|

시장보고서

상품코드

1692561

인도네시아의 도로 화물 운송 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Indonesia Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

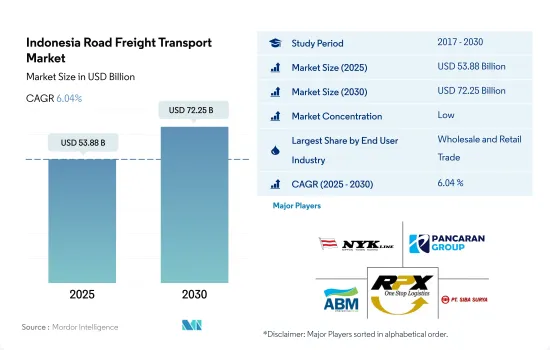

인도네시아의 도로화물 운송 시장 규모는 2025년에 538억 8,000만 달러로 추정되고, 2030년에는 722억 5,000만 달러에 이르고, 예측 기간 중(2025-2030년) CAGR 6.04%로 성장할 것으로 예측됩니다.

도소매업이 제조업과 함께 시장 성장을 견인

- 인도네시아의 소매 부문은 아시아에서 가장 유망한 부문 중 하나이며 방대한 인구, 구매력을 늘린 중간층 확대, 현대 소비 습관의 진화에 힘입어 2024년 7월 인도네시아의 소매 매출은 전년 동월 대비 4.5% 증가하고 6월의 2.7% 증가로 현저한 성장을 보였습니다.

- 인도네시아에서 농업 부문은 특히 기술 도입으로 성장하는 태세를 갖고 있습니다. 또한 인도네시아는 자급자족과 바이오에탄올의 목표 강화를 위해 2030년까지 설탕 생산량을 약 300% 증가시키는 것을 목표로 하고 있습니다.

인도네시아 도로화물 운송 시장 동향

운송 및 보관 부문은 인프라 프로젝트 증가에 힘입어 GDP 기여 증가가 예상된다.

- 2024년 5월 일본 정부는 인도네시아 자카르타의 고속철도 건설에 약 1,407억엔(9억 달러)의 대출을 실시했습니다. 2031년까지의 2기로 나누어 실시됩니다. 이 철도선에는 열차와 신호 시스템 모두에 일본의 첨단 기술이 도입됩니다.

- 운송은 국가 인프라 확장 노력의 최전선에 있습니다. 인도네시아에서 중요한 사업은 135km에 이르는 록스마웨-란사 유료도로입니다. 이 유료 도로는 물류를 최적화해, 수송 및 저장 부문의 GDP에 대한 기여를 높이는데 도움이 될 것 같습니다.

인도네시아는 2022년 원유 가격 상승과 보조금 압력 가운데 재정 과제에 직면했지만, 세율은 2024년까지 유지됐습니다.

- 2024년 11월, 인도네시아는 연료 보조금 제도를 개혁했습니다. 신 대통령은 2023년에 정부 지출의 약 16%를 차지하고 있던 보조금의 삭감을 목표로 하고 있습니다. 현재 보조금은 인플레이션을 억제하는 데 도움이 되고 있지만, 세계의 원유 가격의 변동에 노출되어 있습니다.

- 2024년 6월 현재 인도네시아 에너지 미네랄 자원부(ESDM)는 그린 수소 산업의 성장을 가속하기 위해 그린 수소 개발자에 대한 인센티브 및 감세를 제공하기 위한 규제를 초안했습니다. 이 분야는 수출 상품도 될 수 있습니다.

인도네시아 도로화물 운송 산업 개요

인도네시아의 도로화물 운송 시장은 단편화되어 있으며, 이 시장의 주요 기업은 NYK (Nippon Yusen Kaisha) Line, Pancaran Group, PT ABM Investama TBK(PT Cipta Krida Bahari 포함), PT Repex Wahana(RPX), PT Siba Surya의 5개 기업입니다(알파벳순).

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트·지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 경제 활동별 GDP 분포

- 경제활동별 GDP 성장률

- 경제성과 및 프로파일

- 전자상거래 산업의 동향

- 제조업의 동향

- 운수 및 창고업의 GDP

- 물류 실적

- 도로의 길이

- 수출 동향

- 수입 동향

- 연료 가격 동향

- 트럭 운송 비용

- 유형별 트럭 보유 대수

- 주요 트럭 공급업체

- 도로화물 톤수의 동향

- 도로화물 가격 동향

- 모달 점유율

- 인플레이션율

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 최종 사용자 산업

- 농업, 어업, 임업

- 건설업

- 제조업

- 석유 및 가스, 광업, 채석업

- 도소매업

- 기타

- 수출처

- 국내화물

- 국제화물

- 트럭 적재량

- Full Truckload(FTL)

- Less-than-truckload(LTL)

- 컨테이너 수송

- 컨테이너 수송

- 컨테이너 없음

- 수송 거리

- 장거리 수송

- 단거리 수송

- 상품 구성

- 유체상품

- 고체상품

- 온도 제어

- 비온도 제어

- 온도 제어

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- CJ Logistics Corporation

- DHL Group

- NYK(Nippon Yusen Kaisha) Line

- Pancaran Group

- PT ABM Investama TBK(including PT Cipta Krida Bahari)

- PT Citrabati Logistik International

- PT Prima International Cargo

- PT Repex Wahana(RPX)

- PT Samudera Indonesia Tangguh

- PT Siba Surya

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 물류 시장 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계 밸류체인 분석

- 시장 역학(시장 성장 촉진요인, 억제요인, 기회)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

- 환율

The Indonesia Road Freight Transport Market size is estimated at 53.88 billion USD in 2025, and is expected to reach 72.25 billion USD by 2030, growing at a CAGR of 6.04% during the forecast period (2025-2030).

Wholesale and retail trade, along with manufacturing, are leading the growth of the market

- Indonesia's retail sector stands out as one of the most promising in Asia, bolstered by its vast population, an expanding middle class with increased purchasing power and evolving modern spending habits. In July 2024, retail sales in Indonesia surged by 4.5% YoY, a notable leap from June's 2.7% uptick. This uptick not only marked the third straight month of rising retail turnover but also represented the swiftest pace since March. The momentum was largely driven by ongoing government cash transfers, which bolstered consumer spending. Notably, food sales saw a robust 6.5% increase in July 2024. This uptick in retail sales subsequently spurred a heightened demand for road freight services.

- In Indonesia, the agriculture sector is poised for growth, especially with the infusion of technology. The Ministry of Agriculture, through its Agricultural Quarantine Agency (Barantan), unveiled the "Agro Gemilang" initiative, dubbed "Let's Encourage Exports of the Nation's Millennial Generation," to bolster agricultural exports in the years ahead. Furthermore, Indonesia is targeting a nearly 300% increase in sugar production by 2030, with aspirations of self-sufficiency and bolstering its bioethanol objectives.

Indonesia Road Freight Transport Market Trends

The transportation and storage sector expected to witness boost in GDP contributions, fueled by rising infrastructure projects

- In May 2024, the Japanese government extended a loan of approximately JPY140.7 billion (USD 900 million) for the construction of a high-speed rail line in Jakarta, Indonesia. Spanning 84.1 km, the East-West rail project will be executed in two phases, commencing in 2026 and concluding by 2031. The rail line will incorporate advanced Japanese technology for both trains and signaling systems. These initiatives are poised to enhance the GDP contribution from the transport and storage sector.

- Transportation is at the forefront of the nation's infrastructure expansion efforts. In this domain, ongoing and upcoming initiatives allocate 29% of their overall value to road projects, 22% to rail, and 23% to port infrastructure. These projects are crucial for enhancing connectivity and boosting economic growth. A significant undertaking in Indonesia is the Lhokseumawe to Langsa Toll Road, spanning 135 km. Commencing in early 2024, this ambitious project is slated for completion by late 2027, with the goal of alleviating traffic congestion and shortening travel times. This toll road will be instrumental in optimizing logistics and boosting the transport and storage sector's contribution to GDP.

Indonesia faced fiscal challenges amid surging crude oil prices and subsidy pressures in 2022, however the rates remained unchanged till 2024

- In November 2024, Indonesia reformed its fuel subsidy system. The new president is targeting a reduction in subsidies, which constituted roughly 16% of government spending in 2023. While the subsidy for LPG will stay the same, the government is still determining adjustments for fuel and electricity subsidies. Indonesia's energy subsidies help keep inflation low but expose the nation to global oil price swings. The government plans to replace these subsidies with cash transfers for needy families, aiming to save about USD 12.99 billion through more targeted support.

- As of June 2024, the Indonesian Ministry of Energy and Mineral Resources (ESDM) was drafting regulations to provide incentives and tax relief for green hydrogen developers to boost the industry's growth. ESDM aimed to produce 9.9 million tons of hydrogen per year by 2060 to meet the needs of industry (3.9 Mtpa), transportation (1.1 Mtpa), electricity (4.6 Mtpa), and household gas networks (0.28 Mtpa). These sectors could also become export commodities.

Indonesia Road Freight Transport Industry Overview

The Indonesia Road Freight Transport Market is fragmented, with the major five players in this market being NYK (Nippon Yusen Kaisha) Line, Pancaran Group, PT ABM Investama TBK (including PT Cipta Krida Bahari), PT Repex Wahana (RPX) and PT Siba Surya (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 CJ Logistics Corporation

- 6.4.2 DHL Group

- 6.4.3 NYK (Nippon Yusen Kaisha) Line

- 6.4.4 Pancaran Group

- 6.4.5 PT ABM Investama TBK (including PT Cipta Krida Bahari)

- 6.4.6 PT Citrabati Logistik International

- 6.4.7 PT Prima International Cargo

- 6.4.8 PT Repex Wahana (RPX)

- 6.4.9 PT Samudera Indonesia Tangguh

- 6.4.10 PT Siba Surya

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate