|

시장보고서

상품코드

1636450

미국의 전기자동차 배터리 제조 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)United States Electric Vehicle Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

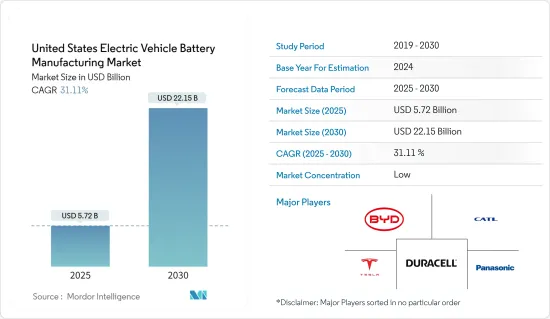

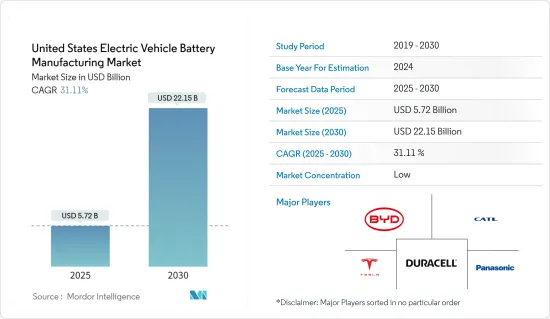

미국의 전기자동차 배터리 제조 시장 규모는 2025년 57억 2,000만 달러, 2030년 221억 5,000만 달러로 추정되며, 예측 기간(2025-2030년)중 CAGR은 31.11%에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 EV용 배터리의 생산 능력 증진을 위한 투자와 배터리 원료(특히 리튬 이온)의 비용 저하가 예측 기간 동안 시장을 견인할 것으로 예상됩니다.

- 한편, 전지 원료의 매장량 부족이 향후 시장의 발판이 될 것으로 예상됩니다.

- 그럼에도 불구하고 미국의 전기자동차의 장기적인 야심적 목표는 예측 기간 동안 큰 기회를 창출할 것으로 예상됩니다.

미국 전기자동차 배터리 제조 시장 동향

리튬 이온 배터리가 큰 점유율을 차지할 전망

- 최근 미국에서는 전기차 수요가 급증하고 있습니다. 이러한 자동차는 주로 배터리를 중심으로 한 에너지 저장 시스템에 의존하며, 모든 전기자동차, 플러그인 하이브리드 자동차 및 하이브리드 자동차에 매우 중요합니다.

- 플러그인 하이브리드 자동차와 올 일렉트릭 자동차의 대부분은 리튬 이온 배터리를 탑재하고 있습니다. 플러그인 하이브리드 자동차의 리튬 배터리 재료에 대한 수요는 리튬 이온 배터리 팩의 가격 하락과 높은 에너지 밀도, 사이클 수명 연장, 효율성 등의 이점에 의해 높아지고 있습니다.

- 2023년에는 리튬이온 배터리 팩의 가격은 전년보다 14% 하락해 139달러/kWh에 정착합니다. 이러한 이점에 그치지 않고 현재 진행중인 연구 개발은 전기자동차용으로 더욱 효과적인 리튬 배터리 재료의 생산을 목표로 하고 있습니다.

- 또한 미국 정부는 전기자동차 배터리 공급 체인을 간소화하기 위해 국내 매장량에서 리튬 광석을 추출하는 것을 우선시하고 있습니다. 예를 들어, 아칸소의 지하 염수 광상에서 리튬을 추출하고 현지에서 배터리 원료로 전환할 계획이 진행 중입니다.

- 2024년 6월 ExxonMobil과 세계 최대 수준의 전기자동차 배터리 개발 기업인 SK On는 구속력이 없는 각서에 서명했습니다. 이를 통해 ExxonMobil은 아칸소주 최초의 프로젝트에서 최대 10만 톤의 MobilTM 리튬을 획득할 수 있게 되었고, 수년간 인수계약의 가능성이 나왔습니다.

- 또한 ExxonMobil은 이 리튬을 이용해 2030년까지 매년 약 100만개의 EV 배터리를 생산해 미국의 EV 공급 체인을 강화하는 것을 목표로 하고 있습니다. 이러한 야심적인 목표를 감안할 때 전기자동차 제조의 리튬 부문은 크게 성장할 준비가되어 있습니다.

- 그 결과, 리튬 이온 배터리 가격의 저하와 미국에서의 새로운 리튬 광석의 발견에 의해 이 분야는 큰 시장 점유율을 차지하게 될 것으로 보입니다.

정부 지원 정책이 시장을 견인할 전망

- 최근 미국의 전기자동차(EV)용 배터리 제조는 세제 우대 조치, 보조금, 보조금, 대출을 제공하는 정부의 지원 정책에 따라 급증하고 있습니다. 첨단 기술 자동차 제조(ATVM) 대출 프로그램 등 연방 정부의 이니셔티브는 최첨단 배터리 기술 및 제조 시설 개발에 자금을 투자하고 있습니다.

- 또한 정부는 배터리 기술 향상을 위한 연구개발에 투자할 뿐만 아니라 유리한 무역정책을 통해 국내 생산을 지지하고 있습니다. 이러한 노력은 EV 배터리 제조 수요를 증폭시키는 것입니다.

- 예를 들어, 미국 에너지부는 2024년 1월 전기자동차 배터리 및 충전 시스템의 연구 개발을 추진하는 프로젝트에 1억 3,100만 달러를 기록했습니다. 이 자금은 EV 생태계를 강화하여 기술 비용 절감, 배터리 차량 주행 거리 연장, 안전하고 지속 가능한 국내 배터리 공급 체인 구축을 지원합니다.

- 전기차 판매량이 증가하는 경향이 있기 때문에 정부는 배터리 제조를 더욱 강화하는 정책을 더욱 도입할 가능성이 높습니다. 국제에너지기구의 보고에 따르면 미국의 전기차 판매량은 2023년 139만대에 달했으며 2022년 99만대에서 현저하게 증가했습니다.

- 이에 따라 정부는 전기차용 배터리의 중요한 공급망을 강화하고 청정에너지로의 이행을 촉진하는 것을 목적으로 국내에서의 배터리 제조·가공을 확대하기 위한 새로운 법률의 제정을 추진하고 있습니다.

- 그 일례로 미국 에너지부는 2023년 11월 초당파 인프라법의 서명 후 첨단 배터리와 재료의 국내 생산을 강화하기 위해 이 법에서 최대 35억 달러를 전국에 배분할 계획을 발표했습니다.

- 이러한 인센티브와 정부의 지원 정책을 통해 시장은 크게 성장하는 태세를 갖추고 있습니다.

미국 EV 배터리 제조 업계 개요

미국의 EV 배터리 제조 시장은 반 파편화되었습니다. 시장의 주요 기업(순부동)은 BYD Company Ltd., Tesla, Inc., Contemporary Amperex Technology Co.Limited, Duracell Inc., Panasonic Holdings Corporation 등입니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모 및 수요 예측(단위: 달러)

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 배터리 생산 능력 증강을 위한 투자

- 배터리 원재료 비용의 저하

- 억제요인

- 원재료의 매장량 부족

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

- 투자 분석

제5장 시장 세분화

- 배터리별

- 리튬 이온

- 납축전지

- 니켈 수소 배터리

- 기타

- 배터리 형상별

- 각형

- 가방형

- 원통형

- 차량별

- 승용차

- 상용차

- 기타

- 추진별

- 배터리 전기자동차

- 하이브리드 전기자동차

- 플러그인 하이브리드 전기자동차

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- BYD Co. Ltd

- Contemporary Amperex Technology Co. Limited

- Duracell Inc

- EnerSys

- GS Yuasa Corporation

- SK On Co, Ltd

- Hyundai Motor Group

- LG Chem Ltd

- Tesla, Inc

- Panasonic Corporation

- List of Other Prominent Companies

- 시장 랭킹 분석

제7장 시장 기회와 앞으로의 동향

- 전기차의 장기적인 야심적 목표

The United States Electric Vehicle Battery Manufacturing Market size is estimated at USD 5.72 billion in 2025, and is expected to reach USD 22.15 billion by 2030, at a CAGR of 31.11% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, investments to enhance electric vehicle battery production capacity, and a decline in the cost of battery raw material, especially lithium-ion, are expected to drive the market in the forecast period.

- On the other hand, the lack of battery raw materials reserves is expected to hamper the market in the future.

- Nevertheless, long-term ambitious targets for electric vehicles in the United States are expected to create a significant opportunity in the forecast period.

United States Electric Vehicle Battery Manufacturing Market Trends

Lithium-ion Battery is Expected to Have a Major Share

- In recent years, the demand for electric vehicles has surged in the United States. These vehicles rely on energy storage systems, primarily batteries, which are crucial for all-electric, plug-in hybrid, and hybrid vehicles.

- Most plug-in hybrids and all-electric vehicles are powered by lithium-ion batteries. The demand for lithium battery materials in plug-in hybrids is rising, driven by the declining prices of lithium-ion battery packs and their advantages, including high energy density, extended cycle life, and efficiency.

- In 2023, lithium-ion battery pack prices dropped by 14% from the previous year, settling at USD139/kWh. Beyond these benefits, ongoing research and development aim to produce even more effective lithium battery materials for electric vehicles.

- Moreover, the United States government is prioritizing the extraction of lithium ores from domestic reserves to streamline the EV battery supply chain. For instance, plans are underway to extract lithium from underground saltwater deposits in Arkansas and convert it into battery-grade material on-site.

- In June 2024, ExxonMobil and SK On, a leading global electric vehicle battery developer, signed a non-binding memorandum of understanding. This sets the stage for a potential multiyear offtake agreement, enabling ExxonMobil to acquire up to 100,000 metric tons of MobilTM Lithium from its first project in Arkansas.

- Additionally, ExxonMobil aims to utilize this lithium to produce approximately 1 million EV batteries each year by 2030, bolstering the U.S. EV supply chain. Given these ambitious targets, the lithium segment in electric vehicle manufacturing is poised for substantial growth.

- Consequently, with declining lithium-ion battery prices and fresh lithium ore discoveries in the United States, the segment is set to command a significant market share.

Supportive Government Policy and Schemes is Expected to Drive the Market

- In recent years, United States electric vehicle (EV) battery manufacturing has surged, due to supportive government policies offering tax incentives, subsidies, grants, and loans. Federal initiatives, such as the Advanced Technology Vehicles Manufacturing (ATVM) loan program, are channeling funds into the development of cutting-edge battery technologies and manufacturing facilities.

- Moreover, the government is not only investing in research and development to enhance battery technology but is also championing domestic production through favorable trade policies. These initiatives are poised to amplify the demand for electric vehicle battery manufacturing.

- For example, in January 2024, the U.S. Department of Energy earmarked USD 131 million for projects aimed at advancing research and development in EV batteries and charging systems. This funding is set to empower the EV ecosystem, helping to reduce technology costs, extend the driving range of battery vehicles, and forge a secure and sustainable domestic battery supply chain.

- With electric vehicle sales on the rise, the government is likely to introduce more policies to further bolster battery manufacturing. The International Energy Agency reported that United States EV car sales reached 1.39 million units in 2023, a notable increase from 0.99 million units in 2022.

- In line with this, the government is pushing for new laws to expand domestic battery manufacturing and processing, aiming to strengthen America's critical supply chains for electric vehicle batteries and facilitate the clean energy transition.

- As a case in point, in November 2023, the U.S. Department of Energy, after the signing of the Bipartisan Infrastructure Law, announced plans to allocate up to USD 3.5 billion from the law to bolster the domestic production of advanced batteries and their materials nationwide.

- Given these incentives and supportive government policies, the market is poised for significant growth.

United States Electric Vehicle Battery Manufacturing Industry Overview

The United States Electric vehicle battery manufacturing market is semi-fragmented. Some of the major players in the market (in no particular order) include BYD Company Ltd, Tesla, Inc., Contemporary Amperex Technology Co. Limited, Duracell Inc., and Panasonic Holdings Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Investments to Enhance the battery production capacity

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Nickel Metal Hydride Battery

- 5.1.4 Others

- 5.2 Battery Form

- 5.2.1 Prismatic

- 5.2.2 Pouch

- 5.2.3 Cylindrical

- 5.3 Vehicle

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.3.3 Others

- 5.4 Propulsion

- 5.4.1 Battery Electric Vehicle

- 5.4.2 Hybrid Electric Vehicle

- 5.4.3 Plug-in Hybrid Electric Vehicle

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 Duracell Inc

- 6.3.4 EnerSys

- 6.3.5 GS Yuasa Corporation

- 6.3.6 SK On Co, Ltd

- 6.3.7 Hyundai Motor Group

- 6.3.8 LG Chem Ltd

- 6.3.9 Tesla, Inc

- 6.3.10 Panasonic Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles