|

시장보고서

상품코드

1640382

소매 분야 UCaaS : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)UCaaS In Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

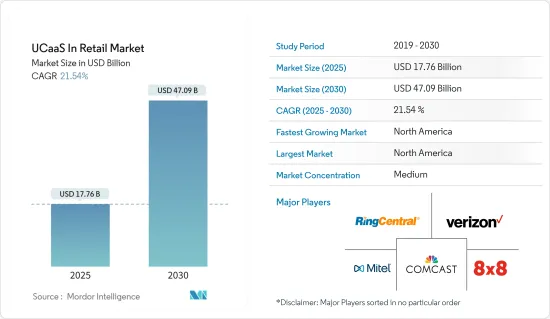

소매 분야 UCaaS 시장 규모는 2025년에 177억 6,000만 달러, 2030년에는 470억 9,000만 달러에 이를 것으로 예측되며, 예측 기간(2025-2030년)의 CAGR은 21.54%입니다.

주요 하이라이트

- 통합 커뮤니케이션(UC) 솔루션을 통해 소매업체는 풍부한 협업 플랫폼과 원활하고 스마트한 상호 작용 수단을 제공할 수 있습니다.

- 단편적인 커뮤니케이션 구조로는 소매 기업이 비즈니스 목표를 달성하고 강력한 브랜드 존재감을 유지하기 어려우나 Unified Communications-as-a-Service(UCaaS)는 소매업 직원들이 사내 협업을 통해 일반 고객 및 잠재 고객과의 상호작용을 보다 효율적이고 수익성이 높게 만듭니다.

- 음성, 메시징, 비디오 및 모바일 기술을 통합함으로써 소매업체는 팀원과 고객 모두에게 더 나은 경험을 제공할 수 있습니다. 협업을 통해 더욱 일관된 메시지를 확보하여 끊임없는 프로젝트 속에서 운영, 브랜드 명확화, 생산성 향상을 가능하게 합니다.

- BYOD 및 기타 모빌리티 솔루션의 보급은 UCaaS 솔루션 채택을 뒷받침하고 있습니다. 게다가, 고객 경험과 점포 업무를 강화하기 위해 IP 애플리케이션 채용이 증가하고 있는 것도 조사 대상 시장의 성장을 뒷받침할 것으로 예상됩니다.

- 시장의 성장을 방해하는 것은 이 기술에 대한 인지도입니다. Retail Week이 실시한 설문조사는 소매업체의 69% 이상이 통합 커뮤니케이션(UC) 솔루션에 대해 인식하지 못했으며, 그 중 38%가 UC 도입의 이점을 알지 못한다고 답했습니다.

- 팬데믹 이후 많은 소매 기업은 서비스 및 지원 업무를 수행하기 위해 원격 근무자와 하이브리드 작업자에 의존해 왔습니다. UCaaS를 통해 이러한 기업들은 담당자가 로컬이든 원격이든 관계없이 더 많은 지원 에이전트와 업무를 수행할 수 있게 되었으며, 추구해왔던 협력적인 접근 방식과 보다 건설적인 커뮤니케이션이 가능해졌습니다.

소매에서의 UcaaS 시장 동향

시장을 견인하는 중소규모 산업 증가

- 중소기업(SMB)의 클라우드 의존도가 높아지고 있으며 앞으로도 증가할 것으로 예상됩니다. UCaaS는 주로 클라우드 기반 모델로 제공될 때 중소기업에 이상적인 솔루션으로 부상하고 있습니다.

- 이러한 솔루션은 실시간 통합 음성 및 협업 기능과 유연하고 확장 가능한 제공 모델을 결합하여 중소기업에 적합합니다. 중소기업의 UCaaS의 주요 이점은 비즈니스 영향보다는 비용 절감에 있습니다.

- 그러나 대기업과 비교하면 SMB는 여전히 UcaaS 도입을 늘려야 합니다. 많은 중소기업이 UCaaS로 전환하지 않는 주된 이유 중 하나는 커뮤니케이션 및 협업 요구 사항을 Google Workplace 및 Microsoft 365와 같은 사무 생산성 제품군에 의존한다는 것입니다.

- 통합 커뮤니케이션(UC) 솔루션을 통해 중소기업은 여러 소프트웨어를 하나의 플랫폼에 통합할 수 있어 비용 절감과 전반적인 효율성을 달성할 수 있습니다. 텍스트, 음성 및 비디오 커뮤니케이션을 위한 효율적인 단일 플랫폼으로 전체 비즈니스 기능 애플리케이션을 통합할 수 있어 어디서나 모든 장치에서 사용할 수 있습니다.

- 게다가 많은 중소기업들은 규제와 정책에 관계없이 지방정부의 거버넌스와 컴플라이언스를 준수하기 위해 많은 시간과 비용을 투자해야 합니다. 그러나 이러한 기업이 통합 커뮤니케이션 솔루션을 채택하면 컴플라이언스를 솔루션 제공업체에 위탁할 수 있어 기업의 리소스를 보다 유용한 업무에 사용할 수 있습니다.

북미가 주요 점유율을 차지

- 이 지역에는 많은 실제 매장이 있으며, 온라인 구매와 상점 수령(BOPIS) 및 상점 반품(BORIS) 유연성을 제공하는 경향이 커지고 있습니다. 이로 인해 반품 승인, 재고 조회, 설치 및 맞춤화 등 부가가치 서비스 예약이 증가하고 있습니다.

- 이 지역의 강력한 소매 부문은 시장에 큰 성장 기회를 제공합니다. 예를 들어 소매업은 미국 최대의 민간 고용 분야이며 연간 GDP에 3조 9,000억 달러를 공헌하고 있습니다(NRF 보고서).

- 게다가, 전미 소매업 협회(NRF)에 의하면, 2023년의 소매 매출은 4%에서 6% 사이의 성장이 전망되고 있습니다. NRF는 2023년 소매 매출액이 5조 1,300억 달러에서 5조 2,300억 달러에 이를 것으로 예측했습니다. UCaaS가 소매업에 필수적인 비즈니스 모델이 되고 있는 가운데, 이러한 성장 동향은 시장에 유리한 시나리오를 가져옵니다.

- 게다가 이 지역의 소매기업은 디지털화가 진행되는 고객층의 기대와 수요에 부응하기 위해 노력하고 있으며, 고객에게 원활한 서비스를 제공하기 위해 직원 간의 연계와 커뮤니케이션의 개선을 요구하고 있습니다. 이 지역의 기업들은 혁신적인 솔루션을 제공함으로써 UCaaS를 더욱 추진하고 있습니다.

- 예를 들어, 아마존 USA는 아마존 웹 서비스 클라우드에서 호스팅되는 클라우드 기반 UCaaS인 Chime을 출시했습니다. CHime은 기업 화상 회의 서비스를 제공하며 데스크톱과 휴대폰 모두에서 작동하고 파일럿 프로젝트로서 소매업체 브룩스 브라더스의 점포에 도입되었습니다. 소매업체에서 UCaaS 수요가 급격히 증가할 것으로 예상되기 때문에 다른 소매업체도 상점에 Chime을 도입할 것으로 예상됩니다.

소매 분야 UcaaS 산업 개요

소매 분야 UCaaS 시장은 적당한 경쟁 구도에 있습니다. 각 회사는 치열한 경쟁에 효과적으로 대응할 수 있는 지속 가능한 솔루션을 제공하기 위해 전략적 혁신, 협업 노력, 확대 노력에 적극적으로 노력하고 있습니다.

2023년 2월 RingCentral은 Avaya와의 전략적 파트너십 연장에 관한 중요한 발표를 했습니다. 이 계약에 따라 Avaya Cloud Office by RingCentral(ACO)은 고객에게 Avaya의 독점적이고 다중 테넌트형 UCaaS 솔루션으로 제공됩니다. 이 다년간의 파트너십 연장에는 고객을 ACO 플랫폼으로 이동시키기 위한 최소 이용자수 보장 및 인센티브 구조 개선이 포함됩니다.

2022년 3월, 8x8은 8x8 Conversation IQ를 발표하고 기업의 제품에 중요한 혁신 기술을 도입했습니다. 이 서비스의 확장은 품질 관리 및 음성 분석을 포함한 공식 고객 센터 기능을 8x8 클라우드 커뮤니케이션 플랫폼의 모든 사용자에게 제공합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 촉진요인과 억제요인의 소개

- 촉진요인

- 고객 경험과 점포 내 업무를 강화하기 위한 IP 용도의 채용 확대

- 이동성과 BYOD에 대한 수요 증가

- 중소기업 수요

- 억제요인

- 점포 인프라 제한으로 기존 시스템을 클라우드에 통합하기 어려움

- 업계의 매력 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 기술 스냅샷

제6장 시장 세분화

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 아시아

- 중국

- 인도

- 일본

- 호주 및 뉴질랜드

- 북미

제7장 경쟁 구도

- 기업 프로파일

- RingCentral Inc.

- 8X8 Inc.

- Verizon Communications Inc.

- Mitel Networks Corporation

- Comcast Corporation

- Vonage Holdins Inc.

- West Corporation

- Star2Star Communications LLC

- DXC Technology Company

- Tyto Oyj

- IBM Corporation

- Alcatel-Lucent USA Inc.

- Cisco Systems Inc.

제8장 투자 분석

제9장 시장 기회와 앞으로의 동향

CSM 25.02.17The UCaaS In Retail Market size is estimated at USD 17.76 billion in 2025, and is expected to reach USD 47.09 billion by 2030, at a CAGR of 21.54% during the forecast period (2025-2030).

Key Highlights

- Unified communication (UC) solutions enable retailers to provide a rich platform for collaboration and a smarter way to interact seamlessly, converging physical experiences with virtual ones while reducing costs and enabling flexible expansions across the enterprise.

- A fragmented communications structure can make it difficult for retailers to reach their business goals and maintain a strong brand presence. Unified Communications-as-a-Service (UCaaS) ensures that retail employees collaborate internally and coordinate more efficient and profitable interactions with the public and potential customers.

- By incorporating voice, messaging, and video and mobile technology, retailers can create an improved experience for both team members and customers. This collaboration secures a more unified message that allows for on-the-go operations, increased brand clarity, and enhanced productivity.

- The growing adoption of BYOD and other mobility solutions has been aiding the adoption of UCaaS solutions. Moreover, the growing adoption of IP applications to enhance customer experience and in-store operations is also expected to boost the growth of the market studied.

- The need for more awareness of the technology is hindering the growth of the market. In one of the surveys done by Retail Week, it was figured out that more than 69% of retailers were not aware of Unified Communication Solutions, and 38% of them said that they needed to learn the benefits of implementing the same.

- Since the start of the pandemic, many retailers have relied on remote or hybrid workers to perform service and support tasks after witnessing a multitude of benefits. UCaaS has made it possible for these businesses to operate with more support agents, whether reps are local or off-site, allowing for a much-needed coordinated approach and more constructive communication.

UCaaS In Retail Market Trends

Increasing Small- and Medium-scale Industries to Drive the Market

- The dependency of small and medium-sized businesses (SMBs) on the cloud is proliferating and is expected to increase in the future. UCaaS has emerged as an ideal solution for SMBs, mainly when delivered in a cloud-based model.

- These solutions combine real-time, integrated voice and collaboration capabilities, along with a flexible and scalable delivery model, making them well suited for SMBs. The primary benefit of UCaaS for SMBs is more about reducing costs than having an impact on business.

- However, compared to large companies, SMBs still need to catch up in their adoption of UCaaS. One key reason many SMBs haven't transitioned to UCaaS is a reliance on their office productivity suite-Google Workplace or Microsoft 365, for instance-for their communications and collaboration needs.

- With unified communication solutions, SMBs are able to integrate multiple software into a single platform, making it possible for them to reduce expenses and increase overall efficiency. Applications across business functions can converge into a single effective platform for text, voice, and video communications, available from anywhere, using any device.

- Moreover, many SMBs are required to spend a significant amount of time and money conforming to their local government's governance and compliance obligations, whether regarding regulations or company policy. However, when these businesses employ unified communication solutions, it becomes the solution provider's job to meet these legal standards, freeing up corporate resources for more useful tasks.

North America to Hold Major Share

- The region has many brick-and-mortar stores, which are increasingly offering buy online and pickup in-store (BOPIS), return in-store (BORIS) flexibility. This is driving more calls for return merchandise authorizations, inventory inquiries, and appointments for value-added services, like installations and customizations.

- The strong retail sector in the region provides significant growth opportunities to the market. For instance, retail is the largest private-sector employer in the United States, contributing USD 3.9 trillion to the annual GDP (as per NRF).

- Moreover, as per the National Retail Federation (NRF), retail sales are expected to grow between 4% and 6% in 2023. In total, NRF forecasts that retail sales will reach between USD 5.13 trillion and USD 5.23 trillion in 2023. With UCaaS becoming an essential business model in the retail sector, such growth trends create a favorable scenario for the market.

- Further, the retailers in the region are scrambling to meet the expectations and demands of an increasingly digital customer base, asking for better cooperation and communication between the staff to provide seamless services to the customers. The companies in the region are further promoting UCaaS by providing innovative solutions.

- For instance, Amazon USA has released Chime, a cloud-based UCaaS hosted in Amazon Web Service's cloud. It provides video conferencing service to enterprises and works on both desktop & mobile phones. It was deployed in retailer Brooks Brothers' stores as a pilot project. Other retailers are expected to incorporate Chime in their stores, as the demand for UCaas in retail is expected to rise dramatically.

UCaaS In Retail Industry Overview

The unified communications-as-a-service (UCaaS) market in the retail sector demonstrates a moderate level of competitiveness. Companies within this market are actively engaged in strategic innovation, collaborative efforts, and expansion endeavors to offer sustainable solutions that can effectively contend with the intensifying competition.

In February 2023, RingCentral made a significant announcement regarding its extended strategic partnership with Avaya. Under this agreement, Avaya Cloud Office by RingCentral (ACO) continues to serve as Avaya's exclusive multi-tenanted UCaaS solution for its customers. This extension of their multi-year partnership involves minimum seat commitments and an improved incentive structure aimed at expediting the migration of customers to the ACO platform.

In March 2022, 8x8 introduced an important enhancement to its offerings by unveiling 8x8 Conversation IQ. This extension of their services brings formal contact center capabilities, including quality management and speech analytics, to all users of the 8x8 cloud communications platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Growing Adoption of IP applications to Enhance Customer Experience and In-store Operations

- 4.3.2 The Increased Demand for Mobility and BYOD

- 4.3.3 Demand from Small- and Medium-sized Businesses

- 4.4 Market Restraints

- 4.4.1 Integration Existing System To Cloud Due To Limited To Store Infrastructures

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 Geography

- 6.1.1 North America

- 6.1.1.1 United States

- 6.1.1.2 Canada

- 6.1.2 Europe

- 6.1.2.1 United Kingdom

- 6.1.2.2 Germany

- 6.1.2.3 France

- 6.1.2.4 Italy

- 6.1.3 Asia

- 6.1.3.1 China

- 6.1.3.2 India

- 6.1.3.3 Japan

- 6.1.3.4 Australia and New Zealand

- 6.1.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 RingCentral Inc.

- 7.1.2 8X8 Inc.

- 7.1.3 Verizon Communications Inc.

- 7.1.4 Mitel Networks Corporation

- 7.1.5 Comcast Corporation

- 7.1.6 Vonage Holdins Inc.

- 7.1.7 West Corporation

- 7.1.8 Star2Star Communications LLC

- 7.1.9 DXC Technology Company

- 7.1.10 Tieto Oyj

- 7.1.11 IBM Corporation

- 7.1.12 Alcatel-Lucent USA Inc.

- 7.1.13 Cisco Systems Inc.