|

시장보고서

상품코드

1635465

아시아태평양의 전기자동차용 배터리 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Asia-Pacific Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

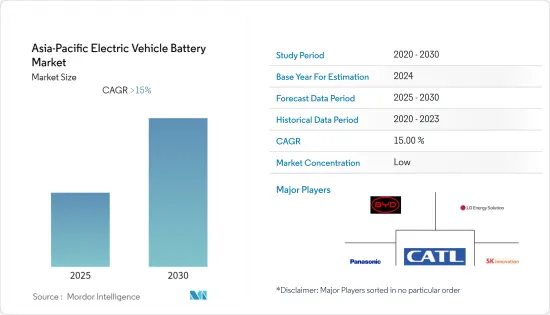

아시아태평양의 전기자동차용 배터리 시장은 예측 기간 중 15% 이상의 CAGR로 추이할 전망

주요 하이라이트

- 단기적으로 아시아태평양의 전기자동차 배터리 시장은 아시아 국가들의 전기자동차에 대한 지속적인 수요 증가와 탄소 없는 교통수단을 추구하는 정부의 구상으로 인해 높은 성장세를 보일 것으로 예상됩니다.

- 한편, 전기자동차와 관련된 주행거리 불안과 온도 문제는 고객 수용성을 떨어뜨려 전기자동차용 배터리 시장에 큰 위협이 되고 있습니다.

- 전기자동차 배터리 산업 전문가들의 연구개발 노력은 시장의 원활한 발전을 위한 충분한 기회를 창출하고 있습니다. 예를 들어 중국의 산업 대기업 CATL은 2023년에 에너지 밀도가 높은 차세대 전기자동차 배터리를 도입할 계획을 발표했습니다.

- 중국은 배기가스 배출이 없는 교통수단을 지향하는 정부 정책에 힘입어 전기자동차의 대량 도입으로 성장률이 높아질 것으로 예상됩니다.

아시아태평양 전기자동차 배터리 시장 동향

리튬이온 배터리, 큰 폭의 성장 전망

- 이 지역에서는 전기자동차에 가장 적합한 기술적 특성으로 인해 리튬이온 배터리의 판매가 급증할 것으로 예상됩니다. 높은 에너지 효율, 고온 성능, 높은 출력 대 중량비, 높은 재활용성 등은 이 기술의 장점 중 일부입니다.

- 2021년 현재 중국과 한국은 전기자동차 시장의 주요 2개국이며, 2021년 BEV 판매량은 한국이 약 7만 2,000대인 반면 중국은 270만 대에 달할 전망입니다. 전기자동차에 대한 수요가 급증하면서 이 지역에서의 리튬이온 배터리 판매는 빠르게 성장하고 있습니다. 또한 민간 투자자들의 리튬이온 배터리 생산 프로젝트도 시장을 주도하고 있습니다.

- 지난 8월, BYD Ord Shs A는 중국 장시성에 전기자동차 배터리 제조 공장을 건설할 계획이라고 발표했습니다. 이 계획에는 공장에 중요한 원료를 공급하기 위한 리튬이온 채굴 및 가공 프로젝트도 포함되어 있습니다. 이 공장은 연간 약 30GWh의 리튬 배터리를 생산할 계획입니다.

- 또한 2022년 9월에는 국내 전기자동차용 배터리 제조업체인 SK이노베이션이 호주의 광산기업인 세계 리튬 리소스(Global Lithium Resources)와 리튬 배터리용 리튬 공급 계약을 체결한 바 있습니다.

- 이러한 발전은 향후 수년간 아시아태평양의 전기자동차 리튬 배터리 시장을 주도할 것으로 예상됩니다.

눈에 띄는 성장이 기대되는 중국

- 중국은 이 지역에서 가장 큰 전기자동차(EV) 시장이자 전 세계에서 다양한 용도의 배터리를 대량 생산하고 있는 것으로 알려져 있습니다. 중국 정부의 무공해 교통수단 보급을 위한 노력으로 인해 앞으로도 그 우위를 유지할 것으로 예상됩니다.

- 예를 들어 중국 정부는 2022년 전기자동차 보조금을 30% 삭감하고 같은 해 말까지 폐지할 예정입니다. 계획된 보조금 삭감은 제조업체가 신기술과 신차를 개발할 때 정부 자금에 대한 의존도를 낮추기 위한 것입니다. 전기자동차 제조업체는 이러한 변화의 첫 번째 수혜자가 될 것으로 예상되며, 자동차 배터리 부문 수요가 증가할 것으로 예상됩니다.

- 중국의 BEV 판매량은 2021년 270만 대를 기록해 2020년 93만 대에서 높은 성장세를 보였습니다. 향후 예정된 전기자동차 공장 프로젝트와 전기자동차 배터리 제조 시장 확대로 인해 중국의 전기자동차 배터리 시장은 더욱 활성화될 것으로 예상됩니다.

- 또한 2022년 6월에는 혼다의 자동차 생산 및 판매 합작회사인 GAC 혼다가 중국 광둥성 광저우시에 전기자동차 신공장 건설을 시작했다고 발표했습니다. 이 공장은 2024년 가동을 시작해 연간 약 12만 대를 생산할 것으로 예상됩니다. 또한 혼다는 2027년까지 'e:N' 시리즈 10종의 EV를 출시할 계획입니다.

- 이러한 발전은 중국의 전기자동차 배터리 시장을 확대할 수 있는 엄청난 잠재력을 가지고 있습니다.

아시아태평양 전기자동차 배터리 산업 개요

아시아태평양 전기자동차 배터리 시장은 세분화되어 있습니다. 주요 기업으로는 LG Energy Solution, Panasonic Holdings Corporation, BYD Ord Shs A, Contemporary Amperex(CATL), SK Innovation 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 조사 방법

제3장 개요

제4장 시장 개요

- 서론

- 2027년까지 시장 규모와 수요 예측(단위 : 10억 달러)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 촉진요인

- 억제요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 세분화

- 배터리 유형

- 리튬이온 배터리

- 납축전지

- 기타 배터리 유형

- 차종

- 배터리 전기자동차(BEV)

- 플러그인 하이브리드차(PHEV)

- 하이브리드 전기자동차(HEV)

- 지역

- 중국

- 한국

- 인도

- 말레이시아

- 기타 아시아태평양

제6장 경쟁 구도

- M&A, 합병사업, 제휴, 협정

- 주요 기업의 전략

- 기업 개요

- LG Energy Solution

- Contemporary Amperex Technology Co Ltd.

- BYD Ord Shs A

- Panasonic Holdings Corporation

- SK Innovation Co Ltd.

- Samsung SDI

- EV Energy

- Murata Electronics

- Duracell

- Enersys

제7장 시장 기회와 향후 동향

KSA 25.01.31The Asia-Pacific Electric Vehicle Battery Market is expected to register a CAGR of greater than 15% during the forecast period.

Key Highlights

- Over the short term, the Asia-Pacific electric vehicle battery market can witness high growth due to the constantly growing demand for electric vehicles in Asian countries and the government's push toward carbon-free transportation.

- On the other hand, range anxiety and temperature issues associated with electric vehicles cause low customer acceptance, which poses a great threat to the electric vehicle battery market.

- Nevertheless, the research and development endeavors made by the electric vehicle battery industry experts create ample opportunities for the smooth progress of the market. For example, China's leading industry player CATL announced plans to introduce next-generation electric vehicle batteries with higher energy density in 2023.

- China is forecasted to grow at a faster rate due to the heavy deployment of electric vehicles backed by government policies for emission-free transportation.

APAC Electric Vehicle Battery Market Trends

Lithium-ion Battery Expected to Witness Significant Growth

- The region is predicted to witness an upsurge in lithium-ion battery sales due to its technical features that are best suited for electric vehicles. High energy efficiency, high-temperature performance, greater power-to-weight ratio, and high recyclability are some of the advantages of the technology.

- As of 2021, China and South Korea were the two leading countries in the electric vehicles market. The BEV sales recorded in South Korea were around 72000 units in 2021, whereas China stood at 2.7 million. The intensively growing demand for electric vehicles led to an escalated growth in lithium-ion battery sales in the region. Moreover, the lithium-ion battery manufacturing projects by private investors have also driven the market.

- In August 2022, BYD Ord Shs A announced that they had planned an electric vehicle battery manufacturing plant in Jiangxi, China. The plan also includes a lithium-ion mining and processing project to supply critical input to the factory. The plant is expected to produce around 30GWh of lithium batteries per year.

- Further, in September 2022, SK Innovation, the Korea-based electric vehicle battery manufacturer, entered into an agreement with Global Lithium Resources, the Australian mining company for the latter to supply lithium for lithium batteries.

- Such developments are expected to steer the lithium battery market for electric vehicle applications in the Asia-Pacific region in the coming years.

China Expected to Witness Significant Growth

- China is the largest market for electric vehicles (EVs) in the region and is also known for the mass production of batteries for various applications worldwide. The country is predicted to maintain its dominance in the future as well due to the government's efforts to promote emission-free transportation in the country.

- For example, the government of China is expected to cut subsidies on electric vehicles by 30% in 2022 and remove it by the end of the year, as the electric vehicle industry in the country is now booming. The planned subsidy cut is aimed at reducing manufacturers' reliance on government funds for developing new technologies and vehicles. Electric vehicle makers are expected to be the first to benefit from this change, thus increasing the demand in the automotive batteries segment.

- The BEV sales in China were recorded as 2.7 million in 2021, a high elevation from 930,000 units in 2020. The electric vehicle battery market is anticipated to get more impetus in the country due to the upcoming electric vehicle factory projects and expansion in the electric vehicle battery manufacturing market.

- Further, in June 2022, GAC Honda, the Honda automobile production and sales joint venture, announced that they had started the construction of a new EV plant in Guangzhou city of Guangdong state, China. The new EV plant is expected to produce around 120,000 units annually once it becomes operational in 2024. Honda also plans to introduce 10 e:N series EV models by 2027.

- Such developments have immense potential to expand China's electric vehicle battery market.

APAC Electric Vehicle Battery Industry Overview

The Asia-Pacific Electric Vehicle battery market is fragmented. Some of the key players (in no particular order) include LG Energy Solution, Panasonic Holdings Corporation, BYD Ord Shs A, Contemporary Amperex Co Ltd (CATL), and SK Innovation Co Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Other Battery Types

- 5.2 Vehicle Type

- 5.2.1 Battery Electric Vehicle (BEV)

- 5.2.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.2.3 Hybrid Electric Vehicle (HEV)

- 5.3 Geography

- 5.3.1 China

- 5.3.2 South Korea

- 5.3.3 India

- 5.3.4 Malaysia

- 5.3.5 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 LG Energy Solution

- 6.3.2 Contemporary Amperex Technology Co Ltd.

- 6.3.3 BYD Ord Shs A

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 SK Innovation Co Ltd.

- 6.3.6 Samsung SDI

- 6.3.7 EV Energy

- 6.3.8 Murata Electronics

- 6.3.9 Duracell

- 6.3.10 Enersys

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

샘플 요청 목록