|

시장보고서

상품코드

1636566

라틴아메리카의 이차 전지 시장 전망 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Latin America Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

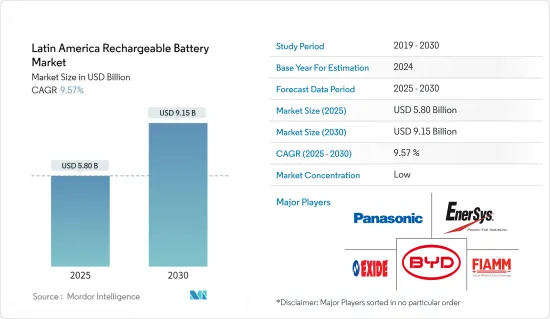

라틴아메리카의 이차 전지 시장 규모는 2025년에 58억 달러로 추정되며, 예측 기간(2025-2030년)의 연평균 성장율(CAGR)은 9.57%로, 2030년에는 91억 5,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 리튬이온 배터리 가격 하락, 전기차 보급 확대, 신재생에너지 채용 확대가 예측 기간 동안 라틴아메리카의 이차 배터리 시장을 주도할 것으로 예상됩니다.

- 반대로 원료 수급 불균형은 예측 기간 동안 시장 성장을 방해하는 요인입니다.

- 그러나 데이터센터와 같은 상업 인프라로부터 수요 증가와 배터리 재활용 및 배터리의 이차 용도에 대한 요구 증가는 라틴아메리카의 이차 배터리 시장에 큰 기회를 가져올 것으로 예상됩니다.

- 브라질은 전기차 판매량의 급증과 재생가능 에너지의 보급으로 이차 전지 시장의 대폭적인 성장이 전망되고 있습니다.

라틴아메리카의 이차 전지 시장 동향

리튬 이온 배터리가 크게 성장

- 예측 기간 동안 리튬 이온 배터리(LIB)는 라틴아메리카의 이차 배터리 시장에서 가장 빠르게 성장하는 부문 중 하나가 될 전망입니다. 리튬 이온 배터리는 용량 대 중량비가 유리하기 때문에 다른 배터리에 비해 인기가 높아지고 있습니다. 리튬 이온 전지의 보급을 촉진하는 기타 요인으로는 뛰어난 성능(긴 수명과 낮은 유지 보수가 특징), 장기의 보존 가능 기간, 가격의 하락 동향 등을 들 수 있습니다.

- 명확한 기술적 이점을 제공하는 리튬 이온(Li-ion) 배터리는 기존의 납 배터리 보다 우수합니다. 예를 들면, 납 배터리의 수명은 통상 약 400-500 사이클이지만, 충전식 리튬 이온 전지는 평균 5,000 사이클 이상의 경이적인 수명을 자랑합니다. 또한 리튬 이온 배터리는 유지 보수 및 교체 빈도가 적습니다. 또한 방전 사이클을 통해 안정적인 전압을 유지하기 위해 연결된 전기 부품의 효율율 오래 유지할 수 있습니다.

- 최근, 주요 업계는 투자를 확대해 규모의 경제와 연구 개발에 중점을 두어 배터리의 성능을 높이고 있습니다. 이러한 경쟁이 급증함에 따라 리튬 이온 배터리의 가격이 현저히 떨어지고 있습니다. 기술 진보, 제조 최적화, 원료 비용 감소로 인해 리튬 이온 배터리의 부피 가중 평균 가격은 2013년 780달러/kWh에서 2023년 139달러/kWh로 급락했습니다. 2025년에는 약 113달러/kWh, 2030년에는 80달러/kWh까지 더욱 하락할 것으로 보이며, 리튬 이온 배터리는 점점 매력적인 선택이 되고 있습니다.

- 역사적으로, 리튬 이온 배터리는 휴대폰나 노트북 등의 가전 제품이 주요 용도였습니다. 그러나 전기자동차와 재생가능 에너지 부문의 배터리 에너지 저장 시스템(BESS)이 리튬 이온 배터리에 대한 의존도를 높이고 있으며, 그 역할은 확대되고 있습니다.

- 라틴아메리카 리튬 이온 배터리 제조 산업은 아직 초기 단계에 있지만, 이 지역에는 필수 원료가 풍부하게 매장되어 있어 다양한 최종 사용자로부터 수요가 급증하고 있기 때문에 시장의 급성장이 전망 되었습니다.

- 리튬 트라이앵글로도 불리는 라틴아메리카는 리튬 이온 전지에 필수적인 방대한 리튬 매장량을 자랑합니다. 이 지대에는 아르헨티나, 볼리비아, 칠레가 포함되어 합쳐 세계의 리튬 매장량의 절반 이상을 보유하고 있습니다. 칠레는 아타카마 사막에 리튬을 풍부하게 염수가 널리 존재하기 때문에 리튬 생산을 선도하고 있습니다. 볼리비아의 우유니 소금 호수는 채굴의 어려움에도 불구하고 세계 최대의 리튬 매장량으로 두드러지고 있습니다. 푸나 지역의 염전을 가진 아르헨티나도 중요한 역할을 합니다. 이들 국가들이 일체가 되어, 세계의 리튬 이온 전지 생산공급망에 불가결한 존재가 되고 있습니다.

- 미국 지질조사국에 따르면 2023년 중반의 리튬 생산량은 칠레가 약 4만 4,000톤, 아르헨티나가 9,600톤, 브라질이 4,900톤으로 되어 있습니다. 이러한 엄청난 생산량으로 라틴아메리카는 세계 리튬 이온 배터리에서 매우 중요한 위치를 차지하고 있습니다.

- 라틴아메리카 국가들은 전기자동차공급망에 더 깊이 관여하기 위해 노력하고 있습니다. 아르헨티나, 칠레, 볼리비아, 브라질과 같은 국가들은 광물 자원을 풍부하게 활용하고 가공 능력을 높이고 자동차 제조에 주목할으로써 채굴 된 리튬의 대부분을 배터리 화학으로의 변환을 목표로 합니다. 또한 아르헨티나의 광산 관계자가 강조한 것처럼 전지나 전기자동차의 제조에도 나서고 있습니다.

- 2023년 4월 중국의 주요 전기자동차 제조업체 BYD는 칠레의 안토파가스타 지방에 2억 9,000만 달러의 리튬 양극 공장을 건설할 계획을 발표했습니다. 이러한 전략적 움직임은 향후 몇 년동안 급증할 것으로 예상됩니다.

- 2023년 중반, 아르헨티나 정부는 최초의 리튬 이온 배터리 공장의 계획을 밝혔습니다. 이 공장에서는 미국의 주요 광산 회사 Livent Corporation이 현지에서 조달 및 가공한 탄산 리튬을 이용합니다. 국영 YPF의 자회사인 YPF Tecnologia(Y-TEC)가 건설하는 이 공장은 풍부한 리튬 매장량에 부가가치를 부여하는 아르헨티나의 의지를 나타냅니다. 700만 달러를 투자해 연간 생산 능력 13MWh, 거치형 에너지 저장배터리 1,000대를 목표로 합니다. 게다가 리튬이온 배터리의 생산에 열심한 현지 기업에의 기술 이전의 기회를 중시하고 있습니다.

- 리튬 이온 배터리는 경량성, 급속 충전 기능, 충전 주기 연장, 비용 저하의 배경으로 특히 이 지역의 리튬 상당한 매장량과 산업의 진보에 의해 시장을 독점하게 될 것으로 예상됩니다.

현저한 성장이 기대되는 브라질

- 브라질은 가까운 미래에 라틴아메리카의 이차 전지 시장에서 지배적인 진출기업으로 등장할 것으로 보입니다. 이 급성장의 주요 요인은 전기 자동차, 재생 가능 에너지, 소비재 등 다양한 부문에서 배터리 수요가 증가하고 있다는 것입니다. 게다가 이 산업의 확대는 정부의 지원책이나 국내의 기술 혁신에 의해 추진되고 있습니다.

- 최근 브라질은 정부의 장려책에 따라 전기차(EV)의 보급이 급속히 진행되고 있습니다. 2023년 브라질의 EV 판매 대수는 약 5만 2,000대(PHEV 3만 3,000대, BEV 1만 9,000대)에 이르렀으며, 2022년 1만 8,500대(PHEV 1만 대, BEV 8,500대)에서 대폭 증가 했습니다. 이 EV 판매 대수의 급증은 향후 이차 전지 시장을 활성화시킬 것으로 예상됩니다.

- 브라질은 2024년 1월부터 100% 수입 전기자동차(EV)에 대해 10% 과세를 시작했습니다. 이에 따라 중국의 자동차 제조업체 몇 사가 현지에서의 투자를 활발하게 하고 있습니다. 특히 BYD는 브라질에 생산 거점을 설립하여 2024년 후반부터 2025년 전반의 생산을 목표로 하고 있습니다.이러한 움직임은 브라질의 국내 EV 제조를 강화하고 이차 전지 수요가 확대될 것으로 기대되고 있습니다.

- 세계 동향을 반영하여 브라질은 이산화탄소 배출량을 줄이고 화석 연료에 대한 의존도를 줄이기 위해 적극적으로 노력하고 있습니다. 전기 자동차로의 전환을 촉진하기 위해 정부는 다양한 보조금과 우대 조치를 전개하고 있습니다. 그 대표 예가 2023년 말에 시작된 ‘그린 모빌리티 혁신 프로그램’으로 2024년부터 2028년에 걸쳐 저공해 운송기술을 개발하는 기업에 대해 190억 헤알이상의 세제 우대 조치가 제공됩니다. 이러한 지원은 EV 부문을 강화하고 이차 전지 시장에 이익을 가져다줍니다.

- 자동차 부문을 제외하고 산업 부문도 시장 성장을 이끌고 있습니다. 백업 전원이나 재생 가능 에너지 저장 등의 용도로 이차 전지를 이용하는 산업이 증가하고 있습니다. 급성장하는 재생 가능 에너지 부문, 특히 태양광 발전과 풍력 발전은 첨단 배터리 기술 수요를 촉진하고 있습니다.

- 국제재생가능에너지기구(IRENA)에 따르면 브라질의 재생가능에너지 용량은 2023년에 약 194GW에 달했고, 2020년부터 28.8% 증가했습니다. 2023년 브라질의 태양광 발전 용량은 37GW 이상, 풍력 발전 용량은 29GW 이상입니다. 정부가 이러한 능력을 더욱 강화할 계획을 세우고 있기 때문에 배터리 에너지 저장 시스템(BESS) 수요는 증가할 것으로 보입니다.

- 2024년 5월 노르웨이의 거대 에너지 기업인 Statkraft AS는 브라질 바이어의 두 풍력 발전소에 275MW의 태양광 용량을 설치하기 위한 9억 2,600만 헤알의(1억 8,070만 달러) 투자 를 발표했습니다. Sol de Brotas로 명명된 이 태양광 발전 자산은 519MW의 Ventos de Santa Eugenia 복합 발전소와 79.8MW의 Morro do Cruzeiro 풍력 발전 복합 발전소와 통합됩니다.

- 2024년에 Sol de Brotas는 BESS 기술을 이용하여 단계적으로 가동이 시작되어, Morro do Cruzeiro는 2025년 8월, Ventos de Santa Eugenia는 2025년 11월에 가동이 시작 됩니다.

- 2023년 초 미국 Fractal EMS와 브라질 You.On은 브라질에서 30MW/60MWh의 축전지 시스템(BESS)을 통합했습니다. Fractal EMS는 BESS가 피크 부하시 전력 공급을 최적화하고, 송전의 회복력을 높이고, 발전소에 대한 의존도를 줄일 수 있다고 강조했습니다. 이러한 프로젝트는 특히 Fractal EMS의 장비에 얽매이지 않는 접근법과 You.On이 Kehua 인버터와 CATL 수냉식 배터리를 선택함으로써 브라질에서 산업용 이차 전지 수요가 높아지는 경향을 보여줍니다.

- 이러한 역학을 고려하면, 브라질의 이차 전지 시장은 당분간 대폭적인 성장을 이룰 것으로 예상됩니다.

라틴아메리카의 이차 전지 산업 개요

라틴아메리카의 이차 전지 시장은 세분화됩니다. 이 시장의 주요 기업(무순서)에는 Exide Industries Ltd, BYD Company Ltd, FIAMM Energy Technology SpA, Panasonic Holdings Corporation, EnerSys 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모와 수요 예측(단위 : 달러)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 성장 촉진요인

- 전기자동차의 보급 확대

- 신재생에너지 도입 증가

- 억제요인

- 원료의 수급 불균형

- 성장 촉진요인

- 공급망 분석

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협 제품 및 서비스

- 경쟁 기업간 경쟁 관계

- 투자분석

제5장 시장 세분화

- 기술

- 납 배터리

- 리튬 이온

- 기타 기술(NiMh, Nicd 등)

- 용도

- 자동차용 전지

- 산업용 전지(동력용, 거치형(텔레콤, UPS, 에너지 저장 시스템(ESS) 등))

- 휴대용 배터리(가전 제품 등)

- 기타

- 지역

- 브라질

- 멕시코

- 칠레

- 콜롬비아

- 아르헨티나

- 기타 라틴아메리카

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- BYD Company Ltd

- EnerSys

- Panasonic Holdings Corporation

- Exide Industries Ltd

- FIAMM Energy Technology SpA

- C&D Technologies Inc.

- Duracell Inc.

- Saft Groupe SA

- Clarios

- Acumuladores Moura SA

- 기타 저명한 기업 일람(회사명, 본사 소재지, 수익, 관련 제품, 사업 부문, 연락처 등)

- 시장 랭킹 분석

제7장 시장 기회와 앞으로의 동향

- 데이터센터 등 상업 인프라로부터 수요

- 배터리 재활용 및 보조 생활 용도에 대한 요구

The Latin America Rechargeable Battery Market size is estimated at USD 5.80 billion in 2025, and is expected to reach USD 9.15 billion by 2030, at a CAGR of 9.57% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, declining lithium-ion battery prices, increasing adoption of electric vehicles, and the growing adoption of renewable energy are expected to drive the Latin America rechargeable battery market during the forecast period.

- Conversely, a mismatch in the demand and supply of raw materials is poised to impede the market's growth during the forecast period.

- However, rising demand from commercial infrastructures like data centers, coupled with the growing need for battery recycling and the second-life application of batteries, is set to unlock vast opportunities for the rechargeable battery market in Latin America.

- Brazil stands to see substantial growth in the rechargeable battery market, driven by surging electric vehicle sales and a broader adoption of renewable energy in the region.

Latin America Rechargeable Battery Market Trends

Lithium-ion Batteries to Witness Significant Growth

- During the forecast period, lithium-ion batteries (LIB) are poised to be among the fastest-growing segments in the Latin American rechargeable battery market. Their favorable capacity-to-weight ratio is making lithium-ion batteries increasingly popular compared to other types. Additional factors driving their adoption include superior performance (characterized by longevity and low maintenance), an extended shelf life, and a downward trend in prices.

- Offering distinct technical advantages, lithium-ion (Li-ion) batteries outshine traditional lead-acid batteries. For instance, while lead-acid batteries typically last for about 400-500 cycles, rechargeable Li-ion batteries boast an impressive average of over 5,000 cycles. Furthermore, Li-ion batteries demand less frequent maintenance and replacement. They also maintain consistent voltage throughout their discharge cycle, ensuring prolonged efficiency for connected electrical components.

- In recent years, major industry players have ramped up investments, focusing on economies of scale and R&D to boost battery performance. This surge in competition has led to a notable drop in lithium-ion battery prices. Thanks to technological advancements, manufacturing optimizations, and falling raw material costs, the volume-weighted average price of lithium-ion batteries plummeted from USD 780/kWh in 2013 to USD 139/kWh in 2023. Projections suggest a further decline to approximately USD 113/kWh by 2025 and USD 80/kWh by 2030, making lithium-ion batteries an increasingly attractive option.

- Historically, lithium-ion batteries found their primary application in consumer electronics like mobile phones and laptops. However, their role has expanded, with electric vehicles and battery energy storage systems (BESS) in the renewable energy sector increasingly relying on them.

- While the lithium-ion battery manufacturing industry in Latin America is still in its nascent stages, the region's abundant reserves of essential raw materials and the surging demand from diverse end-users signal a rapid market growth.

- Latin America, often dubbed the Lithium Triangle, boasts vast lithium reserves, a crucial component for lithium-ion batteries. This triangle encompasses Argentina, Bolivia, and Chile, collectively holding over half of the world's known lithium reserves. Chile leads in production, thanks to its extensive lithium-rich brine deposits in the Atacama Desert. Bolivia's Salar de Uyuni stands out as one of the globe's largest lithium reserves, despite extraction challenges. Argentina, with its salt flats in the Puna region, also plays a significant role. Together, these nations are integral to the global lithium-ion battery production supply chain.

- According to the US Geological Survey, lithium production figures for mid-2023 were approximately 44,000 metric tons in Chile, 9,600 metric tons in Argentina, and 4,900 metric tons in Brazil. Such substantial output positions Latin America as a pivotal player in the global lithium-ion battery landscape.

- Latin American countries are intensifying efforts to deepen their involvement in the electric vehicle supply chain. By capitalizing on their mineral wealth, enhancing processing capabilities, and eyeing vehicle manufacturing, nations like Argentina, Chile, Bolivia, and Brazil aim to transform more of their mined lithium into battery chemicals. They're also venturing into battery and electric vehicle manufacturing, as highlighted by Argentina's mining officials.

- In April 2023, BYD Co Ltd, China's leading electric vehicle manufacturer, announced plans for a USD 290 million lithium cathode factory in Chile's Antofagasta region, as reported by Chile's economic development agency, CORFO. Such strategic moves are expected to proliferate in the coming years.

- In mid-2023, the Argentinean government revealed plans for its inaugural lithium-ion battery plant. This facility will utilize lithium carbonate sourced and processed locally by US mining giant Livent Corporation. Constructed by YPF Tecnologia (Y-TEC), a subsidiary of the state-owned YPF, the plant signifies Argentina's commitment to adding value to its rich lithium reserves. With a USD 7 million investment, the facility aims for an annual production capacity of 13MWh, translating to 1,000 stationary energy storage batteries. Moreover, it emphasizes technology transfer opportunities for local firms keen on lithium-ion battery production.

- Given their lightweight nature, rapid charging capabilities, extended charging cycles, and the backdrop of declining costs, lithium-ion batteries are set to dominate the market, especially with the region's significant lithium reserves and industry advancements.

Brazil is Expected to Witness Significant Growth

- Brazil is poised to emerge as a dominant player in the Latin American rechargeable battery market in the near future. This surge is primarily fueled by the escalating demand for batteries across diverse sectors, notably electric mobility, renewable energy, and consumer goods. Furthermore, the industry's expansion is bolstered by supportive government initiatives and technological innovations within the nation.

- Recently, Brazil has seen a swift uptick in electric vehicle (EV) adoption, thanks to government-backed incentives. In 2023, Brazil's EV sales reached approximately 52,000 units (33,000 PHEV and 19,000 BEV), a substantial leap from 2022's 18,500 units (10,000 PHEV and 8,500 BEV). This surge in EV sales is anticipated to bolster the rechargeable battery market in the years ahead.

- Starting January 2024, Brazil imposed a 10% tax on imported 100% electric vehicles (EVs), set to escalate to 18% in July and peak at 35% by July 2026. In response, several Chinese automakers are ramping up local investments. Notably, BYD is establishing a manufacturing complex in Brazil, targeting production by late 2024 or early 2025, while Great Wall Motor's plant is set to commence operations in 2024. These moves are expected to enhance Brazil's domestic EV manufacturing and amplify the demand for rechargeable batteries.

- Echoing global trends, Brazil is actively working to curtail carbon emissions and reduce fossil fuel reliance. To facilitate this transition to electric mobility, the government has rolled out various subsidies and incentives. A prime example is the Green Mobility and Innovation Programme launched at the end of 2023, offering over BRA 19 billion in tax incentives from 2024 to 2028 for companies developing low-emission transport technologies. Such initiatives are poised to bolster the EV sector, subsequently benefiting the rechargeable battery market.

- Beyond the automotive realm, the industrial sector is also driving market growth. Industries are increasingly turning to rechargeable batteries for applications like backup power and renewable energy storage. The burgeoning renewable energy sector, especially solar and wind, is fueling the demand for advanced battery technologies.

- According to the International Renewable Energy Agency (IRENA), Brazil's renewable energy capacity reached about 194 GW in 2023, marking a 28.8% increase from 2020. In 2023, Brazil boasted over 37 GW in solar and 29 GW in wind energy capacities. With government plans to further boost these capacities, the demand for battery energy storage systems (BESS) is set to rise.

- In May 2024, Norwegian energy giant Statkraft AS unveiled a BRL 926 million (USD 180.7 million) investment to install 275 MW of solar capacity at two wind parks in Bahia, Brazil. The solar asset, named Sol de Brotas, will integrate with the 519 MW Ventos de Santa Eugenia complex and the 79.8 MW Morro do Cruzeiro wind power complex.

- Scheduled for construction in 2024, Sol de Brotas will utilize BESS technology, with operations commencing in phases: Morro do Cruzeiro in August 2025 and Ventos de Santa Eugenia in November 2025.

- In early 2023, United States-based Fractal EMS Inc and Brazil's You.On integrated a 30 MW/60 MWh battery energy storage system (BESS) in Brazil. Fractal EMS highlighted that the BESS will optimize power delivery during peak loads, enhancing transmission line resilience and reducing reliance on peaker plants. Such projects, especially with Fractal EMS's equipment-agnostic approach and You.On's choice of Kehua inverters and CATL liquid-cooled batteries, signal a growing trend in Brazil, boosting the demand for industrial rechargeable batteries.

- Given these dynamics, Brazil's rechargeable battery market is set for substantial growth in the foreseeable future.

Latin America Rechargeable Battery Industry Overview

The Latin Americarechargeable battery market is semi-fragmented. Some of the key players in the market (not in any particular order) include Exide Industries Ltd, BYD Company Ltd, FIAMM Energy Technology SpA, Panasonic Holdings Corporation, and EnerSys.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Growing Renewable Energy Installation

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Mexico

- 5.3.3 Chile

- 5.3.4 Colombia

- 5.3.5 Argentina

- 5.3.6 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 EnerSys

- 6.3.3 Panasonic Holdings Corporation

- 6.3.4 Exide Industries Ltd

- 6.3.5 FIAMM Energy Technology SpA

- 6.3.6 C&D Technologies Inc.

- 6.3.7 Duracell Inc.

- 6.3.8 Saft Groupe SA

- 6.3.9 Clarios

- 6.3.10 Acumuladores Moura S.A.

- 6.4 List of Other Prominent Companies (Company Name, Headquarters, Revenue, Relevant Products, Operating Sector, Contact Details, etc.) (In Brief Tabular Format)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Demand from Commercial Infrastructures Such as Data Centers

- 7.2 Need for a Battery Recycling and Second-life Applications

샘플 요청 목록