|

시장보고서

상품코드

1640662

동아프리카의 석유 및 가스 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)East Africa Oil and Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

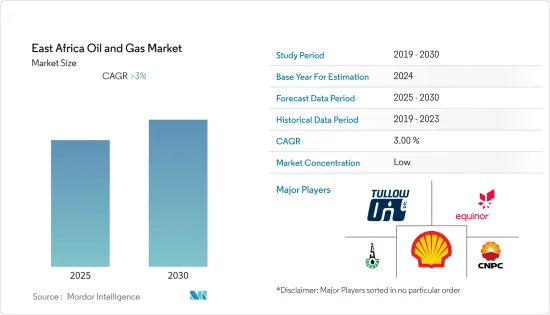

동아프리카의 석유 및 가스 시장은 예측 기간 중에 3% 이상의 CAGR로 추이할 전망입니다.

2020년에는 COVID-19가 시장에 부정적인 영향을 미쳤습니다. 현재 시장은 팬데믹 이전 수준에 도달할 가능성이 높습니다.

주요 하이라이트

- 향후 5-10년간 이 지역의 석유 및 천연 가스 수요 증가와 생산량 증가로 시장은 성장할 것으로 보입니다.

- 한편 남수단과 소말리아 등 동아프리카 국가의 내전에 의한 정정 불안은 예측기간 중 동아프리카의 석유 및 가스 시장의 성장을 방해할 것으로 예상됩니다.

- 석유 및 가스 기업은 동아프리카의 유전 가스전의 탐사 및 생산에 투자할 것으로 예상되며 예측기간 중 동아프리카의 석유 및 가스 시장에 유리한 성장 기회를 창출할 가능성이 높습니다.

- 남 수단은 큰 성장이 예상되며 예측 기간 동안 높은 CAGR로 추이할 가능성이 높습니다. 이 성장은 이 지역의 해상 가스전의 탐사와 생산이 급성장하고 있기 때문입니다.

동아프리카의 석유 및 가스 시장 동향

중류 부문이 현저한 성장 초래

- 동아시아의 중류 석유 및 가스 산업은 동아프리카 경제에 중요합니다. 왜냐하면 이 지역의 수출입 수익의 대부분은 석유 제품에 소비되기 때문입니다. 석유 수요 증가와 이 지역의 시민 구매력 상승이 조사 대상 시장의 성장을 뒷받침하고 있습니다.

- 2021년 현재 남 수단은 동아프리카의 주요 석유 생산국입니다. 이 나라의 석유 생산량은 약 750만 톤에 이릅니다.

- 이 지역에서 가스전이 발견되어 정부가 수입 삭감을 추진하고 있기 때문에 동아프리카의 중류 부문은 2021년에 매우 중요해졌습니다.

- 2022년 4월, Sasol Ltd.는 가스 파이프라인을 건설하고 제안된 아프리카 르네상스 파이프라인(ARP)을 통해 로브마 분지에서 천연 가스를 수입할 계획을 발표하고 모잠비크의 해양 가스 매장량을 최대한 활용하기 위해 액화 천연 가스(LNG)의 유조선 수송을 선택했습니다.

- 2022년 10월, 탄자니아와 케냐의 정상은 양국의 무역 확대와 에너지 비용 절감에 도움이 되는 천연 가스 파이프라인의 건설을 가속화하기로 합의했습니다.

- 2022년 11월, 아프리카, 카리브해, 태평양, 유럽 연합(ACP-EU) 협의회는 이전 결정을 뒤집고 우간다가 동아프리카 원유 파이프라인(EACOP) 프로젝트 개발을 허용하기로 결의했습니다. 전체 길이 1,443km의 파이프라인은 우간다 서부 지역의 유전에서 탄자니아의 탕가 항구까지 이어집니다.

- 따라서 이 지역에서는 더 많은 석유가 사용되고 더 많은 자금이 이 부문에 투입되기 때문에 중류 부문은 크게 성장할 가능성이 높습니다.

현저한 성장을 이루는 남수단

- 남 수단의 석유 생산량은 2016년 680만 톤에서 2017년 750만 톤으로 증가했습니다. 생산량 증가는 예측 기간 동안 남 수단의 석유 및 가스 시장에 성장을 가져올 것으로 예상됩니다.

- 2021년 1월 남수단의 석유성은 2013년에 이 나라에서 내전이 발발한 후 약 8년간 정지했던 유니티주의 타르지트 유전에서 석유 생산을 재개했다고 발표했습니다. 타르지트는 유니티주 남부의 블록 5A라고도 불리며, Sudd Petroleum Operating Company(SPOC)가 운영하고 있습니다.

- 남수단의 석유 매장량은 2022년 10월 35억 배럴로 추정되었습니다. 석유성에 따르면 남수단의 석유 및 가스 매장량의 90% 가까이는 아직 사용되고 있지 않다고 합니다.

- 또한 남수단은 2021년 첫 라이선스 라운드를 시작하여 5개의 탐광 라이선스를 제공했습니다. 정부는 이를 통해 다양한 외국 투자자 그룹을 유치하고 업스트림 투자를 자극하여 원유 생산량을 증가시키고자 합니다.

- 남수단의 석유 및 가스산업은 향후 수년간 크게 성장할 것으로 예상되며, 특히 투자가 확대되고 가스 생산량이 증가하고 있는 중류부문이 유망합니다.

동아프리카의 석유 및 가스 산업 개요

동아프리카의 석유 및 가스 시장은 통합적인 성격을 가지고 있습니다. 이 시장의 주요 기업(순부동)에는 Sudan National Petroleum Corporation, China National Petroleum Corporation, Shell PLC, Equinor ASA, Tullow Oil PLC 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 서문

- 원유 생산량 및 예측(단위 : 1,000 배럴/일)(-2028년)

- 천연가스 생산량 및 예측(석유 환산 100만톤)(2028년)

- 최근 동향 및 개발

- 정부의 규제 및 시책

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 공급망 분석

- PESTLE 분석

제5장 시장 세분화

- 분야별

- 업스트림

- 중류

- 하류

- 개발 장소별

- 온쇼어

- 해외

- 지역별

- 모잠비크

- 탄자니아

- 남 수단

- 케냐

- 기타 동아프리카

제6장 경쟁 구도

- M&A, 합작사업, 제휴 및 협정

- 주요 기업의 전략

- 기업 프로파일

- Shell PLC

- Sudan National Petroleum Corporation

- China National Petroleum Corporation

- Equinor ASA

- Tullow Oil PLC

- Oil and Natural Gas Corporation

제7장 시장 기회 및 향후 동향

AJY 25.02.14The East Africa Oil and Gas Market is expected to register a CAGR of greater than 3% during the forecast period.

In 2020, COVID-19 negatively impacted the market. Presently, the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the next five to ten years, the market is likely to grow because of rising demand and production of oil and natural gas in the region.

- On the other hand, political instability due to civil war in countries in East Africa, like South Sudan and Somalia, is expected to hamper the East Africa Oil and Gas Market's growth during the forecast period.

- Nevertheless, oil and gas companies are expected to invest in the exploration and production of East Africa's oil and gas fields, likely creating lucrative growth opportunities for the East African oil and gas market in the forecast period.

- South Sudan is expected to grow a lot and is likely to record a high CAGR during the time frame of the forecast. This growth is due to the fact that exploration and production of offshore gas fields in the area are growing quickly.

East Africa Oil and Gas Market Trends

Midstream Sector to Witness Significant Growth

- East Asia's midstream oil and gas industry is important to East Africa's economy because most of the region's imports and export earnings are spent on petroleum products.The increasing demand for oil and the rising purchasing power of the citizens in the region have been boosting the growth of the market studied.

- South Sudan was the leading oil producer in East Africa as of 2021. Oil production amounted to roughly 7.5 million metric tons in the country.

- With the discovery of gas fields in the area and the government's push to cut down on imports, the East African midstream sector became very important in 2021.

- In April 2022, Sasol Ltd. announced plans to construct a gas pipeline and import natural gas via the proposed African Renaissance Pipeline (ARP) from the Rovuma Basin, opting for tanker deliveries of liquefied natural gas (LNG) to best tap into Mozambique's offshore gas reserves.

- In October 2022, the leaders of Tanzania and Kenya agreed to speed up the building of a natural gas pipeline that would help both countries trade more and save money on energy costs.The projected natural gas pipeline would run 600 kilometers between Dar es Salaam and Mombasa.

- In November 2022, the African, Caribbean, Pacific, and European Union (ACP-EU) Joint Parliamentary Assembly overturned an earlier decision and voted to allow Uganda to develop the East African Crude Pipeline (EACOP) project. The 1,443-kilometer-long pipeline runs from Uganda's Western Region oil wells to Tanzania's seaport of Tanga.

- Thus, the midstream sector is likely to grow a lot because more oil is being used in the region and more money is being put into the sector.

South Sudan to Witness Significant Growth

- South Sudan increased its oil production from 6.8 million metric tons in 2016 to 7.5 million metric tons in 2017. Increased production is expected to generate growth in the South Sudan oil and gas market during the forecast period.

- In January 2021, the Ministry of Petroleum in South Sudan announced that oil production in Unity State's Tharjiath oilfield had resumed after nearly eight years of shutdown following the outbreak of civil war in the country in 2013. Tharjiath, also known as Block 5A in southern Unity state, is operated by the Sudd Petroleum Operating Company (SPOC).

- South Sudan's oil reserves were estimated to be 3.5 billion barrels as of October 2022. This made them the third largest in sub-Saharan Africa, after Nigeria and Angola.The Ministry of Petroleum says that almost 90% of South Sudan's oil and gas reserves have not been used yet.

- Furthermore, South Sudan launched its first-ever licensing round in 2021, offering five exploration licenses, through which the government hopes to attract a diverse group of foreign investors to stimulate upstream investment and increase its crude oil production.

- South Sudan's oil and gas industry is expected to grow a lot over the next few years, especially in the midstream sector, where investment is growing and gas production is going up.

East Africa Oil and Gas Industry Overview

The East African Oil and Gas Market is consolidated in nature. Some of the major players in the market (not in particular order) include Sudan National Petroleum Corporation, China National Petroleum Corporation, Shell PLC, Equinor ASA, and Tullow Oil PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Crude Oil Production and Forecast in thousand barrels per day, till 2028

- 4.3 Natural Gas Production and Forecast in million-ton oil equivalent, till 2028

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 PESTLE ANALYSIS

5 MARKET SEGMENTATION

- 5.1 Sector

- 5.1.1 Upstream

- 5.1.2 Midstream

- 5.1.3 Downstream

- 5.2 Location of Development

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography

- 5.3.1 Mozambique

- 5.3.2 Tanzania

- 5.3.3 South Sudan

- 5.3.4 Kenya

- 5.3.5 Rest of East Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Shell PLC

- 6.3.2 Sudan National Petroleum Corporation

- 6.3.3 China National Petroleum Corporation

- 6.3.4 Equinor ASA

- 6.3.5 Tullow Oil PLC

- 6.3.6 Oil and Natural Gas Corporation