|

시장보고서

상품코드

1683409

인도의 E-Commerce 포장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)India E-Commerce Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

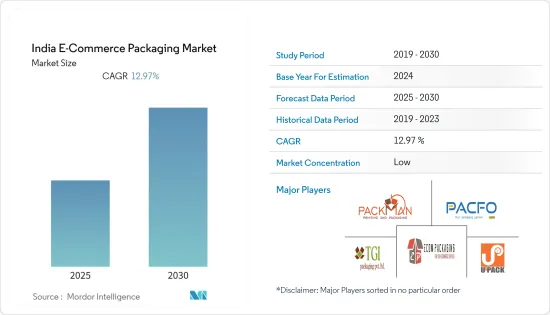

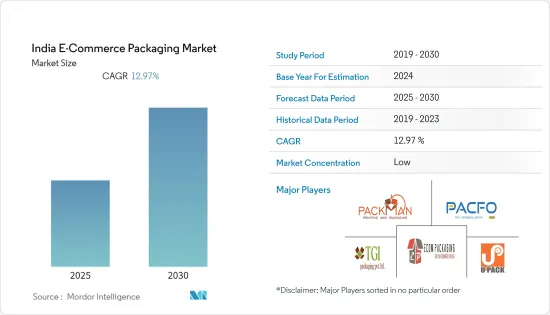

인도의 E-Commerce 포장 시장은 예측 기간 동안 12.97%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 예상됩니다.

주요 하이라이트

- 전자상거래 시장의 급격한 성장은 주로 가전, 패션, 의류, 퍼스널케어 산업이 주도하고 있습니다. 가전, 퍼스널케어, 패션 및 의류에 대한 대규모 투자로 인해 포장에 대한 기회 확대의 여지가 생기고 있습니다.

- 온라인과 오프라인에서 모두 쇼핑할 수 있는 옴니채널 비즈니스 모델의 부상도 이커머스 시장을 부추기고 있으며, Shoppers Stop Ltd와 Infiniti Retail Limited Croma와 같은 옴니채널 소매업체들은 매출을 늘리고 있습니다. 또한, 시내 오프라인 매장을 통해 배송이 가능하기 때문에 배송비가 저렴하고, 배송이 더 빨라지고 있습니다.

- 인도 정부는 외국 기업의 전자상거래 진출을 촉진하기 위해 전자상거래 마켓플레이스 모델에 대한 외국인 직접투자(FDI) 한도를 100%(B2B 모델)까지 상향 조정했습니다.

- 전자상거래 패키징 사업의 확대는 지방의 낮은 인지도를 개선해야 하며, 온라인 플랫폼에 대한 불신도 온라인 상품 구매에 영향을 미치고 있습니다. 이러한 추세는 전자상거래 패키징 분야의 성장을 저해하고 있습니다. 기반이 약하고 기술 전문 지식이 부족하여 E-Commerce 포장 분야의 성장을 저해하고 있습니다.

- 코로나19 사태로 인해 인도 전자상거래 패키징 산업은 국내 봉쇄 조치로 인해 성장세가 크게 둔화되었습니다. 이러한 요인으로 인해 전자상거래 상품의 이동이 제한되어 국내 공급망에 혼란이 발생했습니다.

인도 E-Commerce 포장 시장 동향

보호 포장이 크게 성장한 시장

- IBEF에 따르면, 현재 인도 전자상거래 산업에서 보호 포장에 대한 수요는 전자상거래에서 가전제품 판매의 급속한 성장으로 인해 전례 없는 성장을 보일 것으로 예상되며, 현재 인도 온라인 소매 판매에 가장 큰 기여를 하는 품목은 가전제품으로 48%의 점유율로 시장 성장에 기여하고 있다고 합니다. 시장 성장에 기여하고 있습니다.

- 이러한 보호 포장 제품은 대기, 자기, 정전기, 진동, 충격 등의 손상으로부터 제품을 보호하도록 설계 및 제작되었습니다. 보호 포장은 기계, 설비, 산업용 제품을 보관 및 운송 중 위험으로부터 보호합니다. 또한, 보이드 필링, 랩핑, 플렉서블 쿠션, 블록 및 브레이스, 방어적 봉쇄 및 표면 방어를 통해 보안을 제공합니다.

- 보호 포장은 식품, 전자제품, 화장품, 제약 산업 등 다양한 분야에서 사용되고 있습니다. 제품에는 상자 및 저장 용기, 포장재, 라이너, 스페이서 등이 있습니다. 에어필로우, 종이 필, 기포 완충재, 메일러와 같은 유연한 제품은 전자상거래 시장의 급격한 성장에 따른 주요 수혜 제품이 될 것으로 예상됩니다.

- 휴대폰, 액세서리, 박스 등을 보내기 위한 보호용 에어백은 운송 중 파손으로부터 상품을 보호하는 데 도움이 되기 때문에 전자상거래 분야에서 널리 사용되고 있으며, Vijay Packaging System과 같은 회사는 이러한 유형의 포장을 제공합니다. 폴리프로필렌으로 만들어집니다. 이 회사의 에어 튜브 백은 특히 화장품에 사용되는 병, 병, 용기의 운송에 사용되는 팽창식 에어백입니다.

패션과 의류가 큰 시장 점유율을 차지합니다.

- 미디어 노출, 인식 증가, 가처분 소득 증가로 인해 인도 소비자들은 세계 패션 브랜드에 대한 접근을 원하고 있습니다. 소규모 도시에서는 오프라인 매장을 통한 브랜드 접근성이 제한적이기 때문에 온라인 소매업체에게 기회가 될 수 있습니다.

- IBEF에 따르면, 인도 e-리테일 시장은 이 분야에 대한 막대한 투자와 인터넷 사용자 급증으로 인해 세계에서 가장 빠른 속도로 발전할 것으로 예상되며, IBEF에 따르면 인도에서 의류 및 라이프스타일의 점유율은 약 29%(신발, 가방, 벨트, 벨트, 지갑, 시계, 보석류 포함)에 달할 전망입니다. 포함).

- Apparel Sourcing Week에 따르면 인도의 패션 소매 시장은 2027년까지 1,150억 달러에 달할 것으로 예상되며, 이는 E-Commerce 포장의 성장을 가속할 수 있습니다. 골판지 상자는 어디에나 있고, 소재가 견고하고 내구성이 뛰어나기 때문에 의류 분야의 전자상거래 업계에서 널리 사용되는 포장재입니다.

- 예를 들어, Arihant Agencies는 전자상거래 플랫폼의 의류 부문에 골판지 상자(갈색 외부 상자)를 제공하여 보관 및 배송 중에 제품을 안전하고 안전하게 보관할 수 있습니다. 이 2차 포장은 다양한 크기와 스타일, 기타 사양으로 제공됩니다.

- 이 회사는 또한 제품을 보호하고 원하는 목적지까지 배송할 수 있도록 설계된 택배 가방도 제공합니다. 이 가방은 가볍고 방수 기능이 있으며 비용 효율적입니다. 또한 생분해성, 변조 방지, 투명성, 재활용성이 우수합니다.

인도 E-Commerce 포장 산업 개요

인도의 E-Commerce 포장 시장은 세분화되어 있어 경쟁 기업 간의 적대적 관계가 심화되고 있습니다. 그러나 디자인, 기술, 용도의 혁신은 지속적인 경쟁 우위를 확보할 수 있습니다. 패션, 의류, 가전제품 산업 수요 증가로 인해 여러 시장 개척이 이루어지고 있으며, Packman Packaging과 Oji India Packaging Pvt Ltd가 주요 기업입니다.

- 2022년 8월-Storopack은 새로운 에어쿠션 필름인 AIRplus Bio Home Compostable 필름을 출시했습니다. 이 필름은 재생 가능한 천연 자원인 전분을 사용한 바이오이며, 가정에서 퇴비화할 수 있습니다. 매우 가벼운 에어쿠션은 자연의 순환을 순환시켜 운송 중량과 플라스틱 폐기물을 줄입니다.

기타 특전:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계 매력 Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 바이어의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 시장에 대한 COVID-19의 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

제6장 시장 세분화

- 유형별

- 박스

- 보호 포장

- 기타 포장

- 최종사용자 산업별

- 패션 및 의류

- 가전제품

- 식품 및 음료

- 퍼스널케어 제품

- 기타 최종사용자 산업

제7장 경쟁 구도

- 기업 개요

- Packman Packaging

- U-Pack

- Ecom Packaging

- Avon Pacfo Services LLP

- TGI Packaging Pvt. Ltd

- Kapco Packaging

- Total Pack

- Storopack Ind Pvt. Ltd

- Oji India Packaging Pvt. Ltd

- Astron Packaging Ltd

- B&B Triplewall Containers Limited

제8장 투자 분석

제9장 시장의 미래

LSH 25.03.28The India E-Commerce Packaging Market is expected to register a CAGR of 12.97% during the forecast period.

Key Highlights

- This rapid growth in the e-commerce market is principally driven by the consumer electronics, fashion, apparel, and personal care industries. Considerable investments in consumer electronics, personal care, and fashion and apparel are creating scope for the expansion of packaging opportunities.

- The rising omnichannel business model in the country, where one can shop online and offline, has also boosted the e-commerce market. Omnichannel retailers, such as Shoppers Stop Ltd and Infiniti Retail Limited Croma, are experiencing growth in their sales. They also provide faster delivery with lower shipping costs of packaging as they can ensure delivery from their offline stores in the city.

- To boost the participation of foreign players in the e-commerce landscape, the Indian government hiked the limit of foreign direct investment (FDI) in the e-commerce marketplace model up to 100% (in B2B models).

- The expansion of the e-commerce packaging business needs to be improved by a lack of awareness in rural areas, and online platform distrust also affects goods purchases made online. This trend is preventing the e-commerce packaging sector from growing. A weak foundation and a lack of technological expertise hinder the expansion of the e-commerce packaging sector.

- With the COVID-19 outbreak, the Indian e-commerce packaging industry witnessed a significant decline in growth due to the lockdown in the country. This factor restricted the movement of e-commerce goods and disrupted the supply chain in the country.

India E-Commerce Packaging Market Trends

Protective Packaging to Witness Significant Market Growth

- The demand for protective packaging in the Indian e-commerce industry is set to witness unprecedented growth due to the rapid strides in consumer electronics sales in e-retailing. According to IBEF, consumer electronics is currently the most significant contributor to online retail sales in India, with a 48% share contributing to the market's growth.

- These protective packaging products are designed and constructed to protect the goods from atmospheric, magnetic, electrostatic, vibration, or shock damage. Protective packaging protects machinery, equipment, and industrial goods from harm while being stored and transported. It also provides security through the void fill, wrapping, flexible cushioning, blocking and bracing, defensive containment, and surface defense.

- Protective packaging is used in various applications, such as food, electronics, cosmetics, and pharmaceutical industries. Products include boxes or storage containers, packing materials, liners, and spacers. Flexible products, such as air pillows, paper fill, bubble packaging, and mailers, are expected to be the primary product beneficiaries of rapid growth in the e-commerce market.

- Protective airbags for sending mobile phones, accessories, boxes, etc., are widely used in the e-commerce segment as they help protect goods from damage during transit. Companies, such as Vijay Packaging System, provide these types of packaging. They are made of polypropylene for the e-commerce segment. The company's air tube bags are inflatable airbags used for transporting jars, bottles, and containers, especially for use in cosmetic products.

Fashion and Apparel Accounts for Significant Market Share

- With media exposure, rising awareness, and increasing disposable income, Indian consumers are looking to get access to global fashion brands. The limited reach of brands through brick-and-mortar retail outlets in smaller cities provides an opportunity for online retailers.

- India's e-retail market is anticipated to develop at one of the quickest rates in the world because of significant investment in the area and a sharp rise in internet users. According to IBEF, apparel and lifestyle comprise a share of approximately 29% (including footwear, bags, belts, wallets, watches, and jewelry) in India.

- According to Apparel Sourcing Week, the Indian fashion retail market is set to account for USD 115 billion by 2027, which may aid the growth of e-commerce packaging. Corrugated boxes are ubiquitous and are widely used packaging materials for the e-commerce industry in the apparel segment, as the material is solid and highly durable.

- For instance, Arihant Agencies provides a corrugated box (outer brown box) for the apparel sector in an e-commerce platform, which keeps the product safe and secure while storing and shipping. This secondary packaging is available in different sizes and styles and with other specifications.

- The company also provides courier bags designed to protect products and deliver them to the desired destination. These bags are lightweight, water-resistant, and cost-effective. They are also biodegradable, tamper-proof, transparent, and recyclable.

India E-Commerce Packaging Industry Overview

The Indian e-commerce packaging market is fragmented, thus increasing competitive rivalry in the market. However, design, technology, and application innovation can lead to a sustained competitive advantage. Several developments have been made in the market due to the rising demand from the fashion, garment, and consumer electronics industries, giving the industry a highly competitive position. Packman Packaging and Oji India Packaging Pvt Ltd are the major players.

- August 2022 - Storopack announced a new air cushion film, AIRplus Bio Home Compostable film, which increases the focus on sustainability, as it fulfills the definitions of bioplastics. It is partly bio-based, using the natural and renewable resource starch, and home compostable. The extremely lightweight air cushions reduce shipping weight and plastic waste by closing the natural cycle.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Proliferation of Online Retailing and Emergence of Omnichannel Presence

- 5.2 Market Restraints

- 5.2.1 Regulation Pertaining to the Use of Plastic and Lack of Exposure to Good Manufacturing Practices

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Boxes

- 6.1.2 Protective Packaging

- 6.1.3 Other Types of Packaging

- 6.2 By End-user Industry

- 6.2.1 Fashion and Apparel

- 6.2.2 Consumer Electronics

- 6.2.3 Food and Beverage

- 6.2.4 Personal Care Products

- 6.2.5 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Packman Packaging

- 7.1.2 U-Pack

- 7.1.3 Ecom Packaging

- 7.1.4 Avon Pacfo Services LLP

- 7.1.5 TGI Packaging Pvt. Ltd

- 7.1.6 Kapco Packaging

- 7.1.7 Total Pack

- 7.1.8 Storopack Ind Pvt. Ltd

- 7.1.9 Oji India Packaging Pvt. Ltd

- 7.1.10 Astron Packaging Ltd

- 7.1.11 B&B Triplewall Containers Limited