|

시장보고서

상품코드

1637826

라틴아메리카의 에어로졸 캔 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Latin America Aerosol Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

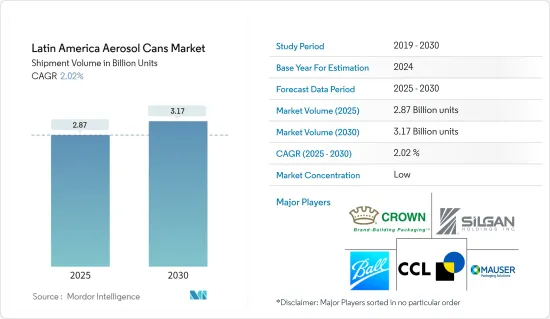

라틴아메리카의 에어로졸 캔 시장 규모는 출하 수량 기준으로 2025년 28억 7,000만개에서 2030년에는 31억 7,000만개로, 예측 기간(2025-2030년)의 CAGR은 2.02%로 성장할 것으로 예측됩니다.

주요 하이라이트

- 에어로졸 캔은 재활용 및 재사용 가능하므로 시장에서 가장 인기가 있습니다. 에어로졸 캔은 대부분 금속으로 만들어져 무기한 재활용할 수 있습니다. 환경 규제에 따라 제조된 에어로졸 캔은 사용자에게 비용 효율적인 포장 솔루션을 제공하는 동시에 폐기에 대한 걱정이 없습니다. 이는 공급업체가 제품에서 지속가능성 목표를 달성하는 데 도움이 됩니다.

- 게다가 화장품 및 퍼스널케어 산업 증가가 시장 성장의 큰 요인이 되고 있습니다. 에어로졸 캔 시장은 가처분 소득 증가, 소비자 라이프 스타일 변화, 제품 프레젠테이션과 차별화, 탈취제, 헤어 스프레이 등 제품 수요 증가로 성장하고 있습니다. 수요가 높기 때문에 알루미늄은 조사 대상 시장에서 빠르게 받아 들여지고 있습니다.

- 라틴아메리카에서는 퍼스널케어와 화장품 산업의 확대에 따라 친환경 포장 캔 수요가 급증하고 있습니다. 퍼스널케어 및 화장품에는 햇빛과 공기에 반응하는 민감한 화학 성분이 포함되어 있기 때문에 특히 에어로졸 금속 캔에 포장됩니다.

- 또한, 이 지역의 의료 인프라가 성장함에 따라 에어로졸 캔은 의료 분야에서 점점 더 많이 사용되고 있습니다. 예를 들어, 흡입기와 점비약은 약물을 효과적으로 공급하기 위해 에어로졸 기술에 의존합니다. 호흡기 질환의 유병률이 증가하고 노화 인구가 증가함에 따라 에어로졸 기반 의료 제품에 대한 수요가 증가하고 있습니다. 이것은 진화하는 의료 요구에 대응하고 특수한 에어로졸 솔루션을 개발하는 제조업체에게 큰 기회를 제공합니다.

- 게다가 자동차 산업에서의 커스터마이징과 유지보수를 위한 스프레이 페인트의 신속한 채용은 브라질과 아르헨티나의 에어로졸 캔 시장에 광범위한 잠재력을 가져왔습니다. 스프레이 도료는 미술용품으로서, 또한 가정에서의 도장에 이용되고 있습니다. 게다가 이 시장의 벤더는 지속가능성에 대한 노력으로 의식을 높이고, 그 결과 변화를 가져오기 위해 재활용 이니셔티브를 추진하고 있습니다.

- 금속 에어로졸 포장은 다른 포장 솔루션과의 경쟁에 직면합니다. 플라스틱, 종이, 유리 등의 대체 포장 솔루션을 사용할 수 있습니다. 플라스틱 포장은 금속 포장의 주요 경쟁자이기도 합니다. 유리 포장도 화장품 산업에서 널리 보급되고 있으며, 다양한 공급업체들이 순환 경제를 지원하기 위해 새로운 지속 가능한 유리 포장을 발표하고 있습니다.

라틴아메리카 에어로졸 캔 시장 동향

화장품 및 퍼스널케어가 큰 시장 점유율을 차지할 전망

- 에어로졸 캔은 내열성이 높기 때문에 화장품 및 퍼스널케어 제품은 특유의 수분 손실 없이 품질을 유지할 수 있습니다. 에어로졸 캔은 또한 라이닝으로 습기를 제어하기 위해 산업에서 사용되어 왔습니다. 주로 화장품이나 퍼스널케어 산업으로, 탈취제나 면도 폼 등의 포장에 사용되고 있습니다. 기밀성이 높은 에어로졸 캔은 제품 품질을 유지하고 유통 기한을 연장하는 데 사용됩니다.

- 에어로졸 캔의 소비는 소득 증가, 소비자 라이프 스타일 변화, 제품 프리젠 테이션 및 차별화, 데오도란트, 헤어 스프레이 및 기타 스킨 크림을 포함한 화장품 및 퍼스널케어 제품 수요 증가로 증가할 것으로 예측됩니다. 예를 들어, Beautycare Brazil(ABIHPEC & ApexBrasil)에 따르면, 브라질의 데오도란트, 헤어케어 제품, 향수 수입은 2023년 각각 1,850만 달러, 5,560만 달러, 1억 7,820만 달러를 차지합니다.

- 또한, 미용 제품 벤더는 표준 포장 솔루션을 찾고 있을 것입니다. 시장 관계자는 제품 출시와 에어로졸 스프레이와 같은 혁신적인 제품 개발에 주력하고 있습니다.

- 그 결과 주요 기업은 특히 헤어 스프레이 및 탈취제와 같은 개인 관리 제품을 위해 알루미늄 기반 에어로졸 캔을 도입했습니다. 또한, 환경 의식이 높은 소비자는 재활용 가능하고 생분해성이 뛰어난 포장재를 채용하고 있으며, 에어로졸 캔의 판매를 촉진하고 있습니다.

브라질이 가장 큰 시장 점유율을 차지할 전망

- 브라질에서는 가처분 소득 증가, 소비자 라이프 스타일 변화, 제품 프레젠테이션과 차별화, 화장품 및 개인 관리, 가정용, 의약품, 수의학, 페인트, 바니시, 자동차 등 다양한 최종 사용자에 대한 수요 증가와 같은 요인이 에어로졸 캔의 소비를 증가시키는 것으로 예상됩니다.

- 2023년 2월에 발표된 ABF(브라질 프랜차이즈 협회)의 보고서에 따르면, 브라질의 급성장 시장 랭킹에서는 미용 체인이 3년 연속으로 선두에 올라 타국에서도 성공을 거두고 있습니다. 프랜차이즈 사업에서는 건강·미용·웰니스 부문으로, 브라질은 라틴아메리카에서 최대의 에스테틱·미용 시장으로 부상해, 미국, 중국, 일본에 이어 세계 제 4위가 되었습니다. 브라질의 개인 관리 부문에서 에어로졸 캔 수요는 편의성, 효율성 및 제품 효능에 대한 소비자의 광범위한 선호도를 반영합니다.

- 개인 관리 산업에서 에어로졸 캔은 탈취제, 헤어 스프레이 및 면도용 거품과 같은 제품을 분배하는 편리하고 위생적인 방법을 설명합니다. 에어로졸 포장이 제공하는 적용의 용이성과 정확한 용량은 소비자의 라이프 스타일에 부합하며 이러한 제품에 대한 지속적인 수요를 견인합니다.

- 또한, 에어로졸 캔 시장은 세계의 기회를 경험하고 있으며, 이 지역의 무역 관계는 제조업체가 눈길을 끌고 무게가 적은 에어로졸 캔의 새로운 형식을 혁신하는 데 도움이 됩니다. 헤어 스프레이와 헤어 무스는 다양한 퍼스널케어 및 화장품 시장에서 수요가 있는 헤어 케어에 필수적인 제품입니다. 그 중에서 무역은 중요한 역할을 합니다. 브라질에서 헤어케어 제품 수출액은 2020년 1억 2,490만 달러에서 2023년에는 2억 20만 달러로 해마다 증가하고 있으며, 브라질 스프레이를 포함한 헤어케어 제품의 동향이 에어로졸 수요의 모습을 만들어 낸 것을 나타냅니다.

- 또한 가정, 인테리어 및 장식품에 대한 지출 증가가 시장 수요를 견인하고 있습니다. 가장 흔한 것은 방향제와 청소 용품입니다. 많은 주택 소유자는 장식, DIY, 주택 개선 프로젝트를 위한 에어로졸 스프레이 페인트를 가지고 있습니다.

라틴아메리카 에어로졸 캔 산업 개요

라틴아메리카의 에어로졸 캔 시장은 파편화되어 있으며, 주요 시장 기업으로는 Crown Holdings Inc., Ball Corporation, CCL Industries Inc., Can-Pack SA, and Ardagh Group 등이 있습니다. 또한 이 시장 공급업체는 시장 점유율과 수익성을 얻기 위해 지속가능성과 제품 강화를 추진하고 있습니다.

2023년 9월, Crown Holdings Inc.는 알루미늄 스튜어드십 이니셔티브와의 일련의 검증을 계속하고 책임있는 조달 사례에 대한 ASI 성능 표준의 인증을 콜롬비아에서 처음으로 취득했습니다. 이 업적은 ASI가 라틴아메리카의 새로운 지역으로 사업을 확대할 것을 촉구하고, 이 지역에서 사업을 전개하는 다른 기업들이 자사의 비즈니스 프로세스를 입증하는 기운을 높일 것으로 기대됩니다.

2023년 4월, Ball Corporation은 회사의 세계 에어로졸 포장 부서가 성능 및 Chain of Custody 기준에 대한 알루미늄 스튜어드십 이니셔티브(ASI) 인증을 획득했다고 발표했습니다. Ball Aerosol 부서는 퍼스널케어, 가정용품 및 음료 산업을 위해 다양한 창의력이 풍부한 무한히 재활용 가능한 알루미늄 포장 솔루션을 제공합니다. 여기에는 1회용 및 복수회용의 다양한 충격압출 알루미늄 병과 저탄소 에너지원에서 생산된 알루미늄 함량이 높은 최첨단 에어로졸 용기가 포함됩니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트에 의한 3개월간의 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 산업 밸류체인 분석

제5장 시장 역학

- 시장 성장 촉진요인

- 화장품 산업에서의 수요 증가

- 에어로졸캔의 재활용성

- 시장 성장 억제요인

- 대체 포장과의 경쟁 격화

제6장 시장 세분화

- 재료별

- 알루미늄

- 스틸 주석

- 최종 사용자 산업별

- 화장품 및 퍼스널케어

- 가정용

- 의약품/수의학

- 도료·바니스

- 자동차

- 기타

- 국가별

- 브라질

- 멕시코

- 아르헨티나

제7장 경쟁 구도

- 기업 프로파일

- Crown Holdings inc.

- Ball Corporation

- CCL Industries Inc.

- Can-Pack SA

- Ardagh Group

- Mauser Packaging Solutions

- Silgan Holdings Inc.

- Tecnocap Group

- LINDAL Group

- Trivium Packaging

제8장 투자 분석

제9장 시장의 미래

JHS 25.02.06The Latin America Aerosol Cans Market size in terms of shipment volume is expected to grow from 2.87 billion units in 2025 to 3.17 billion units by 2030, at a CAGR of 2.02% during the forecast period (2025-2030).

Key Highlights

- Aerosol cans are among the most popular in the market due to their recyclability and reusability. As aerosol cans are mostly made from metal, they can be recycled indefinitely. Manufactured by environmental regulations, aerosol cans provide users with cost-effective packaging solutions while eliminating disposal worries. This helps vendors to meet their sustainability objectives with their products.

- Furthermore, the increasing cosmetics and personal care industries are significant factors behind the market growth. The aerosol cans market is experiencing growth due to rising disposable incomes, changing consumer lifestyles, product presentation and differentiation, and increased demand for products such as deodorants, hairsprays, and more. Due to the high demand, aluminum is rapidly gaining acceptance in the markets studied.

- With the expansion of the personal care and cosmetics industry in Latin America, the demand for eco-friendly packaging cans has surged. As personal care and cosmetic products have sensitive chemical ingredients that are reactive to sun exposure and air, they are packed in aerosol metal cans specifically.

- Moreover, with the growing healthcare infrastructure in the region, aerosol cans are increasingly finding applications in the healthcare sector. Inhalers and nasal sprays, for instance, rely on aerosol technology to deliver medication effectively. With the rising prevalence of respiratory diseases and the growing aging population, the demand for aerosol-based medical products is rising. This presents significant opportunities for manufacturers to cater to the evolving healthcare needs and develop specialized aerosol solutions.

- Additionally, the quick adoption of spray paints for customization and maintenance in the automotive industry has opened a wide range of potential for the aerosol cans market in Brazil and Argentina. Spray paints are utilized as art supplies and for in-home painting. Furthermore, vendors in the market are driven by sustainability efforts to raise awareness and thus promote recycling initiatives to make a difference.

- Metal aerosol packaging faces competition from other packaging solutions. Alternatives such as plastic, paper, or glass packaging solutions are available. Plastic packaging continues to be the main competitor of metal packaging. Glass packaging is also widely popular in the cosmetics industry, and various vendors are launching new sustainable glass packaging to support the circular economy.

Latin America Aerosol Cans Market Trends

Cosmetic and Personal Care is Expected to Account for Significant Market Share

- Aerosol cans have a high-temperature resistance, allowing cosmetics and personal care products to maintain quality without relinquishing the characteristic moisture loss. Aerosol cans have also been used in the industry to control the moisture due to linings. They are mainly used in the cosmetics and personal care industry for packing deodorant, shaving foam, etc. Airtight aerosol cans are used to maintain product quality and extend shelf life.

- Consumption of aerosol cans is projected to increase due to rising incomes, changes in consumer lifestyles, product presentation and differentiation, and increased demand for cosmetic and personal care products, including deodorants, hair sprays, and other skin creams. For instance, according to Beautycare Brazil (ABIHPEC & ApexBrasil), the import of deodorants, hair care products, and fragrances in Brazil accounted for USD 18.5 million, USD 55.6 million, and USD 178.2 million, respectively, in 2023.

- Furthermore, beauty product vendors are probably looking for a standard packaging solution. The market players are focusing on product launches and creating innovative products such as aerosol sprays.

- Consequently, key players are introducing aluminum-based aerosol cans, especially for personal care products such as hair sprays and deodorants. In addition, environmentally-conscious consumers are increasingly adopting packaging materials that can be recycled and are biodegradable, facilitating the sales of aerosol cans.

Brazil is Expected to Account for the Largest Market Share

- In Brazil, factors such as rising disposable income, changes in consumer lifestyles, product presentation and differentiation, and rising demand for various end users, such as cosmetic and personal care, household, pharmaceutical/veterinary, paints and varnishes, and automotive, will increase the consumption of aerosol cans.

- According to the ABF (Brazilian Franchise Association) report published in February 2023, beauty chains lead the ranking of the fastest-growing market in Brazil for the third consecutive year and have been successful in other countries. In the franchising business, in the health, beauty, and wellness segment, Brazil emerged as the largest market for aesthetics and beauty in Latin America and the fourth in the world, behind only the United States, China, and Japan. Brazil's demand for aerosol cans across personal care reflects a broader consumer preference for convenience, efficiency, and product efficacy.

- In the personal care industry, aerosol cans offer a convenient and hygienic way to dispense products such as deodorants, hair sprays, and shaving foams. The ease of application and precise dosage provided by aerosol packaging align well with consumers' lifestyles, driving continued demand for these products.

- Moreover, the market of aerosol cans is experiencing global opportunities where trade relations of the region also help manufacturers innovate new formats of aerosol cans that are more eye-catching and less weighted. Hair spray and hair mousse are essential hair care products that are in demand in different personal care and cosmetic markets. In this context, trade plays an important role. The export value of hair care products from Brazil grew yearly from USD 124.90 million in 2020 to USD 200.20 million in 2023, showing that the growing trend of hair care products, including sprays from Brazil, created a landscape for the aerosol can demand.

- Furthermore, increasing home, interior, and decor spending drives market demand. The most common are air fresheners and cleaning products. Many homeowners have aerosol spray paints for decorating, DIY, and home improvement projects.

Latin America Aerosol Cans Industry OVerview

The Latin American aerosol cans market is fragmented with significant players like Crown Holdings Inc., Ball Corporation, CCL Industries Inc., Can-Pack SA, and Ardagh Group. Furthermore, vendors in the market are driven by sustainability and product enhancements to capture market share and profitability.

In September 2023, Crown Holdings Inc. became the first company in Colombia to receive the ASI Performance Standard certification for responsible sourcing practices, continuing its series of verifications with the Aluminium Stewardship Initiative. This achievement is expected to encourage ASI to expand its operations to new regions in Latin America and create momentum for other undertakings operating in this area to demonstrate their business processes.

In April 2023, Ball Corporation announced that its Global Aerosol Packaging division earned the Aluminium Stewardship Initiative (ASI) certification for the Performance and Chain of Custody Standards. The Ball Aerosol division provides various inventive, infinitely recyclable aluminum packaging solutions for the personal care, home, and beverage industries. These include a variety of impact-extruded aluminum bottles for single- and multiple-use applications and cutting-edge aerosol containers with a high aluminum content produced from low-carbon energy sources.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industrial Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand from the Cosmetic Industry

- 5.1.2 Recyclability of Aerosol Cans

- 5.2 Market Restraints

- 5.2.1 Increasing Competition from Substitute Packaging

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Aluminum

- 6.1.2 Steel-tinplate

- 6.2 By End-user Industry

- 6.2.1 Cosmetic and Personal Care

- 6.2.2 Household

- 6.2.3 Pharmaceutical/Veterinary

- 6.2.4 Paints and Varnishes

- 6.2.5 Automotive

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Mexico

- 6.3.3 Argentina

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Crown Holdings inc.

- 7.1.2 Ball Corporation

- 7.1.3 CCL Industries Inc.

- 7.1.4 Can-Pack SA

- 7.1.5 Ardagh Group

- 7.1.6 Mauser Packaging Solutions

- 7.1.7 Silgan Holdings Inc.

- 7.1.8 Tecnocap Group

- 7.1.9 LINDAL Group

- 7.1.10 Trivium Packaging