|

시장보고서

상품코드

1636511

남미의 전기자동차용 VRLA 배터리 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)South America Electric Vehicle VRLA Batteries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

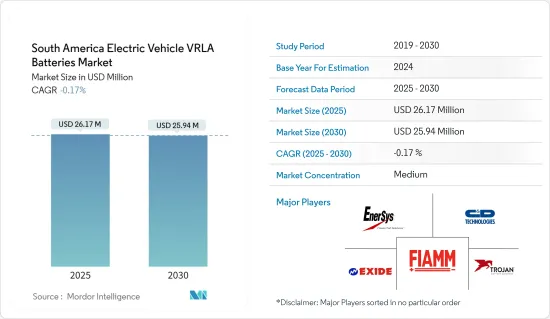

남미 전기자동차용 VRLA 배터리 시장 규모는 2025년 2,617만 달러로 추정되고, 2030년에는 2,594만 달러로 감소할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 특히 리튬이온 전지와 비교했을 경우의 VRLA 전지의 비용효과와 동지역에서의 전동 스쿠터와 전동 오토바이의 인기 급상승이 예측 기간 중의 EV용 VRLA 전지 수요를 강화할 전망입니다.

- 반대로 고성능 리튬 이온 배터리로의 급속한 전환으로 VRLA 배터리는 고성능 EV에 적합하지 않게 되어 전기자동차용 VRLA 배터리 시장의 성장에 큰 과제가 되고 있습니다.

- 그러나, VRLA 배터리는 전기자동차의 보조 전원이나 백업으로서 유용하며, 특히 신뢰성이 에너지 밀도를 능가합니다. 이 틈새 시장은 가까운 미래에 전기자동차용 VRLA 배터리 시장에 큰 성장 전망을 제공합니다.

- 브라질은 남미의 전기자동차용 VRLA 배터리 시장의 선두주자로 부상하려고 합니다. 그 이유는 비용 효율성과 유지 보수가 최소한으로 필요하기 때문에 전기 이륜차에 이러한 배터리의 채택이 증가하고 있기 때문입니다.

남미의 전기자동차용 VRLA 배터리 시장 동향

흡수 유리 매트 배터리가 크게 성장

- 남미의 EV 산업에서 VRLA 배터리, 특히 흡수 유리 매트(AGM) 유형은 비용 효과, 신뢰성 및 유지 보수가 필요하지 않습니다. AGM 배터리는 리튬 이온 배터리보다 저렴한 가격으로 전기자동차에 매력적인 선택입니다.

- VRLA 기술의 서브세트인 AGM 배터리는 기존의 납 축전지를 능가하는 성능으로 주목을 받고 있습니다. 전해액을 흡수하기 위해 유리 매트 세퍼레이터를 사용함으로써 AGM 배터리는 특히 저비용 전기 이동성 용도에서 명확한 이점을 제공합니다.

- 남미에서 하이브리드 자동차와 배터리 전기자동차가 보급됨에 따라 AGM 배터리 수요가 급증하고 있습니다. 남미의 주요 국가에서 EV의 판매 동향은 지속적으로 증가하는 경향이 있습니다. 국제에너지기관의 데이터에 따르면 2023년 전기차 판매 대수는 브라질이 15만 2,000대, 이어서 콜롬비아가 6,100대, 칠레가 920대가 되고 있습니다. 정부가 전기자동차의 보급을 촉진하는 정책을 내세우고 있기 때문에 판매량은 더욱 증가할 전망입니다.

- 도시 지역에서는 마이크로 EV, 전기 자전거 및 스쿠터에 대한 수요가 현저하게 증가하고 있습니다. 이러한 소형 차량이 필요로 하는 전력이 적다는 점을 감안할 때, VRLA 배터리, 특히 AGM 유형의 합리적인 가격과 신뢰성은 이상적인 옵션으로 자리잡고 있습니다.

- 이 지역 정부는 전기 자전거와 스쿠터를 지원하는 협정을 적극적으로 추진하고 있습니다. 주목할만한 예는 2023년 2월 Sunra 아르헨티나 판매자와 현지 정부와의 제휴입니다. 이 제휴는 SUNRA의 전동 자전거 판매 촉진을 강화하고 아르헨티나뿐만 아니라 더 넓은 아메리카 지역의 브랜드 발자국을 강화하는 것을 목표로합니다. 이러한 시도는 이 지역의 전기자동차 시장을 확대하고 AGM 유형을 포함한 VRLA 배터리 수요를 예측 기간 동안 밀어 올립니다.

- 전기자동차에서 AGM 배터리의 중요성이 증가함에 따라 특히 비용에 민감한 지역에서 VRLA 기술의 지속적인 중요성이 뒷받침됩니다. 협정 체결과 프로젝트 승인 등 정부의 이니셔티브이 EV 시장을 더욱 뒷받침하고 있습니다.

- BYD는 2024년 7월 외무부 장관에서 페루에 EV 조립 공장을 건설할 계획을 발표했습니다. 이 공장은 2025년 초에 조업을 시작할 예정으로 연간 생산 능력은 15만대라는 경이적인 규모를 자랑합니다. 이러한 벤처는 이 지역에서의 EV 생산을 향상시킬 뿐만 아니라 향후 몇 년간의 AGM 배터리 수요를 증폭시킬 것으로 예상됩니다.

- 그 결과, EV 생산의 급증과 대응하는 VRLA 배터리 수요가 예측되고, 시장 전망은 계속 견조합니다.

브라질이 시장을 독점할 전망

- 브라질의 EV용 VRLA(밸브 제어 납 축전지) 시장은 소규모이지만 전동 이동성으로의 전환에 중요한 역할을 하고 있습니다. 세계적으로 리튬 이온 배터리는 EV 시장을 선도하고 있습니다. 그러나 브라질에서는 VRLA 배터리, 특히 AGM(Absorbed Glass Mat) 유형이 전동 이륜차, 하이브리드 전기자동차, 산업 용도 등의 분야에서 틈새 시장을 차지하고 있습니다.

- 소비자 수요, 환경 의식 증가, 세액 공제 및 리베이트 등 정부 우대 조치에 힘입어 브라질에서는 최근 EV 판매가 현저하게 증가하고 있습니다. EV의 보급에 따라 VRLA 배터리를 포함한 EV 배터리 수요도 증가하고 있습니다.

- 국제에너지기구(IEA)에 따르면 브라질의 전기차 판매량은 2023년 15만 2,000대에 이르며 2022년 대비 1.81배, 2019년 대비 25.8배라는 경이적인 성장을 보입니다. 정부가 지원 정책을 내세우고 있는 경우도 있어 판매 대수는 앞으로 더욱 증가할 전망입니다.

- 전기 이동성을 강화하고 이산화탄소 배출을 줄이는 브라질의 이니셔티브는 저출력 EV 부문에서 VRLA 배터리의 보급을 간접적으로 뒷받침하고 있습니다. 이는 특히 대중교통의 충실과 청정에너지 솔루션을 우선하는 도시에 적용됩니다.

- 2024년 5월, Raizen, 거대 렌터카 기업 MOVIDA, 중국 자동차 제조업체 BYD로 구성된 컨소시엄은 전기자동차의 목표 대수를 2만대로 끌어올렸습니다. 브라질의 도시 교통을 강화하는 것을 목표로 한 이 제휴는 당초 2025년 말까지 1만대의 전기자동차를 99 앱에 연결시키는 목표를 내걸고 있었습니다. 이러한 시도는 특히 VRLA 기술을 이용한 EV용 배터리 수요를 높일 것으로 예상됩니다.

- EV 보급을 위해 리튬 이온 배터리가 중시되고 있지만, VRLA 배터리, 특히 AGM 유형은 틈새 시장에서 발판을 유지할 것으로 예상됩니다. 여기에는 브라질 국내 전동 이륜차, 유틸리티 차량, 산업 용도 등이 포함됩니다.

- 전기 이륜차용의 새로운 제조 체제가 출현하고 있습니다. 예를 들어 2024년 5월 이륜차 분야에서 압도적인 힘을 자랑하는 Hero MotoCorp가 브라질에서 최초의 해외 제조 부문을 시작할 예정입니다. 이 회사는 올해 상반기에 스쿠터 구색을 확대할 준비를 하고 있습니다. 내년에는 EV 분야에서 큰 도약이 약속되고 있으며, 중급차와 저렴한 부문을 노린 제품의 발매가 예정되어 있습니다. 이러한 노력은 이 지역에서 VRLA 배터리 수요를 증가시킬 것입니다.

- 그 결과 이러한 프로젝트와 대처가 브라질의 EV 생산을 확대하고 예측 기간 동안 EV용 배터리 전해액 수요를 끌어올리게 됩니다.

남미의 전기자동차용 VRLA 배터리 산업 개관

남미의 전기자동차용 VRLA 배터리 시장은 완만합니다. 주요 기업(순부동)으로는 FIAMM Energy Technology SpA, EnerSys, Exide Technologies, Trojan Battery Company, C&D Technologies 등이 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모 및 수요 예측(단위: 달러)

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- VRLA 배터리의 비용 효과

- 전동 스쿠터와 전동 오토바이의 성장

- 억제요인

- 대체 배터리 기술의 가용성

- 성장 촉진요인

- 공급망 분석

- 업계의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협 제품 및 서비스

- 경쟁 기업간 경쟁 관계

- 투자 분석

제5장 시장 세분화

- 유형별

- 흡수 유리 매트 배터리

- 겔 전지

- 차량 유형별

- 이륜차

- 저속 EV

- 산업용 EV

- 지역별

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- FIAMM Energy Technology SpA

- EnerSys

- Exide Technologies

- Trojan Battery Company

- Acumuladores Moura

- C&D Technologies

- Hoppecke Batteries

- Ritar Power

- 기타 유명 기업 일람

- 시장 랭킹/점유율 분석

제7장 시장 기회와 앞으로의 동향

- 백업 및 보조 용도

The South America Electric Vehicle VRLA Batteries Market size is estimated at USD 26.17 million in 2025, and is expected to decline to USD 25.94 million by 2030.

Key Highlights

- Over the medium term, the cost-effectiveness of VRLA batteries, especially when compared to lithium-ion counterparts, coupled with the surging popularity of electric scooters and bikes in the region, is poised to bolster the demand for electric vehicle VRLA batteries during the forecast period.

- Conversely, the swift transition towards advanced lithium-ion batteries is rendering VRLA batteries less pertinent for high-performance EVs, posing a significant challenge to the growth of the electric vehicle VRLA batteries market.

- However, VRLA batteries find utility as auxiliary power sources or backups in electric vehicles, especially where reliability trumps energy density. This niche presents substantial growth prospects for the electric vehicle VRLA batteries market in the near future.

- Brazil is set to emerge as the frontrunner in the South American electric vehicle VRLA batteries market, driven by the increasing adoption of these batteries in electric two-wheelers, thanks to their cost-efficiency and minimal maintenance needs.

South America Electric Vehicle VRLA Batteries Market Trends

Absorbed Glass Mat Battery Witness Significant Growth

- Across the South American EV industry, VRLA batteries, particularly Absorbed Glass Mat (AGM) types, are favored for their cost-effectiveness, reliability, and maintenance-free nature. AGM batteries, being more affordable than lithium-ion counterparts, present an attractive option for electric vehicles.

- AGM batteries, a subset of VRLA technology, have garnered attention for outpacing traditional lead-acid batteries in performance. By utilizing a glass mat separator to absorb the electrolyte, AGM batteries offer distinct advantages, especially in low-cost electric mobility applications.

- As hybrid and battery-electric vehicles gain traction in South America, the demand for AGM batteries is surging. Sales of EVs in key South American nations have shown a consistent upward trend. Data from the International Energy Agency indicates that in 2023, Brazil led with 152,000 electric vehicle sales, trailed by Colombia at 6,100 and Chile at 920. With the government rolling out policies to bolster EV adoption, sales are poised for further growth.

- Urban areas are witnessing a notable uptick in demand for micro-EVs, electric bikes, and scooters. Given that these smaller vehicles require less power, the affordability and reliability of VRLA batteries, especially AGM types, position them as an ideal choice.

- Governments in the region have actively pursued agreements to champion electric bikes and scooters. A notable instance is the February 2023 partnership between SUNRA Argentina distributors and the local government. This alliance aims to elevate the promotion of SUNRA's electric motorcycles, enhancing the brand's footprint in Argentina and the broader Americas. Such endeavors are set to amplify the electric vehicle market in the region, subsequently boosting the demand for VRLA batteries, including AGM types, during the forecast period.

- The growing prominence of AGM batteries in the EV landscape underscores the sustained importance of VRLA technology, especially in cost-sensitive regions. Government initiatives, including signed agreements and project endorsements, further bolster the EV landscape.

- Highlighting this momentum, BYD's announcement in July 2024, as relayed by the Minister of Foreign Affairs, unveiled plans for an EV assembly plant in Peru. Set to kick off in early 2025, the plant boasts an impressive annual production capacity of 150,000 cars. Such ventures are anticipated to not only elevate EV production in the region but also amplify the demand for AGM batteries in the coming years.

- Consequently, with the projected surge in EV production and the corresponding demand for VRLA batteries, the market outlook remains robust.

Brazil Expected to Dominate the Market

- The Brazilian market for EV VRLA (Valve-Regulated Lead-Acid) batteries, while modest, plays a crucial role in the nation's shift towards electric mobility. Globally, lithium-ion batteries lead the EV market. However, in Brazil, VRLA batteries, especially Absorbed Glass Mat (AGM) types, find their niche in sectors like electric two-wheelers, hybrid electric vehicles, and industrial applications.

- Driven by consumer demand, heightened environmental awareness, and government incentives such as tax credits and rebates, Brazil has seen a notable uptick in EV sales over recent years. As EV adoption rises, so does the demand for EV batteries, including VRLA batteries.

- According to the International Energy Agency, electric vehicle sales in Brazil reached 152,000 units in 2023, marking a 1.81-fold increase from 2022 and a staggering 25.8-fold jump from 2019. With the government rolling out supportive policies, sales are poised to climb further in the coming years.

- Brazil's initiatives to bolster electric mobility and curtail its carbon footprint indirectly favor the uptake of VRLA batteries in low-power EV segments. This is especially true in cities prioritizing enhanced public transportation and clean energy solutions.

- In May 2024, a consortium comprising Raizen, car rental giant Movida, and Chinese automaker BYD, ramped up its electric vehicle target to 20,000. This collaboration, aimed at bolstering urban transport in Brazil, originally set a goal of linking 10,000 electric cars to the 99 app by the end of 2025. Such endeavors are anticipated to boost the demand for EV batteries, particularly those utilizing VRLA technology.

- Despite the growing emphasis on lithium-ion batteries for widespread EV adoption, VRLA batteries, especially AGM variants, are expected to maintain their foothold in niche markets. These include electric two-wheelers, utility vehicles, and industrial applications within Brazil.

- New manufacturing setups for electric two-wheelers are emerging. For example, in May 2024, Hero MotoCorp, a dominant player in the two-wheeler sector, is set to launch its first overseas manufacturing unit in Brazil. The company is gearing up to expand its scooter range in the fiscal year's first half. The upcoming year promises significant strides in the EV domain, with product launches aimed at the mid-range and budget-friendly segments. Such initiatives are poised to bolster the demand for VRLA batteries in the region.

- Consequently, these projects and initiatives are set to amplify EV production in Brazil, driving up the demand for EV battery electrolytes during the forecast period.

South America Electric Vehicle VRLA Batteries Industry Overview

The South America Electric Vehicle VRLA Batteries market is moderate. Some of the key players (not in particular order) are FIAMM Energy Technology S.p.A., EnerSys, Exide Technologies, Trojan Battery Company, C&D Technologies, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Cost-Effectiveness of VRLA batteries

- 4.5.1.2 Growth in Electric Scooters and Bikes

- 4.5.2 Restraints

- 4.5.2.1 Availability of Alternate Battery Technology

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Absorbed Glass Mat Battery

- 5.1.2 Gel Battery

- 5.2 By Vehicle Type

- 5.2.1 Two-Wheelers

- 5.2.2 Low-Speed EVs

- 5.2.3 Industrial Evs

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Colombia

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 FIAMM Energy Technology S.p.A.

- 6.3.2 EnerSys

- 6.3.3 Exide Technologies

- 6.3.4 Trojan Battery Company

- 6.3.5 Acumuladores Moura

- 6.3.6 C&D Technologies

- 6.3.7 Hoppecke Batteries

- 6.3.8 Ritar Power

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Backup and Auxiliary Applications

샘플 요청 목록