|

시장보고서

상품코드

1636562

독일의 이차 전지 시장 전망 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Germany Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

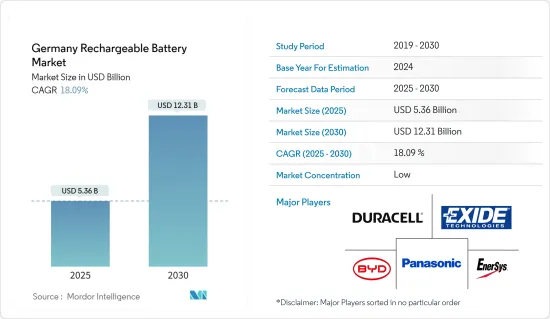

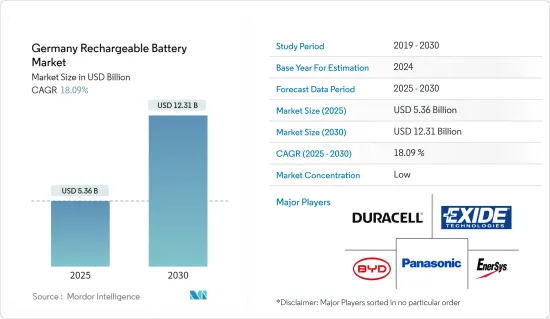

독일의 이차 전지 시장 규모는 2025년에 53억 6,000만 달러로 추정되며, 예측기간(2025-2030년)의 연평균 성장율(CAGR)은 18.09%로, 2030년에는 123억 1,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 전기차(EV) 보급률 상승과 리튬이온 배터리 가격 하락이 예측기간 동안 이차 전지 수요를 주도할 것으로 예상됩니다.

- 한편, 원료의 매장량 부족은 독일의 이차 전지 시장의 성장을 크게 억제할 가능성이 있습니다.

- 그럼에도 불구하고 스마트 워치, 무선 이어폰 및 스마트 밴드 등의 웨어러블 디바이스의 채택이 확대되고 있기 때문에 가까운 미래에 이차 전지 시장의 진출기업에 있어서 큰 기회가 생길 것으로 기대되고 있습니다.

독일의 이차 전지 시장 동향

리튬 이온 배터리 유형이 시장을 독점

- 리튬 이온 이차 전지는 우수한 용량 대 중량비로 다른 기술을 앞지르고 있습니다. 리튬 이온 이차 전지의 보급은 수명 연장, 최소한의 유지 보수, 향상된 보관 수명, 현저한 가격 저하 등의 이점에 의해 더욱 가속화되고 있습니다.

- 리튬 이온 배터리는 전통적으로 다른 배터리보다 비싸지만 시장을 주도하는 기업들은 투자를 강화하고 있습니다. 규모의 경제 실현과 연구개발 노력의 강화에 주력함으로써 경쟁이 심화되어 가격이 저하되고 있습니다.

- 2023년에는 리튬 이온 배터리의 가격이 139달러/kWh로 떨어졌으며 13%의 상당한 하락을 기록했습니다. 지속적인 기술 혁신과 제조 개선으로 인해 가격은 2025년까지 113달러/kWh로 더 낮아지고, 2030년에는 80달러/kWh에 이를 것으로 예측됩니다.

- 리튬 이온 배터리 수요가 급증하고 있는 이유는 재생가능에너지와 전기 자동차로의 전환에 있어서 매우 중요한 역할을 담당하고 있기 때문입니다. 태양광이나 풍력과 같은 신재생에너지원의 간헐적인 성질을 생각하면, 신뢰성이 높은 에너지 저장이 절실히 필요합니다. 리튬 이온 배터리는 에너지 저장 시스템에서 중요한 역할을 하며 수요 및 공급의 균형을 유지하고 그리드의 안정성을 유지하는 데 도움이 됩니다.

- 이 지역에서 배터리 에너지 저장 프로젝트가 급증하는 가운데, 주요 기업은 전국에서 저장 인프라를 구축하기 위해 적극적으로 계약을 맺고 있습니다. 슬로베니아의 NGEN은 2024년 6월 독일 국영 가스 회사 Uniper와 계약을 맺었습니다. 이 프로젝트는 약 5,000만 유로(5,400만 달러)로 2025년 운영을 시작할 예정입니다. 이러한 사업은 예측기간 동안 축전시설에서 리튬 이온 배터리 수요가 높아질 것으로 예상됩니다.

- 리튬 이온 배터리 수요 급증에 대응하기 위해, 각 정부는 관대한 보조금이나 우대조치를 내세우고, 현지 생산의 확대나 기술 혁신의 촉진을 목표로 하고 있습니다. 그 일례가 노스볼트의 사례로 스웨덴의 배터리 전문업체는 노스 볼트는 독일 북부에 전지 공장을 설립하기 위해, 독일과 슈레스비히-홀슈타인 양주로부터 약 7억 유로(7억 5,800만 달러)의 보조금 받았습니다. 이러한 정부의 지원에 의해 국내에서의 전지 생산이 가속해, 향후 수년간에 리튬 이온 전지 수요가 높아지게 될 전망입니다.

- 이러한 개발로 리튬 이온 이차 전지 수요는 예측 기간 동안 성장할 것입니다.

전기차의 보급이 시장을 주도

- 오랫동안 내연 기관차(ICE)가 시장을 독점해 왔습니다. 그러나 환경에 대한 관심이 높아짐에 따라 전기차(EV)로의 전환이 현저해지고 있습니다. EV의 주류는 리튬 이온 이차 전지를 이용한 것으로, 에너지 밀도가 높고, 경량이며, 자기 방전율이 낮고, 유지 관리 필요성이 적은 것이 선호되고 있습니다.

- 플러그인 하이브리드 자동차 및 전기자동차는 리튬 이온 이차 전지 시스템을 전원으로 사용합니다. 탁월한 에너지 밀도, 급속 충전 능력, 강력한 방전력으로 리튬 이온 배터리는 주행 거리와 충전 시간에 대한 OEM 기준을 충족하는 유일한 기술이되었습니다. 대조적으로, 납 배터리는 무거운 무게로 에너지 효율이 떨어지므로 완전한 하이브리드 자동차와 EV에 적합하지 않습니다.

- 독일에서는 최근 전기자동차의 보급이 눈에 띄게 급증하고 있습니다. 예를 들어 국제에너지기구(IEA)의 보고에 따르면 2023년 배터리 전기차의 판매량은 52만대에 이르며 2022년부터 10.6% 증가했습니다. 향후 몇 년동안 이 지역 전체의 EV 판매량이 크게 증가할 예측입니다.

- 이 성장을 가속하기 위해 독일은 전기차를 지지하고 저탄소 수송의 미래를 목표로 하는 여러 정책을 전개하고 있습니다. 이러한 정책적 노력으로 리튬 이온 배터리 수요가 높아지고 있습니다. 2023년 정부는 EV 생산을 촉진하고 탄소 중립을 촉진하는 야심찬 계획을 발표했습니다.

- 독일의 정책적 노력은 하이테크 전략 2025의 채택과 유럽 전지 혁신 프로젝트의 지원으로 분명하게 드러나며, 모두 배터리 기술과 EV 연구에 중점을 둡니다. 또한, 실질적인 보조금 정책은 전기자동차의 보급을 촉진하는 것을 목표로 합니다. EV의 신규 구매자에게는 최대 6,000유로(6,500달러), 플러그인 하이브리드 차량에는 최대 4,500유로(4,900달러)의 보조금이 지급됩니다. 이러한 조치로 EV의 생산이 확대되고 그 결과 이차 전지 수요도 당분간 증가할 전망입니다.

- 또한 전기자동차로의 지역 이동은 부정할 수 없습니다. 주요 기업들은 EV 생산을 촉진하기 위한 투자와 프로젝트를 강화하고 있습니다. 그 일례로 Ford는 2023년 6월 연간 생산 대수 25만대를 목표로 독일 쾰른에 20억 달러의 EV 공장을 건설한다고 발표했습니다. 이 쾰른 공장은 2026년까지 200만대의 EV를 생산한다는 포드의 야심적인 목표를 향한 발판이 됩니다. 이러한 시도는 EV의 생산을 강화할 뿐만 아니라 리튬 이온 배터리 수요가 높아지고 있음을 보여주는 것입니다.

- 정리하면, 이러한 협조적인 대처에 의해 독일에서는 향후 수년간, EV의 판매 대수가 급증해 충전 인프라가 확충되어 이차 전지에 대한 수요가 높아지게 될 것입니다.

독일의 이차 전지 산업 개요

독일의 이차 전지 시장은 세분화되어 있습니다. 주요 기업(무순서)으로는 BYD Company Ltd., Duracell Inc., Exide Technologies, EnerSys, Panasonic Holdings Corporation 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모와 수요 예측(단위 : 달러)

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 전기자동차(EV)의 보급 확대

- 리튬 이온 배터리 가격 저하

- 억제요인

- 원료의 매장량 부족

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

- 투자 분석

제5장 시장 세분화

- 기술

- 리튬 이온

- 납 배터리

- 기타 기술(NiMh, Nicd 등)

- 용도

- 자동차용 전지

- 산업용 전지(동력용, 거치형(텔레콤, UPS, 에너지 저장 시스템(ESS) 등))

- 휴대용 전지(가전 제품 등)

- 기타

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- BYD Company Ltd

- Duracell Inc.

- EnerSys

- Panasonic Holdings Corporation

- Energizer

- Exide Industries Ltd

- Saft Groupe SA

- Varta AG

- BMZ Group

- Akasol AG

- 기타 저명한 기업 일람

- 시장 랭킹, 점유율 분석

제7장 시장 기회와 앞으로의 동향

- 웨어러블 디바이스의 채택 확대

The Germany Rechargeable Battery Market size is estimated at USD 5.36 billion in 2025, and is expected to reach USD 12.31 billion by 2030, at a CAGR of 18.09% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising electric vehicle (EV) adoption and declining lithium-ion battery prices are expected to drive the demand for rechargeable batteries during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the Germany rechargeable battery market.

- Nevertheless, the growing adoption of wearable devices like smartwatches, wireless earphones, smart bands, and more are expected to create significant opportunities for rechargeable battery market players in the near future.

Germany Rechargeable Battery Market Trends

Lithium-Ion Battery Type Dominate the Market

- The lithium-ion rechargeable batteries are outpacing other technologies, due to their superior capacity-to-weight ratio. Their growing adoption is further fueled by advantages like extended lifespan, minimal maintenance, enhanced shelf life, and a notable drop in prices.

- While lithium-ion batteries traditionally commanded a premium over their counterparts, leading market players have been ramping up investments. Their focus on achieving economies of scale and bolstering R&D efforts has intensified competition, subsequently driving down prices.

- In 2023, lithium-ion battery prices dipped to USD 139/kWh, marking a significant 13% drop. With ongoing technological innovations and manufacturing refinements, projections suggest prices will further decline to USD 113/kWh by 2025 and reach USD 80/kWh by 2030.

- The surging demand for lithium-ion batteries is largely attributed to their pivotal role in the shift towards renewable energy and electric mobility. Given the intermittent nature of renewable sources like solar and wind, there's a pressing need for dependable energy storage. Lithium-ion batteries play a crucial role in energy storage systems, helping to balance supply and demand and maintain grid stability.

- As battery energy storage projects proliferate in the region, leading companies are actively contracting to establish storage infrastructures nationwide. A notable example is NGEN, a Slovenian firm, which in June 2024, inked a deal with Uniper, a German state-owned gas entity. They are set to construct a 50 MW/100 MWh battery energy storage facility at the Heyden power station site, a project valued at nearly EUR 50 million (USD 54 million) and slated to commence operations in 2025. Such undertakings are poised to bolster the demand for lithium-ion batteries in storage facilities during the forecast period.

- In response to the surging demand for lithium-ion batteries, governments are rolling out generous subsidies and incentives, aiming to amplify local production and spur innovation. A case in point: Northvolt, a Swedish battery specialist, received a substantial boost of about EUR 700 million (USD 758 million) in subsidies from both Germany and Schleswig-Holstein for establishing a battery factory in northern Germany. Such governmental backing is set to accelerate domestic battery production and subsequently heighten the demand for lithium-ion batteries in the years ahead.

- Given these developments, the demand for lithium-ion rechargeable batteries is poised for growth in the forecast period.

Growth in Electric Vehicle Adoption to Drive the Market

- For a long time, vehicles with internal combustion engines (ICE) dominated the market. However, as environmental concerns grow, there's a noticeable shift towards electric vehicles (EVs). Predominantly, EVs utilize lithium-ion rechargeable batteries, favored for their high energy density, lightweight nature, low self-discharge rates, and minimal maintenance needs.

- Plug-in hybrids and electric vehicles are powered by lithium-ion battery systems. Their unmatched energy density, rapid recharge capability, and robust discharge power make lithium-ion batteries the sole technology meeting OEM standards for driving range and charging time. In contrast, lead-based traction batteries fall short for full hybrids or EVs due to their heftier weight and reduced energy efficiency.

- Germany has seen a remarkable surge in electric vehicle adoption recently. For example, the International Energy Agency (IEA) reported that in 2023, battery electric vehicle sales reached 0.52 million, marking a 10.6% increase from 2022. Projections indicate a substantial rise in EV sales across the region in the coming years.

- To foster this growth, Germany has rolled out multiple policies championing electric vehicles and steering the nation towards a low-carbon transport future. These initiatives have bolstered the demand for lithium-ion batteries. In 2023, the government unveiled ambitious plans to boost EV production and expedite the journey to zero carbon emissions.

- Germany's commitment is evident with the introduction of the High-Tech Strategy 2025 and backing for the European Battery Innovation project, both emphasizing battery tech and EV research. Additionally, a substantial subsidy initiative aims to further the electric vehicle cause. New EV buyers benefit from a subsidy of up to EUR 6,000 (USD 6,500), while plug-in hybrids enjoy up to EUR 4,500 (USD 4,900). Such measures are poised to amplify EV production and, consequently, the demand for rechargeable batteries in the foreseeable future.

- Moreover, the regional shift towards electric vehicles is undeniable. Major companies are ramping up investments and projects to boost EV production. A case in point: Ford's June 2023 announcement of a USD 2 billion EV factory in Cologne, Germany, targeting an annual output of 250,000 vehicles. This Cologne plant is a stepping stone towards Ford's ambitious goal of 2 million EVs by 2026. Such endeavors not only bolster EV production but also signal a rising demand for lithium-ion batteries.

- In summary, with these concerted efforts, Germany is set to see a surge in EV sales, an expanded charging infrastructure, and an increased appetite for rechargeable batteries in the coming years.

Germany Rechargeable Battery Industry Overview

The Germany rechargeable battery market is semi-fragmented. Some of the key players (not in particular order) are BYD Company Ltd, Duracell Inc., Exide Technologies, EnerSys, and Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Electric Vehicle (EV) Adoption

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Duracell Inc.

- 6.3.3 EnerSys

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Energizer

- 6.3.6 Exide Industries Ltd

- 6.3.7 Saft Groupe SA

- 6.3.8 Varta AG

- 6.3.9 BMZ Group

- 6.3.10 Akasol AG

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Wearable Devices

샘플 요청 목록