|

시장보고서

상품코드

1636437

영국의 전기자동차용 배터리 제조 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)United Kingdom Electric Vehicle Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

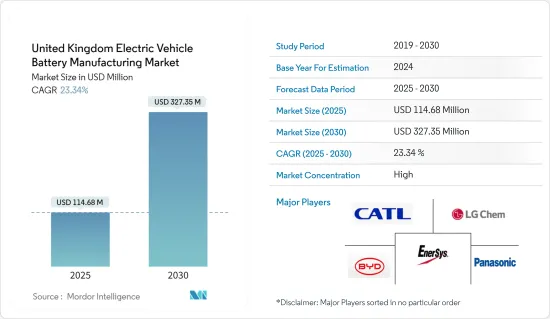

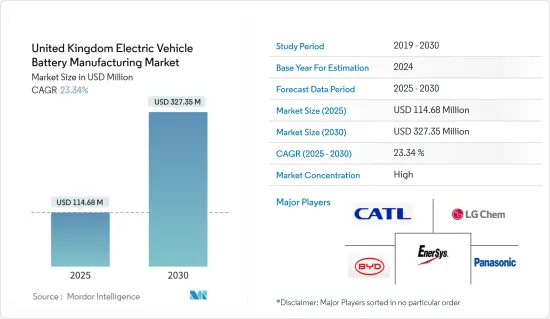

영국의 전기자동차용 배터리 제조 시장 규모는 2025년 1억 1,468만 달러, 2030년 3억 2,735만 달러로 추정되며, 예측 기간(2025-2030년)중 CAGR은 23.34%에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로 영국의 전기자동차용 배터리 제조 시장은 배터리 생산 능력 향상을 위한 투자로 성장할 전망입니다. 게다가 원재료와 전기자동차 배터리의 가격 하락이 정부의 지원 정책과 함께 이 시장을 더욱 뒷받침하고 있습니다.

- 반대로, 원재료의 매장량에 한계가 있는 것이 시장 확대의 과제가 되고 있습니다.

- 그러나 배터리 재료의 기술적 진보가 계속되고 있으며 영국이 야심찬 전기자동차의 장기 목표를 내걸고 있기 때문에 동 시장의 기업에게는 큰 기회가 생기고 있습니다.

영국 전기자동차용 배터리 제조 시장 동향

리튬 이온 배터리 부문이 시장을 독점

- 리튬 이온 배터리 산업의 여명기에는 소비자 일렉트로닉스가 주요 시장이었습니다. 그러나 시간이 지남에 따라 영국(UK)에서의 EV 판매의 급증에 견인되어 전기차(EV) 제조업체가 리튬 이온 전지의 주요 소비자로서 주도권을 잡게 되었습니다.

- 지난 10년간 영국에서는 주로 자동차 분야에서 리튬 이온 배터리 기술이 급성장해 왔습니다. 영국에서 리튬 이온 이차 전지를 선호하게 된 것은 용량 대 중량비가 우수하기 때문입니다. 또한 EV의 리튬 배터리는 NOX, CO2 및 기타 온실가스를 발생시키지 않으므로 기존의 내연기관(ICE) 차량에 비해 환경 부하가 크게 낮습니다. 이러한 장점을 인식하고 영국을 비롯한 일부 국가는 보조금과 정부의 이니셔티브를 통해 EV의 보급과 전지 제조의 성장을 가속하고 있습니다.

- 2023년 전기자동차(EV)용 배터리 팩의 평균 가격은 139달러/kWh로 하락해 2022년부터 13% 하락했습니다. 이 하락은 몇년전의 가격 상승 추세를 따릅니다. 지속적인 기술 발전과 제조 효율성 향상으로 배터리 팩 가격의 지속적인 하락이 예상되고 있으며, 2025년에는 113달러/kWh, 2030년에는 80달러/kWh까지 더욱 급락할 것으로 예상됩니다. 이러한 동향은 영국에서의 리튬 이온 전지 제조의 융성을 뒷받침하고 있습니다.

- 국제에너지기구(IEA)에 따르면 리튬 이온 기술에 90% 이상 의존하는 영국의 전기자동차 판매량은 이 나라의 EV 배터리 제조 시장의 성장을 반영하고 있습니다. 2023년 판매량은 31만대에 달하고, 2022년 27만대에서 14.8% 증가했습니다. 이는 영국의 EV 배터리 제조 상황에서 리튬 이온 배터리가 압도적인 지위를 차지하고 있음을 뒷받침합니다.

- 2024년 3월 리튬 이온 전기자동차 배터리를 전문으로 하는 중국 기업 EVE 에너지는 12억 유로 이상의 대규모 투자 계획을 발표했습니다. 이 투자는 영국 코번트리 교외에 570만 평방 피트의 광대한 기가팩토리를 건설하기 위한 것이며, 영국 전기화의 요점으로 구상되고 있습니다. 이러한 대규모 투자는 영국 전기자동차용 배터리 제조 시장의 강력한 성장 궤도를 보여줍니다.

- 2024년 4월, 대기업 자동차 부품 제조업체인 ADVIK는 영국을 거점으로 하는 첨단 리튬 이온 전지 기업인 Aceleron Energy Ltd.의 사업 자산을 인수해 큰 화제가 되었습니다. 이 전략적 인수는 ADVIK 제품군과 고객 기반을 확대할 뿐만 아니라 차세대 에너지 저장 솔루션에 대한 헌신을 강조합니다. ADVIK의 영국 부문인 ADVIK Technologies Limited가 관리하는 이 인수는 Aceleron의 최첨단 리튬 이온 배터리 기술을 ADVIK 포트폴리오에 통합합니다. 특허기술에 더해 이 인수에 의해 ADVIK는 영국에 시험·시제품 시설을 증설해, 이미 10공장으로 구성된 광범위한 네트워크를 강화합니다.

- 이러한 개발에서 리튬 이온 배터리 분야가 영국 시장을 독점하는 태세에 있음이 분명합니다.

정부 정책과 인센티브가 EV 판매 급증의 원동력

- 영국은 온실가스(GHG), 특히 이산화탄소 배출을 억제하기 위해 여러 법률, 정책, 법률을 제정하고 있습니다. 또한 영국은 배터리 전기자동차에 대한 다양한 우대책을 개발하고 EV 배터리 제조업체에게 유리한 조건을 만들고 있습니다.

- 그 선두에 서는 것이 2022년 4월에 최종 갱신된 넷 제로 전략(Build Back Greener)입니다. 이 전략은 2020년 11월 18일에 도입된 '그린 산업 혁명을 위한 10개 항목 계획'에서 이어져, 2050년까지 정부의 야심적인 넷 제로 배출 목표를 달성하기 위한 정책과 이니셔티브를 포함한 종합적인 로드맵을 제시합니다. 2023년 3월에는 이러한 이니셔티브가 대폭 갱신되어, 상세한 「파워 업 브리튼」을 포함한 광범위한 정책을 발표했습니다.

- 2023년 3월 영국 정부는 배출 감축 전략을 상세하게 설명한 탄소수지계획(CBDP)을 발표했습니다. 이 계획은 고등법원의 판결에 대응하는 것으로, 무공해차(ZEV) 의무화 법안을 포함하고 있었습니다.

- 획기적인 결정으로 영국 정부는 2022년 3월 화석 연료차를 단계적으로 폐지하고 2035년까지 제로 배출 차량만으로 구성된 차량을 목표로 하는 의향을 발표했습니다. 이러한 움직임은 소비자의 기호를 바꾸고 있으며, EV에 끌리는 개인이 늘고 있습니다.

- 또한 정부는 전기자동차 충전 인프라의 확대에 주력하고 있습니다. 국제에너지기관의 데이터는 영국의 EV 충전 포인트가 급증하고 있으며, 2022년 36,900곳에서 2023년에는 53,000곳으로 급증하고 있습니다.

- 2024년 1월 영국은 전기차 전환을 위한 세계에서 가장 야심찬 규제 체제를 도입했습니다. 2024년에 발효된 영국 제로 배출 차량(ZEV) 지침은 2030년까지 제조업자의 생산 목표를 보여줍니다. 2030년까지 영국에서 판매되는 밴의 신차의 70%, 자동차의 신차의 80%를 제로 배출 차로 하는 것을 목표로 하고 있으며, 2035년까지 완전 이행하는 것을 추진하고 있습니다. 이 궤적은 영국의 EV 배터리 제조 시장이 크게 성장할 가능성을 시사합니다.

- 요약하면, 전기자동차의 점유율을 높이기 위해 영국 정부의 협력과 노력이 나라의 배터리 제조 산업에 좋은 징조입니다.

영국 전기자동차용 배터리 제조 업계 개요

영국의 전기자동차용 배터리 제조 시장은 반고착화되고 있습니다. 이 시장의 주요 기업(순부동)으로는 BYD Company Ltd., Duracell Inc., EnerSys, Panasonic Holdings Corporation, Contemporary Amperex Technology Co.Ltd., LG Chem Ltd. 등이 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 시장 개요

- 소개

- 2029년까지 시장 규모 및 수요 예측(단위: 달러)

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 배터리 생산 능력 증강을 위한 투자

- 배터리 원재료 비용의 저하

- 유리한 정부 정책

- 억제요인

- 원료 비축 부족

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

- 투자분석

제2장 시장 세분화

- 배터리별

- 리튬 이온

- 납축전지

- 니켈 수소 전지

- 기타

- 전지 형상별

- 각형

- 가방형

- 원통형

- 차량별

- 승용차

- 상용차

- 기타

- 추진별

- 배터리 전기자동차

- 하이브리드 전기자동차

- 플러그인 하이브리드 전기자동차

제3장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- BYD Co. Ltd

- Contemporary Amperex Technology Co. Limited

- Duracell Inc

- EnerSys

- GS Yuasa Corporation

- LG Chem Ltd

- Exide Industries

- Panasonic Corporation

- List of Other Prominent Companies

- 시장 랭킹 분석

제4장 시장 기회와 앞으로의 동향

- 전기차의 장기적인 야심적 목표

The United Kingdom Electric Vehicle Battery Manufacturing Market size is estimated at USD 114.68 million in 2025, and is expected to reach USD 327.35 million by 2030, at a CAGR of 23.34% during the forecast period (2025-2030).

Key Highlights

- In the medium term, the United Kingdom's Electric Vehicle Battery Manufacturing Market is poised for growth, driven by investments aimed at boosting battery production capacity. Additionally, a drop in the prices of raw materials and EV batteries, combined with supportive government policies, further bolsters this market.

- Conversely, a limited reserve of raw materials poses a challenge to the market's expansion.

- However, with ongoing technological advancements in battery materials and the UK's ambitious long-term electric vehicle targets, significant opportunities arise for players in the market.

United Kingdom Electric Vehicle Battery Manufacturing Market Trends

Lithium-ion Battery Segment to Dominate the Market

- In the early days of the lithium-ion battery industry, consumer electronics were the primary market. However, over time, electric vehicle (EV) manufacturers have taken the lead as the main consumers of lithium-ion batteries, driven by a surge in EV sales in the United Kingdom (UK).

- Over the past decade, the United Kingdom has seen a meteoric rise in lithium-ion battery technology, predominantly in the automotive sector. The growing preference for lithium-ion rechargeable batteries in the UK can be attributed to their superior capacity-to-weight ratio. Furthermore, lithium batteries in EVs produce no NOX, CO2, or other greenhouse gases, resulting in a significantly lower environmental impact compared to traditional internal combustion engine (ICE) vehicles. Recognizing these advantages, the UK and several other nations are promoting EV adoption and battery manufacturing growth through subsidies and government initiatives.

- In 2023, average battery pack prices for electric vehicles (EVs) fell to USD 139/kWh, a notable 13% drop from 2022. This decline followed a trend of rising prices in the years prior. With ongoing technological advancements and improved manufacturing efficiencies, projections indicate a continued decrease in battery pack prices, forecasting USD 113/kWh by 2025 and an even steeper drop to USD 80/kWh by 2030. Such trends bolster the prominence of lithium-ion battery manufacturing in the UK.

- According to the International Energy Agency (IEA), sales of electric vehicles in the United Kingdom, which are over 90% reliant on lithium-ion technology, mirrored the growth of the country's EV battery manufacturing market. In 2023, sales reached 310,000 vehicles, up from 270,000 in 2022, marking a notable 14.8% increase. This underscores the dominant position of lithium-ion batteries in the UK's EV battery manufacturing landscape.

- In March 2024, EVE Energy, a Chinese firm specializing in lithium-ion electric vehicle batteries, unveiled plans for a significant investment exceeding EUR 1.2 billion. The investment is set to fund a sprawling 5.7 million square feet gigafactory on the outskirts of Coventry, United Kingdom, envisioned as a cornerstone of the United Kingdom Centre for Electrification. Such substantial investments signal a robust growth trajectory for the UK's electric vehicle battery manufacturing market.

- In April 2024, ADVIK, a leading automotive component manufacturer, made headlines by acquiring the business assets of Aceleron Energy Ltd., an advanced lithium-ion battery firm based in the UK. This strategic acquisition not only expands ADVIK's product range and customer base but also emphasizes its commitment to next-generation energy storage solutions. Managed by ADVIK Technologies Limited, the company's British division, the acquisition integrates Aceleron's state-of-the-art lithium-ion battery technology into ADVIK's portfolio. In addition to the patented technology, the deal enhances ADVIK's capabilities with extra testing and prototyping facilities in the UK, strengthening its already extensive network of ten plants.

- Given these developments, it's evident that the lithium-ion battery segment is poised to dominate the market in the United Kingdom.

Policies and incentives of the Government are driving the Surge in EV Sales

- The United Kingdom has enacted several legislations, policies, and acts to curb greenhouse gas (GHG) emissions, particularly carbon dioxide. Additionally, the United Kingdom (UK) has rolled out various incentives for battery-electric vehicles, creating favorable conditions for EV battery manufacturers.

- Leading the charge is the Net Zero Strategy (Build Back Greener), which was last updated in April 2022. This strategy, a direct continuation of the Ten-point plan for a green industrial revolution introduced on November 18, 2020, lays out a comprehensive roadmap with policies and initiatives aimed at achieving the government's ambitious net-zero emissions target by 2050. March 2023 saw a significant update to these initiatives, underscored by the extensive policy release, Powering Up Britain, which included the detailed Powering Up Britain: Net Zero Growth Plan.

- In March 2023, the UK government unveiled its Carbon Budget Delivery Plan (CBDP), detailing its emission reduction strategy. This plan was a response to a High Court ruling and encompassed the Zero Emission Vehicle (ZEV) mandate legislation.

- In a landmark decision, the UK government, in March 2022, announced its intent to phase out fossil fuel vehicles, aiming for a fleet exclusively made up of zero-emission vehicles by 2035. These moves are reshaping consumer preferences, with a growing number of individuals gravitating towards EVs.

- Moreover, the government is intensifying its focus on expanding electric vehicle charging infrastructure. Data from the International Energy Agency reveals a surge in the UK's EV charging points, jumping from 36,900 in 2022 to 53,000 in 2023, which notably includes 10,000 Superfast EV charging stations.

- In January 2024, the UK rolled out the globe's most ambitious regulatory framework for the electric vehicle transition. Effective in 2024, the UK's zero-emission vehicle (ZEV) mandate outlines production targets for manufacturers up to 2030. By 2030, the mandate aims for 70% of new vans and 80% of new cars sold in Great Britain to be zero-emission, pushing for a complete transition by 2035. This trajectory hints at significant growth prospects for the UK's EV battery manufacturing market.

- In summary, the UK government's concerted efforts to boost the share of electric vehicles bode well for the country's battery manufacturing industry.

United Kingdom Electric Vehicle Battery Manufacturing Industry Overview

The United Kingdom Electric Vehicle Battery Manufacturing Market is semi-consolidated. Some of the major players in the market (in no particular order) include BYD Company Ltd, Duracell Inc., EnerSys, Panasonic Holdings Corporation, Contemporary Amperex Technology Co. Limited, and LG Chem Ltd among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 MARKET OVERVIEW

- 1.1 Introduction

- 1.2 Market Size and Demand Forecast in USD, till 2029

- 1.3 Recent Trends and Developments

- 1.4 Government Policies and Regulations

- 1.5 Market Dynamics

- 1.5.1 Drivers

- 1.5.1.1 Investments to Enhance the battery production capacity

- 1.5.1.2 Decline in cost of battery raw materials

- 1.5.1.3 Favorable Government Policies

- 1.5.2 Restraints

- 1.5.2.1 Lack of Raw Material Reserves

- 1.5.1 Drivers

- 1.6 Supply Chain Analysis

- 1.7 PESTLE ANALYSIS

- 1.8 Investment Analysis

2 MARKET SEGMENTATION

- 2.1 Battery

- 2.1.1 Lithium-ion

- 2.1.2 Lead-Acid

- 2.1.3 Nickel Metal Hydride Battery

- 2.1.4 Others

- 2.2 Battery Form

- 2.2.1 Prismatic

- 2.2.2 Pouch

- 2.2.3 Cylindrical

- 2.3 Vehicle

- 2.3.1 Passenger Cars

- 2.3.2 Commercial Vehicles

- 2.3.3 Others

- 2.4 Propulsion

- 2.4.1 Battery Electric Vehicle

- 2.4.2 Hybrid Electric Vehicle

- 2.4.3 Plug-in Hybrid Electric Vehicle

3 COMPETITIVE LANDSCAPE

- 3.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 3.2 Strategies Adopted by Leading Players

- 3.3 Company Profiles

- 3.3.1 BYD Co. Ltd

- 3.3.2 Contemporary Amperex Technology Co. Limited

- 3.3.3 Duracell Inc

- 3.3.4 EnerSys

- 3.3.5 GS Yuasa Corporation

- 3.3.6 LG Chem Ltd

- 3.3.7 Exide Industries

- 3.3.8 Panasonic Corporation

- 3.4 List of Other Prominent Companies

- 3.5 Market Ranking Analysis

4 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 4.1 Long-term ambitious targets for electric vehicles