|

시장보고서

상품코드

1684050

통신용 MLCC 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Telecommunication MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

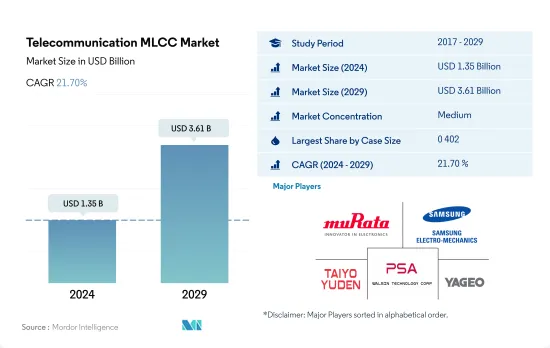

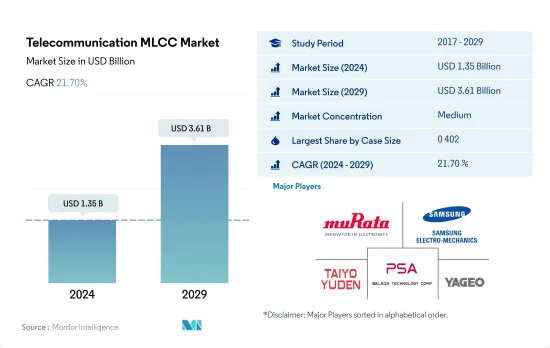

통신용 MLCC 시장 규모는 2024년에 13억 5,000만 달러로 평가되었고, 2029년에는 36억 1,000만 달러에 이를 전망이며, 예측 기간(2024-2029년) 중 CAGR은 21.70%를 나타낼 것으로 예측됩니다.

다양한 케이스 사이즈가 통신용 MLCC의 진화를 촉진

- 통신용 MLCC 시장은 기술의 진보 및 소형이면서 고성능 전자 부품에 대한 수요에 의해 큰 변혁기를 맞이하고 있습니다. 케이스 사이즈별 부문에서는 5가지 주요 카테고리가 두드러집니다. 0 201, 0 402, 0 603, 1 005, 1 210입니다. 각 케이스 사이즈는 업계의 진화를 형성하는데 있어서 매우 중요한 역할을 합니다.

- 0 201의 사례 크기는 진화하는 산업 수요에 부응하기 위한 중심적인 존재입니다. 강력한 성장을 보여주는 이 부문은 2022년에 1억 4,529만 달러의 매출을 기록했습니다. 컴팩트한 폼 팩터는 4K HDR 및 Dolby Atmos 지원과 같은 고급 기능을 실현하기 위해 중요한 셋톱 박스(STB)와 같은 장비의 공간 최적화 요구에 부합합니다.

- 케이스 사이즈 0 603은 협업의 발전과 기술 혁신을 상징합니다. 컴팩트한 폼 팩터는 중국 텔레콤과 중국 유니콤의 5G 네트워크 공유 개념으로 대표되는 전략적 협업을 보완합니다. 사례 크기 1 005는 이러한 혁신에 대응하여 개인화된 서비스와 효율적인 대역폭 사용을 가능하게 합니다. ADB와 KAONMEDIA와 같은 파트너십은 이 케이스 사이즈를 활용하여 최첨단 기술을 도입하여 디바이스 성능을 향상시키고 있습니다.

- 케이스 사이즈 1 210은 통신 인프라에서 중요한 역할을 합니다. 기지국 내에서 효율적인 신호 처리, 전력 변환 및 RF 회로를 가능하게 합니다. Ubiik의 freeRANTM과 Qualcomm의 Compact Macro 5G RAN Platform과 같은 혁신은 고성능 구성 요소에 대한 수요를 입증합니다.

- 통신 시장에서 모든 유형의 케이스 사이즈로 첨단 STB용 소형이면서도 강력한 컴포넌트부터 기지국에서의 효율적인 신호 처리에 이르기까지 사이즈 제약과 기술적 능력의 밸런스를 제공해 업계의 진보에 공헌하고 있습니다.

세계의 통신 인프라에서 MLCC 수요가 늘고 있습니다.

- 세계의 통신 부문은 5G 네트워크의 급속한 배치와 고속 연결 및 고급 통신 서비스에 대한 수요 증가로 역동적인 성장을 이루고 있습니다.

- 아시아태평양은 스마트폰, 데이터 통신 서비스, 디지털 컨텐츠의 보급에 상징되는 바와 같이 통신 업계 급성장의 최전선에 있습니다. 중국 등의 국가들은 5G 기술의 전개를 선구적으로 진행하고 있으며, 수백 만의 5G 기지국이 가동하고 있습니다. 이 지역에서의 MLCC 수요는 고온에 견디고 신호 무결성을 유지할 수 있는 효율적인 통신 기지국의 필요성에 의해 상당한 것이 되고 있습니다. 이 지역이 통신 분야에서 혁신과 리드를 계속하고 있기 때문에 MLCC에 대한 수요는 계속 왕성합니다.

- 미국은 세계의 통신 분야에서 중요한 기업이며 5G 네트워크 구축을 향해 크게 발전하고 있습니다. AT&T, Verizon, T-Mobile과 같은 하이테크 선두가 5G 기술에 많은 투자를 하고 있으며, 통신 기지국에서의 MLCC 수요는 증가하는 경향이 있습니다.

- 유럽에서는 모바일 애플리케이션 및 서비스가 급증하고 통신 인프라 강화의 필요성이 높아지고 있습니다. 영국, 독일, 프랑스, 스페인 등 국가에서 5G 네트워크가 전개되어 기지국에 대한 수요가 증가하고 있습니다. MLCC는 보다 높은 데이터 전송 속도와 대기 시간 단축 등 5G의 고급 기능을 실현하는 데 중요한 역할을 합니다.

- 중동 및 아프리카는 5G 네트워크의 급속한 발전으로 큰 변화를 맞이하고 있습니다. 상용 5G 서비스가 이 지역 전체에 도입됨에 따라 전 세계 기타 지역에 대한 MLCC 수요가 급증하고 있습니다.

세계의 통신용 MLCC 시장 동향

5G 네트워크 도입 증가로 MLCC 수요 촉진

- 5G 기술의 등장은 통신 업계에 큰 진보를 가져왔고, 더 빠른 무선 연결에 혁명을 가져왔습니다. 그 중에서도 5G/mmWave 기지국은 특히 데이터 수요가 높은 도시에서 5G 네트워크를 전개하는 데 필수적인 구성 요소가 되었습니다. 이러한 기지국은 무선 신호의 송수신에 밀리미터파 주파수를 사용하여 5G 기술의 장점을 가능하게 합니다. 5G/mmWave 기지국 내에서의 MLCC 통합은 기능을 지원하는 데 있어 매우 중요한 역할을 하며 통신용 MLCC 시장에 시사합니다.

- 5G/mmWave 기지국은 24GHz에서 100GHz까지 mmWave 주파수의 독특한 특성을 활용하여 초고속, 신뢰성 높은 무선 연결을 실현하도록 설계되었습니다. 5G/mmWave 기지국의 배치는 자율주행차나 IoT 등의 신흥 용도의 가능성을 완전히 발휘하기 위해 매우 중요합니다.

- 과거 분석에서 통신용 MLCC 시장에 있어서 5G/mmWave 기지국의 명확한 성장 패턴과 예측이 떠오르고 있습니다. 이 기지국의 수량은 초기에는 매우 적은 수의 숫자로 시작하여 시간이 지남에 따라 느린 성장을 경험했습니다. 2018년 수량은 9만 유닛에 이르며 2019년에는 12만 유닛으로 증가합니다. COVID-19의 세계적 유행이 가져온 과제에도 불구하고, 5G/mmWave 기지국의 전개는 회복력을 유지해, 2020년에는 13만 대, 2022년에는 22만 대로 더욱 증가했습니다. 예측치에서는 확대가 계속되고 있으며, 2026년에는 50만 유닛에 이를 전망입니다. 이 증가 추세는 특히 인구 밀도가 높은 도시 지역에서 무선 성능을 향상시키기 위해 밀리미터파 주파수를 활용하는 5G 네트워크 수요가 증가하고 있음을 반영합니다.

통신용 MLCC 시장의 성장 탐색

- 통신 시장은 5G 고정 무선 액세스(FWA) 연결의 현저한 급증을 목격하고 있습니다. 2020년부터 2026년까지 CAGR 68%로 지수적으로 확대될 것으로 예측됩니다. 2020년 5G FWA 연결은 200만 건으로 2026년에는 6,500만 건에 이를 것으로 예상됩니다. FWA 장비는 효율적인 성능을 위해 MLCC에 크게 의존하기 때문에 MLCC 제조업체에게 큰 기회가 됩니다. 고객 구내 기기(CPE), 기지국, 네트워크 장비 등의 FWA 기기가 MLCC 수요를 견인하고 있습니다. 5G FWA의 채택이 계속 확대됨에 따라 이러한 커패시터에 대한 요구는 증폭될 것입니다. 5G FWA 디바이스의 특정 요구사항과 기대 성능을 충족하기 위해서는 지속적인 기술 혁신과 생산 및 공급 능력을 조정하는 것이 MLCC 제조업체에게 가장 중요합니다.

- 통신 시장에서 4G 및 기타 기술의 지속적인 중요성을 인식하는 것이 매우 중요합니다. MLCC는 스마트폰, 라우터, IoT 장비 등 이러한 장비에서 전원 관리, 신호 필터링 및 노이즈 억제를 촉진하는 중요한 역할을 합니다. 4G 및 기타 기술의 연결 수가 증가함에 따라 이러한 장비의 MLCC 수요도 증가하고 있습니다. 그럼에도 불구하고 5G FWA 연결의 급속한 성장은 MLCC 제조업체에게 매력적인 시장 기회를 제공합니다. 그러나 4G 및 기타 기술에 대한 지속적인 수요를 인식하는 것도 필수적입니다. 혁신과 파트너십을 통해 두 분야의 독특한 요구를 충족함으로써 MLCC 제조업체는 성장을 가속하고 통신용 MLCC 시장의 잠재력을 극대화할 수 있습니다.

통신용 MLCC 산업 개요

통신용 MLCC 시장은 적당히 통합되어 상위 5개사에서 44.61%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. Murata Manufacturing, Samsung Electro-Mechanics, Taiyo Yuden, Walsin Technology Corporation 및 Yageo Corporation(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 제안

제3장 서문

- 조사 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 기지국 판매

- 5G/mmWave 기지국

- 매크로 4G 기지국

- 매크로 5G/서브 6GHz 기지국

- 소형 4G 기지국

- 소형 5G 기지국

- 셋톱박스 판매

- 세계의 셋톱 박스 판매 대수

- FWA 접속

- 세계의 FWA 접속

- 규제 프레임워크

- 밸류체인 및 유통채널 분석

제5장 시장 세분화

- 디바이스 유형별

- 베이스 스테이션

- 셋톱 박스

- 기타

- 케이스 사이즈별

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 기타

- 전압별

- 50V-200V

- 50V 미만

- 200V 이상

- 정전 용량별

- 10μF-100μF

- 10μF 미만

- 100μF 이상

- 유전 유형별

- 클래스 1

- 클래스 2

- 지역별

- 아시아태평양

- 유럽

- 북미

- 세계 기타 지역

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계 밸류체인 분석

- 시장 역학(DROs)

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Telecommunication MLCC Market size is estimated at 1.35 billion USD in 2024, and is expected to reach 3.61 billion USD by 2029, growing at a CAGR of 21.70% during the forecast period (2024-2029).

Different case sizes are fueling the evolution of telecommunication MLCCs

- The telecommunication MLCC market is undergoing a profound transformation, driven by technological advancements and the demand for compact yet high-performance electronic components. Within the "by case size" segment, five key categories stand out: 0 201, 0 402, 0 603, 1 005, and 1 210. Each case size plays a pivotal role in shaping the industry's evolution.

- The 0 201 case size is central to meeting evolving industry demands. Demonstrating strong growth, this segment generated USD 145.29 million in revenue in 2022. Its compact form factor aligns with the need for space optimization in devices like set-top boxes (STBs), which is crucial for enabling advanced features such as 4K HDR and Dolby Atmos support.

- The 0 603 case size represents collaborative progress and technological innovation. Its compact form factor complements strategic collaborations, exemplified by China Telecom and China Unicom's 5G network sharing initiative. Case Size 1 005 accommodates these innovations, allowing personalized services and efficient bandwidth utilization. Partnerships like ADB and KAONMEDIA leverage this case size to introduce cutting-edge technologies, enhancing device performance.

- The 1 210 case size plays a significant role in telecom infrastructure. It enables efficient signal processing, power conversion, and RF circuitry within base stations. Innovations like Ubiik's freeRANTM and Qualcomm's Compact Macro 5G RAN Platform exemplify the demand for high-performance components.

- Case sizes of all types in the telecommunication market with compact yet powerful components for advanced STBs to efficiently signal processing in base stations contribute to the industry's progress, offering a balance between size constraints and technological capabilities.

The demand for MLCCs is growing in the global telecommunication infrastructure

- The global telecommunication sector is experiencing dynamic growth, driven by the rapid deployment of 5G networks and the increasing demand for high-speed connectivity and advanced communication services.

- Asia-Pacific is at the forefront of the telecommunications industry's surge, marked by the widespread adoption of smartphones, data services, and digital content. Countries such as China are pioneering the deployment of 5G technology, with millions of operational 5G base stations. The demand for MLCCs in the region is substantial, driven by the need for efficient communication base stations that can withstand high temperatures and maintain signal integrity. As the region continues to innovate and lead in telecommunications, the demand for MLCCs remains strong.

- The United States is a key player in the global telecommunication sector, making significant strides in establishing the national 5G network. With tech giants like AT&T, Verizon, and T-Mobile investing heavily in 5G technology, the demand for MLCCs in communication base stations is on the rise.

- Europe has witnessed a surge in mobile applications and services, driving the need for enhanced telecommunications infrastructure. The deployment of 5G networks across countries like the United Kingdom, Germany, France, and Spain has led to an increased demand for base stations. MLCCs are playing a critical role in enabling the advanced functionalities of 5G, such as higher data rates and reduced latency.

- Middle East & Africa is undergoing a significant transformation with the rapid deployment of 5G networks. As commercial 5G services are introduced across the region, the demand for MLCCs in the Rest of the World has surged.

Global Telecommunication MLCC Market Trends

The rising adoption of 5G networks is propelling the MLCC demand

- The emergence of 5G technology has brought significant advancements to the telecommunications industry, revolutionizing wireless connectivity with faster speeds. In this context, 5G/mmWave base stations have become crucial components for deploying 5G networks, particularly in urban areas with high data demand. These base stations use mmWave frequencies to transmit and receive wireless signals, enabling the benefits of 5G technology. The integration of MLCCs within 5G/mmWave base stations plays a pivotal role in supporting functionality and presents implications for the telecom MLCC market.

- 5G/mmWave base stations are designed to deliver ultra-fast and reliable wireless connectivity by leveraging the unique characteristics of mmWave frequencies, ranging from 24 GHz to 100 GHz. The deployment of 5G/mmWave base stations is crucial for achieving the full potential of emerging applications such as autonomous vehicles and IoT.

- Upon historical analysis, a clear growth pattern and projections emerge for 5G/mmWave base stations within the telecom MLCC market. The volume of these base stations started from negligible figures in the early years and experienced gradual growth over time. In 2018, the volume reached 0.09 million units, increasing to 0.12 million units in 2019. Despite the challenges posed by the global COVID-19 pandemic, the deployment of 5G/mmWave base stations remained resilient, with a further increase to 0.13 million units in 2020 and 0.22 million units in 2022. The projected figures indicate a continued expansion, with the volume expected to reach 0.5 million units by 2026. This upward trend reflects the growing demand for 5G networks to leverage mmWave frequencies for enhanced wireless performance, particularly in densely populated urban areas.

Navigating growth in the telecommunications MLCC market

- The telecommunication market is witnessing a remarkable surge in 5G fixed wireless access (FWA) connections. It is projected to expand exponentially at a CAGR of 68% from 2020 to 2026. This growth translates to a substantial increase in volume, with 2 million 5G FWA connections in 2020, which is expected to reach 65 million by 2026. This presents a significant opportunity for MLCC manufacturers, as FWA devices heavily rely on MLCCs for efficient performance. FWA devices, including customer premises equipment (CPE), base stations, and network equipment, are driving the demand for MLCCs. As the adoption of 5G FWA continues to grow, the need for these capacitors will be amplified. To meet the specific requirements and performance expectations of 5G FWA devices, ongoing innovation and alignment of production and supply capabilities are paramount for MLCC manufacturers.

- It is crucial to recognize the continued significance of 4G and other technologies in the telecommunication market. MLCCs play a vital role in these devices, such as smartphones, routers, and IoT devices, facilitating power management, signal filtering, and noise suppression. As the number of 4G and other technology connections increases, so does the demand for MLCCs in these devices. Nevertheless, the rapid growth of 5G FWA connections presents a compelling market opportunity for MLCC manufacturers. However, it is essential to recognize the continued demand for 4G and other technologies. By addressing the unique needs of both segments through innovation and partnerships, MLCC manufacturers can drive growth and capture the full potential of the telecommunications MLCC market.

Telecommunication MLCC Industry Overview

The Telecommunication MLCC Market is moderately consolidated, with the top five companies occupying 44.61%. The major players in this market are Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd, Walsin Technology Corporation and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Base Station Sales

- 4.1.1 5G/mmWave Base Station

- 4.1.2 Macro 4G Base Station

- 4.1.3 Macro-5G/sub6GHz Base Station

- 4.1.4 Small 4G Base Station

- 4.1.5 Small 5G Base Station

- 4.2 Set Top Boxes Sales

- 4.2.1 Global Set Top Boxes Sales

- 4.3 Fwa Connections

- 4.3.1 Global FWA connections

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Device Type

- 5.1.1 Base Stations

- 5.1.2 Set Top Boxes

- 5.1.3 Others

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 50V to 200V

- 5.3.2 Less than 50V

- 5.3.3 More than 200V

- 5.4 Capacitance

- 5.4.1 10 μF to 100 μF

- 5.4.2 Less than 10 μF

- 5.4.3 More than 100 μF

- 5.5 Dielectric Type

- 5.5.1 Class 1

- 5.5.2 Class 2

- 5.6 Region

- 5.6.1 Asia-Pacific

- 5.6.2 Europe

- 5.6.3 North America

- 5.6.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms