|

시장보고서

상품코드

1893731

SUV 시장 : 유형별, 추진별, 클래스별, 좌석수별, EV 유형별, 지역별 예측(-2032년)SUV Market By Type (Mini, Compact, Mid- & Full-Size, MPV), Propulsion (Diesel, Gasoline, Electric), Class (B, C, D, E), Seating Capacity (5-seater,>5-seater), EV Type (BEV, PHEV, FCEV), and Region - Forecast to 2032 |

||||||

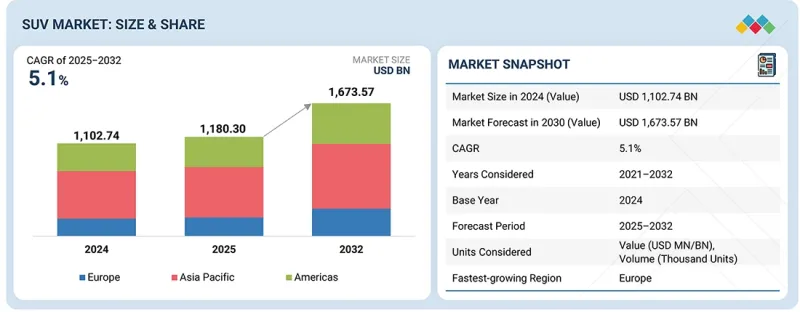

세계 SUV 시장 규모는 2025년 1조 1,803억 달러, 2032년까지 1조 6,735억 7,000만 달러에 이를 것으로 예측되며, CAGR은 5.1%를 나타낼 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 단위 | 금액(100만/10억 달러), 1,000대 |

| 부문 | 유형, 좌석 수, 추진, 클래스, 전기자동차/하이브리드 자동차 유형 |

| 대상 지역 | 아시아태평양, 유럽, 아메리카 |

미국과 유럽에서 SUV 수요는 첨단 섀시 구조에 의해 점차 추진되고 있으며, OEM 각 회사는 적응형 에어 서스펜션, 액티브 롤 컨트롤 및 지형에 최적화된 토크 관리 시스템을 통합하여 온로드 주행 성능과 오프로드 가동성을 양립시키고 있습니다. 프리미엄 SUV의 성장은 존 E/E 아키텍처로의 전환에 의해 지원되고 있어, 실시간 댐핑 제어, 예측적 ADAS 기능, 액티브 노이즈 캔슬링에 의한 NVH 차단성의 향상이 실현되고 있습니다. 고성능 e-SUV에 대한 소비자 수요 증가로 전자화가 가속화되고 있으며, OEM 각사는 800V 플랫폼, 고밀도 NMC 배터리 팩, 멀티 모터 e액슬로의 이행을 추진하고 있습니다. 이들은 견인 능력의 향상과 열적 견뢰성을 실현하여 구미 시장에서 중요한 성능 차별화 요소가 되고 있습니다.

중국, 인도, 일본에서는 모듈식 스케이트보드 플랫폼과 멀티에너지 플랫폼에 의해 소형·중형 SUV의 기세가 형성되고 있습니다. 이를 통해 자동차 제조업체는 차량 아키텍처를 재설계하지 않고 하이브리드, 터보 가솔린 및 BEV 파워트레인을 패키징할 수 있습니다. 1.0-1.5L의 터보차저를 탑재한 GDI 엔진, e-CVT를 탑재한 강력한 하이브리드 시스템, 그리고 현지화된 배터리 모듈로의 이행에 의해 SUV는 세단보다 효율적이고 비용 경쟁력이 높은 것으로 되어 있습니다. 중국과 인도 제조 업체는 경량 멀티 링크 후면 서스펜션, 고장력 강철 케이지, 소형 e 드라이브 유닛도 채택하여 적극적인 가격 설정을 유지하면서 핸들링 성능과 충돌 안전성을 향상시키고 있습니다.

'5인승 부문이 예측 기간에 큰 시장 점유율을 유지할 것으로 예측됩니다.'

아시아태평양과 유럽에서는 미니 SUV, 소형 SUV 및 일부 중형 SUV가 계속 지원을 받고 있습니다. 그 요인은 도시 지역의 기동성과 향상된 캐빈 인체 공학의 균형을 맞춘 최적화 된 2열 시트 구성입니다. 아시아태평양에서는 가처분 소득 증가와 급속한 도시 확대로 젊은 구매자가 SUV로 전환하고 있습니다. 이 SUV는 고급 인포테인먼트 시스템, ADAS Level 1-2 기능, 고효율 터보 하이브리드 파워트레인을 통합하여 대형 부문의 가격 부담 없이 프리미엄 기능을 제공합니다. 자동차 제조업체 각 사는 현지화된 모듈형 플랫폼(예: CMP, TNGA-B, BMA)을 활용해 외형은 컴팩트하게 유지하면서도 실내 공간을 극대화한 넉넉한 5인승 구조를 구현하고 있으며, 이는 도심 밀집 지역에서의 활용 수요에 직접적으로 부합하고 있습니다.

유럽에서는 장거리 주행시의 쾌적성, 개량형 멀티링크 리어 서스펜션, 뛰어난 적재 능력을 갖추면서, 엄격한 EU의 배기가스 규제나 안전 기준에 적합한 차량에 대한 수요에 의해 프리미엄 5인승 중형 SUV가 급성장하고 있습니다. Volkswagen, BMW, Mercedes-Benz, Skoda, Audi 등 유럽 자동차 제조업체는 48V 마일드 하이브리드 시스템 통합, 첨단 섀시 도메인 컨트롤 유닛, 고강도 경량 구조를 채택한 모델로 라인업을 확충하여 효율성과 주행 성능을 함께 향상시키고 있습니다. 이러한 기술 혁신과 넓고 도시 사용에 적합한 차량을 요구하는 소비자의 선호가 결합되어 5인승 SUV 부문의 성장이 뒷받침되고 있습니다.

"클래스 D가 예측 기간에 가장 큰 부문이 될 것으로 예측됩니다."

인도, 중국, 태국이 MQB, TNGA-K, SPA, CLAR 등의 확장 가능한 아키텍처를 채택한 대형 복수열 차량으로 전환하고 있어, 휠 베이스의 연장과 차내 공간의 최적화가 가능하게 되기 때문에 클래스 D가 세계의 SUV 수요를 계속 촉진하고 있습니다.

이 보고서는 세계 SUV 시장에 대한 조사 분석을 통해 주요 촉진요인과 억제요인, 제품 개발 및 혁신, 경쟁 구도에 대한 지식을 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요한 지견

- SUV 시장의 기업에게 매력적인 기회

- SUV 시장 : 유형별

- SUV 시장 : 좌석수별

- SUV 시장 : 클래스별

- SUV 시장 : 추진별

- 전기 SUV 시장 : 유형별

- SUV 시장 : 지역별

제4장 시장 개요

- 시장 역학

- 성장 촉진 요인

- 억제 요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 상호접속된 시장과 부문간 기회

- Tier 1/2/3 공급업체의 전략적 움직임

제5장 기술의 진보, AI에 의한 영향, 특허, 혁신, 장래의 용도

- 주요 기술

- 800V 전동 파워트레인 시스템

- ADAS와 자율주행 스위트

- 보완 기술

- AR 헤드업 디스플레이

- 패키징된 연료전지 파워 모듈

- 기술 로드맵

- 단기 로드맵

- 중기 로드맵

- 장기 로드맵

- 특허 분석

- 미래의 용도

- AI/생성형 AI의 영향

- 주요 이용 사례와 시장의 장래성

- 모범 사례

- AI 도입의 케이스 스터디

- 상호 연결된 생태계와 시장 기업에 미치는 영향

- AI/생성형 AI 채택에 대한 클라이언트의 준비 상황

- 성공 사례와 실세계에의 응용

제6장 고객정세와 구매행동

- 의사결정 프로세스

- 바이어의 스테이크홀더와 구입 평가 기준

- 구매 프로세스의 주요 이해 관계자

- 구입 기준

- 채택 장벽과 내부 과제

- 최종 이용 산업의 미충족 요구

- 시장의 수익성

- 잠재적인 수익

- 비용역학

- 마진 기회 : 용도별

제7장 규제 상황

- 지역 규제 및 규정 준수

- 규제기관, 정부기관, 기타 조직

- 업계 표준

제8장 업계 동향

- 거시경제지표

- GDP의 동향과 예측

- SUV 업계 동향

- 생태계 분석

- OEM

- 부품 제조업체

- 소프트웨어 제공업체

- SUV 충전 제공업체

- 배터리 제조업체

- 최종 사용자

- 공급망 분석

- 가격 설정 분석

- SUV 평균 판매 가격 : 주요 제조업체별(2024년)

- ICE SUV 평균 판매 가격 : 지역별(2024년)

- 전기 SUV 평균 판매 가격 : 지역별(2024년)

- 고객사업에 영향을 주는 동향과 혼란

- 투자 및 자금조달 시나리오

- 자금 제공 : 신청별

- 주요 컨퍼런스 및 이벤트(2025년-2026년)

- 무역 분석

- 수입 시나리오(HS 코드 870380)

- 수출 시나리오(HS 코드 870380)

- 사례 연구 분석

- 전기 SUV 제조 확대

- 프리미엄 전기 SUV 포트폴리오의 쇄신

- 시장의 다양화를 위한 전략적 투자

- 기존/향후 SUV 모델

- 총 소유 비용

- ICE와 EV의 가격 비교

- 부품표

- 세계 SUV L**H의 분석

- 세계의 전기 SUV L**H의 분석

- SUV와 전승용차의 매출 대수의 비교(2018년-2023년)

- SUV와 전승용차의 매출 대수의 비교(2024년-2030년)

- 승용차의 총 매출에 있어서의 SUV의 보급률(2018년-2030년)

- 세계의 SUV의 매출 : 유형별(2023년-2030년)

- 세계의 SUV의 매출 : 추진별(2023년-2030년)

- 세계의 SUV의 매출:지역별(2018년-2030년)

- SUV L**H의 분석 : 지역별

- 북미

- 유럽

- 아시아태평양

- 세계의 평균 배터리 비용 분석

- 전기 SUV의 배터리 용량과 항속 거리 분석

- 전기 SUV의 가격과 항속 거리 분석

- SUV 연료전지

- SUV 플랫폼

- 현재 SUV 플랫폼

- SUV 플랫폼의 미래

- SUV 제조 공장 : OEM별, 입지별

- SUV L**H의 분석 : OEM별

- TOYOTA GROUP

- VOLKSWAGEN GROUP

- HYUNDAI MOTOR COMPANY

제9장 SUV 시장 : 유형별

- 미니

- 소형

- 중형

- 풀 사이즈

- MPV/MUV

- 중요한 지견

제10장 SUV 시장 : 클래스별

- 클래스 B

- 클래스 C

- 클래스 D

- 클래스 E

- 중요한 지견

제11장 SUV 시장 : 좌석수별

- 5인승

- 6인승 이상

- 중요한 지견

제12장 SUV 시장 : 추진별

- 가솔린

- 디젤

- 전기

- 중요한 지견

제13장 전기 SUV 시장 : 유형별

- BEV

- PHEV

- FCEV

- 중요한 지견

제14장 SUV 매출 : 유형별

- 소형

- 아시아태평양

- 유럽

- 아메리카

- 중형

- 아시아태평양

- 유럽

- 아메리카

- 대형

- 아시아태평양

- 유럽

- 아메리카

제15장 SUV 시장 : 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 인도네시아

- 기타 아시아태평양

- 유럽

- 독일

- 프랑스

- 이탈리아

- 스페인

- 영국

- 체코 공화국

- 슬로바키아

- 러시아

- 기타 유럽

- 아메리카

- 미국

- 캐나다

- 멕시코

- 브라질

- 중요한 지견

제16장 경쟁 구도

- 주요 참가 기업의 전략/강점(2023년-2025년)

- 시장 점유율 분석(2024년)

- 수익 분석(2020년-2024년)

- 기업 평가 및 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 경쟁 시나리오

제17장 기업 프로파일

- 주요 기업

- TOYOTA MOTOR CORPORATION

- HONDA MOTOR CO., LTD.

- HYUNDAI MOTOR COMPANY

- GENERAL MOTORS

- STELLANTIS NV

- VOLKSWAGEN GROUP

- FORD MOTOR COMPANY

- MERCEDES-BENZ

- BMW GROUP

- NISSAN MOTORS

- 기타 기업

- RENAULT GROUP

- SUZUKI MOTOR CORPORATION

- SUBARU CORPORATION

- TATA MOTORS

- MITSUBISHI MOTORS CORPORATION

- MAHINDRA & MAHINDRA LIMITED

- VOLVO CAR CORPORATION

- TESLA, INC.

- MAZDA MOTOR CORPORATION

- BYD COMPANY LTD.

- ISUZU MOTORS LIMITED

제18장 조사 방법

제19장 부록

SHW 26.01.06The SUV market is expected to grow from USD 1,180.30 billion in 2025 to USD 1,673.57 billion in 2032, registering a CAGR of 5.1%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD MN/BN), Volume (Thousand Units) |

| Segments | Type, Seating Capacity, Propulsion, Class, Electric & Hybrid Vehicle Type |

| Regions covered | Asia Pacific, Europe, Americas |

In the US and Europe, SUV demand is increasingly driven by advanced chassis architectures, where OEMs are integrating adaptive air suspensions, active roll control, and terrain-calibrated torque management systems to enhance both on-road dynamics and off-road articulation. Premium SUV growth is supported by the shift to zonal E/E architectures, enabling real-time damping control, predictive ADAS functions, and improved NVH isolation through active noise cancellation. Electrification is accelerating due to consumer demand for high-performance e-SUVs, pushing OEMs toward 800V platforms, high-density NMC battery packs, and multi-motor e-axles that deliver higher towing capacity and thermal robustness, critical performance differentiators in the Western market.

In China, India, and Japan, the momentum for compact and mid-size SUVs is being shaped by modular skateboard and multi-energy platforms that enable OEMs to package hybrid, turbo-petrol, and BEV powertrains without requiring redesign of the vehicle architecture. The shift toward 1.0-1.5L turbocharged GDI engines, strong-hybrid systems with e-CVTs, and localized battery modules has made SUVs more efficient and cost-competitive than sedans. Chinese and Indian manufacturers are also deploying lightweight multilink rear suspensions, high-strength steel cages, and compact e-drive units to improve handling and crash safety while maintaining aggressive pricing.

"The 5-seater segment is expected to hold a larger market share during the forecast period."

Mini, compact, and select mid-size SUVs in Asia Pacific and Europe continue to gain traction due to their optimized 2-row configurations, which balance urban maneuverability with enhanced cabin ergonomics. In Asia Pacific, increased disposable income and rapid urban expansion are pushing young buyers toward SUVs that integrate advanced infotainment domains, ADAS Level 1-2 features, and high-efficiency turbo-hybrid powertrains, delivering premium functionality without the pricing burden of larger segments. Automakers are also leveraging localized modular platforms (e.g., CMP, TNGA-B, BMA) to engineer roomier 5-seater layouts and maximize interior volume despite compact exterior footprints, directly appealing to dense-city use cases.

In Europe, the surge in premium 5-seater mid-size SUVs is driven by the demand for vehicles that combine long-distance comfort, upgraded multilink rear suspensions, and enhanced cargo capacity while remaining compliant with stringent EU emissions and safety norms. European OEMs, such as Volkswagen, BMW, Mercedes-Benz, Skoda, and Audi, are expanding their portfolios with models featuring 48V mild-hybrid integration, advanced chassis domain control units, and high-strength, lightweight structures to improve both efficiency and dynamic capability. These engineering advancements, combined with consumer preferences for spacious yet city-suitable vehicles, are reinforcing the growth of the 5-seater SUV segment.

"Class D is expected to be the largest segment during the forecast period."

Class D continues to dominate global SUV demand, as India, China, and Thailand shift toward larger, multi-row vehicles built on scalable architectures like MQB, TNGA-K, SPA, and CLAR, which enable higher wheelbases and improved cabin packaging. These models increasingly feature electrified AWD (e-axles), 2.0-3.0L turbocharged powertrains, and multilink rear suspensions, providing superior tractability and high-speed stability compared to smaller classes. Rising consumer preference for 3-row flexibility, higher towing capacity, and long-distance ride comfort continues to make Class-D SUVs attractive in both ICE and hybrid categories. Premium OEMs, including BMW, Mercedes-Benz, Lexus, Land Rover, and Cadillac, are upgrading this segment with 48V systems, advanced ADAS L2+/L3 preparation, and lightweight aluminum subframes, further driving market growth. As emerging markets upscale and infrastructure improves, Class-D SUVs are becoming the default choice for families seeking larger footprint vehicles with premium mechanical and software capabilities.

The Americas is expected to be the second-largest market during the forecast period."

The Americas remain the second-largest SUV market, driven by strong demand for premium D- and E-segment SUVs equipped with high-output turbo/V6 engines, electrified AWD systems, and advanced ADAS L2+ suites. In the US, luxury OEMs now generate 70-80% of their premium volumes from SUVs, supported by consumer preference for high ground clearance, tow ratings above 3,500-5,000 lbs, multi-terrain drive modes, and long-wheelbase comfort. The shift toward hybrid and extended-range SUV architectures is accelerating as CAFE and EPA standards tighten, pushing Ford, GM, and Stellantis to expand battery-electric body-on-frame platforms. Full-size and three-row SUVs remain dominant due to their superior cabin space and payload/towing capability, making them the preferred choice across the US and Canada. Mexico contributes to strong growth in compact and mid-size SUVs, driven by cost-sensitive buyers and the expansion of local manufacturing by Asian OEMs. The competitive landscape is intensifying as Tesla, Hyundai-Kia, BMW, and Toyota scale up regional production of electric and hybrid SUVs, reshaping the powertrain mix and supply chain localization.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Automotive OEMs - 90%, Tier 1 - 10%

- By Designation: C-level - 35%, Director Level - 55%, Others - 10%

- By Region: North America - 20%, Europe - 45%, Asia Pacific - 30%, Rest of the World - 5%

The SUV market is dominated by established players, such as Toyota Motor Corporation (Japan), Hyundai Motor Company (South Korea), Honda Motor Co., Ltd. (Japan), General Motors (US), Ford Motor Company (US), and Stellantis (Netherlands).

Research Coverage:

The study segments the SUV market and forecasts the market size based on type (mini, compact, mid-size, full-size, MPV/MUV), seating capacity (5-seater, >5-seater), propulsion (diesel, gasoline, electric), class (B, C, D, E), electric & hybrid vehicle type (BEV, PHEV, FCEV), and region (Asia Pacific, Europe, Americas).

Key Benefits of Purchasing this Report

The study provides a comprehensive competitive analysis of key market players, including their company profiles, key insights into product and business offerings, recent developments, and primary market strategies. The report will assist market leaders and new entrants with estimates of revenue figures for the overall SUV market and its subsegments. It helps stakeholders understand the competitive landscape and gain additional insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report provides information on key market drivers, restraints, challenges, and opportunities, enabling stakeholders to stay informed about market dynamics.

The report provides insights into the following points:

- Analysis of key drivers (demand for premium vehicles with advanced features and consumer inclination toward compact and mid-size SUVs), restraints (high cost of SUVs), opportunities (trend of electrification), and challenges (Adherence to fuel economy and emission limits and range limitations of electric SUVs) influencing the growth of the SUV market

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and product launches in the SUV market

- Market Development: Comprehensive information about lucrative markets; the report analyzes the SUV across various regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the SUV market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Toyota Motor Corporation (Japan), Hyundai Motor Company (South Korea), Honda Motor (Japan), General Motors (US), Ford Motor Company (US), and Stellantis (Netherlands)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN SUV MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

- 2.6 SUV PRODUCTION VS. SALES OUTLOOK

- 2.7 SUV PRODUCTION VS. TOTAL CAR PRODUCTION OUTLOOK

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SUV MARKET

- 3.2 SUV MARKET, BY TYPE

- 3.3 SUV MARKET, BY SEATING CAPACITY

- 3.4 SUV MARKET, BY CLASS

- 3.5 SUV MARKET, BY PROPULSION

- 3.6 ELECTRIC SUV MARKET, BY TYPE

- 3.7 SUV MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Surge in demand for premium vehicles with advanced features

- 4.2.1.2 Consumer inclination toward compact and mid-size SUVs

- 4.2.1.3 Launch of new EV models by major OEMs

- 4.2.2 RESTRAINTS

- 4.2.2.1 High cost of SUVs

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Trend of electrification

- 4.2.4 CHALLENGES

- 4.2.4.1 Adherence to fuel economy and emission limits

- 4.2.4.2 Range limitations of electric SUVs

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 SUPPLIERS

5 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 5.1 KEY TECHNOLOGIES

- 5.1.1 800V ELECTRIFIED POWERTRAIN SYSTEMS

- 5.1.2 ADAS AND AUTONOMOUS DRIVING SUITES

- 5.2 COMPLEMENTARY TECHNOLOGIES

- 5.2.1 AR-BASED HEAD-UP DISPLAYS

- 5.2.2 PACKAGED FUEL CELL POWER MODULES

- 5.3 TECHNOLOGY ROADMAP

- 5.3.1 SHORT-TERM ROADMAP

- 5.3.2 MID-TERM ROADMAP

- 5.3.3 LONG-TERM ROADMAP

- 5.4 PATENT ANALYSIS

- 5.5 FUTURE APPLICATIONS

- 5.6 IMPACT OF AI/GEN AI

- 5.6.1 TOP USE CASES AND MARKET POTENTIAL

- 5.6.2 BEST PRACTICES

- 5.6.3 CASE STUDIES OF AI IMPLEMENTATION

- 5.6.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 5.6.5 CLIENTS' READINESS TO ADOPT AI/GEN AI

- 5.6.6 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 5.6.6.1 Ford Motor Company: AI for adaptive vehicle diagnostics and predictive maintenance

- 5.6.6.2 Mercedes-Benz Group: Gen AI for personalized in-cabin experience and design optimization

- 5.6.6.3 Hyundai Motor Company: AI for energy management and off-road performance optimization

6 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 6.1 DECISION-MAKING PROCESS

- 6.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.2.2 BUYING CRITERIA

- 6.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 6.4 UNMET NEEDS FROM END-USE INDUSTRIES

- 6.5 MARKET PROFITABILITY

- 6.5.1 REVENUE POTENTIAL

- 6.5.2 COST DYNAMICS

- 6.5.3 MARGIN OPPORTUNITIES BY APPLICATION

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

8 INDUSTRY TRENDS

- 8.1 MACROECONOMIC INDICATORS

- 8.1.1 INTRODUCTION

- 8.1.2 GDP TRENDS AND FORECAST

- 8.1.3 TRENDS IN SUV INDUSTRY

- 8.2 ECOSYSTEM ANALYSIS

- 8.2.1 OEMS

- 8.2.2 COMPONENT MANUFACTURERS

- 8.2.3 SOFTWARE PROVIDERS

- 8.2.4 SUV CHARGING PROVIDERS

- 8.2.5 BATTERY MANUFACTURERS

- 8.2.6 END USERS

- 8.3 SUPPLY CHAIN ANALYSIS

- 8.4 PRICING ANALYSIS

- 8.4.1 AVERAGE SELLING PRICE OF SUVS OFFERED BY KEY PLAYERS, 2024

- 8.4.2 AVERAGE SELLING PRICE OF ICE SUVS, BY REGION, 2024

- 8.4.3 AVERAGE SELLING PRICE OF ELECTRIC SUVS, BY REGION, 2024

- 8.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 8.6 INVESTMENT AND FUNDING SCENARIO

- 8.7 FUNDING, BY APPLICATION

- 8.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 8.9 TRADE ANALYSIS

- 8.9.1 IMPORT SCENARIO (HS CODE 870380)

- 8.9.2 EXPORT SCENARIO (HS CODE 870380)

- 8.10 CASE STUDY ANALYSIS

- 8.10.1 ELECTRIFIED SUV MANUFACTURING EXPANSION

- 8.10.2 PREMIUM ELECTRIC SUV PORTFOLIO REVAMP

- 8.10.3 STRATEGIC INVESTMENTS FOR MARKET DIVERSIFICATION

- 8.11 EXISTING AND UPCOMING SUV MODELS

- 8.12 TOTAL COST OF OWNERSHIP

- 8.13 ICE VS. EV PRICE COMPARISON

- 8.14 BILL OF MATERIALS

- 8.15 GLOBAL SUV L**H ANALYSIS

- 8.16 GLOBAL ELECTRIC SUV L**H ANALYSIS

- 8.17 SUV VS. TOTAL PASSENGER VEHICLE VOLUME SALES, 2018-2023

- 8.18 SUV VS. TOTAL PASSENGER VEHICLE VOLUME SALES, 2024-2030

- 8.19 SUV PENETRATION IN TOTAL PASSENGER CAR SALES, 2018-2030

- 8.20 GLOBAL SUV SALES, BY TYPE, 2023-2030

- 8.21 GLOBAL SUV SALES, BY PROPULSION, 2023-2030

- 8.22 GLOBAL SUV SALES, BY REGION, 2018-2030

- 8.23 SUV L**H ANALYSIS, BY REGION

- 8.23.1 NORTH AMERICA

- 8.23.2 EUROPE

- 8.23.3 ASIA PACIFIC

- 8.24 GLOBAL AVERAGE BATTERY COST ANALYSIS

- 8.25 ELECTRIC SUV BATTERY CAPACITY VS. RANGE ANALYSIS

- 8.26 ELECTRIC SUV PRICING VS. RANGE ANALYSIS

- 8.27 FUEL CELLS IN SUV

- 8.28 SUV PLATFORMS

- 8.28.1 CURRENT SUV PLATFORMS

- 8.28.2 FUTURE OF SUV PLATFORMS

- 8.29 SUV MANUFACTURING PLANTS BY OEM AND LOCATION

- 8.30 SUV L**H ANALYSIS, BY OEM

- 8.30.1 TOYOTA GROUP

- 8.30.2 VOLKSWAGEN GROUP

- 8.30.3 HYUNDAI MOTOR COMPANY

9 SUV MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 MINI

- 9.2.1 LOWER OWNERSHIP COST TO DRIVE MARKET

- 9.3 COMPACT

- 9.3.1 INCREASED CONSUMER PREFERENCE DUE TO POWERTRAIN VARIANTS AND AFFORDABILITY TO DRIVE MARKET

- 9.4 MID-SIZE

- 9.4.1 BETTER FUNCTIONALITY AND PRACTICAL FEATURES TO DRIVE MARKET

- 9.5 FULL-SIZE

- 9.5.1 LARGER CABIN AREA AND SUPERIOR ENGINE PERFORMANCE TO DRIVE MARKET

- 9.6 MPV/MUV

- 9.6.1 PREFERENCE FOR COMPACT AND MID-SIZE SUVS TO IMPEDE MARKET

- 9.7 PRIMARY INSIGHTS

10 SUV MARKET, BY CLASS

- 10.1 INTRODUCTION

- 10.2 CLASS B

- 10.2.1 ONGOING ENGINEERING UPGRADES TO DRIVE MARKET

- 10.3 CLASS C

- 10.3.1 LONG-WHEELBASE PACKAGING AND ADVANCED SAFETY ELECTRONICS TO DRIVE MARKET

- 10.4 CLASS D

- 10.4.1 IMPROVED CONVENIENCE WITH OFF-ROADING CAPABILITIES TO DRIVE MARKET

- 10.5 CLASS E

- 10.5.1 HIGHER ACCEPTANCE OF LUXURY VEHICLES IN NORTH AMERICA TO DRIVE MARKET

- 10.6 PRIMARY INSIGHTS

11 SUV MARKET, BY SEATING CAPACITY

- 11.1 INTRODUCTION

- 11.2 5-SEATER

- 11.2.1 HIGH DEMAND FOR COMPACT SUVS IN EMERGING COUNTRIES TO DRIVE MARKET

- 11.3 >5-SEATER

- 11.3.1 INCLINATION FOR FULL-SIZE SUVS TO DRIVE MARKET

- 11.4 PRIMARY INSIGHTS

12 SUV MARKET, BY PROPULSION

- 12.1 INTRODUCTION

- 12.2 GASOLINE

- 12.2.1 PUSH FOR CLEANER FUEL WITH ENHANCED PERFORMANCE TO DRIVE MARKET

- 12.3 DIESEL

- 12.3.1 GLOBAL ADOPTION OF EURO 6/VI, BS-VI PHASE II, CHINA 6B, AND US TIER 3 STANDARDS TO IMPEDE MARKET

- 12.4 ELECTRIC

- 12.4.1 STRINGENT EMISSION NORMS AND HIGHER FUEL EFFICIENCY TO DRIVE MARKET

- 12.5 PRIMARY INSIGHTS

13 ELECTRIC SUV MARKET, BY TYPE

- 13.1 INTRODUCTION

- 13.2 BEV

- 13.2.1 DEVELOPMENT OF HIGH-RANGE BATTERIES AND FAST CHARGING INFRASTRUCTURE TO DRIVE MARKET

- 13.3 PHEV

- 13.3.1 ELEVATED DEMAND FOR FLEXIBLE POWERTRAINS TO DRIVE MARKET

- 13.4 FCEV

- 13.4.1 SUBSTANTIAL INVESTMENTS IN NEWER MODELS TO DRIVE MARKET

- 13.5 PRIMARY INSIGHTS

14 SUV SALES, BY TYPE

- 14.1 INTRODUCTION

- 14.2 COMPACT

- 14.2.1 ASIA PACIFIC

- 14.2.2 EUROPE

- 14.2.3 AMERICAS

- 14.3 MID-SIZE

- 14.3.1 ASIA PACIFIC

- 14.3.2 EUROPE

- 14.3.3 AMERICAS

- 14.4 FULL-SIZE

- 14.4.1 ASIA PACIFIC

- 14.4.2 EUROPE

- 14.4.3 AMERICAS

15 SUV MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 ASIA PACIFIC

- 15.2.1 CHINA

- 15.2.1.1 Strong demand for compact and mid-size SUVs to drive market

- 15.2.2 INDIA

- 15.2.2.1 Recent launches and feature updates to drive market

- 15.2.3 JAPAN

- 15.2.3.1 Consumer preference for advanced features with improved cabin comfort to drive market

- 15.2.4 SOUTH KOREA

- 15.2.4.1 Rapid shift toward hybrid and electric SUVs to drive market

- 15.2.5 INDONESIA

- 15.2.5.1 Preference for family-oriented vehicles to drive market

- 15.2.6 REST OF ASIA PACIFIC

- 15.2.1 CHINA

- 15.3 EUROPE

- 15.3.1 GERMANY

- 15.3.1.1 High demand for premium cars to drive market

- 15.3.2 FRANCE

- 15.3.2.1 Shift toward hybrid and fully electric SUVs due to regulatory pressures to drive market

- 15.3.3 ITALY

- 15.3.3.1 Rise of electrification and urban-friendly designs to drive market

- 15.3.4 SPAIN

- 15.3.4.1 Strong consumer demand to drive market

- 15.3.5 UK

- 15.3.5.1 High per capita income and robust economic conditions to drive market

- 15.3.6 CZECH REPUBLIC

- 15.3.6.1 Strong supplier networks and favorable production ecosystem to drive market

- 15.3.7 SLOVAKIA

- 15.3.7.1 Significant presence of OEMs to drive market

- 15.3.8 RUSSIA

- 15.3.8.1 Growing consumer interest in hybrid and fully electric SUVs to drive market

- 15.3.9 REST OF EUROPE

- 15.3.1 GERMANY

- 15.4 AMERICAS

- 15.4.1 US

- 15.4.1.1 High demand for powerful vehicles for off-roading to drive market

- 15.4.2 CANADA

- 15.4.2.1 Regulatory push toward sustainability to drive market

- 15.4.3 MEXICO

- 15.4.3.1 Rise in domestic purchasing power and proximity to US to drive market

- 15.4.4 BRAZIL

- 15.4.4.1 Competitive manufacturing costs and availability of skilled labor to drive market

- 15.4.1 US

- 15.5 PRIMARY INSIGHTS

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 16.3 MARKET SHARE ANALYSIS, 2024

- 16.4 REVENUE ANALYSIS, 2020-2024

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6 BRAND/PRODUCT COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT

- 16.7.5.1 Company footprint

- 16.7.5.2 Region footprint

- 16.7.5.3 Propulsion footprint

- 16.7.5.4 Application footprint

- 16.7.5.5 Type footprint

- 16.8 COMPETITIVE SCENARIO

- 16.8.1 PRODUCT LAUNCHES

- 16.8.2 DEALS

- 16.8.3 EXPANSIONS

- 16.8.4 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 TOYOTA MOTOR CORPORATION

- 17.1.1.1 Business overview

- 17.1.1.2 Products offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches

- 17.1.1.3.2 Deals

- 17.1.1.3.3 Expansions

- 17.1.1.3.4 Other developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 HONDA MOTOR CO., LTD.

- 17.1.2.1 Business overview

- 17.1.2.2 Products offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches

- 17.1.2.3.2 Deals

- 17.1.2.3.3 Expansions

- 17.1.2.3.4 Other developments

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 HYUNDAI MOTOR COMPANY

- 17.1.3.1 Business overview

- 17.1.3.2 Products offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches

- 17.1.3.3.2 Deals

- 17.1.3.3.3 Other developments

- 17.1.3.4 MnM view

- 17.1.3.4.1 Key strengths

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses and competitive threats

- 17.1.4 GENERAL MOTORS

- 17.1.4.1 Business overview

- 17.1.4.2 Products offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches

- 17.1.4.3.2 Deals

- 17.1.4.3.3 Expansions

- 17.1.4.3.4 Other developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 STELLANTIS N.V.

- 17.1.5.1 Business overview

- 17.1.5.2 Products offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches

- 17.1.5.3.2 Deals

- 17.1.5.3.3 Expansions

- 17.1.5.3.4 Other developments

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 VOLKSWAGEN GROUP

- 17.1.6.1 Business overview

- 17.1.6.2 Products offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Product launches

- 17.1.6.3.2 Deals

- 17.1.6.3.3 Expansions

- 17.1.6.3.4 Other developments

- 17.1.6.4 MnM view

- 17.1.6.4.1 Key strengths

- 17.1.6.4.2 Strategic choices

- 17.1.6.4.3 Weaknesses and competitive threats

- 17.1.7 FORD MOTOR COMPANY

- 17.1.7.1 Business overview

- 17.1.7.2 Products offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Deals

- 17.1.7.3.2 Other developments

- 17.1.8 MERCEDES-BENZ

- 17.1.8.1 Business overview

- 17.1.8.2 Products offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product launches

- 17.1.8.3.2 Other developments

- 17.1.9 BMW GROUP

- 17.1.9.1 Business overview

- 17.1.9.2 Products offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches

- 17.1.9.3.2 Expansions

- 17.1.9.3.3 Other developments

- 17.1.10 NISSAN MOTORS

- 17.1.10.1 Business overview

- 17.1.10.2 Products offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches

- 17.1.10.3.2 Deals

- 17.1.1 TOYOTA MOTOR CORPORATION

- 17.2 OTHER PLAYERS

- 17.2.1 RENAULT GROUP

- 17.2.2 SUZUKI MOTOR CORPORATION

- 17.2.3 SUBARU CORPORATION

- 17.2.4 TATA MOTORS

- 17.2.5 MITSUBISHI MOTORS CORPORATION

- 17.2.6 MAHINDRA & MAHINDRA LIMITED

- 17.2.7 VOLVO CAR CORPORATION

- 17.2.8 TESLA, INC.

- 17.2.9 MAZDA MOTOR CORPORATION

- 17.2.10 BYD COMPANY LTD.

- 17.2.11 ISUZU MOTORS LIMITED

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.1.1 SECONDARY DATA

- 18.1.1.1 List of secondary sources to estimate vehicle production

- 18.1.1.2 List of secondary sources to estimate market size

- 18.1.1.3 Key data from secondary sources

- 18.1.2 PRIMARY DATA

- 18.1.2.1 Primary interviewees from demand and supply sides

- 18.1.2.2 Breakdown of primary interviews

- 18.1.2.3 List of primary participants

- 18.1.1 SECONDARY DATA

- 18.2 MARKET SIZE ESTIMATION

- 18.2.1 BOTTOM-UP APPROACH

- 18.2.2 TOP-DOWN APPROACH

- 18.3 DATA TRIANGULATION

- 18.4 FACTOR ANALYSIS

- 18.5 RESEARCH ASSUMPTIONS AND RISK ASSESSMENT

- 18.6 RESEARCH LIMITATIONS

19 APPENDIX

- 19.1 INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.4.1 SUV MARKET, BY CLASS, AT COUNTRY LEVEL

- 19.4.1.1 Class B

- 19.4.1.2 Class C

- 19.4.1.3 Class D

- 19.4.1.4 Class E

- 19.4.2 ELECTRIC SUV MARKET, AT COUNTRY LEVEL

- 19.4.1 SUV MARKET, BY CLASS, AT COUNTRY LEVEL

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS