTHER RETAIL & E-COMMERCE VERTICAL USE CASES

- 8.4 PROFESSIONAL SERVICES

- 8.4.1 AGENTIC AI UNLOCKS SCALABLE EXPERTISE AND ENGAGEMENT INTELLIGENCE ACROSS HIGH-TOUCH PROFESSIONAL SERVICES

- 8.4.2 CONTRACT REVIEW & LEGAL DRAFTING

- 8.4.3 AUDIT WORKFLOW MANAGEMENT

- 8.4.4 PROPOSAL & RFP GENERATION

- 8.4.5 GENERATIVE DESIGN

- 8.4.6 CAMPAIGN VARIANT GENERATION

- 8.4.7 OTHER PROFESSIONAL SERVICE VERTICAL USE CASES

- 8.5 HEALTHCARE & LIFE SCIENCES

- 8.5.1 AGENTIC AI ELEVATES PATIENT CARE AND CLINICAL EFFICIENCY THROUGH SELF-LEARNING DIAGNOSTIC AND WORKFLOW AGENTS

- 8.5.2 CLINICAL TRIAL WORKFLOW OPTIMIZATION

- 8.5.3 AI-POWERED DIAGNOSTIC IMAGING

- 8.5.4 PERSONALIZED TREATMENT PLANNING

- 8.5.5 HOSPITAL RESOURCE ORCHESTRATION

- 8.5.6 AUTONOMOUS CLAIMS REVIEW

- 8.5.7 OTHER HEALTHCARE & LIFE SCIENCES VERTICAL USE CASES

- 8.6 TELECOMMUNICATIONS

- 8.6.1 AGENTIC AI ORCHESTRATES REAL-TIME TELECOM OPERATIONS, BILLING, FRAUD DETECTION, AND CUSTOMER EXPERIENCE AUTOMATION

- 8.6.2 RAN CONFIGURATION OPTIMIZATION

- 8.6.3 TELECOM FRAUD DETECTION

- 8.6.4 PREDICTIVE NETWORK FAULT RESOLUTION

- 8.6.5 DYNAMIC BANDWIDTH ALLOCATION

- 8.6.6 AUTONOMOUS BILLING DISPUTE HANDLING

- 8.6.7 OTHER TELECOMMUNICATIONS VERTICAL USE CASES

- 8.7 SOFTWARE & TECHNOLOGY PROVIDERS

- 8.7.1 SOFTWARE & TECHNOLOGY PROVIDERS EMBED AGENTIC AI TO AUTOMATE PIPELINES, TEST APIS, AND OPTIMIZE CLOUD SPEND

- 8.7.2 DEVOPS PIPELINE AUTOMATION

- 8.7.3 INTELLIGENT FEATURE FLAG MANAGEMENT

- 8.7.4 CONTINUOUS VULNERABILITY REMEDIATION

- 8.7.5 AUTONOMOUS API BEHAVIOR TESTING

- 8.7.6 CLOUD RESOURCE OPTIMIZATION

- 8.7.7 OTHER SOFTWARE & TECHNOLOGY PROVIDERS VERTICAL USE CASES

- 8.8 MEDIA & ENTERTAINMENT

- 8.8.1 MEDIA & ENTERTAINMENT FIRMS LEVERAGE AGENTIC AI FOR CONTENT GENERATION, CURATION, AND AUDIENCE ENGAGEMENT AT SCALE

- 8.8.2 AUTOMATED CONTENT GENERATION

- 8.8.3 INTELLIGENT CONTENT MODERATION

- 8.8.4 CROSS-PLATFORM AUDIENCE PERSONALIZATION

- 8.8.5 AI-ASSISTED PRODUCTION PLANNING

- 8.8.6 LIVE EVENT ORCHESTRATION

- 8.8.7 OTHER MEDIA & ENTERTAINMENT VERTICAL USE CASES

- 8.9 LOGISTICS & TRANSPORTATION

- 8.9.1 AGENTIC AI REDEFINES LOGISTICS WITH AUTONOMOUS ORCHESTRATION AND REAL-TIME OPERATIONAL PRECISION

- 8.9.2 REAL-TIME ROUTE OPTIMIZATION

- 8.9.3 AUTONOMOUS WAREHOUSE COORDINATION

- 8.9.4 DRONE FLEET MANAGEMENT

- 8.9.5 INTELLIGENT LOGISTICS AUDITING

- 8.9.6 MULTI-MODAL DELIVERY ORCHESTRATION

- 8.9.7 OTHER LOGISTICS & TRANSPORTATION VERTICAL USE CASES

- 8.10 GOVERNMENT & DEFENSE

- 8.10.1 GOVERNMENT & DEFENSE ELEVATING NATIONAL RESILIENCE THROUGH AGENTIC AI ORCHESTRATION

- 8.10.2 PUBLIC SAFETY SURVEILLANCE

- 8.10.3 AUTONOMOUS BORDER MONITORING

- 8.10.4 DISASTER RESPONSE PLANNING

- 8.10.5 URBAN MOBILITY COORDINATION

- 8.10.6 PUBLIC INFRASTRUCTURE INCIDENT DETECTION

- 8.10.7 OTHER GOVERNMENT & DEFENSE VERTICAL USE CASES

- 8.11 AUTOMOTIVE

- 8.11.1 TRANSFORMING VEHICLE AUTONOMY AND IN-CABIN EXPERIENCES WITH INTELLIGENT AGENTIC ORCHESTRATION

- 8.11.2 AUTONOMOUS VEHICLE NAVIGATION

- 8.11.3 IN-VEHICLE DECISION SUPPORT

- 8.11.4 DRIVER BEHAVIOR ADAPTATION

- 8.11.5 PREDICTIVE IN-CABIN PERSONALIZATION

- 8.11.6 SAFETY SYSTEM COORDINATION

- 8.11.7 OTHER AUTOMOTIVE VERTICAL USE CASES

- 8.12 ENERGY & UTILITIES

- 8.12.1 ORCHESTRATING INTELLIGENT GRIDS AND ENERGY ASSETS THROUGH AGENTIC AI COORDINATION

- 8.12.2 DECENTRALIZED GRID OPTIMIZATION

- 8.12.3 SMART GRID MANAGEMENT

- 8.12.4 DEMAND RESPONSE MANAGEMENT

- 8.12.5 PIPELINE LEAK DETECTION

- 8.12.6 AUTONOMOUS ENERGY ASSET COORDINATION

- 8.12.7 OTHER ENERGY & UTILITIES VERTICAL USE CASES

- 8.13 MANUFACTURING

- 8.13.1 AGENTIC AI REWIRES MODERN MANUFACTURING FOR AUTONOMOUS RESILIENCE AND ADAPTIVE PRODUCTIVITY

- 8.13.2 SMART FACTORY OPERATIONS

- 8.13.3 PREDICTIVE MAINTENANCE SCHEDULING

- 8.13.4 SUPPLY CHAIN OPTIMIZATION

- 8.13.5 AUTOMATED QUALITY INSPECTION

- 8.13.6 WORKPLACE SAFETY MONITORING

- 8.13.7 OTHER MANUFACTURING VERTICAL USE CASES

9 AGENTIC AI MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.1.1 DRIVERS: AGENTIC AI MARKET, BY END USER

- 9.2 INDIVIDUAL USERS

- 9.3 ENTERPRISES

- 9.3.1 BFSI

- 9.3.1.1 Autonomous agents increasingly being embedded in personalized financial recommendations and automate claims processing

- 9.3.2 RETAIL & E-COMMERCE

- 9.3.2.1 Agentic AI drives always-on personalization, dynamic inventory, and adaptive customer engagement at scale

- 9.3.3 PROFESSIONAL SERVICE PROVIDERS

- 9.3.3.1 Rising demand for faster, cost-efficient expert services pushing agentic AI adoption across professional service firms

- 9.3.4 HEALTHCARE & LIFE SCIENCES

- 9.3.4.1 Agentic AI enables real-time clinical decision support and autonomous patient journey management end-to-end

- 9.3.5 TELECOMMUNICATIONS

- 9.3.5.1 Agentic AI streamlines network operations and personalizes user services for hyperconnected digital environments

- 9.3.6 TECHNOLOGY & SOFTWARE PROVIDERS

- 9.3.6.1 Agentic AI fuels next-gen software development, automated testing, and continuous product innovation cycles

- 9.3.7 MEDIA & ENTERTAINMENT

- 9.3.7.1 Agentic AI powers hyper-personalized content creation and real-time audience engagement experiences

- 9.3.8 TRANSPORTATION & LOGISTICS

- 9.3.8.1 Agentic AI orchestrates supply chain flows and autonomous fleet operations in real-time

- 9.3.9 GOVERNMENT & DEFENSE

- 9.3.9.1 Agentic AI enhances autonomous decision-making for critical defense, public safety, and citizen services

- 9.3.10 AUTOMOTIVE

- 9.3.10.1 Agentic AI integrates autonomous driving, predictive maintenance, and driver experience in next-gen vehicles

- 9.3.11 ENERGY & UTILITIES

- 9.3.11.1 Agentic AI optimizes distributed energy grids and autonomous demand response at scale

- 9.3.12 MANUFACTURING

- 9.3.12.1 Agentic AI automates factory floor coordination, predictive quality control, and adaptive production planning

- 9.3.13 OTHER ENTERPRISES

- 9.3.1 BFSI

10 AGENTIC AI MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: AGENTIC AI MARKET DRIVERS

- 10.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.3 US

- 10.2.4 CANADA

- 10.3 EUROPE

- 10.3.1 EUROPE: AGENTIC AI MARKET DRIVERS

- 10.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.3 UK

- 10.3.4 GERMANY

- 10.3.5 FRANCE

- 10.3.6 ITALY

- 10.3.7 SPAIN

- 10.3.8 NETHERLANDS

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: AGENTIC AI MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.3 CHINA

- 10.4.4 INDIA

- 10.4.5 JAPAN

- 10.4.6 SOUTH KOREA

- 10.4.7 SINGAPORE

- 10.4.8 AUSTRALIA & NEW ZEALAND

- 10.4.9 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: AGENTIC AI MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.3 SAUDI ARABIA

- 10.5.4 UAE

- 10.5.5 QATAR

- 10.5.6 TURKEY

- 10.5.7 REST OF MIDDLE EAST

- 10.5.8 SOUTH AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: AGENTIC AI MARKET DRIVERS

- 10.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.3 BRAZIL

- 10.6.4 MEXICO

- 10.6.5 ARGENTINA

- 10.6.6 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYERS' STRATEGIES, 2022 - 2025

- 11.3 REVENUE ANALYSIS, 2022 - 2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 MARKET RANKING ANALYSIS, 2024

- 11.5 PRODUCT COMPARATIVE ANALYSIS

- 11.5.1 PRODUCT COMPARATIVE ANALYSIS: AGENTIC AI INFRASTRUCTURE PROVIDERS

- 11.5.2 PRODUCT COMPARATIVE ANALYSIS: AGENTIC AI PLATFORM PROVIDERS

- 11.5.3 PRODUCT COMPARATIVE ANALYSIS: AGENTIC AI SAAS PROVIDERS

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS (AGENTIC AI INFRASTRUCTURE VENDORS)

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS (AGENTIC AI INFRASTRUCTURE)

- 11.7.5.1 Overall Company Footprint

- 11.7.5.2 Offering Footprint

- 11.7.5.3 Region Footprint

- 11.7.5.4 Horizontal Use Case Footprint

- 11.7.5.5 End User Footprint

- 11.8 COMPANY EVALUATION MATRIX: KEY PLAYERS (AGENTIC AI PLATFORM VENDORS)

- 11.8.1 STARS

- 11.8.2 EMERGING LEADERS

- 11.8.3 PERVASIVE PLAYERS

- 11.8.4 PARTICIPANTS

- 11.8.5 COMPANY FOOTPRINT: KEY PLAYERS (AGENTIC AI PLATFORMS)

- 11.8.5.1 Overall Company Footprint

- 11.8.5.2 Offering Footprint

- 11.8.5.3 Region Footprint

- 11.8.5.4 Horizontal Use Case Footprint

- 11.8.5.5 End User Footprint

- 11.9 COMPANY EVALUATION MATRIX: KEY PLAYERS (AGENTIC AI SAAS VENDORS)

- 11.9.1 STARS

- 11.9.2 EMERGING LEADERS

- 11.9.3 PERVASIVE PLAYERS

- 11.9.4 PARTICIPANTS

- 11.9.5 COMPANY FOOTPRINT: KEY PLAYERS (AGENTIC AI SAAS)

- 11.9.5.1 Overall Company Footprint

- 11.9.5.2 Offering Footprint

- 11.9.5.3 Region Footprint

- 11.9.5.4 Horizontal Use Case Footprint

- 11.9.5.5 End User Footprint

- 11.10 COMPANY EVALUATION MATRIX: KEY PLAYERS (AGENTIC AI SERVICE PROVIDERS)

- 11.10.1 STARS

- 11.10.2 EMERGING LEADERS

- 11.10.3 PERVASIVE PLAYERS

- 11.10.4 PARTICIPANTS

- 11.10.5 COMPANY FOOTPRINT: KEY PLAYERS (AGENTIC AI SERVICES)

- 11.10.5.1 Overall Company Footprint

- 11.10.5.2 Offering Footprint

- 11.10.5.3 Region Footprint

- 11.10.5.4 Horizontal Use Case Footprint

- 11.10.5.5 End User Footprint

- 11.11 COMPETITIVE SCENARIO

- 11.11.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 11.11.2 DEALS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 AI INFRASTRUCTURE/FRAMEWORK PROVIDERS

- 12.2.1 MICROSOFT

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Product launches and enhancements

- 12.2.1.3.2 Deals

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses and competitive threats

- 12.2.2 NVIDIA

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.3.1 Product launches and enhancements

- 12.2.2.3.2 Deals

- 12.2.3 GOOGLE

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.3.1 Product launches and enhancements

- 12.2.3.3.2 Deals

- 12.2.3.4 MnM view

- 12.2.3.4.1 Key strengths

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses and competitive threats

- 12.2.4 AWS

- 12.2.5 AMD

- 12.2.1 MICROSOFT

- 12.3 AGENTIC AI PLATFORM PROVIDERS

- 12.3.1 OPENAI

- 12.3.1.1 Business overview

- 12.3.1.2 Products/Solutions/Services offered

- 12.3.1.3 Recent developments

- 12.3.1.3.1 Product launches and enhancements

- 12.3.1.3.2 Deals

- 12.3.2 UIPATH

- 12.3.3 SNOWFLAKE

- 12.3.4 AISERA

- 12.3.5 APPIAN

- 12.3.6 NEWGEN

- 12.3.7 AMDOCS

- 12.3.8 HEXAWARE

- 12.3.9 ADEPT AI

- 12.3.10 RELEVANCE AI

- 12.3.1 OPENAI

- 12.4 AGENTIC AI SERVICE PROVIDERS

- 12.4.1 ACCENTURE

- 12.4.1.1 Business overview

- 12.4.1.2 Products/Solutions/Services offered

- 12.4.1.3 Recent developments

- 12.4.1.3.1 Product launches and enhancements

- 12.4.1.3.2 Deals

- 12.4.1.4 MnM view

- 12.4.1.4.1 Key strengths

- 12.4.1.4.2 Strategic choices

- 12.4.1.4.3 Weaknesses and competitive threats

- 12.4.2 COGNIZANT

- 12.4.2.1 Business overview

- 12.4.2.2 Products/Solutions/Services offered

- 12.4.2.3 Recent developments

- 12.4.2.3.1 Product launches and enhancements

- 12.4.2.3.2 Deals

- 12.4.3 NTT DATA

- 12.4.4 DELOITTE

- 12.4.5 EY

- 12.4.6 WIPRO

- 12.4.7 CAPGEMINI

- 12.4.7.1 Business overview

- 12.4.7.2 Products/Solutions/Services offered

- 12.4.7.3 Recent developments

- 12.4.7.3.1 Deals

- 12.4.8 HCL TECH

- 12.4.9 TCS

- 12.4.10 PWC

- 12.4.11 DATAMATICS

- 12.4.1 ACCENTURE

- 12.5 AGENTIC AI SAAS PROVIDERS

- 12.5.1 SAP

- 12.5.1.1 Business overview

- 12.5.1.2 Products/Solutions/Services offered

- 12.5.1.3 Recent developments

- 12.5.1.3.1 Product launches and enhancements

- 12.5.1.3.2 Deals

- 12.5.1.4 MnM view

- 12.5.1.4.1 Key strengths

- 12.5.1.4.2 Strategic choices

- 12.5.1.4.3 Weaknesses and competitive threats

- 12.5.2 IBM

- 12.5.2.1 Business overview

- 12.5.2.2 Products/Solutions/Services offered

- 12.5.2.3 Recent developments

- 12.5.2.3.1 Product launches and enhancements

- 12.5.2.3.2 Deals

- 12.5.2.4 MnM view

- 12.5.2.4.1 Key strengths

- 12.5.2.4.2 Strategic choices

- 12.5.2.4.3 Weaknesses and competitive threats

- 12.5.3 SALESFORCE

- 12.5.3.1 Business overview

- 12.5.3.2 Products/Solutions/Services offered

- 12.5.3.3 Recent developments

- 12.5.3.3.1 Product launches and enhancements

- 12.5.4 SERVICENOW

- 12.5.5 CISCO

- 12.5.6 ALTAIR

- 12.5.7 PEGA

- 12.5.8 CYBERARK

- 12.5.9 ZYCUS

- 12.5.10 ORACLE

- 12.5.11 SAS INSTITUTE

- 12.5.12 AVANADE

- 12.5.13 ERICSSON

- 12.5.14 VALUELABS

- 12.5.15 REWIND AI

- 12.5.16 EMA

- 12.5.17 ORBY AI

- 12.5.18 EXA

- 12.5.19 ARTISAN AI

- 12.5.20 DEXA AI

- 12.5.21 SIMULAR

- 12.5.1 SAP

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 AI AGENTS MARKET - GLOBAL FORECAST TO 2030

- 13.2.1 MARKET DEFINITION

- 13.2.2 MARKET OVERVIEW

- 13.2.2.1 AI agents market, by offering

- 13.2.2.2 AI agents market, by agent system

- 13.2.2.3 AI agents market, by product type

- 13.2.2.4 AI agents market, by agent role

- 13.2.2.5 AI agents market, by end user

- 13.2.2.6 AI agents market, by region

- 13.3 ARTIFICIAL INTELLIGENCE MARKET - GLOBAL FORECAST TO 2032

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.2.1 Artificial intelligence (AI) market, by offering

- 13.3.2.2 Artificial intelligence (AI) market, by technology

- 13.3.2.3 Artificial intelligence (AI) market, by business function

- 13.3.2.4 Artificial intelligence (AI) market, by enterprise application

- 13.3.2.5 Artificial intelligence (AI) market, by end user

- 13.3.2.6 Artificial intelligence (AI) market, by region

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS