|

시장보고서

상품코드

1939031

주문형 비디오(VOD) : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2026-2031년)Video-on-Demand - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

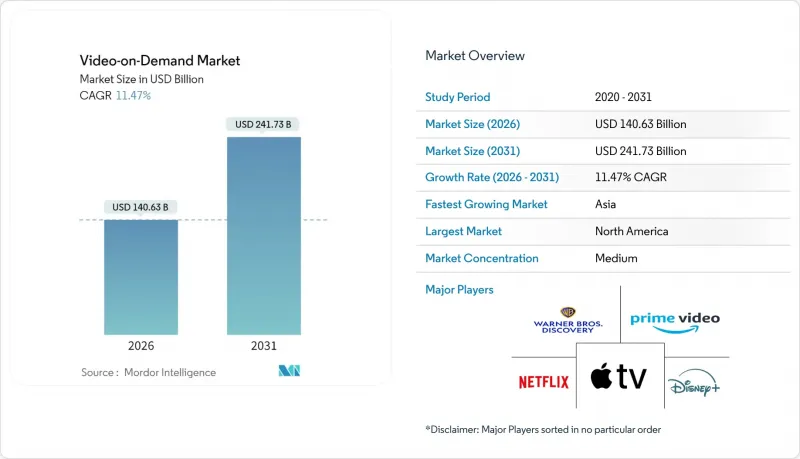

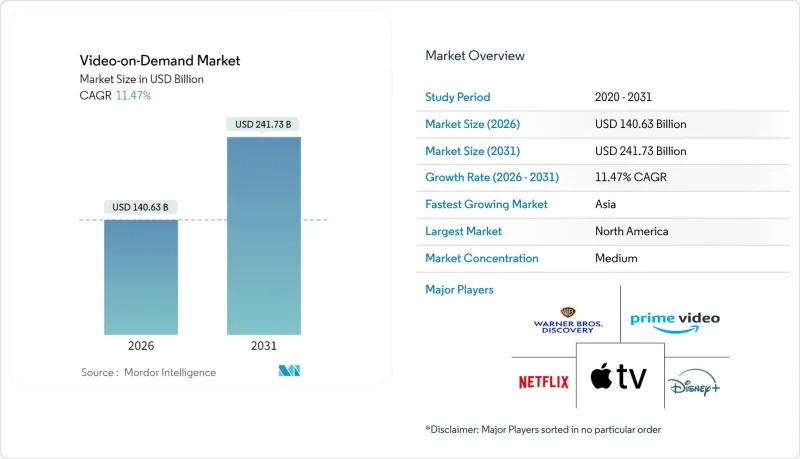

주문형 비디오(VOD) 시장은 2025년에 1,261억 6,000만 달러로 평가되었으며, 2026년 1,406억 3,000만 달러에서 2031년까지 2,417억 3,000만 달러에 달할 것으로 예측됩니다.

예측 기간(2026-2031년) 동안 CAGR은 11.47%로 예상됩니다.

이러한 성장의 가속화는 브로드밴드의 급속한 보급, 디바이스 다양화, 풍부한 컨텐츠 라이브러리, 예약형 TV에서 온디맨드 스트리밍으로의 꾸준한 전환을 반영하고 있습니다. 북미와 서유럽의 초고속 광섬유와 5G의 보급으로 4K 재생이 원활하게 이루어지고 있는 반면, 아시아에서는 현지 언어로 된 제작 예산이 지역 시청자들의 관심을 유지하고 있습니다. 광고 수익형 요금제의 급격한 증가는 가격에 민감한 가구에 새로운 진입 기회를 제공하고, 라틴아메리카에서는 통신 번들로 인해 획득 비용이 감소하고 있습니다. 시장 리더들이 컨텐츠 독점 제공, 교차 서비스 번들, 비용 효율적인 전송 네트워크를 통해 해지 위험을 헤지하고 있기 때문에 경쟁의 강도는 여전히 높은 수준입니다.

세계 VOD 시장 동향 및 인사이트

아시아태평양 신흥 시장에서의 AVOD 플랫폼의 빠른 확산

아시아태평양의 시청자들은 플랫폼이 낮은 비용을 지불하는 대신 높은 도달 범위를 확보하는 전략으로 인해 광고 수익형 서비스를 적극적으로 이용하고 있습니다. 이 전략으로 2023년 지역 전체 동영상 수익은 244억 달러에 달할 것으로 예상하고 있습니다(avia.org). 광고주들은 같은 해 총 14억 명의 순 시청자가 약 140억 시간 동안 아시아 컨텐츠를 시청한 것을 높이 평가하고 있습니다(avia.org). 예측에 따르면, AVOD 인벤토리의 확대에 따라 2030년까지 이 지역에서 210억 달러의 동영상 수익이 추가로 발생할 것으로 예상됩니다(advanced-television.com). 다국어 광고 로딩 개인화 및 오디언스 기반 구매는 CPM을 높이고, 플랫폼은 부족한 구독 수익을 보충할 수 있습니다. 이러한 시너지 효과로 인해 신흥 경제권에서 AVOD는 보조적인 수익원에서 핵심적인 수익기반으로 격상되고 있습니다.

북미 및 서유럽에서 초고속 광대역 보급 확대

광섬유 가정 보급률, 5G 고정형 무선 액세스, 동적 CDN 라우팅이 원활한 UHD 전송을 지원합니다. 서유럽의 OTT 에피소드 및 영화 수익은 2023년 310억 달러에서 2029년까지 480억 달러로 급증할 것으로 예상됩니다(digitaltvnews.net). 각 사업자들은 라이브 트래픽 피크 시 대역폭 사용량을 최대 90%까지 절감할 수 있는 멀티캐스트 지원형 유니캐스트 전송을 시범 운영 중입니다(streamtvinsider.com). 시청자는 TV, 스마트폰, 차량용 스크린에서 더 빠른 시작 시간과 버퍼링 감소의 혜택을 누릴 수 있습니다. 이러한 품질 향상은 시청 시간 증가로 이어져 주문형 비디오(VOD) 시장의 ARPU 안정화를 직접적으로 지원합니다.

컨텐츠 라이선스 비용 상승으로 인한 플랫폼 수익률 압박

인기 컨텐츠를 둘러싼 다년간의 입찰 경쟁으로 인해 최저 보장 금액이 부풀려져 서비스 수익성을 압박하고 있습니다. 일부 중견 업체들은 라이브러리를 정리하고, 독점적인 히트작의 구매자로서의 입지를 구축하거나, 풍부한 백 카탈로그를 수익화할 수 있는 판매자로서의 입지를 구축했습니다. 유럽연합 집행위원회는 생성형 AI 도구가 향후 제작 비용을 절감할 수 있지만, 지출과 수익 간의 단기적인 불균형은 계속되고 있다고 지적했습니다(ec.europa.eu). 그 결과, 사업자들은 가격을 인상하거나 광고가 포함된 하위 요금제를 도입할 수밖에 없어, 주문형 비디오 시장 전체에서 볼 수 있는 이중 수익화 모델이 강화되고 있습니다.

부문 분석

2025년 기준 SVOD가 매출의 83.92%를 차지하며 선점 우위를 반영하고 있지만, AVOD의 예측 CAGR 11.01%는 저비용 엔터테인먼트에 대한 수요가 가속화되고 있음을 보여줍니다. AVOD로 인한 주문형 비디오(VOD) 시장 규모는 전 세계 광고 지출이 커넥티드 스크린으로 이동함에 따라 확대될 것으로 예상됩니다. 한정된 광고와 저렴한 요금을 결합한 하이브리드 패키지가 등장해 구독 피로도를 낮추면서 예측 가능한 현금 수입을 확보할 수 있게 됐습니다. 틈새시장인 TVOD(주문형 TV)는 여전히 블록버스터 영화 개봉에 있어 중요한 역할을 하고 있으며, 스포츠 유료화는 프리미엄 가격의 탄력성을 유지하고 있습니다.

신흥 경제권 소비자들은 AVOD를 대안이 아닌 첫 번째 선택으로 인식하는 경향이 강해지고 있으며, 플랫폼은 광고 크리에이티브의 현지화 및 광고 부담 완화를 추진하고 있습니다. 한편, 광고주는 소셜 미디어 수준의 정확도를 자랑하는 주소 지정이 가능한 타겟팅을 얻을 수 있습니다. 기존 SVOD 사업자에게는 광고 분야로의 단계적 진입이 ARPU(사용자당평균매출액) 하락을 완화시켜 줄 것입니다. 이러한 변화로 인해 VOD 시장 전체에서 고객 경험의 중요성을 훼손하지 않으면서도 수익화 구조는 더욱 정교해질 것입니다.

OTT 스트리밍은 2025년 매출의 71.35%를 차지할 것으로 예상되며, 2031년까지 연평균 11.22%의 CAGR을 기록할 것으로 전망됩니다. 관리형 IPTV와 달리 OTT는 개방형 인터넷과 적응형 비트 레이트 프로토콜을 통해 전 세계로 확장할 수 있습니다. MAUD 평가판은 피크타임 대역폭 수요를 최대 90%까지 감소시켜 라이브 이벤트의 비용 효율성을 더욱 강화합니다(streamtvinsider.com). 따라서 OTT 채널의 주문형 비디오(VOD) 시장 규모는 유료방송 VOD가 존속하는 지역에서도 기존 케이블이나 위성방송을 능가하는 성장이 예상됩니다.

IPTV는 DSL과 광섬유 번들 서비스가 제공되는 지역에서 강력한 지지를 받고 있습니다. 한편, 유럽에서의 HbbTV 보급과 브라질에서 도입 예정인 TV 3.0은 방송의 도달 범위와 브로드밴드의 유연성을 결합한 하이브리드 모델을 강조하고 있습니다(advanced-television.com). 향후 주문형 비디오(VOD) 업계는 엣지 컴퓨팅 노드를 통합하여 볼류메트릭 비디오와 같은 몰입형 경험의 지연을 크게 줄일 수 있을 것으로 예상됩니다.

지역별 분석

북미는 2025년 기준 41.10%의 매출 점유율을 차지하며 가장 큰 기여를 하는 지역으로 남을 것으로 예상됩니다. 이는 초기 브로드밴드 보급과 풍부한 오리지널 컨텐츠 공급망의 덕분입니다. 2025년에 도입된 업계 번들은 여러 주요 서비스를 할인 패키지에 통합하여 구독 피로를 해소하기 위해 도입되었습니다. 연방정부의 인프라 보조금 지원으로 지방에 광섬유를 지속적으로 확장하고 주문형 비디오(VOD) 시장에서의 주도권을 강화하고 있습니다.

아시아태평양은 가장 빠르게 성장하는 지역으로 2031년까지 CAGR 12.05%를 기록할 것으로 예상됩니다. 5G, 클라우드, 현지어 제작에 걸친 국가적 노력이 2023년 지역 수익을 244억 달러로 끌어올렸습니다(avia.org). 인도와 중국이 가입자 증가율 1위를 차지하고 있는 반면, 일본과 한국은 국제적으로 널리 받아들여지는 문화적 히트작을 수출하고 있습니다. 또한, 견조한 디지털 광고 지출이 성장을 뒷받침하며 신흥 경제권에서 광고 수익형 동영상 서비스(AVOD)의 지속가능성을 뒷받침하고 있습니다.

라틴아메리카에서는 규모 확대가 가속화되고 있으며, 2029년까지 SVOD 계정이 1억 6,500만 개에 달할 것으로 예측됩니다(advanced-television.com). 브라질에서만 5,900만 가입자를 돌파할 가능성이 있습니다. 통신사업자와의 제휴를 통해 결제가 원활해지고, 인텔의 2024년 6억 1,800만 달러 투자(entel.cl) 등 진행 중인 광섬유 사업을 통해 대역폭 요구사항도 충족되고 있습니다. 세계 대기업이 지배적인 가운데, 지역 플랫폼은 여전히 8%의 시장 점유율을 확보하고 있으며, 이는 주문형 비디오 시장에서 지역 특유의 스토리텔링에 대한 수요를 반영합니다.

기타 특전:

- 엑셀 형식의 시장 예측(ME) 시트

- 애널리스트의 3개월간 지원

자주 묻는 질문

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 시장 구도

제5장 시장 규모와 성장 예측

제6장 경쟁 구도

제7장 시장 기회와 향후 전망

KSM 26.03.09The Video-on-Demand market was valued at USD 126.16 billion in 2025 and estimated to grow from USD 140.63 billion in 2026 to reach USD 241.73 billion by 2031, at a CAGR of 11.47% during the forecast period (2026-2031).

This acceleration mirrors the steady shift from scheduled television to on-demand streaming, supported by rapid broadband rollouts, device proliferation, and richer content libraries. Ultra-high-speed fiber and 5G coverage in North America and Western Europe enable smooth 4K playback, while local-language production budgets in Asia keep regional viewers engaged. The surge of ad-supported tiers offers price-sensitive households alternative entry points, and telecom bundles are lowering acquisition costs in Latin America. The competitive intensity remains high as market leaders hedge churn risk through content exclusivity, cross-service bundles, and cost-efficient delivery networks.

Global Video-on-Demand Market Trends and Insights

Rapid Adoption of AVOD Platforms in Emerging Asia-Pacific Markets

Asia-Pacific audiences are embracing ad-supported offerings as platforms trade lower fees for higher reach, a tactic that garnered a USD 24.4 billion regional video revenue pool in 2023 avia.org. Advertisers value the 1.4 billion unique viewers who collectively streamed almost 14 billion hours of Asian content in the same year avia.org. Forecasts suggest the region will unlock another USD 21 billion in video earnings by 2030 as AVOD inventory scales advanced-television.com . Multilingual ad load personalization and audience-based buying is raising CPMs, allowing platforms to offset thinner subscription margins. Together, these dynamics elevate AVOD from a supplemental to a core monetization pillar across emerging economies.

Expansion of Ultra-High-Speed Broadband Rollout in North America & Western Europe

Fiber-to-the-home penetration, 5G fixed-wireless access, and dynamic CDN routing now underpin seamless UHD delivery. Western European OTT episode and movie revenue will jump to USD 48 billion by 2029 from USD 31 billion in 2023 digitaltvnews.net . Operators are piloting multicast-assisted unicast delivery that can trim bandwidth use by as much as 90% during live traffic peaks streamtvinsider.com . Viewers benefit through faster start times and reduced buffering across TVs, phones, and in-vehicle screens. Such quality upgrades raise engagement minutes, directly supporting ARPU stability within the Video-on-Demand market.

Escalating Content Licensing Costs Squeezing Platform Margins

Multiyear bidding wars over hit franchises inflate minimum guarantees, squeezing service profitability. Some mid-tier providers have culled libraries, positioning themselves either as buyers of exclusive hits or as sellers monetizing deep back catalogs. The European Commission notes that generative AI tools could eventually ease production costs but the near-term imbalance between spending and returns persists ec.europa.eu. Consequently, operators either push prices up or introduce lower-tier plans with ads, reinforcing the two-track monetization model visible throughout the Video-on-Demand market.

Other drivers and restraints analyzed in the detailed report include:

- Increased Content Investments in Local-Language Originals by Global Streamers

- Bundling of VoD with Telecom & Pay-TV Subscriptions Driving Uptake in South America

- Rising Churn Rates Due to Subscription Fatigue in Matured SVOD Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SVOD controlled 83.92% revenue in 2025, reflecting its early-mover status, but AVOD's 11.01% forecast CAGR signals accelerating demand for low-cost entertainment. The Video-on-Demand market size attributable to AVOD will widen as global advertising outlays migrate to connected screens. Hybrid packages that merge limited ads with modest fees are emerging to curb subscription fatigue while preserving predictable cash receipts. Niche TVOD windows retain relevance for blockbuster premieres, with sports pay-per-view sustaining premium pricing elasticity.

Consumers in emerging economies increasingly treat AVOD as a first-choice service rather than a fallback, prompting platforms to localize ad creative and shorten ad loads. Advertisers, meanwhile, gain addressable targeting that rivals social media precision. For SVOD incumbents, gradual entry into advertising mitigates ARPU erosion. Together, these shifts refine monetization structures without altering the centrality of customer experience within the broader Video-on-Demand market.

OTT streaming garnered 71.35% of 2025 revenues and is forecast at 11.22% CAGR through 2031. Unlike managed IPTV, OTT scales globally via open internet and adaptive bitrate protocols. MAUD trials that cut peak bandwidth needs by up to 90% further bolster cost efficiency for live events streamtvinsider.com. Thus, the Video-on-Demand market size for OTT channels will outpace legacy cable and satellite, even where Pay-TV VoD persists.

IPTV remains entrenched in regions with bundled DSL and fiber offerings, while HbbTV adoption in Europe and Brazil's upcoming TV 3.0 highlight hybrid models that blend broadcast reach with broadband flexibility advanced-television.com. Looking ahead, the Video-on-Demand industry will integrate edge compute nodes to slash latency for immersive experiences such as volumetric video.

The Video-On-Demand (VoD) Market Report is Segmented by Business Model (Subscription VoD, Advertising VoD, and More), Delivery Technology (OTT Streaming, IPTV VoD, and More), Device Type (Smartphones and Tablets, Smart TVs, and More), Content Genre (Entertainment and Drama, Sports, and More), End-User (Residential, Commercial and Enterprise, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the largest contributor at 41.10% revenue share in 2025, benefiting from early broadband ubiquity and deep original-content pipelines. Industry bundles launched in 2025 combine multiple flagship services into discounted packages, an antidote to subscription fatigue. Federal infrastructure grants continue to extend rural fiber, reinforcing the Video-on-Demand market's leadership position.

Asia-Pacific is the fastest-growing territory, tracking a 12.05% CAGR to 2031. National initiatives spanning 5G, cloud, and local-language production have spurred USD 24.4 billion in 2023 regional revenue avia.org. India and China top subscriber additions, while Japan and South Korea export cultural hits that travel well internationally. Growth is further supported by robust digital advertising spend, underpinning AVOD viability across emerging economies.

Latin America shows accelerating scale, projected to host 165 million SVOD accounts by 2029 advanced-television.com. Brazil alone may surpass 59 million subs. Telco partnerships ease payments and satisfy bandwidth requirements via ongoing fiber projects such as Entel's USD 618 million 2024 investment entel.cl. Although global majors dominate, local platforms still secure 8% market share, reflecting regional storytelling demand within the Video-on-Demand market.

- Amazon.com Inc. (Prime Video)

- Netflix Inc.

- The Walt Disney Company (Disney+ and Hulu)

- Warner Bros. Discovery Inc. (Max)

- Apple Inc. (Apple TV+)

- Alphabet Inc. (YouTube Premium and YouTube TV)

- Comcast Corporation (Peacock and Xfinity On-Demand)

- Paramount Global (Paramount+)

- Roku Inc.

- Tencent Holdings Ltd. (Tencent Video)

- Alibaba Group (Youku Tudou)

- Baidu Inc. (iQIYI)

- Zee Entertainment Enterprises Ltd. (ZEE5)

- Reliance Industries Ltd. (JioCinema)

- Novi Digital Entertainment Pvt. Ltd. (Disney+ Hotstar)

- KT Corporation (Olleh TV)

- Rakuten Group (Rakuten Viki)

- Sky Group Limited (NOW)

- Telstra Corporation (Telstra TV Box Office)

- PCCW Media (Viu)

- Globoplay (Grupo Globo)

- Shahid (MBC Group)

- Showmax (MultiChoice)

- Canal+ Group (myCanal)

- Vubiquity Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of AVOD platforms in emerging Asia-Pacific markets

- 4.2.2 Expansion of ultra-high-speed broadband rollout in North America and Western Europe

- 4.2.3 Increased content investments in local-language originals by global streamers

- 4.2.4 Bundling of VoD with telecom and pay-TV subscriptions driving uptake in South America

- 4.2.5 Growing adoption of cloud-native CDN and edge compute lowering VoD latency

- 4.3 Market Restraints

- 4.3.1 Escalating content licensing costs squeezing platform margins

- 4.3.2 Intensifying antitrust scrutiny over exclusive content deals in EU

- 4.3.3 Rising churn rates due to subscription fatigue in matured SVOD markets

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Business Model

- 5.1.1 Subscription Video-on-Demand (SVOD)

- 5.1.2 Advertising Video-on-Demand (AVOD)

- 5.1.3 Transactional/Pay-per-view (TVOD)

- 5.1.4 Hybrid and Other Models

- 5.2 By Delivery Technology

- 5.2.1 Over-the-Top (OTT) Streaming

- 5.2.2 Internet Protocol Television (IPTV) VoD

- 5.2.3 Pay-TV VoD

- 5.2.4 Hybrid Broadcast Broadband TV (HbbTV)

- 5.3 By Device Type

- 5.3.1 Smartphones and Tablets

- 5.3.2 Smart TVs

- 5.3.3 PCs and Laptops

- 5.3.4 Connected Streaming Devices

- 5.3.5 Others

- 5.4 By Content Genre

- 5.4.1 Entertainment and Drama

- 5.4.2 Sports

- 5.4.3 Kids and Family

- 5.4.4 Educational and Documentary

- 5.4.5 Others (News, Lifestyle)

- 5.5 By End-user

- 5.5.1 Residential / Individual

- 5.5.2 Commercial and Enterprise (Hotels, Airlines, Hospitals)

- 5.5.3 Educational Institutions

- 5.5.4 Public Sector and Government

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 New Zealand

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Amazon.com Inc. (Prime Video)

- 6.3.2 Netflix Inc.

- 6.3.3 The Walt Disney Company (Disney+ and Hulu)

- 6.3.4 Warner Bros. Discovery Inc. (Max)

- 6.3.5 Apple Inc. (Apple TV+)

- 6.3.6 Alphabet Inc. (YouTube Premium and YouTube TV)

- 6.3.7 Comcast Corporation (Peacock and Xfinity On-Demand)

- 6.3.8 Paramount Global (Paramount+)

- 6.3.9 Roku Inc.

- 6.3.10 Tencent Holdings Ltd. (Tencent Video)

- 6.3.11 Alibaba Group (Youku Tudou)

- 6.3.12 Baidu Inc. (iQIYI)

- 6.3.13 Zee Entertainment Enterprises Ltd. (ZEE5)

- 6.3.14 Reliance Industries Ltd. (JioCinema)

- 6.3.15 Novi Digital Entertainment Pvt. Ltd. (Disney+ Hotstar)

- 6.3.16 KT Corporation (Olleh TV)

- 6.3.17 Rakuten Group (Rakuten Viki)

- 6.3.18 Sky Group Limited (NOW)

- 6.3.19 Telstra Corporation (Telstra TV Box Office)

- 6.3.20 PCCW Media (Viu)

- 6.3.21 Globoplay (Grupo Globo)

- 6.3.22 Shahid (MBC Group)

- 6.3.23 Showmax (MultiChoice)

- 6.3.24 Canal+ Group (myCanal)

- 6.3.25 Vubiquity Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment