|

시장보고서

상품코드

1910591

리튬이온 배터리 분리막 시장 : 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Lithium-ion Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

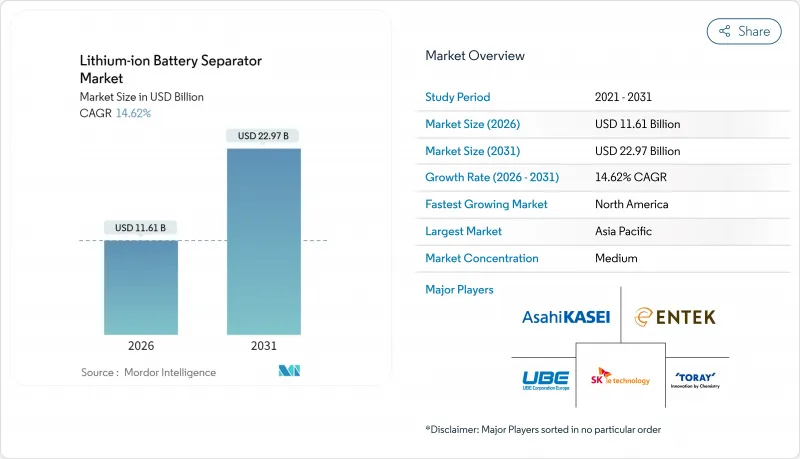

리튬이온 배터리 분리막 시장은 2025년 101억 3,000만 달러에서 2026년에는 116억 1,000만 달러로 성장하고 2026년부터 2031년에 걸쳐 CAGR 14.62%로 성장을 지속하여 2031년에는 229억 7,000만 달러에 달할 전망입니다.

새로운 수요는 전기자동차(EV) 및 대규모 축전 시스템에 의해 발생하고 있으며, 이들은 고니켈 화학 조성과 가혹한 급속 충전 프로파일을 견딜 수 있는 초박형 세라믹 코팅막을 점점 요구하고 있습니다. 습식 공정에 의한 폴리올레핀 분리막은 여전히 주류이지만, 자동차 제조업체가 열전파 방지 대책을 강화함에 따라 코팅 가공품이 빠르게 성장하고 있습니다. 자본은 국내 조달 의무가 있는 지역으로 유입되고 있습니다. 아사히화성의 15억 6,000만 캐나다 달러 규모 온타리오 복합시설은 공급구조를 재편하는 선구자 우대책의 좋은 예입니다. 한편, 북미의 세액 공제, 유럽의 배터리 규제, 중국의 기가팩토리 건설은 세계의 무역 흐름을 분단해 지역 조달을 인증하면서 비용 효율적인 수지 통합에 성공한 공급자를 우대하고 있습니다.

세계의 리튬이온 배터리 분리막 시장의 동향 및 인사이트

리튬이온 배터리의 가격 하락

2024년에는 팩 가격이 100달러/kWh를 밑돌았습니다. 이는 탄산 리튬 비용의 감소와 중국의 셀 과잉 생산 능력에 기인합니다. 가격 탄력성 확대로 신흥 시장에서의 EV 보급이 진행되고, 분리막의 제곱미터당 수요도 연동하여 증가하고 있습니다. 셀 제조업체가 라인 효율화를 위해 코팅 공정을 외부로 위탁하는 경향이 강해지면서, 코팅 필름의 점유율이 확대되고 있습니다. 이에 따라 신규 통합 공장의 목표인 20% 이익률이 뒷받침되고 있습니다. 비용 저하는 기술 업그레이드 사이클의 단축도 촉진하며 내구성을 유지한 박막화가 진행되고 있습니다.

급증하는 세계의 EV 보급

2024년 세계 EV 판매량은 1,700만 대를 돌파했으며, 여기에는 약 21억 평방미터의 분리막 재료가 소비되었습니다. 고니켈 양극재는 발열을 증가시키기 때문에 200°C 이상에서도 안정된 세라믹 코팅 또는 아라미드 강화 분리막의 도입이 요구됩니다. 혼다의 2040년 이후 로드맵 등 자동차 제조업체의 전동화에 대한 대처에 의해 다개년에 걸친 분리막 계약이 체결되어 시장의 변동이 완화됩니다.

폴리올레핀 수지의 수급 불균형

초고분자 폴리에틸렌의 생산 능력은 2022년 이후 수요를 8포인트 밑돌고 있으며, 수지 가격의 상승과 비통합형 제조업체에게 어려움을 초래하고 있습니다. 아사히화성의 자사 수지 공급망은 변동을 완화하여 스팟 수지 경쟁사와 비교해 라인 속도를 배로 증가시키고 있습니다. 북미는 공급 부족으로 신규 참가 기업이 수지의 수입과 세피온사의 아라미드 혼방 수지 등 대체 폴리머의 도입을 요구받고 있습니다.

부문 분석

2025년 시점에서 습식 폴리올레핀은 리튬이온 배터리 분리막 시장의 60.05%를 차지하였습니다. 이 지위는 균일한 기공률과 1마이크로미터 미만의 기공 제어 기술에 의해 구축된 것입니다. 그러나 세라믹 코팅 제품은 CAGR 22.05%로 확대되었으며 175°C 이상의 셧다운 온도를 요구하는 자동차 계약을 획득했습니다. 인라인 코팅은 성형과 슬러리 도포를 일체화하여 수율 손실을 2% 미만으로 줄이고 이익률을 5-7포인트 향상시킵니다.

무코팅 폴리올레핀은 여전히 비용이 많이 드는 장치에 사용되지만 스마트폰조차도 더 얇은 코팅 분리막으로 전환하는 가운데 그 존재감은 희미해지고 있습니다. PVDF-HFP 블렌드와 같은 기능성 폴리머 오버레이는 전해액 접촉각을 5° 미만으로 억제하고 형성 시간을 40% 단축하여 3차 기술 혁명을 시사하고 있습니다.

폴리프로필렌의 점유율 48.02%는 성숙한 압출 라인과 낮은 수지 비용을 반영합니다. 폴리에틸렌은 130°C의 융점 셧다운 특성에 의해 습식 프로세스 배합으로 계속 우위를 유지하지만, 다층 PP/PE/PP 적층 구조가 자동차용 출하량의 3분의 1을 차지하게 되었습니다. 부직포 아라미드 나노섬유 막은 300°C에서의 치수 안정성과 200MPa 이상의 인장 강도를 유지하지만 가격은 15-25 USD/kg입니다.

저온 중축합으로 인한 비용 절감으로 3년 이내에 아라미드 가격이 반감될 수 있어 고급 전기차 및 항공우주 분야에서의 도입 확대가 전망됩니다. 재활용 과제는 여전히 존재합니다. 폴리올레핀 필름은 다운사이클이 가능하지만, 아라미드는 재활용 경로가 없고, 이는 유럽의 2027년 규제 프레임워크에 있어서 과제가 되고 있습니다.

리튬이온 배터리 분리막 시장의 보고서는 분리막 유형(습식 프로세스, 건식 프로세스, 세라믹 코팅), 소재(폴리프로필렌, 부직포, 기타), 두께(15mm 이하, 16-20mm, 그 이상), 형상(파우치형, 원통형, 각형), 코팅(무코팅 폴리올레핀, 인라인 세라믹, 기타), 용도(자동차용 EV, 기타), 지역(북미, 아시아태평양, 기타)으로 분류됩니다.

지역별 분석

2025년 시점에서 아시아태평양은 리튬이온 배터리 분리막 시장의 49.75%를 차지하였으며, 중국이 세계 생산 능력의 75%를 차지하여 이를 견인하였습니다. 중국 기업은 수지의 통합과 노동력의 우위성에 의해 분리막 비용을 일본의 경쟁사보다 30-40% 절감했습니다. 일본의 점유율은 도레이와 스미토모화학이 범용품 등급에서 철수하고 고체배터리의 틈새 시장으로 이행했기 때문에 2018년 35%에서 2021년 20%로 하락했습니다. 한국의 SK아이이테크놀로지는 유럽에서 47.5GWh의 배터리 생산 능력을 보유하고 있지만, 2024년에는 2,910억원의 손실을 계상했으며 이는 이익률의 축소를 나타내고 있습니다.

북미는 CAGR 21.43%로 가장 성장이 빠른 지역이며, 인플레이션 억제법의 우대 조치와 50억 달러를 넘는 분리막 투자 발표가 이를 뒷받침하고 있습니다. 아사히화성의 온타리오 공장은 2027년까지 연간 7억 평방미터의 생산 능력과 지역 점유율 30%를 목표로 하고 있으며, 마이크로포러스사와 세피온사는 각각 버지니아주와 캘리포니아주에서 생산 능력을 확대하고 있습니다. 정책의 안정성은 여전히 중요하며 세액 공제의 폐지는 자산의 유휴화를 초래할 수 있습니다.

유럽 시장은 탄소 실적 규제와 재생재 함량 규제에 의해 현지 생산이 우월한 구조입니다. SK아이이테크놀로지의 폴란드 공장은 3억 4,000만 m2의 생산 능력을 추가하지만, 회사의 재무적 압박은 장기 공급 전망을 불투명하게 합니다. 유럽의 셀 제조업체인 노스볼트, ACC, 베르콜은 자사제 분리막의 개발을 추진하고 있어 기존 제조업체에의 압력을 한층 더 강화하고 있습니다. 남미와 중동, 아프리카는 여전히 소규모이지만, 브라질에서 2024년 15만대의 EV가 도입되었고 사우디아라비아의 산업 정책에 의해 2027년 이후 소규모 현지 생산 능력이 발생할 수 있습니다.

기타 혜택

- 시장 예측(ME) 엑셀 시트

- 3개월 애널리스트 서포트

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 촉진요인

- 리튬이온 배터리 가격의 저하 경향

- 급증하는 세계 전기자동차 보급

- 거치형 에너지 저장 프로젝트의 급속한 성장

- 국내 배터리 공급망에 대한 정부의 우대조치

- OEM이 추진하는 고니켈 양극재용 초박형 분리막

- 지역별 분리막 기가팩토리를 뒷받침하는 현지화 의무

- 억제요인

- 폴리올레핀 수지의 수급 불균형

- 엄격한 안전 및 품질 인증 타임라인

- 습식 프로세스 라인에서의 용매 회수 비용

- 사용 분리막의 재활용 제한

- 공급망 분석

- 규제 상황

- 기술 전망

- Porter's Five Forces

- 공급자의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모 및 성장 예측

- 분리막별

- 습식 폴리올레핀

- 건식 폴리올레핀

- 세라믹 코팅

- 재료별

- 폴리프로필렌(PP)

- 폴리에틸렌(PE)

- 다층 PP/PE/PP

- 부직포 및 기타

- 두께별

- 15마이크로미터 이하

- 16-20µm

- 21-25µm

- 25µm 초과

- 배터리 형상별

- 파우치형 배터리

- 원통형 배터리

- 각형 배터리

- 코팅 기술별

- 인라인 세라믹 코팅

- 오프라인 세라믹 코팅

- 기능성 폴리머 코팅

- 무코팅 폴리올레핀

- 용도별

- 자동차 EV

- 소비자용 전자기기

- 거치형 에너지 저장

- 산업용 공구 및 전동 공구

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 북유럽 국가

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ASEAN 국가

- 호주 및 뉴질랜드

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 움직임(M&A, 제휴, PPA)

- 시장 점유율 분석(주요 기업의 시장 순위 및 점유율)

- 기업 프로파일

- Asahi Kasei Corporation

- Toray Industries Inc.

- SK IE Technology Co. Ltd

- Entek International LLC

- Ube Corporation

- Sumitomo Chemical Co. Ltd

- Celgard LLC(Polypore)

- W-Scope Corporation

- Shenzhen Senior Technology

- Cangzhou Mingzhu Plastic

- Suzhou GreenPower

- Sinoma Science & Tech

- Dreamweaver International

- Gellec Co. Ltd

- Zhongke Science & Tech

- Mitsubishi Paper Mills

- Foshan Jinhui Hi-Tech

- Freudenberg Performance Materials

- Xiangyang Xingyuan

- Teijin Ltd

- Others(validated niche players)

제7장 시장 기회 및 미래 전망

CSM 26.01.28The Lithium-ion Battery Separator Market is expected to grow from USD 10.13 billion in 2025 to USD 11.61 billion in 2026 and is forecast to reach USD 22.97 billion by 2031 at 14.62% CAGR over 2026-2031.

New demand stems from electric vehicles and utility-scale storage, which increasingly specify ultra-thin, ceramic-coated membranes that tolerate high-nickel chemistries and aggressive fast-charge profiles. Wet-process polyolefin separators still dominate, yet coated variants are growing rapidly as automakers elevate thermal-propagation safeguards. Capital is flowing to regions with domestic-content mandates; Asahi Kasei's CAD 1.56 billion Ontario complex exemplifies the first-mover incentives now reshaping the supply map. Meanwhile, North American tax credits, Europe's Battery Regulation, and China's gigafactory build-out are fragmenting global trade flows and rewarding suppliers that certify regional provenance while mastering cost-effective resin integration.

Global Lithium-ion Battery Separator Market Trends and Insights

Declining Lithium-Ion Battery Prices

Pack prices dipped below USD 100 kWh in 2024, aided by lower lithium carbonate costs and Chinese cell overcapacity. Price elasticity widens EV adoption in emerging markets, elevating separator square-meter demand in lockstep. Coated films gain share because cell makers outsource that step for in-line efficiency, supporting 20% margin targets at new integrated plants. Cost deflation also shortens technology refresh cycles, encouraging thinner membranes without sacrificing durability.

Accelerating Global EV Adoption

Global EV sales topped 17 million in 2024, consuming about 2.1 billion m2 of separator material. Nickel-rich cathodes intensify heat generation, forcing the adoption of ceramic-coated or aramid-reinforced separators stable above 200 °C. Automaker electrification pledges, such as Honda's post-2040 roadmap, lock multi-year separator contracts and mitigate market volatility.

Polyolefin Resin Supply-Demand Imbalance

Ultra-high-molecular-weight polyethylene capacity lags demand by eight points since 2022, inflating resin prices and squeezing non-integrated producers. Asahi Kasei's internal resin streams cushion volatility and double line speed relative to spot-resin competitors. North American shortages force startups to import resin or adopt alternative polymers such as Sepion's aramid blends.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Growth in Stationary Energy-Storage Projects

- Government Incentives for Domestic Battery Supply Chains

- Stringent Safety & Quality Certification Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wet-process polyolefin held 60.05% lithium ion battery separator market share in 2025, a position built on uniform porosity and sub-1 µm pore control. Ceramic-coated variants, however, are pacing at 22.05% CAGR, capturing automotive contracts that demand shutdown temperatures above 175 °C. Inline coating integrates formation and slurry application, cutting yield loss to below 2% and boosting margins by 5-7 points.

Uncoated polyolefin still serves cost-sensitive devices, yet its grip is loosening as even smartphones migrate to thinner, coated separators. Functional polymer overlays, such as PVDF-HFP blends, deliver electrolyte contact angles under 5°, trimming formation time by 40% and hinting at a third technology frontier.

Polypropylene's 48.02% share reflects mature extrusion lines and low resin cost. Polyethylene continues to dominate wet-process formulations thanks to its 130 °C melt-point shutdown feature, but multilayer PP/PE/PP stacks now constitute one-third of automotive shipments. Non-woven aramid nanofiber membranes maintain dimensional stability at 300 °C and tensile strengths above 200 MPa, albeit at USD 15-25 kg pricing.

Cost breakthroughs via low-temperature polycondensation could halve aramid pricing within three years, widening adoption in premium EVs and aerospace. Recycling challenges persist: polyolefin films can downcycle, whereas aramid lacks pathways, a liability in Europe's 2027 mandate window.

The Lithium-Ion Battery Separator Market Report is Segmented by Separator Type (Wet-Process, Dry-Process, and Ceramic-Coated), Material (Polypropylene, Non-Woven and Others, and More), Thickness (Up To 15 Mm, 16 To 20 Mm, and More), Form Factor (Pouch, Cylindrical, and Prismatic), Coating (Uncoated Polyolefin, In-Line Ceramic, and More), Application (Automotive EV, and More), and Geography (North America, Asia-Pacific, and More).

Geography Analysis

Asia-Pacific controlled 49.75% of the lithium-ion battery separator market in 2025, led by China's 75% global capacity. Chinese firms lowered separator costs 30-40% below Japanese peers through resin integration and labor advantages. Japan's share slid from 35% in 2018 to 20% in 2021 as Toray and Sumitomo exited commodity grades for solid-state niches. Korea's SK IE Technology holds 47.5 GWh of European battery capacity but logged a 291 billion won loss in 2024, signaling margin pressure.

North America is the fastest-growing region at 21.43% CAGR, buoyed by Inflation Reduction Act incentives and more than USD 5 billion in announced separator investments. Asahi Kasei's Ontario site aims for 700 million m2 annual output and a 30% regional share by 2027, while Microporous and Sepion add capacity in Virginia and California, respectively. Policy stability remains critical; a repeal of credits could strand assets.

Europe's market is shaped by carbon-footprint and recycled-content rules that favor local production. SK IE Technology's Polish plants add 340 million m2 capacity, yet the firm's financial strain clouds longer-term supply. European cell makers Northvolt, ACC, and Verkor pursue in-house separators, further pressuring incumbents. South America and MEA remain minor, but Brazil's 150,000 EVs in 2024 and Saudi industrial policies may spur modest local capacity post-2027.

- Asahi Kasei Corporation

- Toray Industries Inc.

- SK IE Technology Co. Ltd

- Entek International LLC

- Ube Corporation

- Sumitomo Chemical Co. Ltd

- Celgard LLC (Polypore)

- W-Scope Corporation

- Shenzhen Senior Technology

- Cangzhou Mingzhu Plastic

- Suzhou GreenPower

- Sinoma Science & Tech

- Dreamweaver International

- Gellec Co. Ltd

- Zhongke Science & Tech

- Mitsubishi Paper Mills

- Foshan Jinhui Hi-Tech

- Freudenberg Performance Materials

- Xiangyang Xingyuan

- Teijin Ltd

- Others (validated niche players)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Declining lithium-ion battery prices

- 4.2.2 Accelerating global EV adoption

- 4.2.3 Rapid growth in stationary energy-storage projects

- 4.2.4 Government incentives for domestic battery supply chains

- 4.2.5 OEM push for ultra-thin separators for high-Ni cathodes

- 4.2.6 Localization mandates driving regional separator gigafactories

- 4.3 Market Restraints

- 4.3.1 Polyolefin resin supply-demand imbalance

- 4.3.2 Stringent safety & quality certification timelines

- 4.3.3 Solvent-recovery cost challenges in wet-process lines

- 4.3.4 Limited recyclability pathways for spent separators

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Separator Type

- 5.1.1 Wet-Process Polyolefin

- 5.1.2 Dry-Process Polyolefin

- 5.1.3 Ceramic-Coated

- 5.2 By Material

- 5.2.1 Polypropylene (PP)

- 5.2.2 Polyethylene (PE)

- 5.2.3 Multilayer PP/PE/PP

- 5.2.4 Non-woven and Others

- 5.3 By Thickness

- 5.3.1 Up to 15 µm

- 5.3.2 16 to 20 µm

- 5.3.3 21 to 25 µm

- 5.3.4 Above 25 µm

- 5.4 By Battery Form Factor

- 5.4.1 Pouch Cells

- 5.4.2 Cylindrical Cells

- 5.4.3 Prismatic Cells

- 5.5 By Coating Technology

- 5.5.1 In-line Ceramic Coating

- 5.5.2 Offline Ceramic Coating

- 5.5.3 Functional Polymer Coatings

- 5.5.4 Uncoated Polyolefin

- 5.6 By Application

- 5.6.1 Automotive EV

- 5.6.2 Consumer Electronics

- 5.6.3 Stationary Energy Storage

- 5.6.4 Industrial and Power Tools

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Netherlands

- 5.7.2.7 NORDIC Countries

- 5.7.2.8 Russia

- 5.7.2.9 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 South Korea

- 5.7.3.5 ASEAN Countries

- 5.7.3.6 Australia and New Zealand

- 5.7.3.7 Rest of Asia Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 South Africa

- 5.7.5.3 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Asahi Kasei Corporation

- 6.4.2 Toray Industries Inc.

- 6.4.3 SK IE Technology Co. Ltd

- 6.4.4 Entek International LLC

- 6.4.5 Ube Corporation

- 6.4.6 Sumitomo Chemical Co. Ltd

- 6.4.7 Celgard LLC (Polypore)

- 6.4.8 W-Scope Corporation

- 6.4.9 Shenzhen Senior Technology

- 6.4.10 Cangzhou Mingzhu Plastic

- 6.4.11 Suzhou GreenPower

- 6.4.12 Sinoma Science & Tech

- 6.4.13 Dreamweaver International

- 6.4.14 Gellec Co. Ltd

- 6.4.15 Zhongke Science & Tech

- 6.4.16 Mitsubishi Paper Mills

- 6.4.17 Foshan Jinhui Hi-Tech

- 6.4.18 Freudenberg Performance Materials

- 6.4.19 Xiangyang Xingyuan

- 6.4.20 Teijin Ltd

- 6.4.21 Others (validated niche players)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment