|

시장보고서

상품코드

1851060

실시간 결제 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Real-Time Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

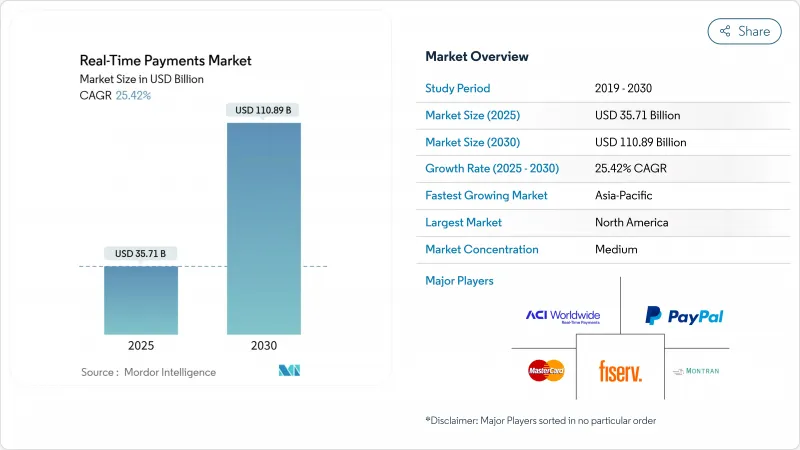

실시간 결제 시장의 규모는 2025년에 357억 1,000만 달러, 2030년에는 1,108억 9,000만 달러에 이를 것으로 예측되며, CAGR은 25.42%로 예상됩니다.

채용이 급증하는 배경에는 규제 의무화, ISO 20022의 2025년 11월 기한, 소매, 급여 및 송장 결제 워크플로 전체에서 즉시 결제를 요구하는 고객 수요가 있습니다. 북미에서는 FedNow 레일이 2025년 4월까지 1300개의 금융기관에 대해 2025년 1분기에 486억 달러에 해당하는 131만건의 거래를 처리하여 강력한 네트워크 효과를 입증했습니다. 2025년 1월에 시행되는 유럽의 인스턴트 지불 규제는 유로존을 24시간 365일 커버해야 하며 은행의 기술 투자를 가속화하고 있습니다. 아시아태평양의 기세는 인도의 UPI를 추가 시장으로 확대하고 싱가포르의 Project Nexus에 의해 뒷받침되며 브라질의 PIX는 2023년에 420억 거래(17조 2,000억 브랜드(3조 4,400억 달러) 상당)를 처리해, 정부 주도 스킴의 스케일 메리트를 부각시켰습니다.

세계의 실시간 결제 시장의 동향과 인사이트

ISO 20022로의 전환이 인프라 현대화를 가속화

2025년 11월 ISO 20022의 기한에 따라 은행은 메시징 엔진과 처리 엔진을 동시에 업데이트해야 하며 실시간 결제 레일을 채택하는 것이 가장 비용 효율적인 규정 준수 경로가 되었습니다. SWIFT는 크로스보더 메시지의 32.9%가 이미 ISO 20022에 대응하고 있으며 2024년 4분기에는 6포인트 증가한다고 지적하고 있습니다. 보다 풍부한 데이터 페이로드는 제재 심사를 개선하고 독일 은행은 기업에 대한 실시간 컴플라이언스의 이점을 제공합니다. 공존기간 종료가 다가오기 때문에 금융기관은 이중 시스템의 오버헤드를 피할 필요가 있습니다. 커뮤니티 뱅크는 ISO 20022 번역 및 인스턴트 결제 연결을 번들로 제공하는 타사 프로세서로 아웃소싱함으로써 능력 격차를 줄입니다.

FedNow의 확대가 아메리카 시장에서의 리더십을 견인

FedNow의 네트워크 효과는 2025년 1분기에 분기 기준으로 취급액이 43.1% 급증하였고 전체 취급액이 140.8% 급증한 것에서도 상업적 이용 사례가 확대되고 있음이 분명히 나타났습니다. 미 연방준비제도이사회(FRB)는 8,000개 기관에 도입을 목표로 전국적인 유비쿼터스화를 목표로 하고 있습니다. 이와 병행하여 브라질의 PIX 2.0은 2025년 9월에 정기 및 할부 기능을 도입할 예정이며, 성숙한 시스템이 다기능 플랫폼으로 진화하는 모습을 보여줍니다. 이러한 이니셔티브를 결합하면 다른 시장이 모방하는 대륙 전체의 퍼포먼스 벤치마크가 설정됩니다.

사기 모니터링의 복잡성은 도입 속도를 제한합니다.

은행은 FedNow, PIX 및 SEPA Instant를 위한 별도의 규칙 세트에 투자해야 합니다. ACI Worldwide의 Banfico와의 유럽 PoC는 EU의 2025년 10월 규정 준수 기한을 충족하기 위한 워크 라운드 파트너십을 보여줍니다. Visa의 Featurespace 인수는 AI 기반 즉각적인 사기 탐지의 자본 집약적 특성을 강조합니다. 소규모 금융 기관은 병렬 시스템에 의한 운영 부담에 직면하고 있으며, 여러 네트워크에 온보딩하는 데 시간이 걸립니다.

부문 분석

피어 투 피어 송금은 2024년 실시간 결제 시장 매출의 55.1%를 차지하였으며 소비자의 보급을 뒷받침하고 있습니다. 현재 비즈니스 주도의 흐름이 개인의 송금을 상회하고 있으며, 즉각적인 급여 지불과 가맹점 결제가 정착됨에 따라, 피어 투 비즈니스의 거래는 연간 28.61% 증가하고 있습니다. FedNow의 급여 및 공급업체에 대한 지불에 있어서의 초기 기업용 시험 운용은 이러한 움직임을 시사하며 운전 자본의 이점이 재무 경영진의 공감을 사고 있는 것을 나타내고 있습니다. 기업 간 도입은 아직 초기 단계이지만 ACH 결제에 수일이 걸린다는 점을 고려하면 최대의 대응 가능 풀이 기대됩니다. BNPL(바이 나우 페이 레이터) 제공업체가 계좌간 결제를 통합함으로써 인터체인지 비용을 최소화한 소비자 대 기업의 흐름이 기세를 늘리고 있습니다. 브라질의 PIX는 이러한 전환을 입증하고 있으며 전자상거래 사업자는 2025년 300억 달러의 즉각적인 결제 매출을 기록할 것으로 예측됩니다. GCC 경제권에서는 정부에서 개인으로의 의무화에 의해 24시간 365일 출금에 대한 새로운 기본적 기대가 태어났고, 즉각적인 인프라가 공공 서비스의 표준으로 정착하고 있습니다.

급여의 실시간 지급이 진행되면 급여 계산의 경제성이 재구성되고 티켓 크기보다 거래 빈도가 증가하므로 절대적인 레일량이 증가합니다. 기업은 재무 프로세스와 AP 프로세스를 동기화하고 주간 지불에서 주문형 푸시로 전환합니다. 크로스보더 기업은 UPI-PayNow 등 양국간 링크를 활용하여 동남아시아에서의 공급업체의 결제주기를 단축합니다. 시장 플랫폼은 수수료와 원본을 동시에 라우팅하는 분할 지불 모델을 도입하여 대조 지연을 제거합니다. 이러한 이용 사례를 결합하여 실시간 결제 시장은 유동성 최적화에 필수적입니다.

플랫폼과 솔루션에 대한 지출은 2024년 수익의 75.6%를 차지하였으며 은행이 전술적 볼트온보다 전반적인 오버홀을 선호한다는 것을 보여줍니다. 메시지 번역, 악성 분석 및 API 오케스트레이션은 통합 스택에서 가장 높은 효율성을 달성하였으며 ISO 20022로의 전환이 계기가 되었습니다. 그러나 서비스 수입은 매년 29.23% 증가하고 있으며 점진적인 롤아웃을 위해 전문 통합업체에 크게 의존하고 있음을 반영합니다. 컨설팅 업무는 준비 상황 평가, 로드맵 설계, 규제 갭 분석을 수행합니다. 금융기관은 24시간 365일의 가동시간을 커버하는 SLA를 요구하는 관리 서비스를 아웃소싱하여 인원을 줄이면서 컴플라이언스를 확보하고 있습니다. ACI 월드와이드와 같은 통합 파트너는 2025년 1분기에 소프트웨어 부문에서 42%의 성장을 기록했으며 플랫폼과 전문 서비스를 결합한 사안이 중견기관에 의해 지원되고 있음을 입증했습니다.

예측 기간 동안 실시간 및 배치 흐름을 병렬로 오케스트레이션할 수 있는 미들웨어가 중요합니다. 컨테이너화된 마이크로서비스를 갖춘 하이브리드 클라우드 오케스트레이터는 레거시 코어에서 점진적으로 분리할 수 있습니다. 이 아키텍처를 통해 은행은 메인프레임 모듈을 점차 폐지하면서 즉시 결제 API로 고객을 프론트엔드화할 수 있습니다. 교육 프로그램은 지속적인 결제와 실시간 유동성 모니터링으로 운영 문화의 변화에 대응합니다.

지역 분석

북미는 FedNow와 Clearing House RTP 네트워크의 성숙을 배경으로 2024년의 수익 점유율이 38.1%에 달한 것으로 나타났습니다. 패키징된 클라우드 커넥터에 힘입어 지방은행이 모여 참여함으로써 거래고의 성장이 가속화되고 있습니다. 인스턴트 직불 인터체인지 처리에 관한 규제의 명확화가 가맹점 채용을 뒷받침하고 있습니다. 캐나다는 2026년에 실시간 레일 개통을 계획하고 있으며 미국과의 사이에 달러 지정 크로스보더 회랑이 설립될 수 있습니다.

아시아태평양은 2030년까지 연평균 복합 성장률(CAGR)이 29.33%로 가장 높을 것으로 예상됩니다. 인도의 UPI는 24년도에 200조 루피(2조 4,000억 달러) 상당의 1,310억 거래를 처리하면서 정부가 지원하는 오픈 API 모델의 규모 이점을 보여줍니다. 싱가포르의 프로젝트 넥서스는 다자간 결제를 위한 템플릿을 제시하고 호주 NPP는 PayTo의 의무화를 최종 결정하고 비즈니스 과금 기능을 확대했습니다. 일본의 지방은행은 현금 없는 거래 비율의 목표 달성을 향해 근대화를 가속하고 있습니다.

유럽에서는 2025년 1월부터 24시간 365일의 수신이 의무화되었으며 독일 은행에서는 동월 즉각 결제가 27% 급증했습니다. 2025년 10월까지 완전한 전송 기능이 도입되면 더욱 보급이 진행될 예정이지만, 규제에 의해 가격 상한이 설정되어 있기 때문에 수수료 마진이 압박될 가능성이 있습니다. 북유럽 P27이 일시정지됨에 따라 SEPA 인스턴트가 유럽 내의 사실상 크로스보더 옵션이 되어 은행은 영국의 FPS와의 양자간 링크를 목표로 하게 됩니다.

남미에서는 PIX가 중심으로, 현재는 마지막 현금 이용 사례를 없애는 할부나 오프라인 모드로까지 확대하고 있습니다. 콜롬비아, 칠레, 아르헨티나에서는 PIX의 민간 파트너십 구조의 재현이 고려되고 있습니다. 중동에서는 사우디아라비아의 Sarie 레일과 UAE의 IPP가 공무원에게 급여의 즉각적인 지불을 의무화하고 있으며 정책 주도의 성장을 경험하고 있습니다. 아프리카에서는 모바일 머니 기업이 개방형 루프 인스턴트 레일을 통합하여 지갑의 유비쿼터스화와 은행 수준의 클리어링을 결합합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 유럽과 아시아태평양에서 ISO 20022 대응 국내 레일의 보급

- FedNow의 확대와 향후의 PIX 2.0이 아메리카에서의 채용을 가속

- 미국의 임시 근로자에 있어서의 실시간 급여 계산과 EWA(earned-wage access) 수요

- BNPL 기업은 유럽에서 즉시 가맹점 결제를 위해 RTP로 시프트하고 있음

- GCC 국가에서의 급여 및 복리후생의 즉각 지급에 관한 정부의 의무화

- RippleNet과 Visa Direct에 의한 국경을 넘은 RTP 회랑의 급증

- 시장 성장 억제요인

- RTP 체계 전체에서 단편화하는 사기 탐지 기준

- 아시아 Tier-2 은행의 레거시 코어 뱅크의 현대화 백 로그

- 카드 토크나이제이션과 계정간 레일의 상호 운용성의 갭

- 미국의 가맹점 서차지 규제의 불확실성

- 밸류체인 분석

- 규제와 규격의 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 시장의 거시 경제 동향의 평가

- 사례 연구와 이용 사례

- 모든 거래에서 차지하는 RTP 거래의 비율 - 지역별 및 주요 국가별 비율

- 비현금거래에서 차지하는 RTP 거래의 비율 - 지역별 및 주요 국가별 내역

제5장 시장 규모와 성장 예측

- 거래 유형별

- 피어 투 피어(P2P)

- 피어 투 비즈니스(P2B)

- 컴포넌트별

- 플랫폼/솔루션

- 서비스

- 전개 모드별

- 클라우드

- On-Premise

- 기업 규모별

- 대기업

- 중소기업

- 최종 사용자 업계별

- 소매 및 전자상거래

- BFSI

- 유틸리티 및 전기통신사업

- 의료

- 정부 및 공공 부문

- 기타 최종 사용자 업계

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동

- 아랍에미리트(UAE)

- 사우디아라비아

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- ACI Worldwide Inc.

- Fiserv Inc.

- PayPal Holdings Inc.

- Mastercard Inc.

- Montran Corporation

- FIS Global

- Temenos AG

- Volante Technologies Inc.

- Finastra Inc.

- Ant Group(Alipay)

- Tencent Holdings Ltd.(WeChat Pay)

- The Clearing House Payments Co.

- Visa Inc.

- SWIFT SCRL

- Worldline SA

- Nets Group

- Nexi SpA

- Ripple Labs Inc.

- Wise PLC

- Pay.UK

- GoCardless Ltd.

- Jack Henry and Associates Inc.

- Infosys Finacle

- VSoft Corporation

- OpenPayd Holdings Ltd.

제7장 시장 기회와 미래 전망

CSM 25.11.20The Real Time Payments market size stands at USD 35.71 billion in 2025 and is forecast to achieve USD 110.89 billion by 2030, reflecting a compelling 25.42% CAGR.

Surging adoption originates from regulatory mandates, the November 2025 ISO 20022 deadline, and customer demand for instantaneous settlement across retail, payroll, and bill-payment workflows. In North America, the FedNow rail welcomed 1,300 institutions by April 2025 and processed 1.31 million transactions worth USD 48.6 billion during Q1 2025, underscoring strong network effects. Europe's Instant Payments Regulation, effective January 2025, requires 24/7 euro-zone coverage, accelerating bank technology investment. Asia-Pacific's momentum is reinforced by India's UPI expansion into additional corridors and Singapore's Project Nexus, while Brazil's PIX processed 42 billion transactions worth BRL 17.2 trillion (USD 3.44 trillion) in 2023, highlighting the scale benefits of government-sponsored schemes.

Global Real-Time Payments Market Trends and Insights

ISO 20022 migration accelerates infrastructure modernization

The November 2025 ISO 20022 deadline compels banks to update messaging and processing engines simultaneously, making real-time payment rail adoption the most cost-efficient compliance path. SWIFT notes that 32.9% of cross-border messages already ride ISO 20022, up six percentage points in Q4 2024. Richer data payloads improve sanctions screening, and Deutsche Bank showcases real-time compliance benefits for corporates. The looming end of the coexistence period forces institutions to avoid dual-system overhead. Community banks mitigate capability gaps by outsourcing to third-party processors that bundle ISO 20022 translation with instant-payment connectivity.

FedNow expansion drives Americas market leadership

FedNow's network effects were evident with a 43.1% quarterly volume spike in Q1 2025 and a 140.8% value leap, signalling widening commercial use cases. The Federal Reserve's ambition to onboard 8,000 institutions positions the rail for nationwide ubiquity. In parallel, Brazil's PIX 2.0 will introduce recurring and instalment capabilities in September 2025, showing how mature systems evolve into multifunction platforms. Combined, these initiatives set cross-continental performance benchmarks that other markets emulate.

Fraud monitoring complexity constrains adoption velocity

Verification-of-Payee frameworks differ across schemes, obliging banks to invest in separate rule sets for FedNow, PIX, and SEPA Instant. ACI Worldwide's European PoC with Banfico illustrates workaround partnerships to meet the EU's October 2025 compliance deadline. Visa's Featurespace acquisition underscores the capital-intensive nature of AI-based instant fraud detection. Smaller institutions face operational strain from parallel systems, slowing onboarding to multiple networks.

Other drivers and restraints analyzed in the detailed report include:

- Earned-wage access transforms payroll economics

- Cross-border RTP corridors reshape international payments

- Legacy infrastructure modernization challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Peer-to-peer transfers accounted for 55.1% of Real Time Payments market revenue in 2024, underscoring widespread consumer adoption. Business-driven flows now outpace personal transfers, with peer-to-business transactions growing 28.61% annually as instant payroll disbursements and merchant settlement take hold. FedNow's early corporate pilots in payroll and supplier payments highlight this pivot, signalling that working-capital benefits resonate with finance executives. Business-to-business adoption remains in early stages but promises the largest addressable pool, given ACH's multi-day settlement drag. Consumer-to-business flows gain momentum where buy-now-pay-later (BNPL) providers embed account-to-account settlement to minimise interchange costs. Brazil's PIX demonstrates this migration, with e-commerce merchants projected to book USD 30 billion in instant-payment turnover during 2025. Government-to-person mandates across GCC economies create a new baseline expectation for 24/7 disbursement, cementing instant infrastructure as a public-service standard.

Real-time salary advances reshape payroll economics, enlarging transaction frequency rather than ticket size, thus increasing absolute rail volume. Corporates synchronise treasury and AP processes, shifting from weekly payment runs to on-demand pushes. Cross-border organisations leverage bilateral links such as UPI-PayNow to shorten supplier settlement cycles in Southeast Asia. Market platforms introduce split-payment models that route commission and principal amounts simultaneously, removing reconciliation delays. These combined use cases reinforce the Real Time Payments market as indispensable for liquidity optimisation.

Platform & solution spending captured 75.6% of 2024 revenue, signalling that banks favour holistic overhauls versus tactical bolt-ons. ISO 20022 migration serves as the triggering event, since message translation, fraud analysis, and API orchestration are most efficient on unified stacks. Yet service revenue rises 29.23% annually, reflecting heavy reliance on specialist integrators for phased rollout. Consulting engagements cover readiness assessments, roadmap design, and regulatory gap analysis. Institutions outsource managed services for SLAs covering 24/7 uptime, ensuring compliance while containing headcount. Integration partners such as ACI Worldwide logged 42% software-segment growth in Q1 2025, proving that combinational platform-plus-professional-services deals resonate with mid-tier institutions.

Over the forecast period, middleware capable of orchestrating real-time and batch flows side-by-side becomes critical. Hybrid-cloud orchestrators with containerised microservices enable progressive decoupling from legacy cores. This architecture allows banks to retire mainframe modules gradually while front-ending customers with instant-payment APIs. Training programmes address the operational culture shift to continuous settlement and real-time liquidity monitoring.

The Global Real-Time Payments Market is Segmented by Transaction Type (Peer-To-Peer (P2P), Peer-To-Business (P2B)), Component (Platform / Solution, Services), Deployment (Cloud, On-Premise), Enterprise Size (Large Enterprises, Small and Medium Enterprises), End-User Industry (Retail and E-Commerce, BFSI, Utilities & Telecom, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America posted 38.1% revenue share in 2024, anchored by FedNow and The Clearing House RTP network maturity. Volume growth accelerates as regional banks join en masse, aided by packaged cloud connectors. Regulatory clarity on interchange treatment for instant debit pushes merchant adoption. Canada plans Real-Time Rail launch in 2026, which could open a USD-denominated cross-border corridor with the United States.

Asia-Pacific delivers the highest CAGR at 29.33% to 2030. India's UPI handled 131 billion transactions worth INR 200 trillion (USD 2.4 trillion) in FY24, illustrating scale benefits of a government-backed open API model. Singapore's Project Nexus presents a template for multi-country clearing, while Australia's NPP finalises PayTo mandates, expanding business billing capabilities. Japan's regional banks accelerate modernization to meet the national cashless-ratio target.

Europe's mandatory 24/7 receiving requirement effective January 2025 induced a 27% instant-payment jump at Deutsche Bank that same month. Full send capability by October 2025 will drive further adoption yet may squeeze fee margins given regulation-imposed price caps. Nordic P27's pause leaves SEPA Instant as the de-facto cross-border option inside Europe, pushing banks toward bilateral links with the UK's FPS.

South America's trajectory centres on PIX, now extending to instalment and offline modes that remove the last cash use-cases. Colombia, Chile, and Argentina examine replicating PIX's public-private partnership structure. The Middle East experiences policy-driven growth where Saudi Arabia's Sarie rail and the UAE's IPP mandate instant salary credits for government workers. Africa witnesses mobile-money players integrating open-loop instant rails, blending wallet ubiquity with bank-grade clearing.

- ACI Worldwide Inc.

- Fiserv Inc.

- PayPal Holdings Inc.

- Mastercard Inc.

- Montran Corporation

- FIS Global

- Temenos AG

- Volante Technologies Inc.

- Finastra Inc.

- Ant Group (Alipay)

- Tencent Holdings Ltd. (WeChat Pay)

- The Clearing House Payments Co.

- Visa Inc.

- SWIFT SCRL

- Worldline SA

- Nets Group

- Nexi SpA

- Ripple Labs Inc.

- Wise PLC

- Pay.UK

- GoCardless Ltd.

- Jack Henry and Associates Inc.

- Infosys Finacle

- VSoft Corporation

- OpenPayd Holdings Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of ISO 20022-enabled domestic rails in Europe and Asia-Pacific

- 4.2.2 Expansion of FedNow and upcoming PIX 2.0 accelerating adoption in the Americas

- 4.2.3 Real-time payroll and earned-wage access (EWA) demand among U.S. gig workers

- 4.2.4 BNPL players shifting to RTP for instant merchant settlement in Europe

- 4.2.5 Government mandates for instant salary and welfare disbursement in GCC countries

- 4.2.6 Surging cross-border RTP corridors via RippleNet and Visa Direct

- 4.3 Market Restraints

- 4.3.1 Fragmented fraud-monitoring standards across RTP schemes

- 4.3.2 Legacy core-bank modernisation backlog in Tier-2 Asian banks

- 4.3.3 Interoperability gaps between card tokenisation and account-to-account rails

- 4.3.4 Merchant surcharge regulation uncertainty in the U.S.

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Standards Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of Macro Economic Trends on the Market

- 4.8 Case Studies and Use-cases

- 4.9 RTP Transactions as % of All Transactions - Regional and Key-Country Split

- 4.10 RTP Transactions as % of Non-Cash Transactions - Regional and Key-Country Split

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Transaction Type

- 5.1.1 Peer-to-Peer (P2P)

- 5.1.2 Peer-to-Business (P2B)

- 5.2 By Component

- 5.2.1 Platform / Solution

- 5.2.2 Services

- 5.3 By Deployment Mode

- 5.3.1 Cloud

- 5.3.2 On-Premise

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By End-User Industry

- 5.5.1 Retail and E-Commerce

- 5.5.2 BFSI

- 5.5.3 Utilities and Telecom

- 5.5.4 Healthcare

- 5.5.5 Government and Public Sector

- 5.5.6 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)}

- 6.4.1 ACI Worldwide Inc.

- 6.4.2 Fiserv Inc.

- 6.4.3 PayPal Holdings Inc.

- 6.4.4 Mastercard Inc.

- 6.4.5 Montran Corporation

- 6.4.6 FIS Global

- 6.4.7 Temenos AG

- 6.4.8 Volante Technologies Inc.

- 6.4.9 Finastra Inc.

- 6.4.10 Ant Group (Alipay)

- 6.4.11 Tencent Holdings Ltd. (WeChat Pay)

- 6.4.12 The Clearing House Payments Co.

- 6.4.13 Visa Inc.

- 6.4.14 SWIFT SCRL

- 6.4.15 Worldline SA

- 6.4.16 Nets Group

- 6.4.17 Nexi SpA

- 6.4.18 Ripple Labs Inc.

- 6.4.19 Wise PLC

- 6.4.20 Pay.UK

- 6.4.21 GoCardless Ltd.

- 6.4.22 Jack Henry and Associates Inc.

- 6.4.23 Infosys Finacle

- 6.4.24 VSoft Corporation

- 6.4.25 OpenPayd Holdings Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment