|

시장보고서

상품코드

1636544

북미의 이차 전지 시장 전망: 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)North America Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

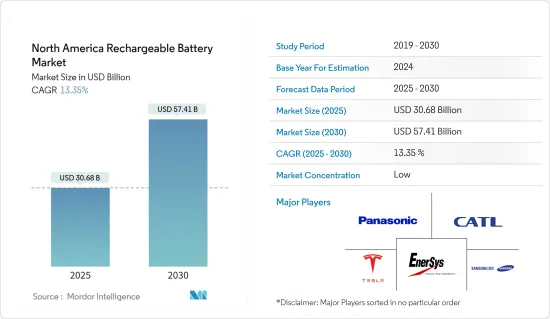

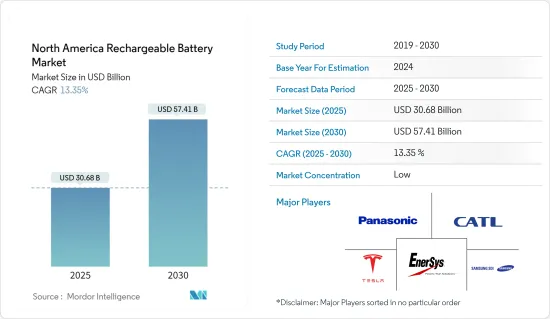

북미의 이차 전지 시장 규모는 2025년에 306억 8,000만 달러로 추정되고, 2030년에는 574억 1,000만 달러에 이를 것으로 예측되며, 예측 기간(2025-2030년)의 연평균 성장률(CAGR)은 13.35%입니다.

주요 하이라이트

- 중기적으로는 리튬이온 배터리 가격 하락, 전기차 보급 확대, 재생가능 에너지 부문 확대가 예측 기간 동안 북미의 이차 배터리 시장을 주도할 것으로 예상됩니다.

- 한편, 원료의 수요및 공급의 불균형이 예측기간 동안 시장 성장을 방해할 것으로 예상됩니다.

- 새로운 배터리 기술과 첨단 배터리 화학의 개발이 진행됨에 따라 북미의 이차 전지 시장에 큰 기회가 생길 수 있습니다.

- 미국은 전기자동차 산업의 확대와 다양한 재생 가능 에너지 프로젝트에서 에너지 저장 시스템으로 배터리 채택 증가로 향후 몇 년동안 시장을 독점할 것으로 예상됩니다.

북미의 이차 전지 시장 전망

자동차 용도의 괄목할 만한 성장세

- 앞으로 수년간 자동차 용도, 특히 전기자동차(EV)는 리튬 이온 배터리를 중심으로 하는 이차 배터리의 주요 부문이 될 전망입니다. 북미의 이차 전지 산업은 전기자동차의 보급이 큰 원동력이 되어 큰 성장을 이룰 것으로 예상됩니다.

- 또한, 납 배터리는 자동차 산업의 시동, 조명, 점화(SLI) 액세서리에서 중요한 역할을 합니다. 이 SLI 배터리는 자동차 엔진 시동에 필수적인 초기 전력을 공급하며 일반적으로 딥 사이클 배터리보다 작고 가볍습니다.

- 미국은 이 지역에서 전기자동차의 주요 시장으로 주목받고 있습니다. 예를 들어 국제에너지기구(IEA)는 미국에서 배터리 전기자동차(BEV)의 판매 대수는 2023년에 약 110만대에 달하고, 2022년부터 37% 증가한다고 보고했습니다. 이에 대해 캐나다와 멕시코의 BEV 판매 대수는 각각 약 13만대와 1만 3,000대였습니다. 이 EV 보급의 급증은 북미 전역에서 이차 전지 수요를 끌어올리게 됩니다.

- 게다가 에너지효율 및 재생가능에너지국은 2023년 초 미국 정부가 북미에서 전기자동차 배터리 공장 계획을 발표했다고 강조했습니다. 이 지역의 제조 능력은 2021년 연간 55기가와트(GWh/년)에서 2030년에는 연간 1,000GWh로 급증할 것으로 예측되고 있습니다. 향후 예정되어 있는 프로젝트의 대부분은 2025년부터 2030년 사이에 생산을 개시할 예정이며, 자동차용 이차 전지 시장의 성장이 예상됩니다.

- 2023년 7월 캐나다 정부는 자동차 제조업체인 Stellantis와 제휴하여 온타리오 주 윈저에 전기자동차 배터리 공장을 설립했습니다. 이 계약에 따라 캐나다 정부는 스텔란티스에 약 110억 달러의 인센티브를 제공하고 청정 에너지 공급망을 강화하는 것을 목표로 하고 있습니다. 이러한 움직임은 캐나다에서 자동차용 이차 전지 시장을 더욱 견고하게 만들 것으로 기대됩니다.

- 2023년 초, 독일 자동차 제조업체인 BMW는 멕시코의 San Luis Potosi에 8억 유로를 투자한다고 발표했습니다. 이 투자는 고전압 배터리와 완전 전기자동차 Neue Klasse(뉴ㅍ클라ㅆ쎄)모델을 생산하기 위한 것입니다. BMW는 투자액의 절반 이상을 멕시코에 할당할 계획에 있으며, 5억 3,900만 달러를 기존 공장의 배터리 조립 센터에 충당하고, 나머지 3억 2,300만 달러를 차체 공장의 적합과 배터리 팩 설치를 위한 새로운 조립 라인의 확립에 충당합니다. 이러한 노력은 북미 자동차 부문에서 이차 전지 시장의 성장을 뒷받침할 것으로 기대됩니다.

- 게다가 리튬 이온 전지의 가격이 저하되고, 전지 기술이 발전함에 따라 시장 경쟁 전기자동차가 등장하여 이차 전지 수요가 더욱 높아질 것으로 보입니다.

시장을 독점하는 미국

- 가전제품, 전기자동차(EV), 배터리를 이용한 에너지 저장 프로젝트에 대한 수요의 급증에 더해, 재생 가능 에너지 인프라의 확대와 탄탄한 산업 기반으로, 미국은 이차 전지의 세계의 핫스팟으로서 부상 하고 있습니다. 이러한 역학을 통해 미국은 북미에서 이차 전지의 주요 시장으로서의 지위를 확고하게 하고 있습니다.

- 최근 미국의 배터리 에너지 저장 시스템(BESS)은 정부의 이니셔티브와 신재생에너지에 대한 투자 증가에 힘입어 현저한 성장을 이루고 있습니다. 미국은 재생가능에너지의 세계적 리더로서 급부상하고 있으며, 국제재생가능에너지기구(IRENA)의 보고에 따르면 2014년부터 2023년에 걸쳐 미국의 재생가능에너지 용량은 2배 이상으로 증가하여 2023년에 는 385GW 이상에 도달했습니다.

- 신재생에너지 발전의 급속한 증가에 따라 미국은 신재생에너지의 고집적화에 의한 송전망의 안정성이라는 과제에 직면하고 있습니다. 태양에너지와 풍력에너지의 간헐적인 성질을 고려하면, 수요가 많을 떄 이 에너지를 저장하는 것이 매우 중요합니다. 이 필요성은 미국에서 BESS 수요를 높이고 이차 전지의 성장을 가속하고 있습니다.

- 미국에너지정보국(EIA)에 따르면 2021년 이후 증가세를 보이고 있는 미국의 배터리 저장 용량은 개발자가 상업운전 개시일을 충족할 것을 조건으로 2024년 말까지 89% 증가할 것으로 예측되었습니다. 개발자는 2024년 말까지 미국의 축전지 용량을 30GW 이상으로 하는 것을 목표로, 석유액, 지열원, 나무 쓰레기, 매립지 가스의 용량을 뛰어넘게 됩니다.

- 2023년 시점에서 캘리포니아 주가 730만kW에서 가장 많고 텍사스 주 320만kW가 그 뒤를 잇고 있습니다. EIA는 2023년 말 시점에서 미국 전력회사 규모의 배터리 용량이 합하면 약 1,600만kW에 이르렀으며, 2024년에는 1,500만kW, 2025년에는 9,000만kW가 계획되었고 지적했습니다. 이 궤적은 향후 몇 년동안 이차 전지 기술 수요가 급증할 것으로 보입니다.

- 전자 부품이 소형화되고 처리 능력이 높아짐에 따라 가전제품의 인기가 높아지고 있습니다. 이러한 첨단 장비에는 가볍고 정교한 배터리 팩이 필요합니다. 소비자기술협회(Consumer Technology Association)가 발표한 미국 스마트폰 판매량이 2012년 337억 달러에서 2022년 약 747억 달러로 급증한다는 보고에서 강조된 스마트폰과 노트북 소비 급증은 휴대 기기에서 리튬 이온 배터리 수요 증가를 뒷받침하고 있습니다.

- 이를 통해 미국은 도시화, 소비자 지출 증가, 첨단 장비 및 자동차로의 전환에 힘입어 북미의 이차 전지 시장을 선도할 것으로 보입니다.

북미의 이차 전지 산업 개요

북미의 2차 전지 시장은 세분화되어 있습니다. 이 시장의 주요 기업(무순서)에는 Panasonic Corporation, Contemporary Amperex Technology Co.Limited, Tesla Inc., EnerSys, Samsung SDI 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모와 수요 예측(단위 : 달러)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 성장 촉진요인

- 전기자동차의 보급 확대

- 리튬 이온 전지 비용 저하

- 억제요인

- 원료의 수요와 공급 불균형

- 성장 촉진요인

- 공급망 분석

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협 제품 및 서비스

- 경쟁 기업간 경쟁 관계

- 투자분석

제5장 시장 세분화

- 기술

- 납 배터리

- 리튬 이온

- 기타 기술(NiMh, Nicd 등)

- 용도

- 자동차용 전지

- 산업용 전지(동력용, 거치형(텔레콤, UPS, 에너지 저장 시스템(ESS) 등))

- 휴대용 배터리(가전 제품 등)

- 기타

- 지역

- 미국

- 캐나다

- 기타 북미

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Panasonic Corporation

- Contemporary Amperex Technology Co. Limited

- Tesla Inc.

- EnerSys

- Samsung SDI Co. Ltd

- Duracell Inc.

- Exide Technologies

- Clarios, LLC.

- LG Chem Ltd.

- Johnson Controls International PLC

- BYD Co.Ltd.

- 기타 저명한 기업 일람(회사명, 본사 소재지, 관련 제품과 서비스, 연락처 등)

- 시장 랭킹/공유(%) 분석

제7장 시장 기회와 앞으로의 전망

- 새로운 배터리 기술과 선진 배터리 화학의 개발의 진전

The North America Rechargeable Battery Market size is estimated at USD 30.68 billion in 2025, and is expected to reach USD 57.41 billion by 2030, at a CAGR of 13.35% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, declining lithium-ion battery prices, increasing adoption of electric vehicles, and the growing renewable energy sector are expected to drive the North American rechargeable battery market during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials is expected to hinder the market's growth during the forecast period.

- Nevertheless, the growing progress in developing new battery technologies and advanced battery chemistries will likely create significant opportunities for the North America rechargeable battery market.

- The United States is expected to dominate the market in the upcoming years due to the expansion of the electric vehicle industry and the increasing adoption of batteries as energy storage systems in various renewable energy projects.

North America Rechargeable Battery Market Trends

Automotive Application to Witness Significant Growth

- In the coming years, automotive applications, especially electric vehicles (EVs), are poised to be a dominant segment for rechargeable batteries, predominantly lithium-ion batteries. North America's rechargeable battery industry is set to experience significant growth, largely driven by the rising adoption of electric vehicles.

- Additionally, lead-acid batteries play a crucial role in the automotive industry's starting, lighting, and ignition (SLI) accessories. These SLI batteries provide the essential initial power burst needed to start a vehicle's engine, and they are generally smaller and lighter than deep-cycle batteries.

- The United States stands out as a leading market for electric vehicles in the region. For instance, the International Energy Agency (IEA) reported that battery electric vehicle (BEV) sales in the United States reached approximately 1.1 million units in 2023, marking a 37% increase from 2022. In comparison, Canada and Mexico recorded BEV sales of about 130 thousand and 13 thousand units, respectively. This surge in EV adoption is set to boost the demand for rechargeable batteries across North America.

- Moreover, the Office of Energy Efficiency and Renewable Energy highlighted that in early 2023, the United States government announced plans for electric vehicle battery plants in North America. Manufacturing capacity in the region is projected to soar from 55 gigawatts per year (GWh/year) in 2021 to a staggering 1000 GWh/year by 2030. Most of the upcoming projects are slated to commence production between 2025 and 2030, underscoring the anticipated growth of the rechargeable battery market for automotive applications.

- In July 2023, the Canadian government partnered with car manufacturer Stellantis to establish an electric vehicle battery plant in Windsor, Ontario. Under the agreement, the Canadian government is set to provide Stellantis with approximately USD 11 billion in incentives, aimed at bolstering the clean energy supply chain. This move is expected to further solidify the rechargeable battery market for automotive applications in Canada.

- In early 2023, BMW, the German automaker, declared an investment of EUR 800 million in San Luis Potosi, Mexico. This investment is aimed at producing high-voltage batteries and the fully electric "Neue Klasse" models. BMW's expansion plans allocate over half of the investment to Mexico, with USD 539 million dedicated to the battery assembly center at the existing plant and the remaining USD 323 million for adapting the body shop and establishing a new assembly line for battery pack installation. Such initiatives are expected to bolster the rechargeable battery market growth in North America's automotive sector.

- Furthermore, as lithium-ion battery prices decline and battery technologies advance, the market is likely to see the emergence of price-competitive electric vehicles, further fueling the demand for rechargeable batteries.

The United States to Dominate the Market

- Driven by the surging demand for consumer electronics, electric vehicles (EVs), and battery-based energy storage projects, coupled with an expanding renewable power infrastructure and a robust industrial base, the United States has emerged as a global hotspot for rechargeable batteries. These dynamics solidify the United States' position as North America's leading market for rechargeable batteries.

- In recent years, the battery energy storage system (BESS) in the United States has witnessed significant growth, bolstered by government initiatives and rising investments in renewable energy. The United States stands out as a global leader in renewable energy, with the International Renewable Energy Agency (IRENA) reporting that from 2014 to 2023, the nation's renewable energy capacity more than doubled, reaching over 385 GW by 2023.

- With the rapid growth in renewable power generation, the United States faces challenges in grid stability due to high renewable integration. Given the intermittent nature of solar and wind energy, it's crucial to store this energy during peak demand. This need bolsters the demand for BESS in the United States, subsequently driving the growth of rechargeable batteries.

- According to the United States Energy Information Administration (EIA), the nation's battery storage capacity, which has been on the rise since 2021, is projected to grow by 89% by the end of 2024, contingent on developers meeting their commercial operation dates. Developers aim to push the United States battery capacity beyond 30 GW by the end of 2024, surpassing capacities of petroleum liquids, geothermal sources, wood waste, and landfill gas.

- As of 2023, California leads with the highest installed battery storage capacity at 7.3 GW, followed by Texas at 3.2 GW, while other states collectively hold around 3.5 GW. The EIA notes that the combined United States utility-scale battery capacity reached about 16 GW at the end of 2023, with plans for an additional 15 GW in 2024 and 9 GW in 2025. This trajectory indicates a burgeoning demand for rechargeable battery technologies in the coming years.

- As electronic components shrink and processing power escalates, the popularity of consumer electronics is on the rise. These advanced devices demand lightweight, sophisticated battery packs. The surge in smartphone and laptop consumption, highlighted by the Consumer Technology Association's report of United States smartphone sales jumping from USD 33.7 billion in 2012 to approximately USD 74.7 billion in 2022, underscores the growing demand for lithium-ion batteries in portable devices.

- Given these factors, the United States is poised to lead North America's rechargeable battery market, buoyed by urbanization, rising consumer spending, and a shift towards advanced devices and vehicles.

North America Rechargeable Battery Industry Overview

The North America rechargeable battery market is fragmented. Some of the key players in the market (not in any particular order) include Panasonic Corporation, Contemporary Amperex Technology Co. Limited, Tesla Inc., EnerSys, and Samsung SDI Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Declining Lithium-ion Battery Cost

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 Tesla Inc.

- 6.3.4 EnerSys

- 6.3.5 Samsung SDI Co. Ltd

- 6.3.6 Duracell Inc.

- 6.3.7 Exide Technologies

- 6.3.8 Clarios, LLC.

- 6.3.9 LG Chem Ltd.

- 6.3.10 Johnson Controls International PLC

- 6.3.11 BYD Co.Ltd.

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Progress in Developing New Battery Technologies and Advanced Battery Chemistries

샘플 요청 목록