|

시장보고서

상품코드

1690848

캐러밴 및 모터홈 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Caravan And Motorhome - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

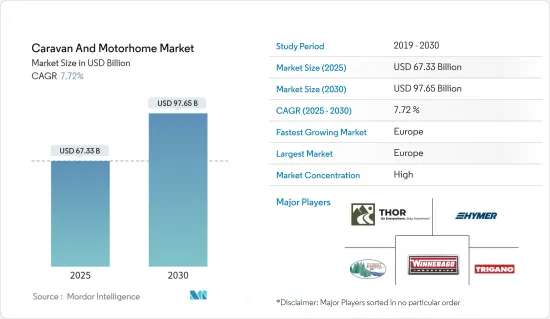

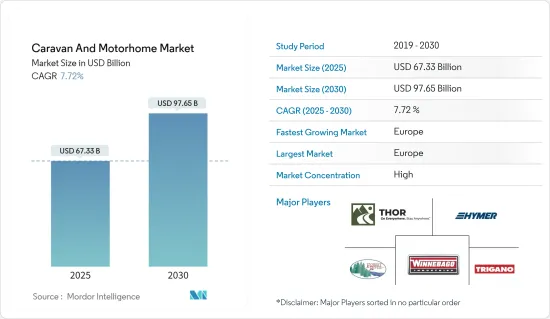

세계의 캐러밴 및 모터홈 시장 규모는 2025년 673억 3,000만 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR 7.72%로 확대되어, 2030년에는 976억 5,000만 달러에 이를 것으로 예측됩니다.

캐러밴 및 모터홈 시장은 소비자의 선호 변화와 라이프 스타일의 동향을 반영하여 최근 몇 년간 현저한 성장과 진화를 이루고 있습니다. 특필해야 할 동향의 하나는 캐러밴이나 모터홈을 사용한 여행이, 휴가를 보내는데 선호되는 방법으로서 인기가 높아지고 있는 것입니다. 소비자들은 이러한 레크리에이션 차량이 제공하는 자유와 유연성을 요구하고 있으며, 자신의 페이스로 다양한 목적지를 탐험할 수 있습니다. 이러한 여행 선호도의 변화는 야외 및 자연을 기반으로 한 경험에 대한 관심 증가와 함께 캐러밴 및 모터홈 시장의 확대에 기여합니다.

제품의 다양성 측면에서 제조업체는 다양한 선호와 요구 사항에 대응하는 광범위한 캐러밴 및 모터홈 모델을 발표함으로써 수요 증가에 부응했습니다. 현대적인 디자인에는 종종 여행 경험을 향상시키기 위해 혁신적인 기능, 기술 발전 및 편의 시설 향상이 포함되어 있습니다. 게다가 이 업계에서는 지속가능성과 환경친화적인 관행이 중시되고 있으며, 제조업체는 소비자들 사이에서 높아지는 환경책임에 대한 의식에 맞추어 에너지 효율적인 시스템과 소재를 도입하고 있습니다.

미니 캐러밴의 동향은 컴팩트한 디자인이 특징으로, 일반적으로 발자국을 억제한 유선형의 바디를 특징으로 합니다. 작음에도 불구하고, 제조업체 각사는 실내 공간을 최대한으로 활용해, 필수 불가결한 설비를 담는 것에 주력하고 있습니다. 미니 캐러밴에는 종종 아늑한 취침 공간, 기본 주방 시설 및 현명한 수납 솔루션이 장착되어 있습니다. 기능과 공간의 효과적인 활용에 중점을 두고 컴팩트한 설정으로 편안한 캠프 경험을 제공합니다.

미니 캐러밴은 티어 드롭 트레일러, 마이크로 캐러밴, 폴딩 캠퍼라고도 불리며 대형 모델에 비해 저렴한 가격을 실현하고 있습니다. 엔트리 레벨 옵션은 5,000 유로 전후부터 시작되며 장비가 충실한 유형은 15,000 유로에서 20,000 유로에 이릅니다. 이 가격 우위는 예산에 중점을 둔 여행자와 처음으로 캐러밴를 이용하는 사람들을 끌어들입니다.

2023년 3월까지 분기에는 여행자 수가 크게 증가하고 호주 전역에서 24% 증가하는 450만 명의 개인 여행이 실시되었습니다. 또한, 캐러밴과 캠핑의 즐거움을 만끽하는 여행객들이 늘어나면서 숙박 횟수가 1,800만 일로 22%나 급증했습니다. 이러한 여행과 레저의 급증은 연간 누계로 1,550만 회의 여행, 6,230만 일의 숙박, 112억 달러의 관광객 소비에 공헌하고 있습니다. 특필해야할 것은 이 숫자가 유행 전의 통계인 1,400만회의 여행과 5,900만일을 웃돌고 있는 것입니다.

모터홈은 세계에서 특히 유럽에서 인기가 높아지고 있습니다. 부유층(HNWI) 증가와 더불어 충분한 RV 주차장이 있는 것이 북미와 유럽에서의 보급을 뒷받침하고 있습니다.

캐러밴 및 모터홈 시장 동향

모터홈은 앞으로 수년 만에 주목을 받을 것으로 예상

캠프와 여행은 밀레니얼 세대들 사이에서 점점 인기있는 레크리에이션이 되고 있습니다. 유형 C 모터홈은 연비 효율면에서 유형 A 및 B 모터홈보다 우수합니다. 많은 레크리에셔널 차량 제조업체들이 Ford와 Mercedes-Benz 벤츠의 섀시를 기반으로 한 유형 C 차량을 도입하고 있습니다.

특히 독일 시장에서는 소형 밴(유형 B) 모터홈 수요가 높아지고 있으며, 많은 신흥 기업과 신규 참가 기업이 OEM의 재고 차량과 기존 밴을 캠핑카로 개조하는 서비스를 제공합니다.

- 2023년 3월, 밴 컨버전을 전문으로 하는 Krug Expedition는 'Rhinoceros on Wheels'라는 모터홈을 발표했습니다. Rhino XL은 가혹한 상황에도 견딜 수 있도록 만들어진 견고한 오프로드 모터홈입니다.

- 2024년 2월 Goboony는 스위스 재보험 자회사인 iptiQ와 협력하여 모터홈 보험 솔루션을 발표했습니다.

A, B, C 유형의 모터홈에서의 이러한 개발은 향후 수년간 전체 시장 성장에 기여할 것으로 예상됩니다.

유럽은 시장에서 중요한 역할을 할 것으로 보입니다.

유럽은 캐러밴 및 모터홈 시장에서 매우 중요한 역할을 합니다.

- 캐러밴과 모터홈은 유럽에 깊게 뿌리를 둔 문화입니다. 캐러밴을 사용하여 다양한 목적지를 둘러보고 탐험하는 개념은 이동 생활과 야외 모험에 대한 문화적 친화성을 반영하여 수십년동안 받아 들여졌습니다. 이 문화적 수용은 캐러밴과 모터홈의 지속적인 수요를 창출하고 유럽에서 여행과 레저 활동의 필수적인 부분이되었습니다.

- 유럽에는 그림같은 시골에서부터 활기 넘치는 도시까지 다양한 풍경과 목적지가 있습니다. 이 지리적 다양성은 여행자에게 다양한 장소를 탐험하도록 촉구하며, 캐러밴과 모터홈은 이를 위한 이상적인 수단을 제공합니다. 이러한 차량이 제공하는 자유와 유연성은 개인적이고 몰입감 있는 여행 경험을 요구하는 유럽 여행자의 선호도와 일치합니다.

2022년 말까지 유럽에서는 630만대 이상의 캐러밴 및 모터홈이 등록되어 5년 전 520만대에서 현저하게 증가했습니다. 이 기간 동안 캐러밴는 캠프 장비 전체의 거의 3분의 2를 차지했습니다. 그러나 캠핑카의 현저한 급증은 분명하며, 모터홈의 수는 유럽에서 280만대에 달했으며, 2017년 기록된 숫자에 비해 50% 증가를 보이고 있습니다. 그 결과, 캐러밴과 모터홈의 비율은 44%에 비해 56%가 되었습니다. 지난 5년간 캐러밴 주차장은 5% 성장을 이루었으며, 모터홈의 수가 캐러밴을 능가한다는 시나리오가 임박하고 있음을 시사합니다. 네덜란드에서는 캠핑카의 수가 2017년 10만 5,000대에서 2022년 말까지 18만대 가까이까지 증가한 반면, 캐러밴의 수는 여전히 42만 4,000대였습니다. KCI는 네덜란드의 캐러밴과 캠핑카의 총 수가 60만대를 넘어섰다고 보고했으며, 이러한 이정표의 첫 사례가 되었습니다. 유럽 국가 중에서 네덜란드는 모터홈과 캐러밴의 보유 대수가 가장 많으며, 독일이 약 160만대, 프랑스가 약 115만대, 영국이 약 83만 5,000대였습니다.

캐러밴 및 모터홈 산업 개요

캐러밴 및 모터홈 시장은 격렬하게 통합되어 있으며 여러 제조업체가 고급 기능을 갖춘 제품을 제공합니다. 각 회사는 M&A, 제휴, 협력 등의 전략을 통해 시장 점유율을 확대하고 있습니다. 예를 들면

- 2023년 10월, Mink Campers는 이 회사의 캠핑카 시리즈의 최신 버전인 MINK-E를 발표했습니다. MINK-E는 환경 친화적 인 완전 전동 유형으로 야외 풍경의 어려운 예측 불가능한 지형을 탐색하도록 설계되었습니다. 13.5피트(4.1미터)의 Mink Camper는 클래식하고 공기역학 기반의 티어드롭형을 유지하며 1,150파운드(520kg)의 무게로 컴팩트한 사이즈를 실현하고 있습니다.

- 2023년 7월, ARB Earth Camper의 소개는 모험을 추구하는 사람들이 캐러밴 라이프 스타일의 스릴을 희생하지 않고 더 가벼운 여행 트레일러를 선택할 수 있다는 설득력있는 증거입니다.

- 2022년 1월, Ford-Werke GmbH와 Erwin Hymer Group(EHG)은 고객 대응 레크리에이션 차량 및 모터홈의 기반으로 Ford Transit 및 Ford Transit Custom 납품에 대한 프레임워크 계약을 체결했습니다. 이 계약을 통해 양사는 성장하는 레저 차량 시장에 자본 참여를 하게 됩니다. 이 공급 계약에는 EHG 브랜드 캠핑카, 세미 통합형 모터홈, 알코브 모터홈으로의 개조를 위한 Ford Transit Custom 밴 및 스켈레탈 섀시 캡 모델 및 Ford Transit Custom 콤비 밴이 포함됩니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

- 업계의 매력도 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 제품 유형

- 캐러밴

- 여행 트레일러

- 피프스 휠 트레일러

- 폴딩 캠프 트레일러

- 트랙 캠핑

- 모터홈

- 유형 A

- 유형 B

- 유형 C

- 최종 사용자별

- 직접 구매

- 함대 오너

- 캐러밴

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 한국

- 기타 아시아태평양

- 세계 기타 지역

- 남미

- 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Thor Industries Inc.

- Swift Group

- Forest River Inc.

- Winnebago Industries Inc.

- Burstner GmbH & Co. KG

- Triple E Recreational Vehicles

- Hymer GmbH & Co. KG

- Jayco Inc.

- Dethleffs GmbH & Co. KG

- Knaus Tabbert AG

- Trigano SA

제7장 시장 기회와 앞으로의 동향

JHS 25.04.09The Caravan And Motorhome Market size is estimated at USD 67.33 billion in 2025, and is expected to reach USD 97.65 billion by 2030, at a CAGR of 7.72% during the forecast period (2025-2030).

The caravan and motorhome market has witnessed significant growth and evolution in recent years, reflecting changing consumer preferences and lifestyle trends. One notable trend is the increasing popularity of caravan and motorhome travel as a preferred mode of vacationing. Consumers are seeking the freedom and flexibility that these recreational vehicles provide, allowing them to explore diverse destinations at their own pace. This shift in travel preferences, coupled with a growing interest in outdoor and nature-based experiences, has contributed to the expansion of the caravan and motorhome market.

In terms of product diversity, manufacturers have responded to the rising demand by introducing a wide range of caravan and motorhome models, catering to various preferences and requirements. Modern designs often incorporate innovative features, technological advancements, and improved amenities to enhance the overall travel experience. Additionally, there is a notable emphasis on sustainability and eco-friendly practices within the industry, with manufacturers incorporating energy-efficient systems and materials to align with the growing awareness of environmental responsibility among consumers.

The trend of mini caravans is picking up pace as they are characterized by their compact design, typically featuring a streamlined body with a reduced footprint. Despite their smaller size, manufacturers focus on maximizing interior space to include essential amenities. Mini caravans often come equipped with a cozy sleeping area, basic kitchen facilities, and clever storage solutions. The emphasis is on functionality and efficient use of space to provide a comfortable camping experience within a compact setup.

Mini caravans, also known as teardrop trailers, micro caravans, or folding campers, offer affordability compared to larger models. Entry-level options start around EUR 5,000, with well-equipped versions reaching EUR 15,000 - EUR 20,000. This price advantage attracts budget-conscious travelers and first-time caravanners.

In the quarter spanning March 2023, there was a substantial rise in travel figures, with individuals undertaking 4.5 million trips, marking a 24% increase across Australia. Additionally, the delights of caravanning and camping were savored, with 18 million nights spent, reflecting a substantial 22% surge. This surge in travel and leisure activities contributes to an annual rolling total of 15.5 million trips, 62.3 million nights, and an impressive USD 11.2 billion in visitor expenditure. Notably, these figures surpass the pre-pandemic statistics, which stood at 14 million trips and 59 million nights.

Motorhomes are becoming increasingly popular around the world, particularly in Europe. The rising number of high-net-worth individuals (HNWI), combined with the availability of ample RV parking, is driving its adoption in North America and Europe.

Caravan And Motorhome Market Trends

Motorhomes are Anticipated to Gain Prominence Over the Coming Years

Camping and travel are becoming increasingly popular recreational activities among millennials. Type C motorhomes outperform type A and B motorhomes in terms of fuel efficiency. Many recreational vehicle manufacturers are introducing type C vehicles based on Ford and Mercedes-Benz chassis.

With the increasing demand for small van (type B) motorhomes, especially in the German market, many new companies and start-ups are offering services to convert stock OEM vehicles and existing vans into campervans.

- In March 2023, Krug Expedition, a company specializing in van conversions, revealed its motorhome referred to as the "Rhinoceros on Wheels. The Rhino XL is a robust off-road motorhome built to withstand extreme conditions.

- In February 2024, Goboony collaborated with iptiQ, a subsidiary of Swiss Re, to introduce a motorhome insurance solution.

Such developments across type A, B, and C motorhomes are expected to contribute to the overall growth of the market in the coming years.

Europe is Likely to Play a Key Role in the Market

Europe plays a pivotal role in the market of caravans and motorhomes due to several factors that contribute to the region's prominence in this industry.

- Caravanning and motorhoming have deep cultural roots in Europe. The concept of touring and exploring different destinations using caravans has been embraced for decades, reflecting a cultural affinity for mobile living and outdoor adventures. This cultural acceptance has created a sustained demand for caravans and motorhomes, making them an integral part of travel and leisure activities in Europe.

- Europe boasts diverse landscapes and destinations, ranging from picturesque countryside to vibrant cities. This geographical diversity encourages travelers to explore various locations, and caravans and motorhomes offer an ideal means for this. The freedom and flexibility provided by these vehicles align with the preferences of European travelers who seek personalized and immersive travel experiences.

By the end of 2022, Europe witnessed registrations of over 6.3 million caravans and motorhomes, a notable increase from 5.2 million five years prior. During that period, caravans constituted almost two-thirds of all camping equipment. However, the remarkable surge in campers is evident, with the count of motorhomes reaching 2.8 million in Europe, marking a 50% rise compared to the figures recorded in 2017. Consequently, the proportion between caravans and motorhomes now stands at 56% compared to 44%. Over the past five years, the caravan park has experienced a growth of slightly over 5%, suggesting an impending scenario where motorhomes may surpass caravans in numbers. While this shift is still a distant prospect in the Netherlands, where the camper count rose from 105,000 in 2017 to nearly 180,000 by the end of 2022, there are still 424,000 caravans in the country. Last year, KCI reported a combined count of over 600,000 caravans and campers in the Netherlands, marking the first instance of such a milestone. Among European countries, the Netherlands boasts the highest ownership of motorhomes and caravans, following Germany with almost 1.6 million units, France with 1.15 million, and Great Britain with 835,000.

Caravan And Motorhome Industry Overview

The caravan and motorhomes market is intensely consolidated, with several manufacturers offering products with advanced features. Companies are increasing their market share through strategies such as mergers and acquisitions, partnerships, and collaborations. For instance,

- In October 2023, Mink Campers revealed the latest iteration of its camper series with the MINK-E, an environmentally friendly, fully electric version designed for navigating the challenging and unpredictable terrains of outdoor landscapes. The Mink Camper, measuring 13.5 ft (4.1 meters), maintains its classic and aerodynamic teardrop shape, ensuring a compact size with a weight of 1,150 lbs (520 kg).

- In July 2023, the introduction of the ARB Earth Camper serves as compelling evidence that adventure seekers can opt for a lighter travel trailer without sacrificing the thrill of the caravanning lifestyle.

- In January 2022, Ford-Werke GmbH and Erwin Hymer Group (EHG) signed a framework agreement for the delivery of Ford Transit and Ford Transit Custom as the foundation for customer-ready recreational vehicles and motorhomes. The agreement will allow both companies to capitalize on the growing leisure vehicle market. The supply agreement includes Ford Transit panel van and skeletal chassis cab models, as well as Ford Transit Custom kombi vans, for conversion into camper vans, semi-integrated motorhomes, and alcove motorhomes by EHG brands.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market size in value USD Billion)

- 5.1 Product Type

- 5.1.1 Caravan

- 5.1.1.1 Travel Trailers

- 5.1.1.2 Fifth-wheel Trailers

- 5.1.1.3 Folding Camp Trailers

- 5.1.1.4 Truck Campers

- 5.1.2 Motorhome

- 5.1.2.1 Type A

- 5.1.2.2 Type B

- 5.1.2.3 Type C

- 5.1.3 By End User

- 5.1.3.1 Direct Buyers

- 5.1.3.2 Fleet Owners

- 5.1.1 Caravan

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.4.1 South America

- 5.2.4.2 Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Thor Industries Inc.

- 6.2.2 Swift Group

- 6.2.3 Forest River Inc.

- 6.2.4 Winnebago Industries Inc.

- 6.2.5 Burstner GmbH & Co. KG

- 6.2.6 Triple E Recreational Vehicles

- 6.2.7 Hymer GmbH & Co. KG

- 6.2.8 Jayco Inc.

- 6.2.9 Dethleffs GmbH & Co. KG

- 6.2.10 Knaus Tabbert AG

- 6.2.11 Trigano SA