|

시장보고서

상품코드

1630396

서비스 통합 및 관리 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Global Service Integration and Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

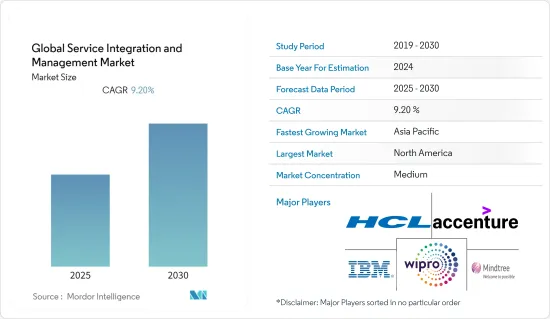

세계의 서비스 통합 및 관리 시장은 예측 기간 동안 CAGR 9.2%를 기록할 전망입니다.

주요 하이라이트

- 최근 엔터프라이즈 IT 환경은 하이브리드 기술의 상승과 지속적인 공급업체가 제공하는 서비스로 더욱 복잡해지고 있습니다. 기업의 주요 과제는 여러 공급업체를 효과적으로 협력하고 통일적으로 관리하는 복잡성을 극복하는 것입니다.

- IT 지출 증가와 비용 절감의 필요성이 시장 성장의 주요 요인이 되고 있습니다. Flexera 2021 State of Tech Spend에 따르면 전 세계 기업의 거의 절반(49%)이 2021년 IT 지출 증가를 전망하고 있습니다. 또한 비용 절감은 기업의 가장 중요한 과제이며 2020년의 9%에서 2021년에는 27%로 3배로 증가할 전망입니다. 서비스 통합 및 관리는 여러 업무 및 서비스를 관리하는 비용을 절감하는 데 도움이 됩니다.

- 또한 중소기업의 아웃소싱 동향도 SIAM 시장에 새로운 기회를 창출하고 있습니다. 커스텀 웹 개발과 웹 디자인을 제공하는 Tech Behemoths가 중소 IT 기업을 대상으로 실시한 조사(2021년 6월)에 따르면 응답자의 약 38.5%가 프로젝트를 아웃소싱하고 있으며 응답자의 76%가 비용 효율성과 유연성의 이점을 모두 지적합니다. 또한 응답자의 38.5%가 더 높은 수익률을 제시합니다.(n=38개국 중소기업 324개사).

- 그러나 통일된 SLA나 규제에 대한 대응이 이루어지지 않은 것은 예측 기간 동안 시장 성장을 방해할 것으로 예상됩니다. 2021년 8월, Financial Industry Regulatory Authority(FINRA)는 타사 공급업체에 위탁하는 업무에 대해 충분한 감독 체제를 유지하도록 기업에 주의를 촉구했습니다. 이 기관은 또한 사이버 보안에 관한 규칙 3110, 규칙 1220, 규칙 4370, 비즈니스 연속성 계획 등의 규칙을 따르는 것을 강조합니다.

- COVID-19의 보급은 선진국뿐만 아니라 신흥국에서도 일시적인 경기 감속으로 많은 기업들이 통합 서비스 지출을 줄이기 때문에 시장에 부정적인 영향을 미칩니다. 대기업의 경우 클라우드 인프라에 대한 지출이 증가하기 때문에 시장은 안정적인 속도로 성장할 것으로 예상됩니다. 바이러스의 영향에 따라 매니지드 서비스 및 기술 아웃소싱의 성장으로 시장 확대가 예상됩니다.

서비스 통합 및 관리 시장 동향

클라우드 기술이 크게 성장

- 기업이 다양한 목적으로 클라우드를 채택하게 되면서 데이터의 양, 유형, 소스가 폭발적으로 증가하고 실시간으로 데이터를 활용하는 용도에 대한 수요가 급증했습니다. 또한 온프레미스, 프라이빗 클라우드 및 다중 공급업체의 퍼블릭 클라우드에 존재하는 데이터와 서비스를 통합할 필요성이 증가하여 서비스로서의 통합 플랫폼(iPaaS) 시장이 활성화되고 있습니다.

- 최근 SaaS 기반 공급업체가 시장에 늘어나고 있으며, 기업은 자사에 적합한 플랫폼을 선택하는 데 문제에 직면하고 있습니다. 이후 조직의 방화벽 내부 경계 외부에 존재하는 데이터를 제어하고 관리해야 하므로 클라우드 기반 서비스 통합 솔루션의 채택이 증가하고 있습니다.

- 엔터프라이즈가 온프레미스와 온클라우드 애플리케이션을 혼합한 경우, 둘 다 별도의 통합 도구를 사용하면 IT 인프라에 불필요한 복잡성이 발생하고 대기 시간이 발생합니다. 하이브리드 통합은 클라우드와 프라이빗 간을 오가는 동안 통합을 다시 쓰는 작업을 필요로 하지 않습니다.

- 또한 고객에게 IT 서비스의 엔드 투 엔드 제공을 관리하는 정보 기술 서비스 관리(ITSM)를 구현하고 문서화하는 가장 널리 채택 된 모범 사례 지침 프레임 워크 인 정보 기술 기반 라이브러리(ITIL 4)의 이용이 중요해지면서 제공되는 광범위한 이점은 클라우드 서비스 통합 및 관리 시장을 더욱 확대할 것입니다.

- 게다가 Epicor Software의 연간 통찰력 보고서에 따르면 미국 중규모 기업의 94%가 2021년에 클라우드를 도입했으며 2020년에 클라우드를 전략적 우선순위로 선언한 25%에서 증가한 수치입니다. 클라우드 마이그레이션의 주요 촉진요인으로는 암호화, 다중 요소 인증(MFA), 24시간 모니터링을 통한 보안 향상(34%), 품질 관리(32%) 등이 있습니다. 또한 응답자의 82%가 코로나19로 인해 클라우드 마이그레이션 계획을 앞당겼다고 답하는 등 코로나19도 국내 클라우드 도입을 촉진하는 데 중요한 역할을 했습니다.

북미가 큰 점유율을 차지할 전망

- 북미는 예측 기간 동안 크게 성장할 것으로 예상되지만, 이는 주로 여러 산업 기업의 존재와 이 지역의 여러 조직에서 클라우드 기반 서비스의 급속한 채용으로 인한 것입니다. 또한 고급 통합 서비스에 대한 요구가 증가하고 워크로드가 클라우드 환경으로 이동하는 등 다양한 요인이 IPaaS 솔루션에 대한 수요를 촉진할 것으로 예상됩니다.

- 다양한 최종 사용자 기업들이 이 지역에서의 존재를 확대하고 있으며, IT 기능의 아웃소싱 요구가 탄생하고 있습니다. 2021년 8월, Amazon Inc.는 미국에서 백화점과 같은 대규모 소매점포를 여러개 개설할 계획을 발표했습니다. 대형 점포의 개설 설계화는 온라인 쇼핑 기업의 오프라인 소매에서의 새로운 확대를 의미합니다.

- 이 지역에서는 생산성, 직원 만족도, 비용 효율성을 높이기 위한 BYOD 정책의 급속한 도입으로 클라우드 기반 ITSM이 성장하고 있습니다. 이러한 정책은 정보에 대한 원격 액세스가 필요하며 클라우드 기반 정보 기술 서비스 관리 솔루션이 이를 촉진합니다.

- Cisco's Internet Business Solutions Group이 실시한 조사에 따르면 미국 기업이 종합적인 BYOD 정책을 도입하면 직원 1인당 매년 3,150달러의 비용 절감이 가능합니다. 또한 직원은 평균 965달러를 디바이스에, 매년 734달러를 데이터 플랜에 지출합니다.

- 이 지역의 IT 및 통신 및 BFSI 업계에서의 투자와 개발의 확대는 시장에 기회를 가져올 것으로 기대되고 있습니다. 게다가 COVID-19는 지역 전체에서 기업의 사업 운영을 확실히 회복시키기 위한 디지털 기술에 대한 고객 수요를 가속화하여 기존 제품 대신 클라우드 기반 제품을 제공합니다.

서비스 통합 및 관리 산업 개요

서비스 통합 및 관리 시장은 적당히 단편화되어 있으며 다음과 같은 주요 기업이 있습니다. IBM Corporation and SreviceNow Inc. occupying a significant share. To sustain the market and retain their clients, the companies are employing several competitive strategies, including product innovations and partnerships.

- 2021년 9월 - HCL Technologies(HCL)는 고객의 디지털 혁신을 가속화하는 솔루션을 개발하기 위해 전문 HCL 시스코 에코시스템 유닛을 출시했습니다. HCL의 시스코 에코시스템 유닛은 시스코 기술을 활용한 전문 지식, 솔루션 및 비즈니스 성과 모델을 개발합니다. 그 목표는 Software-Defined Network Transformation, Network-as-a-Service, Digital Workplace, Multi-Cloud Modernization, Hyper-Automation, Security, Enhanced Application Experience, Private 5G, Telco Modernization 등의 복잡한 트랜스포메이션 이니셔티브를 성공하는 것입니다.

- 2021년 7월 - XYPRO Technology Corporation (XYPRO)은 HPE NonStop 시스템을 통해 스위트 제품 전체를 제공하기 위해, Hewlett Packard Enterprise (HPE)와의 제휴 확대를 발표했습니다. 이를 통해 XYPRO는 미션 크리티컬 데이터베이스 관리, 보안 및 통합 솔루션의 가용성을 HPE 고객 기반의 새로운 시장으로 확장합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 경쟁 기업 간 경쟁 관계

- 대체품의 위협

- COVID-19의 업계에 대한 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 서비스 관리의 복잡화

- 멀티 벤더 아웃소싱 수요 증가

- 시장 성장 억제요인

- 통일된 SLA와 규제 준수의 부족

제6장 시장 세분화

- 구성 요소별

- 솔루션

- 비즈니스 솔루션

- 기술 솔루션

- 서비스별

- 솔루션

- 조직 규모별

- 중소기업

- 대기업

- 최종 사용자 업계별

- BFSI

- IT 및 통신

- 헬스케어

- 소매

- 기타 최종 사용자 산업

- 지역별

- 북미

- 유럽

- 아시아태평양

- 세계 기타 지역

제7장 경쟁 구도

- 기업 프로파일

- HCL Technologies

- Hewlett Packard Enterprise(HPE)

- IBM Corporation

- Infosys Limited

- Mindtree Limited

- Capgemini SE

- AtoS SE

- Accenture PLC

- Fujitsu Limited

- Wipro Limited

제8장 투자 분석

제9장 시장의 미래

KTH 25.02.05The Global Service Integration and Management Market is expected to register a CAGR of 9.2% during the forecast period.

Key Highlights

- Lately, the enterprise IT environment has become more complex with the rise of hybrid technologies and services provided by an ever-increasing number of suppliers. The major challenge for the enterprises is to get their multiple suppliers to work together effectively and overcome the complexities of governing them uniformly, thus, giving rise to the adoption of service integration and management (SIAM) services and solutions.

- The increase in the IT spending and the need for cost savings are major factors that are contributing to the growth of the market. According to Flexera 2021 State of Tech Spend, almost half (49%) of the companies globally expect to increase IT spending in 2021. In addition, cost-saving is a top initiative for the companies, which is expected to triple from 9% in 2020 to 27% in 2021. Service integration and management assist in reducing the costs of managing multiple operations and services.

- Moreover, the outsourcing trend amongst small to medium enterprises is also creating new opportunities for the SIAM market. According to a survey of small and medium IT companies by Tech Behemoths (June 2021), a custom web development and web design provider, about 38.5% of the respondents outsourced their projects, and 76% of the respondents pointed out that they have both cost efficiency and flexibility benefits. In addition, 38.5% of the respondents suggested higher profit margins. (n=324 SME from 38 countries).

- However, the lack of uniform SLAs and regulatory compliances is expected to hinder the growth of the market over the forecast period. In August 2021, Financial Industry Regulatory Authority (FINRA) cautioned firms to maintain a sufficient supervisory system for activities outsourced to third-party vendors. The organization also emphasized following rules such as Rule 3110, Rule 1220, Rule 4370 for cybersecurity, business continuity plans, and others.

- The spread of COVID-19 has negatively impacted the market as many organizations would be reducing the integration services spending due to temporary slowdown in developed as well as emerging countries. In the case of large organizations, the market is expected to grow at a steady pace due to increased spending on the cloud infrastructure. As the impact of the virus subsides, the market is anticipated to grow due to the growth of managed services and technology outsourcing.

Service Integration & Management Market Trends

Cloud Technology to witness significant growth

- The increased adoption of cloud by businesses for various purposes has led to an explosion in the volume, variety, and sources of data, surging demand for applications that leverage data in real-time and an increasing need to integrate data and services that live on-premises, in private clouds, and in multiple vendors' public clouds and thus has boosted the market for Integration Platform as a Service (iPaaS).

- With the recent increase of SaaS-based providers in the market, enterprises are facing issues in choosing the right platform for their organizations. Subsequently, data that exists outside the internal boundary of the organization's firewall needs to be controlled and managed, thus increasing the adoption of cloud-based service integration solutions.

- When the enterprises have a mix of on-premise and on-cloud applications, using separate integration tools for both of them creates an unwanted complexity in the IT infrastructure as well as introduces latency. Hybrid integration eliminates the task of rewriting integration while moving back and forth from cloud to private.

- Moreover, the increased emphasis on the use of Information Technology Infrastructure Library (ITIL 4), the most widely adopted best-practices guidance framework for implementing and documenting Information Technology Service Management (ITSM) which is responsible for managing end-to-end delivery of IT services to customers will further proliferate the market for cloud service integration and management due to the wide range of benefits provided.

- Additionally, according to Epicor Software's annual insights report, 94% of mid-sized essential businesses in the United States are adopting cloud in 2021, up from 25%, which declared cloud a strategic priority in 2020. Some of the major drivers for cloud migration included improved security (34%) via encryption, multifactor authentication (MFA) and 24-hour monitoring, and quality control (32%). In addition, COVID-19 has also played a major role in pushing cloud adoption in the country, with 82% of the respondents suggesting that they accelerated their cloud migration plans because of COVID-19.

North America is Expected to Hold Major Share

- The North American region is expected to significant growth during the forecast period, primarily owing to the presence of multiple industry players, coupled with the rapid adoption of cloud-based services among various organizations in the region. Various factors, such as the increased need for advanced integration services and the increased shift of the workloads to the cloud environment, are also expected to drive the demand for IPaaS solutions.

- Various end-user companies are expanding their presence in the region, which creates a need for outsourcing IT functions. In August 2021, Amazon Inc. announced plans to open several large retail locations in the United States which would operate akin to the departmental stores. The plan to launch large stores marks a new expansion for the online shopping company in offline retail.

- The region is witnessing the growth of cloud-based ITSM, owing to the rapid adoption of BYOD policies for improved productivity, employee satisfaction, and cost-effectiveness. These policies require remote accessibility of information, which is facilitated by cloud-based Information Technology Service Management solutions.

- According to a study conducted by Cisco's Internet Business Solutions Group, the companies in the United States can save as much as USD 3,150 per employee every year if they implement a comprehensive BYOD policy. Moreover, employees are spending an average of USD 965 on their devices as well as USD 734 each year on data plans.

- The growing investments and developments in the IT and telecommunication and BFSI industry in the region are expected to create opportunities for the market. Furthermore, Covid-19 has accelerated customer demand for digital technologies to ensure resilient enterprise business operations across the region, resulting in cloud-based offerings replacing traditional products.

Service Integration & Management Industry Overview

The Service Integration and Management Market is moderately fragmented, with some major players such as IBM Corporation and SreviceNow Inc. occupying a significant share. To sustain the market and retain their clients, the companies are employing several competitive strategies, including product innovations and partnerships.

- September 2021 - HCL Technologies (HCL) has initiated a dedicated HCL Cisco Ecosystem Unit to develop solutions to help clients accelerate their digital transformations. HCL's Cisco Ecosystem Unit would develop expertise, solutions, and business outcome models using Cisco technology. Its goal is to make complicated transformation initiatives such as software-defined network transformation, network-as-a-service, digital workplace, multi-cloud modernization, hyper-automation, security, enhanced application experience, private 5G, and telco modernization a success.

- July 2021 - XYPRO Technology Corporation (XYPRO), announced the expansion of its partnership with Hewlett Packard Enterprise (HPE) to deliver its entire suite through HPE NonStop systems. The expansion would support XYPRO to extend the availability of mission critical database management, security and integration solutions into new markets within HPE's customer base.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of impact of COVID-19 on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Complexities of Service Management

- 5.1.2 Increasing Demand for Multi-Vendor Outsourcing

- 5.2 Market Restraints

- 5.2.1 Lack of Uniform SLAs and Regulatory Compliances

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.1.1 Business Solutions

- 6.1.1.2 Technology Solutions

- 6.1.2 Services

- 6.1.1 Solutions

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By End user Industry

- 6.3.1 BFSI

- 6.3.2 IT and Telecom

- 6.3.3 Healthcare

- 6.3.4 Retail

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 HCL Technologies

- 7.1.2 Hewlett Packard Enterprise (HPE)

- 7.1.3 IBM Corporation

- 7.1.4 Infosys Limited

- 7.1.5 Mindtree Limited

- 7.1.6 Capgemini SE

- 7.1.7 AtoS SE

- 7.1.8 Accenture PLC

- 7.1.9 Fujitsu Limited

- 7.1.10 Wipro Limited