|

시장보고서

상품코드

1636418

프랑스의 전기자동차 배터리 분리막 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)France Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

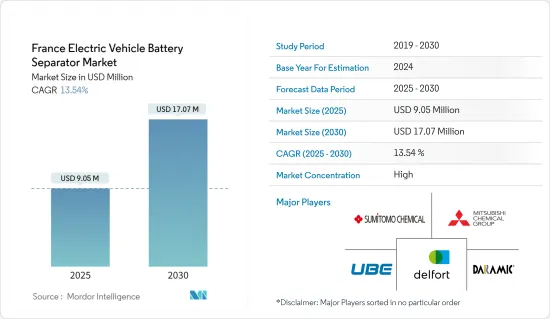

프랑스 전기자동차 배터리 분리막 시장 규모는 2025년 905만 달러, 2030년 1,707만 달러로 추정되며, 예측기간(2025-2030년) CAGR은 13.54%에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 전기자동차의 보급과 리튬 이온 배터리의 가격 하락이 예측 기간 시장을 견인할 것으로 보입니다.

- 한편, 원재료의 수급 격차가 예측 기간 동안 시장 성장을 억제할 것으로 예상됩니다.

- 그럼에도 불구하고 첨단 배터리 기술 개발이 진행됨에 따라 프랑스 전기자동차 배터리 분리기 시장에 비즈니스 기회가 생길 가능성이 높습니다.

프랑스 전기자동차 배터리 분리막 시장 동향

리튬 이온 배터리 부문이 급성장

- 다양한 배터리 유형 중 리튬 이온 배터리(LIB)가 예측 기간 동안 프랑스 전기자동차(EV)용 배터리 분리막 시장을 선도할 것으로 보입니다. 리튬 이온 배터리는 우수한 용량 대 중량비로 다른 배터리 유형을 능가합니다. LIB 채용이 증가하고 있는 이유는 최소한의 유지보수로 성능이 향상되고 보존 기간이 길고 가격이 급락하고 있기 때문입니다.

- 납 배터리와 비교하면 리튬 이온(Li-ion) 배터리는 기술적으로 많은 이점을 보여줍니다. 예를 들어, 납 배터리의 수명이 약 400-500 사이클인 반면, 충전식 리튬 이온 배터리는 평균 5,000 사이클 이상이라는 경이적인 수명을 자랑합니다. 또한, 리튬 이온 배터리는 유지 보수 빈도 및 방전 사이클 동안 전압의 안정성에서 점에서 납 축배터리를 능가하며, 전기 부품의 효율을 장기간에 걸쳐 유지할 수 있습니다.

- 최근 업계를 선도하는 기업들은 투자를 확대하고 규모의 장점과 R&D에 중점을 두고 배터리 성능을 높이고 있습니다. 이러한 경쟁이 급증함에 따라 리튬 이온 배터리의 가격이 현저하게 떨어지고 있습니다. 기술 진보, 제조 최적화, 원재료 비용 감소로 인해 리튬 이온 배터리의 부피 가중 평균 가격은 2013년 780달러/kWh에서 2023년 139달러/kWh로 크게 떨어졌습니다. 예측에서는 2025년에는 113달러/kWh 정도까지 더욱 하락했고, 2030년에는 80달러/kWh라는 야심적인 목표가 나타났습니다. 이러한 배터리 비용의 저하 동향은 리튬 이온 배터리를 점점 매력적인 옵션으로 자리매김하고 있습니다.

- 역사적으로, 리튬 이온 배터리는 휴대폰이나 노트북 등의 소비자용 전자 기기에 주로 사용되어 왔습니다. 그러나 그 역할은 진화해 현재는 하이브리드차, 배터리식 전기자동차(BEV) 전반, 재생 가능 에너지 분야의 배터리 축전 시스템(BESS)의 전원으로서 선호되고 있습니다.

- 2024년 5월, Verco은 16개의 상업 은행과 3개의 공공 은행의 지원을 받아 13억 유로 이상의 녹색 금융을 확보했다고 발표했습니다. 이 기금은 Dankerk에 위치한 Verco의 리튬 이온 기가 공장 건설에 충당됩니다. 이번 자금 조달로 Verco의 배터리 기가팩토리 및 베르콜 혁신 센터를 위해 확보한 자금 총액은 30억 유로를 넘었습니다. 이 엄청난 지원은 저탄소 고성능 배터리를 유럽 자동차 부문에 공급하고 전기 이동성과 에너지 저장에서 유럽 대륙의 산업 주권을 강화하는 Verco의 사명에 대한 은행 파트너의 신뢰를 뒷받침합니다.

- 프랑스에서는 전기자동차용 리튬이온 배터리 제조업체인 Automotive Energy Supply Corporation(AESC)이 2025년까지 오드프랑스의 두에에 기가팩토리를 시작할 준비를 진행하고 있습니다. 이 공장의 1기 공사에서는 Renault의 ECHO 5와 크로스오버 다목적차 4Ever에 대응해 최대 9기가와트의 생산능력을 가지며 연간 20만대의 전기자동차에 충분한 전력을 공급합니다.

- 또한 3개의 확장 계획을 통해 2030년까지 시설용량이 24-30기가와트까지 증가할 수 있습니다. 유럽 투자 은행은 3억 3,720만 유로의 직접 대출과 상업 은행에 대한 1억 1,280만 유로의 간접 대출로 AESC를 지원했으며, 이 계약은 2023년 9월에 체결되었습니다. 이러한 리튬 이온 배터리의 제조 능력의 확대는 배터리 부품, 특히 리튬 이온 배터리의 분리막에 대한 수요가 향후 급증할 것을 시사하고 있습니다.

- 경량성, 급속 충전, 충전 사이클의 연장, 비용의 저하, 업계의 진보를 고려하면, 리튬 이온 배터리는 예측 기간중, 프랑스의 전기자동차 배터리 분리막 시장에서 가장 급성장하는 부문이 될 전망입니다.

전기자동차의 보급이 시장을 견인

- 프랑스에서는 전기자동차(EV)의 판매가 급증하고 있어 EV용 배터리 재료 수요가 높아지고 있습니다. EV 판매량이 급증함에 따라 이러한 재료의 현지 생산과 투자가 증가하고 프랑스 배터리 공급망이 강화되고 있습니다.

- 프랑스는 청정 에너지와 전기자동차에 힘을 쏟고 있으며, 특히 분리막를 비롯한 배터리 부품의 중시를 강화하고 있습니다. 국제에너지기구(IEA)는 이 동향을 강조해 프랑스에서의 배터리 전기자동차(BEV) 판매량이 2023년에는 약 31만대에 달하고, 2022년 21만대에서 47% 급증할 것으로 지적했습니다. 이 EV의 급속한 보급은 분리기를 포함한 배터리 부품 수요가 급증하고 있음을 보여줍니다.

- 게다가 프랑스 정부는 2024년 5월 자국의 자동차 제조업체에 대해 10년 후까지 전기자동차 또는 하이브리드차를 200만대 생산한다는 야심적인 목표를 설정했습니다. 이것은 압도적인 시장 점유율을 자랑하는 중국과의 가혹한 경쟁에서의 일입니다. 새로운 중기계획 협정의 일환으로 자동차 업계는 2027년까지 80만대의 전기자동차 판매라는 중간 목표를 목표로 하고 있으며, 이는 2022년 20만대에서 크게 상승한 것입니다. 또한 자동차 제조업체는 전기자동차(EV) 판매량을 2022년 1만 6,500대에서 연간 10만대로 끌어올리는 것을 목표로 하고 있습니다.

- 또한 보조금, 감세, 엄격한 배기 가스 규제 등 정부의 시책이 EV 시장을 활성화시켜 EV용 배터리와 분리막 등 그 부품 수요를 높이고 있습니다. 예를 들어 정부는 2024년 EV 생산과 구매를 촉진하기 위해 다양한 프로그램에 15억 유로(16억 달러)를 할당했습니다. 프랑스에서 판매되는 신차의 20% 가까이가 전기자동차이지만, 그 중 국산차는 불과 12%에 불과합니다. 그러나 이러한 지원책에 따라 프랑스는 EV용 배터리의 제조환경을 강화하는 태세를 갖추어 배터리 분리막 시장의 성장 확대에 길을 열었습니다.

- 2023년 5월 Stellantis는 TotalEnergies 및 Mercedes-Benz와 제휴하여 프랑스의 빌리 벨크로 두브란에 Automotive Cells Company(ACC)의 배터리 기가 공장의 출시를 축하했습니다. 이 시설은 유럽에서 계획된 3가지 중 첫 번째로 13기가와트(GWh) 생산 라인 능력으로 시작하여 2030년까지 40GWh로 확장하는 것을 목표로 하고 있습니다. CO2 배출량을 줄인 고성능 리튬 이온 배터리를 목표로 하는 이 기가팩토리는 2030년까지 유럽에서 배터리 생산 능력을 250GWh로 확대하는 Stellantis의 야망에서 매우 중요한 역할을 하고 있습니다. 배터리 생산에서 이러한 도약은 배터리 분리기 부문을 강화할 것입니다.

- 또한 프랑스의 역동적인 EV 시장은 배터리 기술, 특히 분리기의 기술 혁신을 촉진하고 있습니다. Arkema와 ProLogium의 차세대 리튬 세라믹 배터리용 첨단 재료에 대한 공동 연구 등은 이 지역 수요 증가를 뒷받침하고 있습니다.

- 이러한 역학을 고려하면, 프랑스는 대폭적인 EV 수요 급증 직전에 있어, 예견 가능한 장래에 EV용 배터리 분리막의 요구가 증폭하는 것은 필연적입니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모 및 수요 예측(단위: 달러)

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 전기자동차의 보급 확대

- 리튬 이온 배터리의 가격 저하

- 억제요인

- 원재료의 수급 격차

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

- 투자 분석

제5장 시장 세분화

- 배터리 유형

- 리튬 이온 배터리

- 납축배터리

- 기타 배터리 유형

- 재료 유형

- 폴리프로필렌

- 폴리에틸렌

- 기타 소재 유형

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Sumitomo Chemical Co. Ltd

- Delfortgroup AG

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Daramic SAS

- SK innovation Co., Ltd.

- Toray Industries, Inc.

- 기타 유명 기업 일람

- 시장 랭킹 분석

제7장 시장 기회와 앞으로의 동향

- 배터리 기술의 개발과 선진화의 진전

The France Electric Vehicle Battery Separator Market size is estimated at USD 9.05 million in 2025, and is expected to reach USD 17.07 million by 2030, at a CAGR of 13.54% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the growing adoption of electric vehicles and the decreasing price of lithium-ion batteries is expected to drive the market in the forecast period.

- On the other hand, the demand-supply gap of raw materials are expected to restrain market growth during the forecast period.

- Nevertheless, the growing progress in developing and advanced battery technologies are likely to create opportunities for the France electric vehicle battery separator market.

France Electric Vehicle Battery Separator Market Trends

Lithium-ion Battery Segment to be the Fastest Growing

- Among various battery types, lithium-ion batteries (LIBs) are set to lead the France electric vehicle (EV) battery separator market during the forecast period. LIBs are outpacing other battery types, thanks to their superior capacity-to-weight ratio. Their rising adoption is further fueled by advantages like extended performance with minimal maintenance, a longer shelf life, and plummeting prices.

- When compared to lead-acid batteries, lithium-ion (Li-ion) batteries showcase numerous technical benefits. For instance, while lead-acid batteries offer a lifespan of about 400-500 cycles, rechargeable Li-ion batteries boast an impressive average of over 5,000 cycles. Moreover, Li-ion batteries outshine lead-acid ones in terms of maintenance frequency and voltage consistency throughout the discharge cycle, ensuring prolonged efficiency of electrical components.

- In recent years, major industry players have ramped up investments, focusing on economies of scale and R&D to boost battery performance. This surge in competition has led to a notable drop in lithium-ion battery prices. Thanks to technological advancements, manufacturing optimizations, and falling raw material costs, the volume-weighted average price of lithium-ion batteries saw a significant decline from USD 780/kWh in 2013 to USD 139/kWh in 2023. Projections suggest a further dip to around USD 113/kWh by 2025 and an ambitious target of USD 80/kWh by 2030. Such a downward trend in battery costs positions lithium-ion batteries as an increasingly attractive option.

- Historically, lithium-ion batteries found their primary application in consumer electronics like mobile phones and laptops. Yet, their role has evolved, and they are now the preferred power source for hybrids, the entire range of battery electric vehicles (BEVs), and battery energy storage systems (BESS) within the renewable energy sector.

- In May 2024, Verkor announced securing over EUR 1.3 billion in green financing, backed by 16 commercial banks and 3 public banks. These funds are earmarked for constructing Verkor's inaugural lithium-ion Gigafactory in Dunkirk, boasting an initial production capacity of 16 GWh/year. With this latest financing, Verkor's total secured funding for its battery gigafactory and the Verkor Innovation Centre surpasses EUR 3 billion. This substantial backing underscores banking partners' confidence in Verkor's mission to deliver low-carbon, high-performance batteries to Europe's automotive sector, bolstering the continent's industrial sovereignty in electric mobility and energy storage.

- In France, Automotive Energy Supply Corporation (AESC), a lithium-ion battery manufacturer for electric vehicles, is gearing up to launch a gigafactory in Douai, Hauts-de-France, by 2025. The factory's inaugural phase will cater to Renault's ECHO 5 and the 4Ever crossover utility vehicle, with a combined capacity of up to 9 Gigawatt-hours, sufficient to power 200,000 electric cars annually.

- Additionally, the plans for three expansions could see the facility's capacity soar to between 24 to 30 gigawatt-hours by 2030. The European Investment Bank is backing AESC with a direct loan of EUR 337.2 million and an additional EUR 112.8 million in indirect loans to commercial banks, a deal inked in September 2023. Such expansive lithium-ion battery manufacturing capabilities signal a burgeoning demand for battery components, notably lithium-ion battery separators, in the coming years.

- Given their lightweight nature, rapid charging, extended charging cycles, decreasing costs, and advancements in the industry, lithium-ion batteries are poised to be the fastest-growing segment in the France electric vehicle battery separator market during the forecast period.

Growing Adoption of Electric Vehicles to Drive the Market

- France's surging electric vehicle (EV) sales are propelling a heightened demand for EV battery materials, with separators taking center stage. As EV sales soar, local production and investments in these materials are on the rise, fortifying France's battery supply chain.

- France's dedication to clean energy and electric vehicles is intensifying its emphasis on battery components, notably separators. The International Energy Agency (IEA) highlighted this trend, noting that battery electric vehicle (BEV) sales in France reached around 310,000 units in 2023, a 47% leap from 210,000 units in 2022. This rapid surge in EV adoption signals a burgeoning demand for battery components, including separators.

- Moreover, in May 2024, the French government set an ambitious target for its carmakers: produce two million electric or hybrid vehicles by the decade's end. This comes amid stiff competition from China's dominant market. As part of a new medium-term planning agreement, the industry aims for an interim target of 800,000 electric vehicle sales by 2027, a significant leap from 200,000 in 2022. Furthermore, carmakers are setting their sights on boosting sales of electric light utility vehicles to 100,000 annually, up from just 16,500 in 2022.

- Additionally, government measures like subsidies, tax breaks, and stringent emissions regulations are energizing the EV market, subsequently heightening the demand for EV batteries and their components, such as separators. For instance, in 2024, the government allocated EUR 1.5 billion (USD 1.6 billion) across various programs to spur EV production and purchases. While nearly 20% of new cars sold in France are electric, only 12% of those are domestically produced. However, with these supportive measures, France is poised to bolster its EV battery manufacturing landscape, paving the way for heightened growth in the battery separator market.

- In May 2023, Stellantis, in partnership with TotalEnergies and Mercedes-Benz, celebrated the launch of the Automotive Cells Company's (ACC) battery gigafactory in Billy-Berclau Douvrin, France. This facility, the first of three planned in Europe, commenced with a production line capacity of 13 gigawatt-hours (GWh) and aims to scale up to 40 GWh by 2030. Targeting high-performance lithium-ion batteries with a reduced CO2 footprint, the gigafactory plays a pivotal role in Stellantis' ambition to escalate battery manufacturing capacity to 250 GWh in Europe by 2030. Such strides in battery production are set to bolster the battery separator sector.

- Moreover, France's dynamic EV market is catalyzing innovations in battery technology, especially in separators. Collaborations, like those between Arkema and ProLogium on advanced materials for next-gen lithium ceramic batteries, underscore the region's growing demand.

- Considering these dynamics, France is on the brink of a significant EV demand surge, which will inevitably amplify the need for EV battery separators in the foreseeable future.

France Electric Vehicle Battery Separator Industry Overview

The France rechargeable battery market is semi-consolidated. Some of the key players in the market (not in any particular order) include Sumitomo Chemical Co. Ltd, Mitsubishi Chemical Group Corporation, UBE Corporation, Daramic SAS and Delfortgroup AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Decreasing Price of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Gap of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Other Battery Types

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Sumitomo Chemical Co. Ltd

- 6.3.2 Delfortgroup AG

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 UBE Corporation

- 6.3.5 Daramic SAS

- 6.3.6 SK innovation Co., Ltd.

- 6.3.7 Toray Industries, Inc.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Progress in Developing and Advanced Battery Technologies

샘플 요청 목록