|

시장보고서

상품코드

1683949

실내 LED 조명 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Indoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

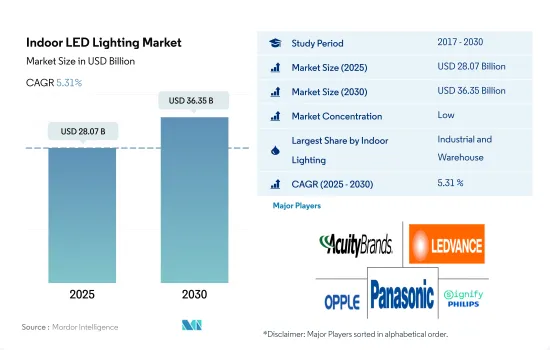

실내 LED 조명 시장 규모는 2025년에 280억 7,000만 달러에 달할 것으로 추정됩니다. 2030년에는 363억 5,000만 달러에 이를 것으로 예상되며, 예측 기간(2025-2030년)의 CAGR은 5.31%를 나타낼 것으로 전망됩니다.

산업 생산 수요 증가, 저장 공간 요구 증가, 사무실 공간 가용성 증가 등이 지역의 실내 LED 조명 시장 수요를 이끌고 있습니다.

- 금액 점유율에서는 2023년에 산업·창고(I&W)가 점유율의 대부분(49.2%)을 차지했고 상업(31.1%), 주택(17.5%), 농업이 이어졌습니다. 향후 몇 년간(I&W)과 농업용 조명의 점유율이 상승하고 나머지 부문에서는 약간의 감소가 예상됩니다. COVID-19 기간 동안 세계 각지에서 산업계는 여러 안팎의 역풍에 직면했습니다. 많은 국가들이 2021년 산업 생산을 유지했습니다. 2021년 미국은 2020년 대비 11.55% 증가한 2조 4,971억 달러를 생산했습니다. 이 기간 동안 영국은 2,748억 7,000만 달러를 생산해 2020년 대비 16.57% 증가했습니다. 이와 같이 산업 생산 증가는 창고의 필요성을 높여 향후 몇 년간의 실내 조명 수요를 증가시키는 결과가 되었습니다.

- 정부 보조금과 주택 제도는 많은 국가에서 새로운 주택 도입에 중요한 역할을 합니다. 인도에서는 정부가 몇 가지 에너지 절약 프로그램을 도입하고 있습니다. 예를 들어, 중앙정부의 야심찬 프라단 맨토리 아와스 요자나(PMAY) 프로그램은 2022년까지 전국에서 2,000만 호의 저렴한 도영 주택을 건설하는 것을 목표로 했습니다. 캐나다의 캘거리에서는 2022년에 여러 문 주택 프로젝트가 17,306건의 착공을 기록했습니다.

- 전자상거래와 수출 붐을 통해 새로운 창고 및 기타 물류 인프라에 대한 수요가 증가하고 있으며 물류 관련 건축물이 점점 더 중요한 분야가 되고 있습니다. 2022년 7월 Yum China Holdings Inc.는 상하이 가정지구에서 면적 6만 1,000제곱미터의 Yum China Supply Chain Management Center를 건설하기 시작했습니다. 이러한 사례는 세계 실내 LED 시장의 성장을 가속할 것으로 예상됩니다.

세계 전자상거래, 주택소유, 스마트시티 개발이 진행됨에 따라 LED 조명 매출이 증가할 것으로 보입니다.

- 금액 점유율과 수량 점유율에서 아시아태평양은 실내 LED 조명의 대부분을 차지합니다. 금액 점유율에서 2023년 아시아태평양은 북미에 이어 2위, 이어 유럽, 중동, 아프리카, 남미가 되었습니다. 2021년 아시아태평양에서는 중국 생산액은 4,865억 8,000만 달러, 2020년 대비 26.04% 증가했습니다. 2022년 산업 생산은 3.6% 증가했습니다. 2023년 3월 중국의 산업 생산은 전년 대비 3.9% 증가했습니다. 이와 같이 팬데믹 후 산업 생산 증가는 향후 몇 년 동안 실내 조명에 대한 수요로 이어질 것입니다.

- 게다가 북미에서는 2022년까지 미국의 신흥기업의 대부분이 소매업에 특화된 기업이 되었고(15.05%), 이는 실점포와 전자상거래 기업 1사가 포함된 수치입니다. 이어 레스토랑과 같은 식품업체가 13.71%를 차지했습니다. 신흥기업 증가로 이 지역에서는 실내 LED 수요가 높아질 것으로 예상됩니다.

- 게다가 유럽에서는 2017년부터 2020년까지 독일의 소유주 비율이 약간 떨어졌습니다. 2021년에는 인구의 약 49.1%가 아파트에 살았고, 2022년에는 46.7%가 아파트에 살게 되었습니다. 그 결과, 독일의 소유주율은 유럽에서 가장 낮고 임대 아파트 시장은 최대급입니다. 인플레이션과 고금리로 인해 주택가격은 분기 기준으로 지난 16년간 가장 급락했습니다. 도시와 지방 주택과 아파트는 평균 3.6% 하락했습니다. 내년 신축주택건설이 줄어들 것으로 예상됩니다. 전반적으로 LED 조명 수요 성장률은 주택 판매 수요에 따라 달라질 수 있지만 임대 주택 증가는 국내 LED 채용을 가속화할 수 있습니다.

세계의 실내 LED 조명 시장 동향

인구 증가, 친환경 빌딩, 정부에 의한 LED 도입 촉진 프로그램이 시장을 견인

- 세계 인구는 2020년 77억 9천만 명에서 2023년 80억 명에 이르렀습니다. 인구상위국에는 중국(14억 5,000만명), 인도(14억 2,000만명), 미국(3억3,680만명)이 포함됩니다. 게다가 세계 고용자 수는 2015년 31억 6천만 명에서 2022년에는 33억 2천만 명으로 증가하여 거의 1억 3천만 명 증가했습니다. 고용자 수가 증가하고 인구가 증가함에 따라 더 많은 지식이 국민에게 확산됨에 따라 LED 사용이 증가할 것으로 보입니다.

- COVID-19의 대유행에도 불구하고 에너지 효율적인 건설에 대한 세계 지출은 2019년 1,650억 달러에서 2020년에는 1,840억 달러 이상으로 11.4% 증가했습니다. 에너지 효율에 대한 투자의 연간 성장률은 2015년 이후 처음으로 3%를 초과했습니다. 에너지 효율적인 건물의 개발이 진행되고, 인구 증가의 주택 요구에 대응하기 위해, 주택의 방수를 늘려야 하기 때문에 LED 수요가 증가합니다.

- 세계적으로는 신축 주택의 발매가 증가하고 있어, 조명의 필요성으로부터 LED의 보급이 진행되고 있습니다. 예를 들어 인도에서는 뭄바이 수도권(MMR)의 신규 발매 호수가 전년의 56,883호에서 2022년에는 2배 이상의 1,24,652호로 증가했습니다. 브라질의 어포 더블 주택 프로그램도 재개되었습니다. 브라질 대통령은 저소득자를 위한 전국 연방 주택 프로그램을 2023년 2월에 재개할 계획을 발표했습니다. 이 대통령은 2009년에 "Minha Casa, Minha Vida"(직역하면 "내 집, 내 인생")이라고 명명된 이 프로그램을 창설했습니다. 이러한 사례는 이 나라의 LED 조명 수요를 더욱 높일 것으로 예상됩니다.

스마트시티, 친환경 빌딩 개발, 정부의 이니셔티브이 시장 성장을 견인

- 스마트 시티와 주택의 개발은 북미 정부에 의해 지원되고 있으며, 주택과 상업 분야에서도 신기술의 채용이 진행되고 있습니다. 예를 들어, 미국의 친환경 빌딩은 2021년에 극적으로 증가했으며 현재 830억 달러를 넘어섰습니다. 이것은 친환경 빌딩 분야의 확대를 나타내는 것으로, 빌딩이나 부동산업계의 탄소 실적의 저감에 필수적입니다. LED는 에너지 효율이 높기 때문에 건설 활동 증가와 친환경 빌딩의 채용이 그 사용을 촉진합니다. 그 결과 이 지역의 LED 시장이 확대되고 있습니다.

- 상업용 전력 사용은 매일 10시간에서 12시간 지속됩니다. 산업 부문의 전력 소비는 하루 24시간으로 주택 부문에서는 5.5-7시간입니다. 에너지 효율적인 조명 솔루션에 대한 수요가 아시아태평양에서 높아질 것으로 예상되는 이유는 인도 UJALA 프로그램과 SLNP 프로그램과 같은 정부 이니셔티브가 각각 LED를 저렴한 가격으로 제공하거나 가로등 LED 설치 프로젝트를 실시하여 다양한 산업에서의 이용을 촉진하고 있기 때문입니다.

- 정부가 유익한 이니셔티브에 참여하고 지원하게 되면서 에너지 효율적인 조명 시스템에 대한 요구 증가가 주로 인식되고 있습니다. 세계 수많은 정부가 성능 요건, 라벨링, 인센티브 제도 등 다양한 노력을 통해 비효율적인 광원을 단계적으로 폐지하도록 신속하게 움직이고 있습니다. 예를 들어, EU는 에코디자인 지침과 유해물질 제한 지침에 근거한 요구사항을 수정했으며, LED로의 전환이 10년 이상 시작된 유럽에서는 2023년에 모든 형광등을 실질적으로 금지했습니다.

실내 LED 조명 산업 개요

실내 LED 조명 시장은 세분화되어 상위 5개사에서 36.84%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. ACUITY BRANDS, INC., LEDVANCE GmbH(MLS), OPPLE Lighting, Panasonic Holdings Corporation and Signify(Philips)(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구

- 1인당 소득

- LED 총 수입량

- 조명 전력 소비량

- 가구수

- LED 보급률

- 원예 면적

- 규제 프레임워크

- 아르헨티나

- 브라질

- 중국

- 프랑스

- 독일

- 걸프 협력 회의

- 인도

- 일본

- 남아프리카

- 영국

- 미국

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 실내 조명

- 농업용 조명

- 상업용 조명

- 사무실

- 소매

- 기타

- 산업 및 창고

- 주택

- 지역

- 아시아태평양

- 유럽

- 중동 및 아프리카

- 북미

- 남미

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- ACUITY BRANDS, INC.

- ams-OSRAM AG

- Current Lighting Solutions, LLC.

- EGLO Leuchten GmbH

- LEDVANCE GmbH(MLS Co Ltd)

- Nichia Corporation

- OPPLE Lighting Co., Ltd

- Panasonic Holdings Corporation

- Signify(Philips)

- Thorn Lighting Ltd.(Zumtobel Group)

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Indoor LED Lighting Market size is estimated at 28.07 billion USD in 2025, and is expected to reach 36.35 billion USD by 2030, growing at a CAGR of 5.31% during the forecast period (2025-2030).

The increasing demand for industrial production, rising need for storage space, and increasing availability of office space drive the demand for indoor LED lighting market in the region

- In terms of value share, in 2023, industrial and warehouse (I&W) accounted for the majority of the share (49.2%), followed by commercial (31.1%), residential (17.5%), and agricultural. The market share is expected to gain in (I&W) and agricultural lighting in coming years and a small reduction in the remaining divisions. Across the globe, industries faced several internal and external headwinds during COVID-19. A large number of countries sustained their industrial production in 2021. In 2021, the United States produced a total of USD 2,497.1 billion, an increase of 11.55% compared to 2020. During the same period, the UK produced a total of USD 274.87 billion, an increase of 16.57% compared to 2020. Thus, the growing industrial production resulted in creating more need for warehouses and increasing the demand for indoor lighting in coming years.

- Government subsidies and housing schemes play a key role in the adoption of new houses in many nations. In India, the government has introduced several energy-saving programs. For example, the central government's ambitious Pradhan Mantri Awas Yojana (PMAY) program aimed to build 20 million affordable metropolitan housing units nationwide by 2022. In Calgary, Canada, under multi-units, home projects fueled 17,306 starts in 2022.

- E-commerce and the export boom have led to demand for new warehouses and other logistics infrastructure, and logistics-related building is becoming an increasingly important sector. In July 2022, Yum China Holdings Inc. commenced the construction of the Yum China Supply Chain Management Center in Shanghai's Jiading district, with an area of 61,000 square meters. Such instances are expected to drive the growth of the global indoor LED market.

Rising e-commerce, home ownership, and smart city development across the world would boost LED light sales

- In terms of value and volume share, Asia-Pacific has the majority share in indoor LED lighting. In terms of value share, in 2023, APAC stood second after North America, followed by Europe, the Middle East & Africa, and South America. In 2021, in APAC, China's output value totaled USD 486.58 billion, an increase of 26.04% compared to 2020. In 2022, industrial production increased by 3.6%. In March 2023, China's industrial production increased by 3.9% year-on-year. Thus, post-pandemic increases in industrial output will lead to demand for indoor lighting in the coming years.

- Furthermore, in North America, by 2022, most US startups were expected to be retail-focused (15.05%), including both brick-and-mortar stores and one e-commerce company. Restaurants and other food businesses followed, accounting for 13.71% of new businesses. An increase in the number of startups is expected to increase the demand for indoor LEDs in the region.

- Additionally, in Europe, between 2017 and 2020, the German homeownership rate declined slightly. About 49.1% of the population lived in apartments in 2021 and 46.7% in 2022. As a result, Germany has the lowest homeownership rate in Europe and one of the largest rental apartment markets. Inflation and high-interest rates have pushed home prices to their steepest quarterly decline in 16 years. Urban and rural homes and apartments fell an average of 3.6%. New home construction is expected to decline next year. Overall, the growth rate of demand for LED lighting may fluctuate depending on home sales demand, but growth in rental housing could accelerate LED adoption in the country.

Global Indoor LED Lighting Market Trends

The market is driven by increasing population, green buildings, and government programs to promote LED adoption

- The world's population reached 8 billion people in 2023, up from 7.79 billion in 2020. The largest countries by population included China (1.45 billion), India (1.42 billion), and the US (336.8 million). Furthermore, global employment increased to 3.32 billion people in 2022 from 3.16 billion in 2015, an increase of almost 0.13 billion people. The use of LEDs will increase as more knowledge is spread throughout the population as a result of the rise in the number of employed individuals and population growth.

- Despite the COVID-19 pandemic, worldwide spending on energy-efficient construction increased by an exceptional 11.4% in 2020 to over USD 184 billion, up from USD 165 billion in 2019. The yearly growth rate for investments in energy efficiency surpassed 3% for the first time since 2015. The requirement for additional rooms in a house will result in increased demand for LEDs due to the rise in the development of energy-efficient buildings and to meet the residential needs of the expanding population.

- Globally, launches of new houses have been rising, creating more LED penetration due to the need for illumination. For instance, in India, new launches in the Mumbai Metropolitan Region (MMR) increased over two-fold to 1,24,652 units in 2022 from 56,883 units in the previous year. Brazil's affordable housing program also restarted. The Brazilian President announced plans to restart the nationwide federal housing program for low-income individuals in February 2023. The President created the program, named "Minha Casa, Minha Vida," which translates to "My Home, My Life," in 2009. Such instances are further expected to raise the demand for LED lighting in the country.

Development of smart cities, green buildings, and government initiatives to drive the growth of the market

- The development of smart cities and homes is being supported by governments in North America, which are also adopting new technology in the residential and commercial sectors. As an illustration, green buildings in the US increased dramatically in 2021 and now exceed USD 83 billion dollars. This demonstrates the expansion of the green building sector, which is crucial for lowering the carbon footprint of the building and real estate industries. As LED is energy efficient, increased construction activity and the adoption of green building practices will encourage its use. As a result, the LED market in the area is expanding.

- Commercial electricity use lasts between 10 and 12 hours every day. Electricity consumption in the industrial sector accounts for 24 hours a day, while in the residential sector, it varies from 5.5 to 7 hours. The demand for energy-efficient lighting solutions is expected to rise in Asia-Pacific, in part because of government initiatives like India's UJALA and SLNP programs, which offer LEDs at reduced prices and LED installation projects for streetlights, respectively, and promote their use in a variety of industries.

- After governments began taking part in and supporting beneficial efforts, the growing need for energy-efficient lighting systems was mainly realized. Numerous governments all over the world are moving swiftly to phase out inefficient light sources through a variety of efforts like performance requirements, labeling, and incentive schemes. For instance, the EU modified requirements under the Ecodesign Directive and the Restriction of Hazardous Substances Directive, which essentially prohibited all fluorescent lighting in 2023 in Europe, where the transition to LED began more than ten years ago.

Indoor LED Lighting Industry Overview

The Indoor LED Lighting Market is fragmented, with the top five companies occupying 36.84%. The major players in this market are ACUITY BRANDS, INC., LEDVANCE GmbH (MLS Co Ltd), OPPLE Lighting Co., Ltd, Panasonic Holdings Corporation and Signify (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 Horticulture Area

- 4.8 Regulatory Framework

- 4.8.1 Argentina

- 4.8.2 Brazil

- 4.8.3 China

- 4.8.4 France

- 4.8.5 Germany

- 4.8.6 Gulf Cooperation Council

- 4.8.7 India

- 4.8.8 Japan

- 4.8.9 South Africa

- 4.8.10 United Kingdom

- 4.8.11 United States

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

- 5.2 Region

- 5.2.1 Asia-Pacific

- 5.2.2 Europe

- 5.2.3 Middle East and Africa

- 5.2.4 North America

- 5.2.5 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 ams-OSRAM AG

- 6.4.3 Current Lighting Solutions, LLC.

- 6.4.4 EGLO Leuchten GmbH

- 6.4.5 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.6 Nichia Corporation

- 6.4.7 OPPLE Lighting Co., Ltd

- 6.4.8 Panasonic Holdings Corporation

- 6.4.9 Signify (Philips)

- 6.4.10 Thorn Lighting Ltd. (Zumtobel Group)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms