|

시장보고서

상품코드

1443913

모터홈 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Motorhome - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

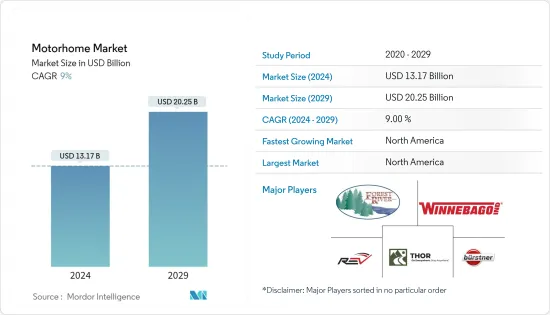

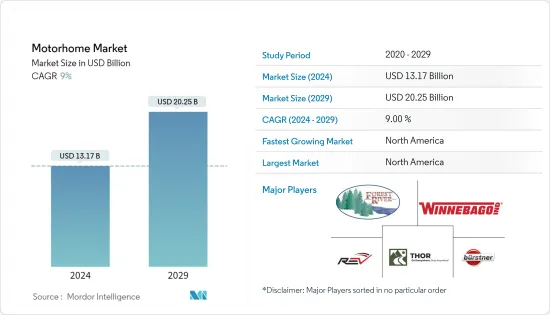

모터홈 시장 규모는 2024년 131억 7,000만 달러에 이를 것으로 추정됩니다. 2029년까지 202억 5,000만 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 9%의 연평균 복합 성장률(CAGR)을 나타낼 전망입니다.

COVID-19의 발생은 모터홈 산업에 다양한 영향을 미쳤습니다. 캠핑카에서의 캠핑은 집에서 생활하는 것과 마찬가지로 거주, 수면, 요리 및 위생 옵션을 갖춘 독립적 인 여행이 가능하기 때문에 대유행 중 및 대유행 후 가장 안전한 휴가 중 하나로 간주됩니다. 또한 모터홈 제조업체는 고객에게 차량의 편안함, 고급 스러움 및 최적의 에너지 효율성을 제공합니다. 따라서 캠핑카가 더 안전한 캠핑카에서 휴가를 선호하기 시작함에 따라 캠핑카 시장은 모멘텀을 얻기 시작했으며 향후 몇 년동안 계속 성장할 것으로 예상됩니다. 예를 들어, 2022년 1월, Entegra 코치는 메르세데스 벤츠 스프린터 4X4 플랫폼에 구축된 Entegra 클래스 B 모터홈을 출시했습니다.

장기적으로 대규모 승객 그룹의 편안한 여행과 숙박에 대한 수요가 빠르게 증가하고 있으며, 이는 전 세계적으로 모터홈의 도입을 촉진할 것입니다. 전통적인 휴가 패키지에서 로드트립으로의 소비자 선호도 변화로 인해 견인 가능한 전기 RV 차량에 대한 시장 수요가 증가하고 있습니다. 또한, 엄격한 자동차 배기가스 규제 시행으로 인해 소비자들은 전기 자동차 및 하이브리드 RV로 전환하여 시장 규모를 확대할 것입니다. 예를 들어, 2022년 8월에는 Opel Zafira-e Life를 기반으로 한 Crosscamp Flex가 최신 모델로 출시될 예정입니다. 독일 뒤셀도르프에서 열린 캐러밴 살롱 2022에서 첫 선을 보였으며, 2023년에 판매가 시작될 예정입니다. 전동식 Crosscamp Flex는 75kWh의 배터리를 탑재하고 WLTP 주행거리는 200마일입니다.

모터홈은 다른 일반적인 휴가 활동에 비해 여행 비용이 저렴하다는 추가적인 이점도 있습니다. 앞서 언급 한 장점으로 인해 최근 몇 년동안 캠핑카에 대한 시장의 관심이 높아졌으며 이는 앞으로도 계속 될 것으로 예상됩니다. 반면, 모터홈의 높은 임대 비용은 시장 성장을 제한할 것으로 예상됩니다.

북미는 이 지역의 캠핑카 소유 가구(주로 밀레니얼 세대) 증가와 캠핑카 대여에 대한 수요 증가로 인해 2021년 세계 캠핑카 시장에서 큰 비중을 차지할 것으로 예상됩니다.

모터홈 시장 동향

부유층과 밀레니얼 세대 증가

노동인구 증가는 1인당 소득 증가에 크게 기여하고 있습니다. 그 결과 많은 HNWI(고액자산가)의 여행, 캠핑 등 여가 활동에 대한 지출이 전 세계적으로 증가하고 있습니다.

미국은 세계 최대 경제 대국이자 대부분의 부유층이 살고 있는 국가입니다. 중국의 인구는 세계 최대 규모이며, 지속적으로 성장하는 경제와 방대한 비즈니스 기회와 함께 중국의 부유층 수가 증가하는 주요 요인으로 작용하고 있으며, 2022년 11월기존 차량 및 전기 자동차, 중형 및 대형 상용차용 완전 자동 변속기의 주요 설계 및 제조 업체 인 Allison Transmission Co. 회사 인 Allison Transmission은 중국 캠핑카 시장에서 견인력을 얻기 위해 Qingling Automobile과 성공적으로 제휴하여 10 개 이상의 새로운 중국 RV 브랜드가 Qingling 700P 소형 트럭 섀시와 Allison 변속기 사용으로 인기를 얻었습니다. 를 사용하여 인기를 얻고 있습니다.

세계 부 보고서에 따르면 호주의 억만장자는 2020년에 4% 증가했다고 합니다. 이는 호주의 GDP의 7%를 차지하는 광산 사업 증가에 기인합니다. 인도는 억만장자 수는 적지만 '성장의 원동력'으로 알려져 있습니다. 개인 억만장자가 성장하고 경제에 기여할 수 있는 큰 기회를 제공합니다.

1인당 소득이 증가하고 부유층이 증가함에 따라 전 세계적으로 여행 및 캠핑과 같은 레크리에이션 활동에 대한 평균 지출이 증가하고 있습니다. 캠핑과 여행은 밀레니얼 세대 사이에서 레크리에이션 활동으로 점점 더 인기를 얻고 있습니다.

또한, 독일 구매자들은 더 많은 편의 기능과 기능을 중시하고 있습니다. 차량에 연결된 모바일 애플리케이션의 인기가 높아지고 있으며, 탱크의 물과 휘발유 수준, 배터리용량 등의 세부 정보를 표시하는 모바일 애플리케이션이 인기를 끌고 있습니다. 유럽 캐러밴 연맹에 따르면 2021년 독일에서 82,017대의 캠핑카가 새로 등록되었습니다. 또한 독일에는 광범위한 캠핑장 네트워크가 있습니다. 이 모든 요인들이 향후 캠핑카의 성장으로 이어질 것입니다.

북미가 시장에서 중요한 역할을 할 것으로 기대됨

북미는 이 지역의 캠핑카 소유 가구(대부분 밀레니얼 세대) 증가와 캠핑카 대여에 대한 수요 증가로 인해 예측 기간 동안 상당한 점유율을 차지했습니다. 미국은 세계 주요 RV 제조 기지 중 하나입니다. RV 산업 협회가 의뢰한 조사에 따르면 미국의 RV 소유율은 빠르게 증가하고 있습니다.

- RV 산업 협회가 제조업체를 대상으로 실시한 2021년 12월 조사에 따르면 2021년 RV 총 출하량은 600,240대의 기록적인 도매 출하량을 기록했으며, 2017년 총 출하량 504,599대 대비 19% 증가했습니다.

- 2021년 RV 총 출하량은 2020년 출하량 43만 412대보다 39.5% 증가했습니다. 전통적인 여행용 트레일러를 필두로 한 견인형 RV는 2020년 대비 39.6% 증가한 54만 4,028대의 도매 출하량으로 2021년을 마감했습니다. 캠핑카는 전년 대비 37.8% 증가한 것으로 나타났습니다. 56,212대가 판매되었습니다. 파크 모델 RV는 2020년 대비 5.7% 증가한 3,923대가 출하되어 2020년을 마감했습니다.

모터홈은 미국에서 휴가, 동반자, 반려동물 동반 여행, 비즈니스, 야외 스포츠 및 기타 레저 활동뿐만 아니라 야외 스포츠 및 기타 레저 활동을 위한 선호 교통 수단으로 인기가 높습니다. 국내 캠핑장 수 증가는 캠핑카를 이용한 레저 여행에 대한 선호도가 점점 더 높아지고 있음을 반영합니다. 이에 따라 주요 기업들은 신제품을 개발하고 EV 캠핑카에 집중하고 있으며, 2022년 1월 토르(Thor)는 주행거리 300마일의 콘셉트 EV 캠핑카를 발표했습니다. 이 회사는 전기차와 트럭에 대한 소비자의 선호도가 변화함에 따라 캠핑카의 성장 궤도도 그려질 수 있다고 말했습니다.

또한, 판매자들은 새로운 모터홈 모델뿐만 아니라 중고차 및 자격을 갖춘 대출자가 이용할 수 있는 융자 옵션에 대해서도 유리한 거래와 혜택을 제공합니다. 이러한 차량에 대한 수요가 급증하면서 이 기회를 포착하고 시장을 독점하려는 저명한 금융 관계자들의 관심을 불러일으키고 있습니다.

젊은 세대의 모터홈 채택 증가, 기술 발전으로 인한 모터홈 도입, 건전한 경제는 예측 기간 동안 시장 성장에 크게 기여할 것으로 예상됩니다.

모터홈 산업 개요

대기업은 비용 절감을 통해 판매를 강화하려고 노력하는 반면, 소규모 기업은 신제품 출시 및 확장에 주력하고 있습니다. 시장 리더는 소규모 기업을 인수하려고 노력하고 있으며, 2022년 1월RV 제조업체 인 Winnebago Industries는 동종 최초의 "완전 전기 무공해 모터홈"개념을 발표했습니다. 이로써 이 회사는 전기 모터홈 시장으로 확장하려는 자동차 제조업체의 대열에 합류하게 됩니다.

모터홈 시장의 주요 기업으로는 Thor Industries, Inc., Winnebago Industries, Inc. 메르세데스-벤츠는 2021년 8월, 뒤셀도르프 캐러밴 살롱에서 신형 소형 밴 '신형 시탄'을 첫 공개할 예정이라고 밝혔습니다. 이 스탠드에는 Le Voyageur, Kabe, Eura Mobil, Alphavan의 메르세데스-벤츠 스프린터를 기반으로 한 모터홈과 메르세데스-벤츠 마르코 폴로(Marco Polo) 모터홈 밴 모델도 함께 전시될 예정입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

- 업계의 매력 - Porter의 Five Forces 분석

- 신규 진출업체의 위협

- 바이어의 교섭력

- 공급 기업의 교섭력

- 대체 제품의 위협

- 경쟁 기업간 경쟁도

제5장 시장 세분화

- 유형별

- 클래스 A

- 클래스 B

- 클래스 C

- 최종사용자별

- 플릿 소유자

- 직접 구입자

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 한국

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카공화국

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 개요

- Thor Industries, Inc.

- Winnebago Industries, Inc.

- Dethleffs GmbH &Co. KG

- Hymer GmbH &Co. KG

- Forest River Inc.

- Rapido Motorhomes

- The Swift Group

- Tiffin Motorhomes Inc.

- Triple E Recreational Vehicles

- BURSTNER GMBH &CO. KG

제7장 시장 기회와 향후 동향

LSH 24.03.13The Motorhome Market size is estimated at USD 13.17 billion in 2024, and is expected to reach USD 20.25 billion by 2029, growing at a CAGR of 9% during the forecast period (2024-2029).

The COVID-19 outbreak had a mixed effect on the motorhome industry. Camping in motorhomes can be seen as one of the safest vacations during and post-pandemic period as one can travel independently with living, sleeping, cooking, and sanitary options, which is similar to living at home. Moreover, motorhome manufacturers provide comfort, luxury, and optimal energy efficiency in the vehicles for the customers. Therefore, the motorhome market began to gain traction as campers began to prefer safer motorhome vacations, and growth is expected to continue in the coming years. For instance,

Key Highlights

- In January 2022, Entegra coach launched the Entegra Class B motorhome built on the Mercedes Benz Sprinter 4X4 platform.

Over the long term, rapidly increasing demand for comfortable travel and accommodation of large passenger groups will fuel the adoption of Motorhomes across the globe. The shift in consumer preference from conventional holiday packages to road trips drives the market demand for towable and motorized recreational vehicles. Further, implementing stringent vehicle emission regulations encourages consumers to switch to electric and hybrid recreational vehicles, augmenting the market size. For instance,

Key Highlights

- In August 2022, The Crosscamp Flex, which is based on an Opel Zafira-e Life, was the most recent model on the horizon. It debuted at the Caravan Salon 2022 in Dusseldorf, Germany, and sales will begin in 2023. The electric Crosscamp Flex is powered by a 75-kilowatt-hour battery and has a WLTP driving range of 200 miles.

Motorhomes have the added benefit of lowering excursion costs when compared to other common get-away activities. The previously mentioned benefits have been driving market interest in motorhomes in recent years, and this is likely to continue in the future. The high rental cost of motorhomes, on the other hand, is expected to limit the market growth.

North America will hold a significant share of the global motorhome market in 2021, owing to an increasing number of motorhome-owning households (mostly millennials) and rising demand for motorhome rentals in the region.

Key Highlights

- In March 2021, Rev Recreation Group (RRG) introduced the new diesel-powered luxury motor coach 2021 American Dream 39RK to add the luxury factor into recreational vehicles.

Motorhome Market Trends

Increasing Nmber of HNWI and Millennials

The growing working population is a significant contributor to rising per capita income. As a result, many HNWI (High Net Worth Individuals) spending on recreational activities, such as traveling and camping, is increasing globally.

The United States has the world's largest economy and is home to most HNWI. China's population as the world's largest, combined with the country's continuously growing economy and tremendous business opportunities, are huge factors for the country's larger number of HNWI. For instance,

- In November 2022, Allison Transmission, a leading designer and manufacturer of conventional and electric vehicles and fully automatic transmissions for medium and heavy commercial vehicles, successfully collaborated with Qingling Motors Co., Ltd to gain traction in the Chinese motorhome market.

- More than ten new Chinese RV brands have gained popularity due to their use of the Qingling 700P light truck chassis and Allison transmission.

According to the world wealth report, Australia's millionaires increased by 4% in 2020, owing to increased mining operations, which contributed 7% of the country's GDP. Although India has fewer millionaires, the country is known as the "engine of growth." It offers enormous opportunities for individual millionaires to grow and contribute to the economy.

With rising per capita income and an increase in the number of HNWI, average spending on recreational activities, such as traveling and camping, is increasing globally. Camping and travel are becoming increasingly popular recreational activities among millennials.

Further, in Germany, buyers are placing value on more comfort and features. Mobile applications linked to the vehicle, with details like water and gas levels in tanks and battery capacity, are becoming popular. According to the European Caravan Federation, in 2021, 82,017 new motorhomes were registered in Germany . Moreover, Germany also has an extensive network of campsites. All these factors are leading to the growth of motorhomes in the upcoming time period.

North America Region Expected to Play Key role in the Market

North America accounted for a sizable share during the forecast period, owing to an increasing number of motorhome-owning households (the majority of which are millennials) and rising demand for motorhome rentals in the region. The United States is one of the world's major RV manufacturing hubs. According to a study commissioned by the Recreation Vehicle Industry Association, RV ownership in the United States is rapidly increasing.

- According to the RV Industry Association's December 2021 survey of manufacturers, total RV shipments for 2021 ended with a record 600,240 wholesale shipments, a 19% increase over the 2017 total of 504,599 shipments.

- Total RV shipments in 2021 are up 39.5% from 430,412 units shipped in 2020. Towable RVs, led by conventional travel trailers, ended 2021 with 544,028 wholesale shipments, a 39.6% increase over 2020. Motorhomes finished up 37.8% from the previous year, with 56,212 units sold. With 3,923 units shipped, Park Model RV completed the year with a 5.7% increase over 2020.

Motorhomes are popular in the United States for vacationing and tailgating, traveling with pets, doing business, and as a preferred mode of transportation for outdoor sports and other leisure activities. The growing number of campgrounds in the country reflects the ever-increasing preference for recreational travel in motorhomes. As a result, major players are developing new products and focusing on EV motorhomes. For instance,

- In January 2022, Thor unveiled a concept EV motorhome with 300 miles range. The company stated that shifting consumer preferences in electric cars and trucks may also portray growth paths for motorhomes.

Furthermore, sellers are offering lucrative deals and benefits not only on new motorhome models but also on pre-owned units and accessible financing options for qualified borrowers. The surge in demand for these vehicles has piqued the interest of prominent financial players who want to seize the opportunity and dominate the market.

Additionally, the younger generation's increasing adoption of motorhomes, the introduction of motorhomes with technological advancements, and a healthy economy are expected to significantly contribute to the market's growth during the forecast period.

Motorhome Industry Overview

Major players are trying to consolidate their sales by cutting costs, while smaller players focus on new product launches and expansions. Market leaders are trying to acquire smaller players. For instance,

- In January 2022, Winnebago Industries, the RV manufacturer, unveiled its concept for an "all-electric zero-emission motorhome," the first of its kind. With it, the company joins a growing list of automakers looking to expand into the electric campervan market.

Some major players in the motorhome market are Thor Industries, Inc., Winnebago Industries, Inc., and Forest River, Inc. The competition among manufacturers has increased over the past few years due to the growing demand for fuel-efficient vehicles.

- In August 2021, Mercedes-Benz announced that its new small van, "the new Citan," will be unveiled at the Caravan Salon in Dusseldorf. The stand will also feature motorhomes based on the Mercedes-Benz Sprinter from Le Voyageur, Kabe, Eura Mobil, and Alphavan, as well as Mercedes-Benz Marco Polo camper van models. The new Citan is an entirely new design.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size Value in USD Billion)

- 5.1 By Type

- 5.1.1 Class A

- 5.1.2 Class B

- 5.1.3 Class C

- 5.2 By End-User

- 5.2.1 Fleet Owners

- 5.2.2 Direct Buyers

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Thor Industries, Inc.

- 6.2.2 Winnebago Industries, Inc.

- 6.2.3 Dethleffs GmbH & Co. KG

- 6.2.4 Hymer GmbH & Co. KG

- 6.2.5 Forest River Inc.

- 6.2.6 Rapido Motorhomes

- 6.2.7 The Swift Group

- 6.2.8 Tiffin Motorhomes Inc.

- 6.2.9 Triple E Recreational Vehicles

- 6.2.10 BURSTNER GMBH & CO. KG