|

시장보고서

상품코드

1692139

유럽의 도로 화물 운송 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

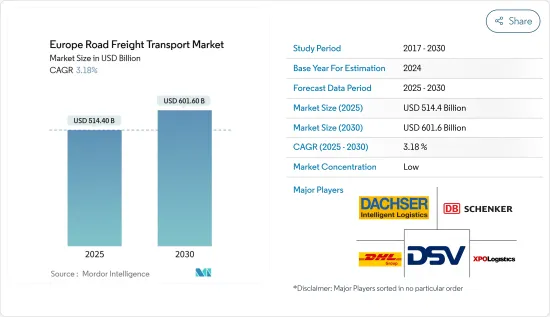

유럽의 도로 화물 운송 시장 규모는 2024년에 4,968억 3,000만 달러로 추정되고, 2030년에는 6,015억 9,000만 달러에 이를 전망이며, 예측 기간(2024-2030년) 중 CAGR 3.24%로 성장할 것으로 예측됩니다.

소매 전자상거래의 급증이 도매 및 소매업 최종 사용자 부문의 진보를 견인

- 2022년 제조 최종사용자 부문은 인간과 로봇의 협동이 증가하여 생산이 촉진되면서 성장했습니다. 독일은 세계 5위의 로봇 시장으로, 2만 2,000대의 산업용 로봇이 다양한 산업에서 활용되고 있으며, 2021년 기준으로 전 세계 로봇 설치 대수의 6%를 차지했습니다. 게다가 2021년에는 독일의 식품 소매 기업인 슈워츠 그룹이 유럽 역내의 총매출액이 1,537억 5,000만 달러에 달해 유럽 제일의 소매 기업으로 떠올랐습니다. 독일에서는 2022년 내구소비재 소매 매출액이 전년 대비 1.50% 증가한 것으로 평가되었습니다. 이는 2022년 개인소비 추정치 5.40% 증가에 힘입은 것입니다.

- 유럽의 석유 및 가스, 광업, 채석 부문에서는 독일의 재기화 계획이 석유 및 가스 최종 사용자 부문의 성장을 가속하는 요인의 하나가 되고 있습니다. 이 나라의 천연가스 수요는 러시아가 공급하고 있습니다. 그 결과 독일은 2022-2026년 유럽에서 가장 높은 LNG 재가스화 능력을 추가할 것으로 예상되며, 2026년까지 이 지역 총 추가 능력의 36%를 차지할 전망입니다. 2022년에는 이탈리아의 에너지 순수입 비용은 2배 이상이 되어 1,132억 4,000만 달러에 이른 것으로 평가됩니다.

- 도매 및 소매업의 최종 사용자 부문은 주로 유럽의 전자상거래 산업의 확대가 예상되고 2023-2027년 CAGR 8.85를 기록할 것으로 예측되고 있기 때문에 향후 수년간 대폭 성장을 이룰 태세입니다. 독일 전자상거래 시장은 2025년까지 6,840만 명의 사용자가 시장에 진입해 2022년 80.1%에서 81.9%의 보급률을 달성할 것으로 예측됩니다.

유럽 전역에서의 도로 화물 운송량 개척 및 인프라 정비를 위한 정부의 대처가 시장 성장을 견인

- 2022년 프랑스의 국제 도로 화물 운송에 의한 EU역내 및 역외 운송 톤수는 주요한 것이었습니다. 예를 들면, 프랑스와 스위스 간의 도로 운송에 의한 EU 역외 EU의 총 수송 톤수는 도로 수송에 의한 총 수송 톤수의 7.3%의 점유율을 차지했으며, 프랑스와 영국 간의 도로 운송에 의한 EU 역외 EU의 총 수송 톤수는 2022년에 6.5%의 점유율을 차지했습니다. 2022년 상반기 도로 운송량은 이탈리아 화물의 68.1%를 차지하고 수송량(톤킬로)은 전년 대비 1.5% 증가했습니다. 이탈리아의 도로 운송 부문의 기업수는, 2022년 말 기준으로 약 100,797사에 이르러, 2021년말 기준의 99,465사에서 1.34% 증가했습니다.

- 도로 화물 운송 시장에서는 독일에서는 약 35,000사의 도로 화물 회사에 약 430,000명의 종업원이 일하고 있어 과거 5년간은 안정되어 있습니다. 2021년 독일 적재량 3.5톤 차량은 96만 4,696대로 2020년 대비 1.3%, 5년간 3.4%의 신장세를 보였습니다. 모든 주요국의 경제활동 저하와 인플레이션으로 인한 연료비와 임금 비용 상승으로 네덜란드에서는 2022년 27주부터 30주에 걸쳐 트럭에 의한 화물 운송이 감소했습니다. 제25주 이후 트럭으로 인한 화물 움직임 감소폭은 2021년 같은 주 대비 주당 9-21% 감소했습니다.

- 북유럽에서는 2022년 트럭의 해외 운송량이 6.7% 증가했습니다. 덴마크로부터의 트럭 수출의 주요 도착지는 네덜란드, 폴란드, 독일로, 전체 수출의 54%의 점유율을 차지했습니다. 영국에서는 수출과 수입 상위 5개국은 장기간에 걸쳐 비교적 일정합니다. 그러나 독일에 대한 수출은 2000년 140만 톤에서 2021년에는 19만 톤으로 감소했습니다.

유럽의 도로 화물 운송 시장 동향

유럽 연합(EU), 경기 회복을 뒷받침하는 135개 운송 프로젝트에 57억 6,000만 달러를 할당

- 운송 및 창고 부문은 다양한 업계의 업무를 지원하는데 중요한 역할을 담당하고 있으며, 독일이 프랑스와 영국을 제치고 압도적인 톱이 되고 있습니다. 세계적으로 독일은 상품의 수출입 모두 제3위입니다. 독일 연방정부는 교통 인프라에 대한 투자를 확대할 의향을 표명해, 2022년에는 연방 고속도로에 120억 유로(128억 달러) 이상, 수로에 약 17억 유로(18억 1,000만 달러)를 할당해 교통망의 개선에 대한 약속을 나타냈습니다.

- 독일 정부는 도로망보다 철도망에 투자할 의향입니다. 2022년에는 독일 철도, 연방정부, 지방정부가 철도 인프라에 약 136억 유로(145억 1,000만 달러)를 투자했습니다. 니더작센주, 함부르크주, 브레멘주, 메클렌부르크=서포메라니아주, 슐레스비히=홀슈타인주는 DB와 손잡고 2030년까지 철도망 현대화에 투자합니다.

- 2022년 유럽 연합(EU)은 약 135개의 교통 인프라 프로젝트에 대한 보조금 54억 유로를 승인했습니다. 이러한 프로젝트는 EU 회원국의 대홍수 후 경제 회복을 지원하고 교통망을 강화하며 지속 가능한 운송을 촉진하고 안전성을 높이며 고용 기회를 창출하는 것을 목적으로 하고 있습니다. 지원되는 프로젝트는 모두 유럽 횡단 교통 네트워크의 일부이며, EU 가맹국을 연결해 2030년까지 TEN-T 코어 네트워크를, 2050년까지 포괄적 네트워크를 완성시킨다는 EU의 목표에 따른 것입니다.

2023년 2월 이후 러시아에서 수입 금지로 중동, 아시아, 북미에서 디젤 수입이 증가하고 있습니다.

- 가솔린 가격은 2022년 1분기에 유로존 19개국 대부분의 리터당 2유로(2.13달러)를 넘어섰습니다. 가격 상승의 주된 이유는 러시아와 우크라이나의 분쟁으로 인한 공급 문제로, 러시아는 EU 석유 수요의 4분의 1 이상을 공급하고 있었습니다. 2021년, 유로권의 가솔린 1리터의 평균 가격은 1.30유로(1.38달러)이었지만, 2022년의 연초에는 1리터당 약 1.55유로(1.65달러)가 되었습니다.

- 러시아는 유럽에서 가장 큰 디젤 공급국입니다. 2023년 유럽에서는 디젤 가격이 하락했습니다. EU가 러시아로부터의 석유제품 수입 금지를 실시한 2023년 2월 이후, 러시아로부터 유럽으로의 디젤 수출은 평균 24,000배럴/일로, 2022년에 러시아가 유럽에 보낸 630,000배럴/일로부터 96% 감소했습니다. 2월부터 5월까지의 유럽으로의 디젤 수출은, 중동으로부터 51%(16만 b/d), 아시아로부터 97%(14만 7,000 b/d), 북미로부터 65%(4만 7,000 b/d) 증가했습니다.

- 덴마크는 가솔린 가격이 가장 높고 핀란드는 디젤 가격이 가장 높습니다. 오스트리아는 휘발유가 가장 싸고 스페인은 디젤이 가장 저렴합니다. 영국의 연료 가격은 2022년에 사상 최고치를 기록했고, 7월 평균 휘발유 가격은 191.53페소/리터, 디젤 가격은 199.05페소/리터에 달했습니다. 2023년 들어 영국 주유소 평균 가격은 리터당 150페소(1.80달러)를 돌파했고 디젤은 리터당 152.41페소(1.83달러)로 상승했습니다. 2023년 1월 스페인의 연료 가격은 영국보다 휘발유 리터당 약 20센트, 디젤로 40센트 낮아졌습니다.

유럽의 도로 화물 운송 산업 개요

유럽의 도로 화물 운송 시장은 세분화되어 있으며 상위 5개 기업에서 5.99%를 차지하고 있습니다. 이 시장의 주요 기업은 다음과 같습니다. Dachser, DB Schenker, DHL Group, DSV A/S(De Sammensluttede Vognmaend af Air and Sea)and XPO, Inc.(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 제안

제3장 서문

- 조사의 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 경제 활동별 GDP 분포

- 경제 활동별 GDP 성장률

- 경제성과 및 프로파일

- 전자상거래 산업의 동향

- 제조업의 동향

- 운수 및 창고업의 GDP

- 물류 실적

- 알바니아

- 불가리아

- 크로아티아

- 체코 공화국

- 덴마크

- 에스토니아

- 핀란드

- 프랑스

- 독일

- 헝가리

- 아이슬란드

- 이탈리아

- 라트비아

- 리투아니아

- 네덜란드

- 노르웨이

- 폴란드

- 루마니아

- 러시아

- 슬로바키아 공화국

- 슬로베니아

- 스페인

- 스웨덴

- 스위스

- 영국

- 도로 길이

- 수출 동향

- 수입 동향

- 연료 가격 동향

- 트럭 운송 비용

- 유형별 트럭 보유 대수

- 주요 트럭 공급업체

- 도로화물 톤수의 동향

- 도로화물 가격 동향

- 모달 점유율

- 인플레이션율

- 규제 프레임워크

- 밸류체인 및 유통채널 분석

제5장 시장 세분화

- 최종 사용자 산업별

- 농업, 어업 및 임업

- 건설업

- 제조업

- 석유 및 가스, 광업, 채석업

- 도매 및 소매업

- 기타

- 수출처별

- 국내 화물

- 국제 화물

- 트럭 적재량별

- 모든 트랙 적재(FTL)

- 소구 화물(LTL)

- 컨테이너 수송별

- 컨테이너 수송

- 컨테이너 없음

- 거리별

- 장거리 수송

- 단거리 수송

- 상품 구성별

- 유체상품

- 고체상품

- 온도 제어별

- 비온도 제어

- 온도 제어

- 국가별

- 프랑스

- 독일

- 이탈리아

- 네덜란드

- 북유럽

- 러시아

- 스페인

- 영국

- 기타 유럽

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- AP Moller-Maersk

- CH Robinson

- Dachser

- DB Schenker

- DHL Group

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- Kuehne Nagel

- Mainfreight

- Scan Global Logistics

- XPO, Inc.

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 물류 시장 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계 밸류체인 분석

- 시장 역학(시장 성장 촉진요인, 억제요인, 기회)

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

- 환율

The Europe Road Freight Transport Market size is estimated at 496.83 billion USD in 2024, and is expected to reach 601.59 billion USD by 2030, growing at a CAGR of 3.24% during the forecast period (2024-2030).

Retail e-commerce surge driving advancements in the wholesale and retail trade end user segment

- In 2022, the manufacturing end-user segment grew due to the rise in human-robot collaboration, which boosted production. Germany is the fifth largest robot market globally, with 22,000 industrial robots utilized in various industries, accounting for 6% of the global robot installations as of 2021. Moreover, in 2021, the Schwarz Group, a German food retailer, emerged as the foremost retail company in Europe, with a total revenue of USD 153.75 billion within the region. In Germany, the retail sales of consumer durables were projected to increase by 1.50% YoY in 2022. This was supported by an estimated 5.40% increase in private consumption in 2022.

- In Europe's oil and gas, mining, and quarrying sectors, German regasification plans are one of the factors driving growth in the oil and gas end-user segments. Russia supplies the country's natural gas needs. As a result, Germany is expected to add the highest LNG regasification capacity in Europe between 2022 and 2026, accounting for 36% of the region's total capacity additions by 2026. In 2022, Italy's net energy import costs are expected to more than double, reaching USD 113.24 billion.

- The wholesale and retail trade end-user segment is poised for substantial growth in the upcoming years, primarily driven by the anticipated expansion of the European e-commerce industry, projected to register a compounded annual growth rate (CAGR) of 8.85 from 2023 to 2027. In the context of the German e-commerce landscape, it is projected that the market will encompass 68.4 million users by 2025, achieving a penetration rate of 81.9%, marking an increase from 80.1% in 2022.

Increasing road freight volume transported across Europe and government initiatives to develop the infrastructure are driving the growth in the market

- In 2022, the EU and extra-EU tons transported by international road freight transportation in France were major. For instance, the total EU/extra-EU transported by road between France and Switzerland held a share of 7.3% of the total tonnage transported by road, and the total EU/extra-EU transported by road between France and the United Kingdom held a share of 6.5% in 2022. Road haulage transported 68.1% of Italian goods during the first half of 2022, resulting in a 1.5% increase in transport (measured in tonne-km) compared to the previous year. The number of companies in the Italian road haulage sector reached approximately 100,797 units at the end of 2022, a rise of 1.34% from 99,465 at the end of 2021.

- The road freight transport market employs about 430,000 employees in Germany in about 35,000 road freight companies, which has been stable over the past five years. The fleet with a carrying capacity of 3.5 tons in 2021 was 964,696 in Germany and had a growth of 1.3% compared to 2020 and 3.4% over five years. The declining activity in all major economies and inflation, which led to a rise in fuel and wage costs, resulted in the decline of freight transportation through trucks between the 27th and 30th week of 2022 in the Netherlands. Since week 25, the weekly decrease in the movement of trucks was 9-21% lower than the same week in 2021.

- In the Nordics, the overseas shipments of trucks increased by 6.7% in 2022. The main destinations for truck exports from Denmark are the Netherlands, Poland, and Germany, with a combined 54% share of total exports. In the UK, the top five countries for exports and imports have remained relatively constant over time. However, exports to Germany decreased from 1.4 million tons in 2000 to 0.19 million tons in 2021.

Europe Road Freight Transport Market Trends

European Union allocated USD 5.76 billion to 135 transportation projects to boost economic recovery

- The transportation and warehouse sector plays a crucial role in supporting operations across various industries, with Germany leading as the dominant player, surpassing France and the United Kingdom. Globally, Germany ranks third in both imports and exports of goods. The German federal government expressed its intention to increase investments in transportation infrastructure, allocating over EUR 12 billion (USD 12.80 billion) for federal highways and around EUR 1.7 billion (USD 1.81 billion) for waterways in 2022, thereby demonstrating its commitment to improving transportation networks.

- The German government intends to invest more in rail than road network. In 2022, Deutsche Bahn, the federal government, and the local and regional governments invested roughly EUR 13.6 billion (USD 14.51 billion) in rail infrastructure. Lower Saxony, Hamburg, Bremen, Mecklenburg-Western Pomerania, and Schleswig-Holstein are partnering with DB to invest in modernizing their rail network by 2030.

- In 2022, the European Union approved EUR 5.4 billion through grants for approximately 135 transport infrastructural projects. These projects aim to aid post-pandemic economic recovery in the EU Member States, enhance transport links, promote sustainable transportation, boost safety, and create job opportunities. All supported projects are part of the Trans-European Transport Network, which connects EU Member States and aligns with the European Union's goal of completing the TEN-T core network by 2030 and the comprehensive network by 2050, all while aligning with climate objectives outlined in the European Green Deal.

Since February 2023, diesel imports from the Middle East, Asia, and North America have increased due to the ban on imports from Russia

- Gasoline prices surpassed EUR 2 (USD 2.13) per liter in most of the 19 eurozone countries in Q1 2022. The main reason behind the increased prices was supply issues due to the conflict between Russia and Ukraine, as Russia supplied more than a quarter of the EU's petroleum needs. In 2021, the average price for a liter of gasoline in the eurozone was EUR 1.30 (USD 1.38); at the start of 2022, the price was about EUR 1.55 (USD 1.65) per liter.

- Russia has been Europe's largest supplier of diesel. In 2023, diesel prices declined in Europe. Since February 2023, when the European Union implemented the ban on petroleum product imports from Russia, diesel exports from Russia to Europe have averaged 24,000 barrels per day (b/d), down by 96% from the 630,000 b/d Russia sent to Europe in 2022. From February through May, diesel exports to Europe increased by 51% (160,000 b/d) from the Middle East, by 97% (147,000 b/d) from Asia, and by 65% (47,000 b/d) from North America.

- Denmark is the most expensive country for petrol, and Finland is the most expensive for diesel. Austria has the cheapest petrol, and Spain is the cheapest for diesel. Fuel prices in the United Kingdom reached record highs in 2022, with the average price of petrol hitting 191.53 p-per-litre and diesel reaching 199.05 p-per-litre in July. The average cost of petrol at UK forecourts has risen to break 150p a liter (USD 1.80) since the start of 2023, and diesel has risen to 152.41p a liter (USD 1.83). Spanish fuel prices were lower than in the United Kingdom by about 20 cents per liter for petrol and 40 cents per liter for diesel in January 2023.

Europe Road Freight Transport Industry Overview

The Europe Road Freight Transport Market is fragmented, with the top five companies occupying 5.99%. The major players in this market are Dachser, DB Schenker, DHL Group, DSV A/S (De Sammensluttede Vognmaend af Air and Sea) and XPO, Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.5.1 Albania

- 4.5.2 Bulgaria

- 4.5.3 Croatia

- 4.5.4 Czech Republic

- 4.5.5 Denmark

- 4.5.6 Estonia

- 4.5.7 Finland

- 4.5.8 France

- 4.5.9 Germany

- 4.5.10 Hungary

- 4.5.11 Iceland

- 4.5.12 Italy

- 4.5.13 Latvia

- 4.5.14 Lithuania

- 4.5.15 Netherlands

- 4.5.16 Norway

- 4.5.17 Poland

- 4.5.18 Romania

- 4.5.19 Russia

- 4.5.20 Slovak Republic

- 4.5.21 Slovenia

- 4.5.22 Spain

- 4.5.23 Sweden

- 4.5.24 Switzerland

- 4.5.25 United Kingdom

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

- 5.8 Country

- 5.8.1 France

- 5.8.2 Germany

- 5.8.3 Italy

- 5.8.4 Netherlands

- 5.8.5 Nordics

- 5.8.6 Russia

- 5.8.7 Spain

- 5.8.8 United Kingdom

- 5.8.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 A.P. Moller - Maersk

- 6.4.2 C.H. Robinson

- 6.4.3 Dachser

- 6.4.4 DB Schenker

- 6.4.5 DHL Group

- 6.4.6 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.7 Kuehne + Nagel

- 6.4.8 Mainfreight

- 6.4.9 Scan Global Logistics

- 6.4.10 XPO, Inc.

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate