|

시장보고서

상품코드

1819097

신속 식품안전검사 시장 예측(-2030년) : 검사 대상, 검사 식품, 기술, 최종사용자, 지역별Rapid Food Safety Testing Market by Target Tested, Food Tested, Technology, End User, and Region - Global Forecast to 2030 |

||||||

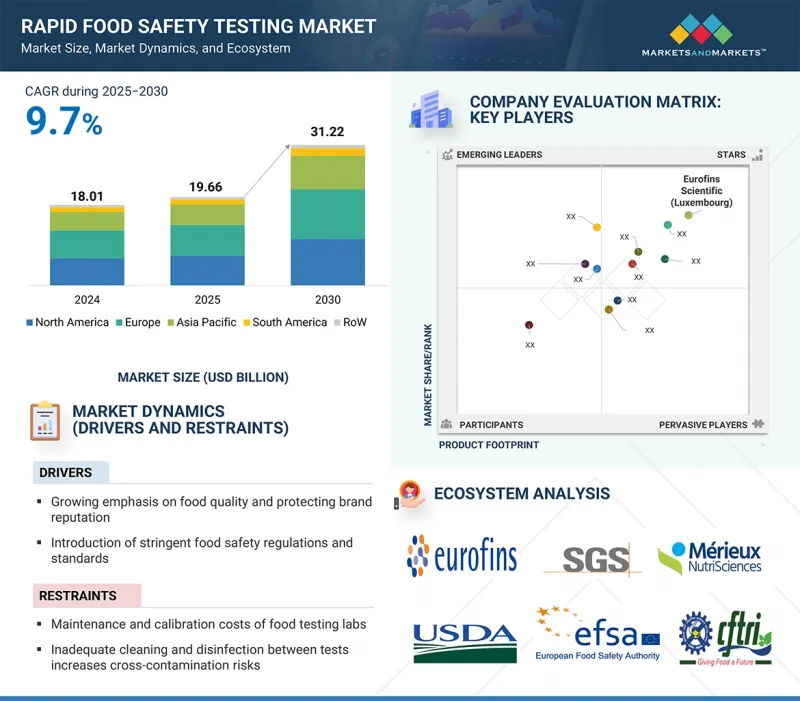

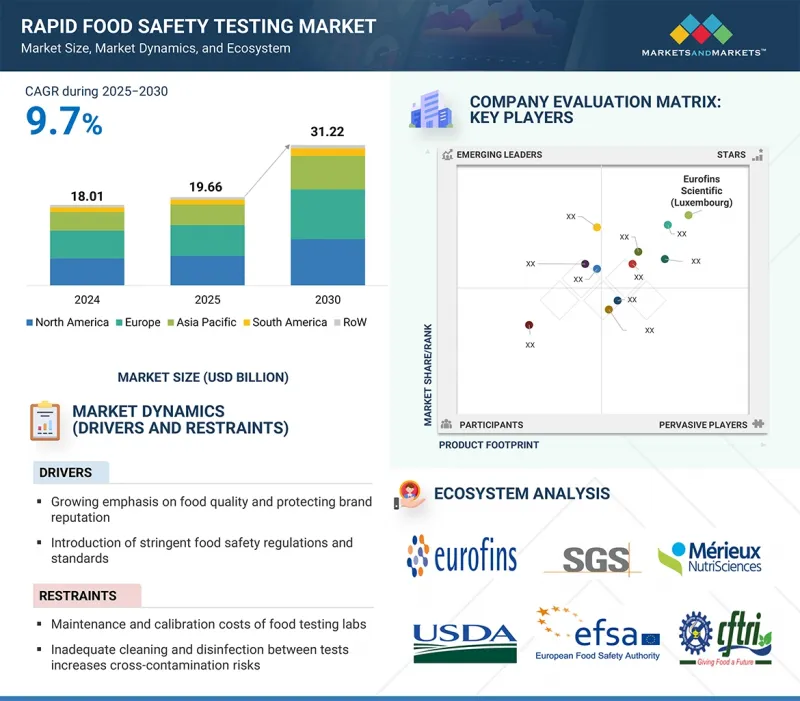

세계의 신속 식품안전검사 시장 규모는 2025년 196억 6,000만 달러에서 예측 기간 중 CAGR 9.7%로 추이하며, 2030년에는 312억 2,000만 달러에 달할 것으로 예측됩니다.

편의성이 높은 포장 식품에 대한 수요 증가는 신속 식품 안전 검사 시장의 주요 촉진요인입니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러)·수량(유닛) |

| 부문별 | 검사 대상, 검사 식품, 기술, 최종사용자, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미, 기타 지역 |

RTE 식품, 냉동식품, 유제품, 육류, 스낵 등 포장 식품은 대규모 가공과 긴 공급망을 거치기 때문에 병원균, 알레르겐, 화학물질 잔류물에 의한 오염 위험이 높아집니다. 소비자들은 식품 안전에 대한 인식이 매우 높기 때문에 제조업체들은 PCR, ELISA, 크로마토그래피와 같은 신속 검사법을 도입하여 상품이 매장에 진열되기 전에 안전성을 보장하고 있습니다. 예를 들어 Nestle과 PepsiCo는 엄격한 세계 식품 안전 기준을 충족하기 위해 신속한 미생물 검사 및 알레르겐 검사를 활용하고 있습니다. 마찬가지로 Tyson Foods는 육류 제품에 대한 신속한 병원체 검출을 통해 규정 준수와 소비자 신뢰를 보장합니다. 이러한 수요는 전 세계에서 신속 검사 기술의 채택을 촉진하고 있습니다.

"기술별로는 면역측정법 부문이 시장 점유율 3위를 차지할 것으로 전망"

면역측정법에 기반한 검사는 항원항체 반응을 이용하여 식품내 오염물질, 병원체, 독소, 알레르겐을 검출하는 신속 식품안전 검사법입니다. 주요 유형으로는 효소면역측정법(ELISA), 측방유동 어세이법(LFA), 방사성 면역측정법(RIA) 등이 있습니다. 신속하고 비용 효율적이며, 고감도 검출이 가능합니다. 유제품, 육류, 수산물, 곡물, 견과류, 가공식품에 널리 적용되고 있습니다. 면역측정법은 살모넬라균, 리스테리아균, 대장균 등의 병원체, 알레르겐(땅콩, 글루텐, 콩), 독소, 마이코톡신 등을 대상으로 합니다. 그 다양성과 신속성은 안전 기준 준수를 보장하고 소비자의 건강을 보호하는 데 필수적입니다.

"검사 식품별로는 육류, 가금류, 수산물 부문이 중요한 비중을 차지합니다."

육류, 가금류, 수산물은 높은 단백질과 영양가 때문에 전 세계에서 소비되는 동물성 식품입니다. 육류에는 소고기, 돼지고기, 양고기가 포함되며, 가금류에는 닭고기, 칠면조, 오리고기가 포함됩니다. 수산물에는 어패류, 조개류, 갑각류가 포함됩니다. 이러한 식품은 매우 부패하기 쉽고 살모넬라균, 리스테리아균, 대장균 등의 병원균, 독소, 알레르겐에 의해 오염되기 쉽다는 특징이 있습니다. PCR 기반 검사, 면역측정법(ELISA, LFA), 크로마토그래피, 분광법, 편의성이 높은 신속검사 등의 기술이 널리 사용되고 있습니다. 전 세계에서 단백질이 풍부한 식단 및 가공육 제품에 대한 수요가 증가함에 따라 소비량이 증가하고 있으며, 안전, 규제 준수 및 소비자 보호를 보장하기 위한 신속한 식품 안전 검사에 큰 성장 기회가 창출되고 있습니다.

"아시아태평양은 시장에서 3번째로 높은 점유율을 차지하고 있습니다."

아시아태평양 시장은 식중독에 대한 우려 증가, 포장 식품 및 가공식품 소비 증가, 엄격한 규제 기준 등으로 인해 빠르게 성장하고 있습니다. 중국, 인도, 일본, 호주 등의 국가에서는 식품 안전을 보장하기 위해 PCR, 면역측정법, 크로마토그래피와 같은 첨단 검사법에 대한 수요가 증가하고 있습니다. 또한 중산층 인구 증가와 도시화의 진전은 안전하고 고품질의 식품에 대한 수요를 증가시키고 있습니다.

세계의 신속 식품안전검사 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인의 분석, 기술·특허의 동향, 법규제 환경, 사례 연구, 시장 규모 추이·예측, 각종 구분·지역/주요 국가별 상세 분석, 경쟁 구도, 주요 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 거시경제 지표

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- AI/생성형 AI가 식품안전검사 시장에 미치는 영향

제6장 업계 동향

- 2025년 미국 관세의 영향 - 신속 식품안전검사 시장

- 밸류체인 분석

- 무역 분석

- 기술 분석

- 가격 분석

- 에코시스템 분석

- 고객 사업에 영향을 미치는 동향/혼란

- 특허 분석

- 2025-2026년의 주요 컨퍼런스와 이벤트

- 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 사례 연구 분석

- 투자와 자금조달 시나리오

제7장 신속 식품안전검사 시장 : 시험 대상별

- 병원체

- 대장균

- 살모넬라균

- 캄필로박터

- 리스테리아균

- 기타

- GMO

- 농약

- 마이코톡신

- 알레르겐

- 중금속

- 기타

제8장 신속 식품안전검사 시장 : 검사 식품별

- 육류·가금·수산물

- 유제품

- 가공식품

- 과일·채소

- 곡물

- 기타

제9장 신속 식품안전검사 시장 : 기술별

- 편리성 중시형 검사

- PCR 검사

- 면역측정법

- 크로마토그래피·분광 분석

- 기타

제10장 신속 식품안전검사 솔루션 최종사용자

- 식품제조업체

- 식품 서비스 및 케이터링 회사

- 소매점과 슈퍼마켓

- 기타

제11장 신속 식품안전검사 시장 : 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 폴란드

- 기타

- 아시아태평양

- 중국

- 인도

- 일본

- 호주와 뉴질랜드

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

- 세계의 기타 지역

- 중동

- 아프리카

제12장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 신규 기업/중소기업

- 기업 평가와 재무 지표

- 브랜드/서비스 비교 분석

- 경쟁 시나리오와 동향

제13장 기업 개요

- 주요 기업

- EUROFINS SCIENTIFIC

- SGS SOCIETE GENERALE DE SURVEILLANCE SA.

- ALS

- INTERTEK GROUP PLC

- MERIEUX NUTRISCIENCES CORPORATION

- TUV SUD

- ASUREQUALITY

- TENTAMUS

- ALFA CHEMISTRY

- TUV NORD GROUP

- MICROBAC LABORATORIES

- HILL LABS

- FOODCHAIN ID

- ROMER LABS DIVISION HOLDING

- AGQ LABS

- 기타 기업

- CERTIFIED GROUP

- SYMBIO LABS

- AGROLAB

- OMIC USA INC.

- FARE LABS

- CAMPDEN BRI

- MITRA S.K. PRIVATE LIMITED

- ELEMENT MATERIALS TECHNOLOGY

- AMLAB SERVICES PTE. LTD.

- COTECNA

제14장 인접 시장과 관련 시장

제15장 부록

KSA 25.10.01The global market for rapid food safety testing is estimated to be valued at USD 19.66 billion in 2025 and is projected to reach USD 31.22 billion by 2030, at a CAGR of 9.7% during the forecast period. The rising demand for convenience and packaged food products is a major driver of the rapid food safety testing market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) and Volume (Units) |

| Segments | By Target Tested, Food Tested, Technology, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

Packaged foods, such as ready-to-eat meals, frozen products, dairy, meat, and snacks, undergo extensive processing and longer supply chains, increasing the risk of contamination by pathogens, allergens, or chemical residues. Consumers are highly conscious of food safety, pushing manufacturers to adopt rapid testing methods like PCR, ELISA, and chromatography to ensure product safety before reaching shelves. For example, Nestle and PepsiCo rely on rapid microbial and allergen testing to meet strict global food safety standards. Similarly, Tyson Foods uses rapid pathogen detection for meat products, ensuring compliance and consumer trust. This demand boosts the adoption of rapid testing technologies worldwide.

"Immunoassay-based testing segment is expected to hold the third-largest share by technology of the rapid food safety testing market."

Immunoassay-based testing is a rapid food safety testing method that uses antigen-antibody reactions to detect contaminants, pathogens, toxins, or allergens in food. Its main types include Enzyme-Linked Immunosorbent Assay (ELISA), Lateral Flow Assay (LFA), and Radioimmunoassay (RIA). In the rapid food safety testing market, it enables quick, cost-effective, and highly sensitive detection. It is widely applied to dairy, meat, seafood, grains, nuts, and processed foods. Immunoassays target pathogens like Salmonella, Listeria, E. coli, allergens (peanuts, gluten, soy), toxins, and mycotoxins. Their versatility and speed make them critical for ensuring compliance with safety standards and protecting consumer health.

"The meat, poultry & seafood segment holds a significant share in the food tested segment of the rapid food safety testing market."

Meat, poultry, and seafood are animal-derived food products consumed globally for their high protein and nutrient content. Meat includes beef, pork, and lamb; poultry covers chicken, turkey, and duck; seafoods comprise fish, shellfish, and crustaceans. These foods are highly perishable and prone to contamination by pathogens (Salmonella, Listeria, E. coli), toxins, and allergens. Rapid food safety testing technologies such as PCR-based testing, immunoassays (ELISA, LFA), chromatography, spectrometry, and convenience-based tests are widely used in meat, poultry & seafood testing. With rising global demand for protein-rich diets and processed meat products, consumption is increasing, creating significant opportunities for rapid food safety testing to ensure safety, compliance, and consumer protection.

Asia Pacific holds the third-largest share in the global rapid food safety testing market.

The Asia Pacific rapid food safety testing market is expanding rapidly, driven by growing concerns over foodborne illnesses, rising consumption of packaged and processed foods, and stricter regulatory standards. Countries such as China, India, Japan, and Australia are witnessing increasing demand for advanced testing methods like PCR, immunoassays, and chromatography to ensure food safety. The growing middle-class population and urbanization further boost demand for safe and high-quality food. A recent development occurred in 2025 when SGS launched its new next-generation rapid microbiological testing platform in Singapore, enhancing detection speed and accuracy. Key regulatory bodies include Food Safety and Standards Authority of India (FSSAI) (India), National Medical Products Administration (NMPA) (China), Ministry of Health, Labour and Welfare (MHLW) (Japan), and Food Standards Australia New Zealand (FSANZ) (Australia-New Zealand), ensuring compliance, safety, and consumer protection.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the rapid food safety testing market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 50%, Executives- 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World - 10%

Prominent companies in the market include Eurofins Scientific (Luxembourg), SGS Societe Generale de Surveillance SA (Switzerland), ALS (Australia), Intertek Group plc (UK), Merieux NutriSciences (US), TUV SUD (Germany), AsureQuality (New Zealand), Neogen Corporation (US), QIAGEN (Netherlands), TUV NORD GROUP (Germany), Microbac Laboratories (US), Hill Labs (New Zealand), FoodChain ID (US), Romer Labs Division Holding (Austria), and Promega Corporation (US).

Other players include Certified Group (US), Symbio Labs (Australia), AGROLAB (Germany), OMIC USA Inc. (US), AccreditedTestLabs (US), Campden BRI (UK), Mitra S.K. Private Limited (India), Element Material Technology (UK), Daane Labs (US), and Cotecna (Switzerland).

Research Coverage:

This research report categorizes the rapid food safety testing market by target tested (pathogens, GMOs, pesticides, mycotoxins, allergens, heavy metals, other targets tested), food tested (meat, poultry & seafood, dairy products, processed foods, fruits & vegetables, cereals & grains, other food tested), technology (convenience-based testing, PCR-based testing, immunoassay-based testing, chromatography & spectrometry, and other technologies), end user (food manufacturers, food service & catering companies, retail & supermarkets, other end users), and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the rapid food safety testing market. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, service launches, mergers and acquisitions, and recent developments associated with the rapid food safety testing market. Competitive analysis of upcoming startups in the rapid food safety testing market ecosystem is covered in this report. Furthermore, industry-specific trends such as technology analysis, ecosystem and market mapping, and patent and regulatory landscape, among others, are also covered in the study.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall rapid food safety testing and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Growing emphasis on food quality and protecting brand reputation), restraints (Maintenance and calibration costs of food testing labs), opportunities (Integration of AI and machine learning for predictive food safety analytics), and challenges (High cost associated with the procurement of food safety testing equipment).

- Service Launch/Innovation: Detailed insights on research & development activities and service launches in the rapid food safety testing market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the rapid food safety testing market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the rapid food safety testing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players such as Eurofins Scientific (Luxembourg), SGS Societe Generale de Surveillance SA (Switzerland), ALS (Australia), Intertek Group plc (UK), Merieux NutriSciences (US), and other players in the rapid food safety testing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 RAPID FOOD SAFETY TESTING MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.2.3 BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.3 MARKET BREAKUP AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RAPID FOOD SAFETY TESTING MARKET

- 4.2 RAPID FOOD SAFETY TESTING MARKET, BY COUNTRY

- 4.3 EUROPE: RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED AND COUNTRY

- 4.4 RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED

- 4.5 RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED

- 4.6 RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GLOBAL ECONOMIC OUTLOOK: RISING FOODBORNE DISEASE CASES DRIVE MARKET

- 5.2.2 GLOBAL ECONOMIC OUTLOOK: RISING TRADE OPPORTUNITIES

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Growing emphasis on food quality and protecting brand reputation

- 5.3.1.2 Introduction of stringent food safety regulations and standards

- 5.3.1.3 Rise in food recalls

- 5.3.1.4 Increase in demand for convenience and packaged food products

- 5.3.2 RESTRAINTS

- 5.3.2.1 Maintenance and calibration costs of food testing labs

- 5.3.2.2 Inadequate cleaning and disinfection between tests increase cross-contamination risks

- 5.3.2.3 Lack of coordination between market stakeholders and improper enforcement of regulatory laws and supporting infrastructure

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Integration of AI and ML for predictive food safety analytics

- 5.3.3.2 Government-funded programs to modernize food safety infrastructure

- 5.3.3.3 Increasing focus on importance of food safety

- 5.3.4 CHALLENGES

- 5.3.4.1 High costs associated with procurement of food safety testing equipment

- 5.3.4.2 Rapid tests frequently experience delays in availability for newly identified pathogens

- 5.3.1 DRIVERS

- 5.4 IMPACT OF AI/GEN AI ON FOOD SAFETY TESTING MARKET

- 5.4.1 USE OF GEN AI IN FOOD SAFETY TESTING MARKET

- 5.4.2 CASE STUDY ANALYSIS

- 5.4.2.1 AI-enabled food plants to conduct rapid, real-time contaminant testing directly on-site

- 5.4.2.2 TAAG Xpert Assistant, a web-based AI-driven platform, reduces contamination detection time

- 5.4.3 IMPACT ON RAPID FOOD SAFETY TESTING MARKET

- 5.4.4 ADJACENT ECOSYSTEMS WORKING ON GENERATIVE AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 IMPACT OF 2025 US TARIFFS-RAPID FOOD SAFETY TESTING MARKET

- 6.2.1 INTRODUCTION

- 6.2.2 KEY TARIFF RATES

- 6.2.3 DISRUPTION IN FOOD SAFETY TESTING INDUSTRY

- 6.2.4 PRICE IMPACT ANALYSIS

- 6.2.5 IMPACT ON COUNTRY/REGION

- 6.2.5.1 US

- 6.2.5.2 Europe

- 6.2.5.3 Asia Pacific

- 6.2.6 IMPACT ON END-USE INDUSTRIES

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & DEVELOPMENT

- 6.3.2 SOURCING

- 6.3.3 DATA ANALYSIS & INTERPRETATION

- 6.3.4 CONSULTATION & ADVISORY SERVICE

- 6.3.5 COLLABORATION & NETWORKING

- 6.3.6 END USERS

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO (HS CODE 3822)

- 6.4.2 EXPORT SCENARIO (HS CODE 3822)

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 PCR

- 6.5.1.2 Immunoassay

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Sample preparation

- 6.5.2.2 Data processing and analytics

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Food processing automation & control

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 INTRODUCTION

- 6.6.2 AVERAGE SELLING PRICE, BY KEY PLAYER

- 6.6.3 AVERAGE SELLING PRICE TREND, BY REGION

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES & EVENTS, 2025-2026

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 REGULATORY FRAMEWORK

- 6.11.2.1 North America

- 6.11.2.2 Europe

- 6.11.2.3 Asia Pacific

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 DRIVING TRUST THROUGH SPEED AND ACCURACY: SGS'S JOURNEY TO CII FOOD SAFETY RECOGNITION

- 6.14.2 EUROFINS ELEVATES FRUIT SAFETY: RAPID AND RELIABLE PATULIN TESTING

- 6.15 INVESTMENT AND FUNDING SCENARIO

7 RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED

- 7.1 INTRODUCTION

- 7.2 PATHOGENS

- 7.2.1 RISING FOOD SAFETY CONCERNS AND DEMAND FOR ACCURATE PATHOGEN DETECTION TO DRIVE MARKET

- 7.2.2 E. COLI

- 7.2.3 SALMONELLA

- 7.2.4 CAMPYLOBACTER

- 7.2.5 LISTERIA

- 7.2.6 OTHER PATHOGENS

- 7.3 GMOS

- 7.3.1 ENSURING FOOD SAFETY AND COMPLIANCE WITH RAPID GMO TESTING TO DRIVE MARKET

- 7.4 PESTICIDES

- 7.4.1 ENSURING COMPLIANCE AND SAFETY THROUGH ADVANCED PESTICIDE TESTING TO DRIVE MARKET

- 7.5 MYCOTOXINS

- 7.5.1 ENHANCING FOOD SAFETY THROUGH RAPID MYCOTOXIN DETECTION TO DRIVE MARKET

- 7.6 ALLERGENS

- 7.6.1 SAFEGUARDING FOOD PRODUCTS FROM HIDDEN ALLERGENS TO DRIVE MARKET

- 7.7 HEAVY METALS

- 7.7.1 CONCERNS OVER RISING HEAVY METAL CONTAMINATION AND INCREASED REGULATORY ENFORCEMENT TO DRIVE DEMAND FOR FOOD HEAVY METALS TESTING

- 7.8 OTHER TARGETS TESTED

8 RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED

- 8.1 INTRODUCTION

- 8.2 MEAT, POULTRY, AND SEAFOOD

- 8.2.1 ADVANCED PATHOGEN AND CONTAMINANT DETECTION IN MEAT, POULTRY, AND SEAFOOD TO DRIVE MARKET

- 8.3 DAIRY PRODUCTS

- 8.3.1 STRINGENT REGULATIONS, TECHNOLOGICAL ADVANCEMENTS, AND RISING DAIRY SAFETY CONCERNS TO BOOST MARKET GROWTH

- 8.4 PROCESSED FOODS

- 8.4.1 EXPANDING PROCESSED FOOD CONSUMPTION AND TECHNOLOGICAL ADVANCEMENTS IN RAPID FOOD SAFETY TESTING TO DRIVE MARKET

- 8.5 FRUITS & VEGETABLES

- 8.5.1 STRINGENT SAFETY TESTING OF FRUITS & VEGETABLES AGAINST PESTICIDES AND CONTAMINANTS TO DRIVE MARKET

- 8.6 CEREALS & GRAINS

- 8.6.1 KEY ROLE OF LEADING FOOD TESTING COMPANIES IN ENSURING CEREAL & GRAIN SAFETY TO DRIVE MARKET

- 8.7 OTHER FOODS TESTED

9 RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 CONVENIENCE-BASED TESTING

- 9.2.1 EXPANDING USER-FRIENDLY RAPID FOOD SAFETY TESTING TECHNOLOGIES TO DRIVE MARKET

- 9.3 PCR-BASED TESTING

- 9.3.1 OPTIMIZING FOOD SAFETY MONITORING ACROSS DIVERSE FOOD TYPES TO DRIVE MARKET

- 9.4 IMMUNOASSAY-BASED TESTING

- 9.4.1 IMMUNOASSAY-BASED RAPID FOOD SAFETY TESTING TO WITNESS GROWTH AS DEMAND RISES FOR QUICK AND ACCURATE FOOD HAZARD DETECTION

- 9.5 CHROMATOGRAPHY & SPECTROMETRY

- 9.5.1 CUTTING-EDGE CHROMATOGRAPHY & SPECTROMETRY SOLUTIONS TO DRIVE MARKET

- 9.6 OTHER TECHNOLOGIES

10 END USERS OF RAPID FOOD SAFETY TESTING SOLUTIONS

- 10.1 INTRODUCTION

- 10.2 FOOD MANUFACTURERS

- 10.3 FOOD SERVICE & CATERING COMPANIES

- 10.4 RETAIL & SUPERMARKETS

- 10.5 OTHER END USERS

11 RAPID FOOD SAFETY TESTING MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Rising concern over USDA food recalls linked to contamination to drive market

- 11.2.2 CANADA

- 11.2.2.1 Stringent export regulations on food safety to drive market

- 11.2.3 MEXICO

- 11.2.3.1 Rising incidences of foodborne diseases to drive market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Enforcing stringent EU food safety norms to drive market

- 11.3.2 UK

- 11.3.2.1 Growing public health concerns from food poisoning incidences to drive market

- 11.3.3 FRANCE

- 11.3.3.1 Rising consumption of dairy products to drive market

- 11.3.4 ITALY

- 11.3.4.1 Increasing trade resulting in growing requirement for food safety testing to drive market

- 11.3.5 POLAND

- 11.3.5.1 Stringent food safety regulations to drive market

- 11.3.6 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Stringent government regulations and policies to strengthen growth prospects

- 11.4.2 INDIA

- 11.4.2.1 Adoption of advanced technologies and analytical instruments in food laboratories to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Push for global standards to boost rapid food safety testing adoption

- 11.4.4 AUSTRALIA & NEW ZEALAND

- 11.4.4.1 Rising investments from global companies to drive market

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Need to ensure food safety and protect public health and growing concern about dangers of foodborne illnesses to drive market

- 11.5.2 ARGENTINA

- 11.5.2.1 Strengthening public health protection and ensuring food supply chain safety to drive market

- 11.5.3 REST OF SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.6 REST OF THE WORLD

- 11.6.1 MIDDLE EAST

- 11.6.1.1 Growing dependence on food imports to drive market

- 11.6.2 AFRICA

- 11.6.2.1 Increasing foodborne-related cases to spur demand for rapid food safety testing

- 11.6.1 MIDDLE EAST

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Regional footprint

- 12.5.5.3 Target tested footprint

- 12.5.5.4 Food tested footprint

- 12.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2024

- 12.6.5.1 Detailed list of key start-ups/SMEs

- 12.6.5.2 Competitive benchmarking of key start-ups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- 12.8 BRAND/SERVICE COMPARATIVE ANALYSIS

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 SERVICE LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 EUROFINS SCIENTIFIC

- 13.1.1.1 Business overview

- 13.1.1.2 Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 SGS SOCIETE GENERALE DE SURVEILLANCE SA.

- 13.1.2.1 Business overview

- 13.1.2.2 Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Expansions

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 ALS

- 13.1.3.1 Business overview

- 13.1.3.2 Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Service launches

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 INTERTEK GROUP PLC

- 13.1.4.1 Business overview

- 13.1.4.2 Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Expansions

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 MERIEUX NUTRISCIENCES CORPORATION

- 13.1.5.1 Business overview

- 13.1.5.2 Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 TUV SUD

- 13.1.6.1 Business overview

- 13.1.6.2 Services offered

- 13.1.6.3 MnM view

- 13.1.7 ASUREQUALITY

- 13.1.7.1 Business overview

- 13.1.7.2 Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Expansions

- 13.1.7.3.2 Deals

- 13.1.7.4 MnM view

- 13.1.8 TENTAMUS

- 13.1.8.1 Business overview

- 13.1.8.2 Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Service launches

- 13.1.8.3.2 Expansions

- 13.1.8.4 MnM view

- 13.1.9 ALFA CHEMISTRY

- 13.1.9.1 Business overview

- 13.1.9.2 Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Service launches

- 13.1.9.4 MnM view

- 13.1.10 TUV NORD GROUP

- 13.1.10.1 Business overview

- 13.1.10.2 Services offered

- 13.1.10.3 MnM view

- 13.1.11 MICROBAC LABORATORIES

- 13.1.11.1 Business overview

- 13.1.11.2 Services offered

- 13.1.11.3 MnM view

- 13.1.12 HILL LABS

- 13.1.12.1 Business overview

- 13.1.12.2 Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Expansions

- 13.1.12.4 MnM view

- 13.1.13 FOODCHAIN ID

- 13.1.13.1 Business overview

- 13.1.13.2 Services offered

- 13.1.13.3 MnM view

- 13.1.14 ROMER LABS DIVISION HOLDING

- 13.1.14.1 Business overview

- 13.1.14.2 Services offered

- 13.1.14.3 MnM view

- 13.1.15 AGQ LABS

- 13.1.15.1 Business overview

- 13.1.15.2 Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Expansions

- 13.1.15.3.2 Deals

- 13.1.15.4 MnM view

- 13.1.1 EUROFINS SCIENTIFIC

- 13.2 OTHER PLAYERS

- 13.2.1 CERTIFIED GROUP

- 13.2.1.1 Business overview

- 13.2.1.2 Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Expansions

- 13.2.1.4 MnM view

- 13.2.2 SYMBIO LABS

- 13.2.2.1 Business overview

- 13.2.2.2 Services offered

- 13.2.2.3 MnM view

- 13.2.3 AGROLAB

- 13.2.3.1 Business overview

- 13.2.3.2 Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Deals

- 13.2.3.3.2 Expansions

- 13.2.3.4 MnM view

- 13.2.4 OMIC USA INC.

- 13.2.4.1 Business overview

- 13.2.4.2 Services offered

- 13.2.4.3 MnM view

- 13.2.5 FARE LABS

- 13.2.5.1 Business overview

- 13.2.5.2 Services offered

- 13.2.5.3 MnM view

- 13.2.6 CAMPDEN BRI

- 13.2.7 MITRA S.K. PRIVATE LIMITED

- 13.2.8 ELEMENT MATERIALS TECHNOLOGY

- 13.2.9 AMLAB SERVICES PTE. LTD.

- 13.2.10 COTECNA

- 13.2.1 CERTIFIED GROUP

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 FOOD SAFETY TESTING MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.4 FOOD PATHOGEN TESTING MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS