|

시장보고서

상품코드

1636194

미국의 급여 서비스 시장 전망 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)United States Payroll Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

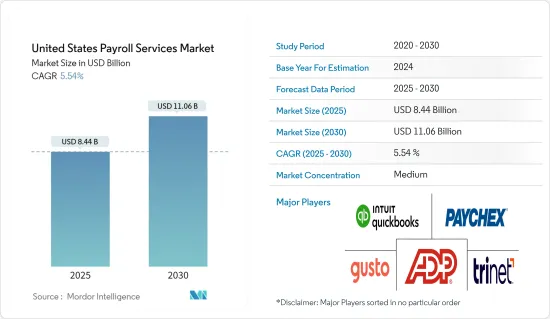

미국의 급여 서비스 시장 규모는 2025년에 84억 4,000만 달러로 추정되고, 2030년에는 110억 6,000만 달러에 이를 것으로 예측되며, 예측 기간(2025-2030년)의 연평균 성장율(CAGR)은 5.54%입니다.

기업의 급여 및 재무 프로세스 관리를 지원하는 중요한 산업인 미국 급여 서비스 시장은 괄목할 만한 성장과 진화를 거듭해 왔습니다. 급여 운영을 간소화하고 오류를 줄이며 복잡한 세법을 준수하기 위해 전문 서비스와 기술 중심 솔루션에 의존하는 기업이 점점 더 많아지고 있습니다.

급여 관리의 복잡성은 미국 시장의 주요 동인으로 두드러집니다. 기업들은 미로처럼 얽힌 세금 코드와 다양한 정부 차원의 보고 요건으로 인해 규정을 준수하는 데 어려움을 겪고 있습니다. 따라서 많은 기업이 이러한 복잡성을 해결하고 오류를 최소화하며 과태료를 피하기 위해 전문 급여 제공업체를 선택합니다.

기술, 특히 클라우드 기반 솔루션이 미국의 급여 환경을 재편하고 있습니다. 이러한 혁신적인 소프트웨어 플랫폼은 기업에 향상된 유연성, 자동화, 접근성을 제공합니다. 급여 프로세스를 간소화할 뿐만 아니라 셀프 서비스 옵션과 실시간 보고 기능을 통해 직원의 역량을 강화하여 전반적인 효율성을 높입니다.

또한, 규정 준수는 미국 급여 서비스 시장의 초석으로 남아 있습니다. 서비스 제공업체는 진화하는 세금 및 노동법을 주의 깊게 모니터링하여 고객, 특히 사내 전문 지식이 부족한 소규모 기업이 규정을 준수하고 최신 정보를 얻을 수 있도록 지원합니다.

미국의 급여 서비스 시장 동향

미국의 급여 서비스에 영향을 미치는 긱 경제(Gig Economy)의 상승

Gig Economy는 미국의 급여 서비스 환경을 재편하고 있습니다. 긱 경제는 프리랜서, 독립 계약자, 임시직 근로자가 급증하면서 전통적인 고용 구조에서 벗어나고 있습니다. 긱 워커는 기존 근로자와 달리 더 복잡한 급여 요구 사항을 제시하는 경우가 많습니다. 긱 워커는 여러 수입원을 병행하고, 비표준 시간으로 일하며, 다양한 보상 체계를 활용합니다. 이에 대응하여 급여 서비스 제공업체는 특화된 솔루션을 맞춤화하고 있습니다. 이러한 솔루션은 적응형 결제 방법부터 종합적인 세금 관리까지 다양하며, 긱 워커를 고용하는 기업이 규정을 준수할 수 있도록 지원합니다.

셀프 서비스 포털은 이러한 진화하는 환경에서 각광받고 있습니다. 긱 워커는 점점 더 자신의 급여 기록, 세금 양식 및 기타 급여 관련 세부 정보에 원활하게 액세스할 수 있기를 원합니다. 이를 인식한 급여 서비스 제공업체는 포털을 개편하고 있습니다. 이러한 업데이트는 유연성, 모바일 접근성, 사용자 지정 가능한 기능을 우선시하여 긱 워커의 다양한 선호도에 맞춰 진행됩니다.

예측 가능한 워크로드를 위해 설계된 기존의 급여 가격 구조는 긱 워커에게 적합하지 않은 경우가 많습니다. 이러한 격차를 해소하기 위해 급여 서비스 제공업체는 혁신적인 가격 모델을 출시하고 있습니다. 이러한 새로운 접근 방식에는 온디맨드 서비스, '종량제' 옵션 또는 특정 급여 작업에 맞춘 고정 요금이 포함될 수 있습니다.

데이터 보안 및 클라우드 솔루션은 미국의 급여 서비스 시장 성장을 가속

기업들이 사이버 위협, 데이터 유출, 무단 액세스로부터 민감한 직원 정보를 보호하는 것이 매우 중요하다는 점을 인식함에 따라 데이터 보안은 미국 급여 서비스 시장을 이끄는 가장 중요한 관심사입니다. 급여 서비스 제공업체는 사회보장번호부터 은행 정보까지 다양한 민감한 직원 데이터를 관리합니다. 서비스 제공업체는 신원 도용 및 금융 사기와 같은 위험 때문에 강력한 데이터 보안을 우선시합니다. 여기에는 암호화, 보안 데이터 센터, 엄격한 액세스 제어와 같은 조치가 포함됩니다.

급여 서비스 제공업체는 데이터 보호 규정을 준수하는 것이 무엇보다 중요합니다. 미국에서는 GDPR 및 CCPA와 같은 규정이 매우 중요합니다. 규정 준수는 민감한 데이터를 보호할 뿐만 아니라 법적 및 재정적 영향으로부터 비즈니스를 보호합니다.

또한, 업계가 클라우드 기반 급여 솔루션으로 전환함에 따라 안전하고 확장 가능한 인프라의 필요성이 강조되고 있습니다. 클라우드 플랫폼은 자동 백업 및 실시간 모니터링과 같은 기능을 통해 데이터 보호를 강화하여 데이터 손실이나 다운타임의 위험을 줄여줍니다.

미국의 급여 서비스 산업 개요

미국의 급여 계산 서비스 시장은 경쟁이 치열하고 세분화되고 있으며, 여러 주요 기업들이 시장 점유율을 다투고 있습니다. 이 시장에서 주요 경쟁 업체는 ADP, Paychex, Intuit(QuickBooks), TriNet, Gusto 등입니다. 이러한 유명 공급업체는 첨단 기술, 견고한 보안 조치, 법규 준수 전문 지식을 활용하여 신뢰할 수 있는 급여 계산 처리 및 인사 서비스를 추구하는 고객을 유치하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학과 인사이트

- 시장 개요

- 시장 성장 촉진요인

- 급여규제의 복잡화

- 긱 경제의 대두

- 시장 성장 억제요인

- 데이터 유출 및 데이터 보안에 대한 우려

- 급여 계산 업무의 아웃소싱을 제한하는 규제나 계약상의 제약

- 시장 기회

- 인사 및 급여 솔루션의 통합

- 클라우드 기반의 급여 계산 소프트웨어나 자동화 솔루션 등의 디지털 기술의 채용

- 밸류체인 분석

- 업계의 매력 Porter's Five Forces 분석

- 신규 진입업자의 위협

- 구매자, 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 업계의 기술적 진보에 관한 통찰

- 시장에 대한 COVID-19의 영향

제5장 시장 세분화

- 유형별

- 소기업

- 중기업

- 대기업

- 최종 사용자별

- 헬스케어

- 제조업

- 소매

- IT

- 금융

- 전문 서비스

제6장 경쟁 구도

- 시장 집중도 개요

- 기업 프로파일

- ADP(Automatic Data Processing)

- Paychex

- Gusto

- Intuit(QuickBooks)

- TriNet

- Paycor

- Zenefits

- SurePayroll

- OnPay

- Square Payroll

제7장 향후 시장 동향

제8장 면책사항 및 회사 소개

HBR 25.02.10The United States Payroll Services Market size is estimated at USD 8.44 billion in 2025, and is expected to reach USD 11.06 billion by 2030, at a CAGR of 5.54% during the forecast period (2025-2030).

The US payroll services market, a vital industry aiding businesses in managing payroll and financial processes, has seen remarkable growth and evolution. Companies increasingly turn to specialized services and technology-driven solutions to streamline payroll operations, reduce errors, and comply with intricate tax laws.

The complexity of payroll administration stands out as a primary driver for the US market. Businesses grapple with ensuring compliance due to the maze of tax codes and reporting requirements across different government levels. Consequently, many opt for specialized payroll providers, entrusting them to navigate these complexities, minimize errors, and avoid penalties.

Technology, especially cloud-based solutions, is reshaping the US payroll landscape. These innovative software platforms offer businesses enhanced flexibility, automation, and accessibility. They not only streamline payroll processes but also empower employees with self-service options and real-time reporting, boosting overall efficiency.

Furthermore, regulatory adherence remains a cornerstone of the US payroll services market. Providers vigilantly monitor evolving tax and labor laws, ensuring their clients, especially smaller businesses lacking in-house expertise, remain compliant and informed.

United States Payroll Services Market Trends

Rise of Gig Economy Influencing US Payroll Services

The gig economy is reshaping the US payroll services landscape. This economy is marked by a surge in freelancers, independent contractors, and temporary workers, diverging from traditional employment structures. Unlike their traditional counterparts, gig workers often present more intricate payroll demands. They juggle multiple income streams, work non-standard hours, and navigate varied compensation schemes. In response, payroll service providers are tailoring specialized solutions. These offerings range from adaptable payment methods to comprehensive tax management, ensuring businesses engaging gig workers remain compliant.

Self-service portals are gaining prominence in this evolving landscape. Gig workers increasingly seek seamless access to their payment records, tax forms, and other payroll specifics. Recognizing this, payroll service providers are revamping their portals. These updates prioritize flexibility, mobile accessibility, and customizable features, aligning with the diverse preferences of gig workers.

Conventional payroll pricing structures, designed for more predictable workloads, often fall short for gig workers. To bridge this gap, payroll service providers are rolling out innovative pricing models. These new approaches might include on-demand services, "pay-as-you-go" options, or flat fees tailored for specific payroll tasks.

Data Security and Cloud Solutions Propel Growth in the US Payroll Services Market

Data security is a paramount concern driving the US payroll services market as businesses recognize the critical importance of safeguarding sensitive employee information from cyber threats, data breaches, and unauthorized access. Payroll service providers manage a wealth of sensitive employee data, from social security numbers to banking details. Providers prioritize robust data security because of the risks, such as identity theft and financial fraud. This includes measures like encryption, secure data centers, and stringent access controls.

Adhering to data protection regulations is paramount for payroll service providers. In the United States, regulations like the GDPR and CCPA are pivotal. Compliance not only safeguards sensitive data but also shields businesses from legal and financial repercussions.

Furthermore, the industry's pivot toward cloud-based payroll solutions underscores the need for secure, scalable infrastructure. With features like automated backups and real-time monitoring, cloud platforms bolster data protection, reducing the risk of data loss or downtime.

United States Payroll Services Industry Overview

The US payroll services market is highly competitive and fragmented, with several key players vying for market share. Major competitors in the market include ADP, Paychex, Intuit (QuickBooks), TriNet, and Gusto. These established providers leverage advanced technology, robust security measures, and regulatory compliance expertise to attract clients seeking reliable payroll processing and HR services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Complexity of Payroll Regulations

- 4.2.2 Rise of Gig Economy

- 4.3 Market Restraints

- 4.3.1 Concerns about Data Breaches and Data Security

- 4.3.2 Regulatory or Contractual Restrictions that Limit the Outsourcing of Payroll Services

- 4.4 Market Opportunities

- 4.4.1 Integration of HR and Payroll Solutions

- 4.4.2 Adoption of Digital Technologies Such as Cloud-based Payroll Software and Automated Solution

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights Into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Small-size Company

- 5.1.2 Mid-size Company

- 5.1.3 Large Enterprises

- 5.2 By End User

- 5.2.1 Healthcare

- 5.2.2 Manufacturing

- 5.2.3 Retail

- 5.2.4 IT

- 5.2.5 Finance

- 5.2.6 Professional Services

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 ADP (Automatic Data Processing)

- 6.2.2 Paychex

- 6.2.3 Gusto

- 6.2.4 Intuit (QuickBooks)

- 6.2.5 TriNet

- 6.2.6 Paycor

- 6.2.7 Zenefits

- 6.2.8 SurePayroll

- 6.2.9 OnPay

- 6.2.10 Square Payroll*