|

시장보고서

상품코드

1636532

미국의 이차 전지 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)United States Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

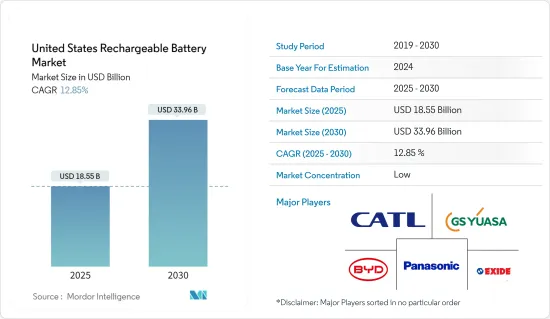

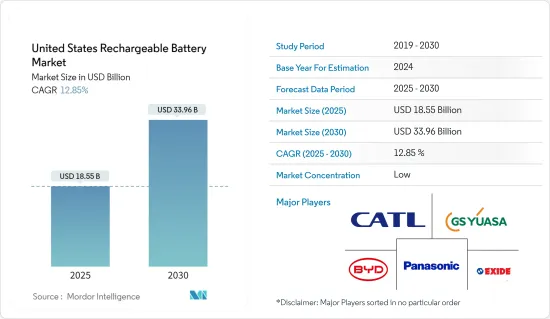

미국의 이차 전지 시장 규모는 2025년 185억 5,000만 달러, 2030년 339억 6,000만 달러로 추정되고, 예측 기간(2025-2030년)중 CAGR은 12.85%에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 전기자동차 수요 증가와 가전 판매 확대 등의 요인이 예측 기간 중 미국 이차 전지 시장의 가장 큰 촉진요인 중 하나가 될 것으로 예상됩니다.

- 반대로 미국은 배터리 조달에 있어서 공급망의 큰 제약에 직면하고 있으며, 예측 기간 동안 이 나라의 이차 배터리 시장에 잠재적인 위협이 되고 있습니다.

- 그러나 에너지 밀도, 충전 사이클 및 에너지 보유의 지속적인 발전은 보다 효율적인 이차 전지를 가져오고 시장의 많은 미래 기회에 대한 길을 열고 있습니다.

미국의 이차 전지 시장 동향

성장이 기대되는 리튬 이온 배터리

- 리튬 이온 배터리는 검토 중인 시장에서 상당한 성장을 이루려고 합니다. 리튬 이온 배터리의 인기가 증가하고 있는 이유는 특히 다른 유형의 배터리와 비교할 때 용량 대 중량비가 양호하기 때문입니다. 리튬 이온 배터리의 채용에 박차를 가하는 기타 요인으로는 우수한 성능(특히 장수명과 최소한의 유지보수), 보존 기간 연장, 가격 저하 등이 있습니다. 리튬 이온 배터리는 일반적으로 같은 유형보다 높은 가격이지만, 그 이점은 수요를 견인하고 있습니다.

- 소비자 일렉트로닉스는 점점 리튬 이온 배터리를 채택하고 있습니다. 이 분야에는 스마트폰, 노트북, 태블릿, 웨어러블이 포함됩니다. 이 장비는 경량 부품, 효율적인 충전 사이클 및 배터리 수명 연장이 요구되므로 리튬 이온 배터리가 선택되었습니다. 첨단 전자기기에 대한 수요가 높아짐에 따라 리튬이온 배터리 수요도 증가하고 시장 확대를 추진하고 있습니다.

- 또한, 태양광과 풍력과 같은 신재생에너지원으로의 세계적인 변화는 에너지 저장 솔루션 수요를 증폭시키고 있습니다. 리튬 이온 배터리는 이 역할이 뛰어나 재생 가능 에너지로부터의 잉여 에너지를 능숙하게 저장하고 필요에 따라 방출합니다. 이 기능은 송전망의 안정성을 향상시킬뿐만 아니라 화석 연료에 대한 의존도를 억제합니다.

- 최근, 리튬 이온 배터리와 셀 팩의 가격이 저하되고 있어, 최종 사용자 산업에 있어서 매력이 증가하고 있습니다. 2022년의 약간의 가격 상승에 이어 2023년에는 하락세가 재개되었습니다. 특필해야할 것은 리튬 이온 배터리 팩의 가격이 14% 급락해 139달러/kWh라는 역사적인 저가를 기록한 것입니다. 이 가격 하락은 배터리 밸류 체인 전체를 통해 생산 능력이 확대된 것 외에 원재료와 부품 비용의 삭감에 의한 점이 큽니다.

- 리튬 이온 기술의 지속적인 R&D는 에너지 밀도, 안전성 및 비용 효율성 향상을 가져옵니다. 리튬-니켈-망간-코발트-옥사이드(NMC)와 리튬-철-인산염(LFP)과 같은 전지 화학의 혁신은 전지 수명 연장, 에너지 저장량 증가, 열 안정성 향상을 가져다 다양한 용도로 그 매력을 넓히고 있습니다.

- 예를 들어, 미국 에너지부는 2023년 3월 우수한 에너지 밀도와 효율을 자랑하는 획기적인 리튬 배터리 기술을 발표했습니다. 이러한 첨단 배터리는 자동차, 국내 항공기 및 장거리 트럭에 사용할 가능성이 예상됩니다. 또한, 이 배터리의 전기화학적 화학적 특성은 안전성을 높이고 운전 조건과 온도 변화가 심한 산업에도 적합합니다.

- 이러한 통찰에서 리튬 이온 전지는 향후 수년간 현저한 성장을 이룰 것으로 보입니다.

전기차 수요 증가가 시장을 견인

- 미국은 세계 자동차 시장의 주요 기업이며 자동차 생산뿐만 아니라 이차 전지의 최고 시장이기도합니다. 화석연료 가격 상승을 배경으로 전기자동차(EV) 판매량이 증가하고 있으며, 미국 자동차산업은 앞으로 수년간 EV가 주류를 차지할 것으로 보입니다.

- EV의 보급을 촉진하기 위해 미국은 내연 기관차(ICE)의 판매 정지 기한을 2035년으로 설정했습니다. 게다가 미국은 향후 수십년동안 경제 전체에서 넷 제로 배출을 달성하기로 약속합니다. 이러한 장래를 바라본 정책이 EV 제조업체의 연구개발 투자를 활성화시키고 있습니다.

- 이러한 노력으로 미국에서 전기자동차가 급속히 보급되고 있습니다. 국제에너지기구의 데이터에 따르면 미국의 전기차 판매량은 2022년부터 2023년까지 37.5% 급증합니다. 이는 2019년부터 2023년까지의 CAGR이 71.6%라는 놀라운 숫자에 이어 EV에 대한 기운이 높아지고 있음을 뒷받침하고 있습니다.

- EV 수요의 급증에 따라 전지의 요구도 높아지고 있기 때문에 미국에서는 전지 생산 시설이 급증하고 이차 전지 분야의 연구 개발 활동도 활발해지고 있습니다.

- 예를 들어 Environmental Defense Fund의 2024년 1월 분석에 따르면 미국은 2028년까지 연간 1,000기가와트 이상 전기자동차 배터리 생산 능력을 발표할 예정입니다. 1,000만대의 전기자동차에 충분한 이 생산능력은 미국 환경보호청이 설정한 2030년의 판매 예측을 상회합니다.

- 이러한 역학을 고려하면 전기자동차 판매가 앞으로 수년간 미국의 이차 전지 시장의 주요 촉진요인이 될 것이 분명합니다.

미국 이차 전지 산업 개요

미국의 이차 전지 시장은 세분화되어 있습니다. 이 시장의 주요 기업(순부동)에는 BYD, Contemporary Amperex Technology, Exide Industries, Panasonic Corporation, GS Yuasa Corporation 등이 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모 및 수요 예측(단위: 달러)

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 전기자동차 수요 증가

- 가전 수요 증가

- 억제요인

- 공급망의 제약

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

- 투자분석

제5장 시장 세분화

- 기술별

- 납산

- 리튬 이온

- 기타(NiMh, NiCd 등)

- 용도별

- 자동차

- 산업용 전지

- 휴대용 배터리

- 기타 용도

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- BYD Co. Ltd.

- LG Chem Ltd.

- Contemporary Amperex Technology Co Ltd

- Exide Industries

- Saft Groupe SA

- Samsung SDI Co., Ltd.

- Murata Manufacturing Co., Ltd.

- Panasonic Corporation

- GS Yuasa Corporation

- Tesla, Inc.

- 기타 유명 기업 일람

- 시장 랭킹 분석

제7장 시장 기회와 앞으로의 동향

- 기술 혁신의 진전

The United States Rechargeable Battery Market size is estimated at USD 18.55 billion in 2025, and is expected to reach USD 33.96 billion by 2030, at a CAGR of 12.85% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing demand for electric vehicles and growing sales of consumer electronics are expected to be among the most significant drivers for the United States rechargeable battery market during the forecast period.

- Conversely, the United States faces significant supply chain constraints in procuring batteries, posing a potential threat to its rechargeable battery market during the forecast period.

- However, ongoing advancements in energy density, charging cycles, and energy retention have resulted in more efficient rechargeable batteries, paving the way for numerous future opportunities in the market.

United States Rechargeable Battery Market Trends

Lithium-Ion Batteries Expected to Witness Growth

- Lithium-ion batteries are poised for substantial growth in the market under consideration. Their rising popularity, especially when compared to other battery types, can be attributed to their favorable capacity-to-weight ratio. Additional factors fueling their adoption include superior performance (notably, a long lifespan and minimal maintenance), an extended shelf life, and decreasing prices. While lithium-ion batteries typically command a higher price than their counterparts, their advantages are driving demand.

- Consumer electronics are increasingly turning to lithium-ion batteries. This sector encompasses smartphones, laptops, tablets, and wearables. These devices demand lightweight components, efficient charging cycles, and prolonged battery life, making lithium-ion batteries the preferred choice. As the appetite for advanced electronics grows, so too will the demand for lithium-ion batteries, propelling market expansion.

- Moreover, the global shift towards renewable energy sources, like solar and wind, is amplifying the demand for energy storage solutions. Lithium-ion batteries excel in this role, adeptly storing excess energy from renewables and releasing it as needed. This capability not only bolsters grid stability but also curtails dependence on fossil fuels.

- In recent years, declining prices of lithium-ion batteries and cell packs have made them increasingly appealing to end-user industries. Following minor price increases in 2022, a downward trend resumed in 2023. Notably, the cost of lithium-ion battery packs plummeted by 14%, hitting a historic low of USD 139/kWh. This price drop is largely due to reductions in raw material and component costs, alongside expanded production capacities throughout the battery value chain.

- Ongoing research and development in lithium-ion technology are yielding enhancements in energy density, safety, and cost-effectiveness. Innovations in battery chemistries, such as lithium-nickel-manganese-cobalt-oxide (NMC) and lithium-iron-phosphate (LFP), are resulting in extended battery life, increased energy storage, and enhanced thermal stability, broadening their appeal across various applications.

- For example, in March 2023, the U.S. Department of Energy unveiled a groundbreaking lithium battery technology boasting superior energy density and efficiency. These advanced batteries are touted for potential use in power cars, domestic airplanes, and long-haul trucks. Furthermore, the battery's electrochemical chemistry enhances safety, making them suitable for industries with demanding operational conditions and temperature variations.

- Given these insights, lithium-ion batteries are set to experience notable growth in the coming years.

Growing Demand for Electric Vehicles to Drive The Market

- The United States stands as a key player in the global automobile market, leading not only in automobile production but also ranking among the top markets for rechargeable batteries. With rising electric vehicle (EV) sales, driven by escalating fossil fuel prices, the United States automobile industry is set to be dominated by EVs in the coming years.

- In a bid to boost EV adoption, the United States has set a 2035 deadline to halt sales of internal combustion engine (ICE) vehicles. Additionally, the United States has committed to achieving economy-wide net-zero emissions in the coming decades. Such forward-looking policies have spurred EV manufacturers to ramp up their R&D investments.

- These initiatives have catalyzed a swift embrace of electric vehicles across the nation. Data from the International Energy Agency highlights a 37.5% surge in United States electric vehicle sales from 2022 to 2023. This comes on the heels of a remarkable 71.6% annual average growth rate from 2019 to 2023, underscoring the escalating momentum towards EVs.

- As EV demand surges, so too does the need for batteries, prompting a proliferation of battery production facilities and heightened R&D activities in the United States rechargeable battery sector.

- For example, a January 2024 analysis by the Environmental Defense Fund revealed that the United States is set to unveil over 1,000 gigawatt hours per year of electric vehicle battery production capacity by 2028. This capacity, sufficient to power 10 million electric cars, exceeds the sales projections for 2030 set by the United States Environmental Protection Agency.

- Given these dynamics, it's clear that electric vehicle sales will be a primary driver of the rechargeable battery market in the United States in the years to come.

United States Rechargeable Battery Industry Overview

The United States Rechargeable Battery Market is fragmented. Some of the key players in this market (in no particular order) are BYD Co. Ltd., Contemporary Amperex Technology Co. Ltd., Exide Industries, Panasonic Corporation, and GS Yuasa Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Demand for Electric Vehicles

- 4.5.1.2 Growing Demand for Consumer Electronics

- 4.5.2 Restraints

- 4.5.2.1 Supply Chain Constraints

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Others (NiMh, NiCd, etc.)

- 5.2 Applications

- 5.2.1 Automobiles

- 5.2.2 Industrial Batteries

- 5.2.3 Portable Batteries

- 5.2.4 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd.

- 6.3.2 LG Chem Ltd.

- 6.3.3 Contemporary Amperex Technology Co Ltd

- 6.3.4 Exide Industries

- 6.3.5 Saft Groupe SA

- 6.3.6 Samsung SDI Co., Ltd.

- 6.3.7 Murata Manufacturing Co., Ltd.

- 6.3.8 Panasonic Corporation

- 6.3.9 GS Yuasa Corporation

- 6.3.10 Tesla, Inc.

- 6.4 List of other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Technological Innovation

샘플 요청 목록