|

시장보고서

상품코드

1788512

스포츠 애널리틱스 시장 : 제공별, 스포츠 유형별 예측(-2030년)Sports Analytics Market by Offering, Sports Type (Team Sports, Individual Sports, Racing Sports, Virtual Sports ) - Global Forecast to 2030 |

||||||

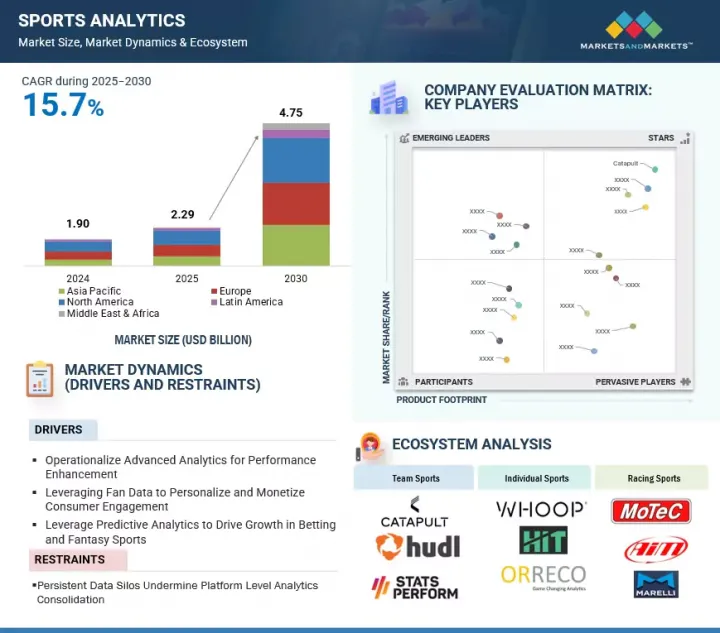

세계의 스포츠 애널리틱스 시장은 강력하게 성장하고 있으며, 2025년 22억 9,000만 달러에서 2030년까지 47억 5,000만 달러로 증가할 것으로 예측되며, 예측 기간에 CAGR 15.7%의 성장이 예상됩니다.

경쟁이 심화됨에 따라 스포츠 조직은 관찰형 코칭에서 데이터 중심 성능 모델로 전환하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제공, 배포 방식, 스포츠 유형, 용도, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동, 아프리카, 라틴아메리카 |

고급 분석 플랫폼은 이제 교육 부하 최적화, 바이오메카닉 모니터링, 전술 세련의 핵심이 되었습니다. AI가 탑재된 툴은 실시간 생리학적 데이터와 게임 플레이 데이터를 정밀한 코칭과 부상 경감을 지원하는 실용적인 지식으로 변환합니다. 일상 업무에 애널리틱스를 통합함으로써 팀은 일관된 성능 향상을 실현하고 선수의 성장을 가속화하며 압력에서 정보를 기반으로 조정할 수 있습니다. 이러한 구조화된 애널리틱스 우선 접근 방식은 클럽과 연맹이 인재를 관리하고, 출력을 극대화하고, 장기적인 경쟁 우위를 유지하는 방법을 변화시키고 있습니다.

경기 스포츠에서의 예측 분석에 의한 전략적 이익의 가속

스포츠 애널리틱스 시장에서는 결과 예측, 부상 위험 모델링 및 실시간 의사결정 지원에 대한 수요가 증가함에 따라 예측 분석 도구가 급성장을 보이고 있습니다. 이러한 도구는 머신러닝을 활용하여 과거 데이터와 라이브 데이터를 분석하여 보다 정확한 경기 예측, 선수의 작업 부하 관리, 전략적 계획을 가능하게 합니다. 이러한 도구의 급속한 보급은 특히 스포츠 베팅, 판타지 리그, 경쟁 우위를 추구하는 엘리트 팀 환경에서 두드러집니다. AI 기능이 확장되고 데이터 품질이 향상됨에 따라 예측 분석은 프로 스포츠 및 상업 스포츠 에코시스템에서 성능 최적화와 수익 창출의 형태를 계속 변화시키고 있습니다.

실시간 게임 인텔리전스를 통한 전술적 정확성과 인력 개발 극대화

스포츠 팀과 클럽은 성능 최적화, 부상 예방, 전술적 의사결정에 대한 일관된 투자로 스포츠 분석 시장에서 가장 큰 최종 사용자 부문이 되었습니다. 이러한 조직은 애널리틱스를 활용하여 실시간 선수 추적, 생체 정보 분석 및 전략 모델링을 통해 경쟁 우위를 확보하고 있습니다. 프로 리그에서 높은 채용률, 대학 수준에서의 관심 증가, AI 도구 통합 증가는 시장 점유율을 더욱 강화하고 있습니다. 데이터 인프라가 확대되고 성과 기반의 성능 향상에 대한 수요가 증가함에 따라 팀과 클럽은 세계 스포츠 생태계의 애널리틱스 혁신과 도입의 주요 추진 요인이 되고 있습니다.

북미는 엘리트 퍼포먼스 시스템의 규모를 확대하고 아시아태평양은 애널리틱스 중심의 스포츠 혁신을 촉진

북미는 세계 스포츠 애널리틱스 시장을 독점하고 있으며, 이는 성능 분석 소프트웨어의 보급, 리그 및 프랜차이즈 운영과의 깊은 통합, 선수 추적 및 비디오 애널리틱스와 같은 기술에 대한 조기 투자 때문입니다. NFL, NBA, MLB 엘리트 팀은 실시간 성능 모델, 부상 예측 도구, 전술 비디오 브레이크다운 플랫폼을 배포하여 선수의 출력과 게임 전략을 최적화합니다. 전문 공급업체의 존재, 성숙한 데이터 인프라, 견고한 스포츠 테크 에코시스템이 전문가와 대학 모두에서 지속적인 혁신을 촉진하고 있습니다.

한편 아시아태평양은 국내 스포츠의 디지털화 진행, 프로리그 투자 증가, 정부가 지원하는 스포츠 과학 구상에 힘입어 가장 빠르게 성장하고 있는 지역입니다. 인도, 일본, 호주 등 시장에서는 트레이닝 부하 관리, 예측적 상해 예방, 상대 분석에 대한 AI 솔루션이 확대되고 있습니다. 이 지역에서는 스포츠 및 청소년 스포츠 프로그램이 급성장하고 있으며 팬 참여 분석 및 스카우팅 도구의 채택도 가속화되고 있습니다. 데이터 구동 전략이 경쟁 성공의 중심이 됨에 따라 아시아태평양은 새로운 수요에서 혁신 중심 수요로 전환하고 있으며, 스포츠 애널리틱스 확대의 중요한 기반으로 자리잡고 있습니다.

이 보고서는 세계의 스포츠 애널리틱스 시장에 대한 조사 분석을 통해 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 스포츠 애널리틱스 시장의 기업에게 매력적인 기회

- 스포츠 애널리틱스 시장 : 상위 3 솔루션

- 북미의 스포츠 애널리틱스 시장 : 전개 방식별, 솔루션별

- 스포츠 애널리틱스 시장 : 지역별

제5장 시장 개요와 산업 동향

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 스포츠 애널리틱스 시장의 진화

- 공급망 분석

- 생태계 분석

- 실적 분석 소프트웨어

- 동영상 애널리틱스 플랫폼

- 예측 분석 도구

- 기타 솔루션

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 사례 연구 1 : IBM과 ESPN이 확장 가능한 AI 주도의 의사 결정 지원으로 FANTASY FOOTBALL 체험을 변화

- 사례 연구 2: ORLANDO MAGIC과 SAS INSTITUTE가 애널리틱스를 활용하여 수익 과제를 극복

- 사례 연구 3: BOSTON CELTICS와 MISSION CLOUD가 클라우드를 통해 데이터 분석을 가속화하여 경영 효율성을 향상

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 주요 규제

- 특허 분석

- 조사 방법

- 특허출원건수 : 서류종별(2016-2025년)

- 혁신과 특허출원

- 가격 설정 분석

- 평균 판매 가격 : 주요 기업별(2025년)

- 평균 판매 가격 : 스포츠 유형별(2025년)

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 고객사업에 영향을 주는 동향/혼란

- 지역 스포츠 베팅과 온라인 판타지 수익 동향(2025-2026년)

- 미래 전망과 새로운 이용 사례

- 차세대 팬 인게이지먼트 모델

- 개별화된 선수의 건강과 영양

- 베팅 및 판타지 스포츠 애널리틱스의 상승

- e스포츠와 가상 리그와의 통합

- 스포츠 애널리틱스에 관한 바이어의 시점

- 클럽과 협회에 있어서의 중요한 의사 결정 기준

- 애널리틱스 플랫폼 분석을 구축할지, 구매할지

- ROI와 비즈니스 케이스 고려 사항

- 조달 모델과 가격 설정의 동향

제6장 스포츠 애널리틱스 시장 : 제공별

- 소개

- 솔루션

- 서비스

제7장 스포츠 애널리틱스 시장 : 전개 방식별

- 소개

- 클라우드

- On-Premise

- 하이브리드

제8장 스포츠 애널리틱스 시장 : 스포츠 유형별

- 소개

- 팀 스포츠

- 개인 스포츠

- 레이싱 스포츠

- 온라인 및 가상 스포츠

- 신흥 스포츠

제9장 스포츠 애널리틱스 시장 : 용도별

- 소개

- 온필드

- 오프필드

제10장 스포츠 애널리틱스 시장 : 최종 사용자별

- 소개

- 스포츠 팀 및 클럽

- 스포츠 아카데미 및 컬리지

- 스포츠 리그 및 통괄 단체

- 방송국 및 미디어 플레이어

- 스폰서십 마케팅 에이전시

- 스포츠 용품 제조업체

- 스포츠 베팅 기업

- 기타 최종 사용자

제11장 스포츠 애널리틱스 시장 : 지역별

- 소개

- 북미

- 북미의 스포츠 애널리틱스 시장 성장 촉진요인

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 스포츠 애널리틱스 시장 성장 촉진요인

- 유럽의 거시 경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 스포츠 애널리틱스 시장 성장 촉진요인

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 인도

- 한국

- 호주 및 뉴질랜드

- 싱가포르

- 기타 아시아태평양

- 중동 및 아프리카

- 중동 및 아프리카의 스포츠 애널리틱스 시장 성장 촉진요인

- 중동 및 아프리카의 거시 경제 전망

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 카타르

- 튀르키예

- 기타 중동 및 아프리카

- 라틴아메리카

- 라틴아메리카의 스포츠 애널리틱스 시장 성장 촉진요인

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

제12장 경쟁 구도

- 개요

- 주요 참가 기업의 전략/강점(2021-2025년)

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 제품 비교

- 제품 비교 분석 : 팀 스포츠별

- 제품 비교 분석 : 개인 스포츠별

- 제품 비교 분석 : 온라인 및 가상 스포츠별

- 기업 평가 및 재무 지표

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제13장 기업 프로파일

- 소개

- 주요 기업

- IBM

- SAP

- SAS INSTITUTE

- HCLTECH

- ZEBRA TECHNOLOGIES

- GLOBALSTEP

- STATS PERFORM

- SPORTRADAR

- HUDL

- EXL

- CHYRON

- CATAPULT

- 기타 기업

- MOTEC(BOSCH)

- SPORTS ANALYTICS WORLD

- VEKTA

- BODYPRO(HEALTHCENTRAL NETWORK)

- ZONE14

- SPORTLOGIQ

- UPLIFT LABS

- KITMAN LABS

- ORRECO

- TRUMEDIA NETWORKS

- VEO TECHNOLOGIES

- SPORTANALYTICS

- SPORTAI

- RACE TECHNOLOGY

- PANDASCORE

제14장 인접 시장과 관련 시장

- 소개

- 스포츠용 AI 시장 - 세계 예측(-2030년)

- 시장의 정의

- 시장 개요

- 미디어용 AI 시장 - 세계 예측(-2030년)

- 시장의 정의

- 시장 개요

제15장 부록

JHS 25.08.20The sports analytics market is experiencing strong growth, projected to rise from USD 2.29 billion in 2025 to USD 4.75 billion by 2030, at a CAGR of 15.7% during the forecast period. As competitive demands intensify, sports organizations are shifting from observational coaching to data-driven performance models.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD Billion |

| Segments | Offering, Deployment Mode, Sports Type, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Advanced analytics platforms are now central to optimizing training loads, monitoring biomechanics, and refining tactics. AI-powered tools convert real-time physiological and gameplay data into actionable insights that support precision coaching and injury mitigation. By embedding analytics into day-to-day operations, teams unlock consistent performance gains, accelerate player development, and make informed adjustments under pressure. This structured, analytics-first approach is transforming how clubs and federations manage talent, maximize output, and sustain long-term competitive advantages.

"Accelerating Strategic Gains with Predictive Analytics in Competitive Sports"

Predictive analytics tools are experiencing the fastest growth in the sports analytics market, driven by increasing demand for outcome forecasting, injury risk modeling, and real-time decision support. These tools leverage machine learning to analyze historical and live data, enabling more accurate game predictions, player workload management, and strategic planning. Their rapid adoption is especially evident in sports betting, fantasy leagues, and elite team environments seeking competitive advantages. As AI capabilities expand and data quality improves, predictive analytics continue to reshape performance optimization and revenue generation across both professional and commercial sports ecosystems.

"Maximizing Tactical Precision and Talent Development Through Real-time Game Intelligence"

Sports teams and clubs represent the largest end-user segment in the sports analytics market due to their consistent investment in performance optimization, injury prevention, and tactical decision-making. These organizations utilize analytics to gain competitive advantages through real-time player tracking, biometric analysis, and strategy modeling. High adoption across professional leagues, growing interest at the collegiate level, and increasing integration of AI tools further strengthen their market share. With expanding data infrastructure and rising demand for outcome-based performance improvements, teams and clubs continue to be the primary drivers of analytics innovation and implementation in global sports ecosystems.

"North America scales elite performance systems while Asia Pacific fuels analytics-led sports innovation."

North America dominates the global sports analytics market, led by widespread use of performance analysis software, deep integration with league and franchise operations, and early investment in technologies like player tracking and video analytics. Elite teams across the NFL, NBA, and MLB deploy real-time performance models, injury forecasting tools, and tactical video breakdown platforms to optimize athlete output and game strategy. The presence of specialized vendors, mature data infrastructure, and a robust sports-tech ecosystem fosters continuous innovation across both professional and collegiate levels.

In contrast, Asia Pacific is the fastest-growing region, propelled by increased digitization of domestic sports, rising investments in professional leagues, and government-backed sports science initiatives. Markets like India, Japan, and Australia are scaling AI-powered solutions for training load management, predictive injury prevention, and opponent analysis. The region's rapid growth in esports and youth sports programs is also accelerating the adoption of fan engagement analytics and scouting tools. As data-driven strategies become central to competitive success, Asia Pacific is transitioning from emerging to innovation-driven demand, establishing itself as a vital hub for sports analytics expansion.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the sports analytics market.

- By Company: Tier I - 25%, Tier II - 45%, and Tier III - 30%

- By Designation: C-Level Executives - 35%, D-Level Executives - 40%, and Others - 25%

- By Region: North America - 45%, Europe - 25%, Asia Pacific - 15%, Middle East & Africa - 10%, and Latin America - 5%

The report includes a study of key players offering sports analytics. The major market players include IBM (US), SAS Institute (US), SAP (Germany), HCL Technologies (India), Salesforce (US), Zebra Technologies (US), Catapult (Australia), EXL (US), Chyron (US), GlobalStep (US), Stats Perform (US), Exasol (Germany), DataArt (US), TruMedia Networks (US), Orreco (Ireland), Sportradar (Switzerland), Whoop (US), Kitman Labs (Ireland), Hudl (US), Trace (US), Kinduct Technologies (Canada), Oracle (US), Uplift Labs (US), SportLogiq (Canada), SportAnalytics (Serbia), L2P Limited (UK), Quant4Sport (UK), Veo Technologies (Denmark), Carv (UK), Real Sports AI (UK), Vekta (US), Zone14 (Austria), SportAI (US), BodyPro (US), HIT Coach (US), Pulse (Various), PunchLab (Italy), Marelli (Italy), MoTeC (Australia), Race Technologies (US), and PandaScore (France).

Research Coverage

This research report categorizes the Sports Analytics market based on offering (solution (performance analytics software, video analytics platforms, predictive analytics tools, and other solutions)) and services (professional services (training & consulting services, system integration & implementation services, support & maintenance services) and managed services, deployment mode (cloud, on-premises, and hybrid), sports type (team sports (cricket, football (soccer), American football/rugby, basketball, baseball, hockey, volleyball), individual sports individual sports (call tennis, athletics (track & field), golf, swimming, cycling, gymnastics, combat sports (boxing, mixed martial arts (MMA), wrestling, judo), other individual sports), racing sports (Formula 1, MotoGP, National Association for Stock Car Auto Racing (NASCAR), horse racing, and other racing sports), online or virtual sports (fantasy sports, online betting, daily fantasy leagues, online poker & card games and other online sports) and emerging sports (digital extreme sports, paralympic sports, and other emerging sports)), application (on field (player load & movement analysis, player tracking & movement, injury prediction & health monitoring, biomechanical & kinematic analysis, training & recovery optimization, match fitness & performance benchmarking, and other on-field applications)) and off-field (opposition scouting, in-game decision support, fan engagement & experience, sponsorship & marketing ROI, merchandise sales optimization, fan behavior tracking and other off-field applications)), end user (sports teams & clubs, sports academies & colleges, sports leagues/associations & governing bodies, broadcasters & media companies, sponsorship & marketing agencies, sports equipment manufacturers, ad sports betting companies), and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

The scope of the report covers detailed information regarding drivers, restraints, challenges, and opportunities influencing the growth of the sports analytics market. A detailed analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, product & service launches, and mergers and acquisitions; and recent developments associated with the market. This report also covered the competitive analysis of upcoming startups in the market ecosystem.

Key Benefits of Buying the Report

The report will provide market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall sports analytics market and its subsegments. It will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. It will also help stakeholders understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Operationalize Advanced Analytics for Performance Enhancement, Leveraging Fan Data to Personalize and Monetize Consumer Engagement, Leverage Predictive Analytics to Drive Growth in Betting and Fantasy Sports), restraints (Persistent Data Silos Undermine Platform Level Analytics Consolidation), opportunities (Enable Scalable Performance Optimization in Sports through Modular Analytics Deployment, Advance Tactical Precision and Player Development through Specialized Esports Analytics), and challenges (Ensure Data Confidentiality and Integrity with Secure Architectures and Access Control Protocols, Rapid Software Evolution Limits Analytics Accessibility for Smaller Teams)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in sports Analytics

- Market Development: Comprehensive information about lucrative markets - analyzing the market across varied regions

- Market Diversification: Exhaustive information about new solutions & services, untapped geographies, recent developments, and investments in the Sports Analytics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as IBM (US), SAS Institute (US), SAP (Germany), HCL Technologies (India), Salesforce (US), Zebra Technologies (US), Catapult (Australia), EXL (US), Chyron (US), GlobalStep (US), Stats Perform (US), Exasol (Germany), DataArt (US), TruMedia Networks (US), Orreco (Ireland), Sportradar (Switzerland), Whoop (US), Kitman Labs (Ireland), Hudl (US), Trace (US), Kinduct Technologies (Canada), Oracle (US), Uplift Labs (US), SportLogiq (Canada), SportAnalytics (Serbia), L2P Limited (UK), Quant4Sport (UK), Veo Technologies (Denmark), Carv (UK), Real Sports AI (UK), Vekta (US), Zone14 (Austria), SportAI (US), BodyPro (US), HIT Coach (US), Pulse (Various), PunchLab (Italy), Marelli (Italy), MoTeC (Australia), Race Technologies (US), and PandaScore (France).

The report also helps stakeholders understand the pulse of the sports analytics market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SPORTS ANALYTICS MARKET

- 4.2 SPORTS ANALYTICS MARKET: TOP THREE SOLUTIONS

- 4.3 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY DEPLOYMENT MODE AND SOLUTION

- 4.4 SPORTS ANALYTICS MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing reliance on advanced analytics to optimize player performance

- 5.2.1.2 Rising adoption of fan data analytics for personalized engagement and revenue growth

- 5.2.1.3 Growing use of predictive analytics in legal sports betting and fantasy sports

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fragmented data ecosystems undermining cross-functional analytics

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing deployment of modular analytics for performance optimization in emerging sports

- 5.2.3.2 Rising esports sector fueling real-time analytics innovation and audience-centric expansion

- 5.2.4 CHALLENGES

- 5.2.4.1 Inadequate data security exposing sensitive player movement and tactical analytics

- 5.2.4.2 Frequent software updates disrupting workflow continuity

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF SPORTS ANALYTICS MARKET

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PERFORMANCE ANALYTICS SOFTWARE

- 5.5.2 VIDEO ANALYTICS PLATFORMS

- 5.5.3 PREDICTIVE ANALYTICS TOOLS

- 5.5.4 OTHER SOLUTIONS

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 CASE STUDY 1: IBM AND ESPN TRANSFORM FANTASY FOOTBALL EXPERIENCE WITH SCALABLE, AI-DRIVEN DECISION SUPPORT

- 5.7.2 CASE STUDY 2: ORLANDO MAGIC AND SAS INSTITUTE LEVERAGE ANALYTICS TO OVERCOME REVENUE CHALLENGES

- 5.7.3 CASE STUDY 3: BOSTON CELTICS AND MISSION CLOUD ACCELERATE DATA ANALYTICS AND ENHANCE OPERATIONAL EFFICIENCY THROUGH CLOUD

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Computer vision

- 5.8.1.2 Internet of Things (IoT)

- 5.8.1.3 Edge computing

- 5.8.1.4 Natural language processing (NLP)

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Blockchain

- 5.8.2.2 Cloud computing

- 5.8.2.3 Digital twin

- 5.8.2.4 GPS & LPS

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Augmented reality (AR) and virtual reality (VR)

- 5.8.3.2 Geospatial analytics

- 5.8.3.3 5G and advanced connectivity

- 5.8.1 KEY TECHNOLOGIES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 KEY REGULATIONS

- 5.9.2.1 North America

- 5.9.2.1.1 US

- 5.9.2.1.2 Canada

- 5.9.2.2 Europe

- 5.9.2.2.1 UK

- 5.9.2.3 Asia Pacific

- 5.9.2.3.1 India

- 5.9.2.3.2 China

- 5.9.2.3.3 Japan

- 5.9.2.3.4 South Korea

- 5.9.2.3.5 Australia

- 5.9.2.3.6 New Zealand

- 5.9.2.4 Middle East & Africa

- 5.9.2.4.1 Saudi Arabia

- 5.9.2.4.2 UAE

- 5.9.2.4.3 Qatar

- 5.9.2.4.4 Turkey

- 5.9.2.4.5 South Africa

- 5.9.2.5 Latin America

- 5.9.2.5.1 Brazil

- 5.9.2.1 North America

- 5.10 PATENT ANALYSIS

- 5.10.1 METHODOLOGY

- 5.10.2 PATENTS FILED, BY DOCUMENT TYPE, 2016-2025

- 5.10.3 INNOVATION AND PATENT APPLICATIONS

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE OF OFFERINGS, BY KEY PLAYER, 2025

- 5.11.2 AVERAGE SELLING PRICE, BY SPORTS TYPE, 2025

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 REGIONAL SPORTS BETTING AND ONLINE FANTASY REVENUE TRENDS (2025-2026)

- 5.17 FUTURE OUTLOOK AND EMERGING USE CASES

- 5.17.1 NEXT-GEN FAN ENGAGEMENT MODELS

- 5.17.2 PERSONALIZED ATHLETE HEALTH AND NUTRITION

- 5.17.3 RISE OF BETTING AND FANTASY SPORTS ANALYTICS

- 5.17.4 INTEGRATION WITH E-SPORTS AND VIRTUAL LEAGUES

- 5.18 BUYER'S PERSPECTIVE ON SPORTS ANALYTICS

- 5.18.1 KEY DECISION CRITERIA FOR CLUBS AND ASSOCIATIONS

- 5.18.2 BUILD VS. BUY ANALYSIS FOR ANALYTICS PLATFORMS

- 5.18.3 ROI AND BUSINESS CASE CONSIDERATIONS

- 5.18.4 PROCUREMENT MODELS AND PRICING TRENDS

6 SPORTS ANALYTICS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: SPORTS ANALYTICS MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 PERFORMANCE ANALYTICS SOFTWARE

- 6.2.1.1 Enhancing player efficiency and tactical accuracy through performance insights

- 6.2.2 VIDEO ANALYTICS PLATFORMS

- 6.2.2.1 Driving tactical precision and visual breakdown for smarter game planning

- 6.2.3 PREDICTIVE ANALYTICS TOOLS

- 6.2.3.1 Optimizing strategic forecasting and outcome modeling with advanced predictive tools

- 6.2.4 OTHER SOLUTIONS

- 6.2.1 PERFORMANCE ANALYTICS SOFTWARE

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Aligning analytics execution with strategic objectives through expert-led services

- 6.3.1.2 Training & consulting services

- 6.3.1.3 System integration & implementation services

- 6.3.1.4 Support & maintenance services

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Ensuring seamless operations and scalable performance through managed analytics services

- 6.3.1 PROFESSIONAL SERVICES

7 SPORTS ANALYTICS MARKET, BY DEPLOYMENT MODE

- 7.1 INTRODUCTION

- 7.1.1 DEPLOYMENT MODE: SPORTS ANALYTICS MARKET DRIVERS

- 7.2 CLOUD

- 7.2.1 ENABLING SCALABLE, REAL-TIME ANALYTICS WITH FLEXIBLE CLOUD-BASED INFRASTRUCTURE

- 7.3 ON-PREMISES

- 7.3.1 DELIVERING DATA CONTROL AND COMPLIANCE THROUGH ON-PREMISES DEPLOYMENT MODELS

- 7.4 HYBRID

- 7.4.1 BALANCING FLEXIBILITY AND CONTROL IN SPORTS ANALYTICS WITH HYBRID DEPLOYMENT

8 SPORTS ANALYTICS MARKET, BY SPORTS TYPE

- 8.1 INTRODUCTION

- 8.1.1 SPORTS TYPE: SPORTS ANALYTICS MARKET DRIVERS

- 8.2 TEAM SPORTS

- 8.2.1 ENHANCING TACTICAL COORDINATION AND SCALABLE FAN ENGAGEMENT THROUGH SPORTS INTELLIGENCE TOOLS

- 8.2.2 CRICKET

- 8.2.3 FOOTBALL (SOCCER)

- 8.2.4 AMERICAN FOOTBALL

- 8.2.5 BASKETBALL

- 8.2.6 BASEBALL

- 8.2.7 HOCKEY

- 8.2.8 VOLLEYBALL

- 8.2.9 OTHER TEAM SPORTS

- 8.3 INDIVIDUAL SPORTS

- 8.3.1 PERSONALIZED PERFORMANCE OPTIMIZATION DRIVING ANALYTICS ADOPTION IN INDIVIDUAL SPORTS

- 8.3.2 TENNIS

- 8.3.3 ATHLETICS (TRACK & FIELD)

- 8.3.4 GOLF

- 8.3.5 SWIMMING

- 8.3.6 CYCLING

- 8.3.7 GYMNASTICS

- 8.3.8 COMBAT SPORTS

- 8.3.8.1 Boxing

- 8.3.8.2 Mixed martial arts (MMA)

- 8.3.8.3 Wrestling

- 8.3.8.4 Judo

- 8.3.9 OTHER INDIVIDUAL SPORTS

- 8.4 RACING SPORTS

- 8.4.1 IMPROVING TACTICAL ACCURACY AND COMPETITIVE CONSISTENCY IN RACE ENVIRONMENTS

- 8.4.2 FORMULA 1

- 8.4.3 MOTOGP

- 8.4.4 NATIONAL ASSOCIATION FOR STOCK CAR AUTO RACING (NASCAR)

- 8.4.5 HORSE RACING

- 8.4.6 OTHER RACING SPORTS

- 8.5 ONLINE OR VIRTUAL SPORTS

- 8.5.1 DRIVING ENGAGEMENT AND MONETIZATION THROUGH REAL-TIME COMPETITIVE INTELLIGENCE

- 8.5.2 FANTASY SPORTS

- 8.5.3 ONLINE BETTING

- 8.5.4 DAILY FANTASY SPORTS

- 8.5.5 ONLINE POKER & CARD GAMES

- 8.5.6 OTHER ONLINE SPORTS

- 8.6 EMERGING SPORTS

- 8.6.1 BUILDING DATA-FIRST GROWTH MODELS FOR NICHE AND HYBRID SPORTS FORMATS

- 8.6.2 DIGITAL EXTREME SPORTS

- 8.6.3 PARALYMPIC SPORTS

- 8.6.4 OTHER EMERGING SPORTS

9 SPORTS ANALYTICS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.1.1 APPLICATION: SPORTS ANALYTICS MARKET DRIVERS

- 9.2 ON-FIELD

- 9.2.1 MAXIMIZING ON-FIELD PERFORMANCE THROUGH TACTICAL INSIGHTS AND REAL-TIME DECISION SUPPORT

- 9.2.2 PLAYER PERFORMANCE ANALYSIS

- 9.2.3 TACTICAL AND POSITIONAL ANALYSIS

- 9.2.4 GAME STRATEGY OPTIMIZATION

- 9.2.5 FATIGUE AND WORKLOAD MONITORING

- 9.2.6 OPPONENT SCOUTING AND MATCH PREPARATION

- 9.2.7 INJURY RISK PREDICTION

- 9.2.8 OTHER ON-FIELD APPLICATIONS

- 9.3 OFF-FIELD

- 9.3.1 OPTIMIZING OFF-FIELD DECISIONS THROUGH STRATEGIC, OPERATIONAL, AND COMMERCIAL ANALYTICS

- 9.3.2 FAN ENGAGEMENT ANALYTICS

- 9.3.3 SPONSORSHIP VALUATION AND ROI TRACKING

- 9.3.4 TICKETING AND ATTENDANCE FORECASTING

- 9.3.5 SOCIAL MEDIA AND SENTIMENT ANALYSIS

- 9.3.6 MERCHANDISE SALES OPTIMIZATION

- 9.3.7 OTHER OFF-FIELD APPLICATIONS

10 SPORTS ANALYTICS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.1.1 END USER: SPORTS ANALYTICS MARKET DRIVERS

- 10.1.2 SPORTS TEAMS & CLUBS

- 10.1.2.1 Leveraging data to enhance competitive performance and guide tactical, physical, and talent decisions

- 10.1.3 SPORTS ACADEMIES & COLLEGES

- 10.1.3.1 Driving athlete development and curriculum design through integrated performance and training analytics

- 10.1.4 SPORTS LEAGUES & GOVERNING BODIES

- 10.1.4.1 Optimizing competition integrity and strategic growth through data-driven oversight

- 10.1.5 BROADCASTERS & MEDIA COMPANIES

- 10.1.5.1 Enhancing viewer experience and content strategy through real-time performance and audience analytics

- 10.1.6 SPONSORSHIP & MARKETING AGENCIES

- 10.1.6.1 Using fan engagement and performance data to maximize sponsorship and campaign outcomes

- 10.1.7 SPORTS EQUIPMENT MANUFACTURERS

- 10.1.7.1 Driving product innovation and athlete-centric solutions through data insights and performance trends

- 10.1.8 SPORTS BETTING COMPANIES

- 10.1.8.1 Maximizing competitive advantage through real-time data and predictive analytics in betting operations

- 10.1.9 OTHER END USERS

11 SPORTS ANALYTICS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: SPORTS ANALYTICS MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.3.1 Integrating sports analytics for performance optimization and enhanced betting insights

- 11.2.4 CANADA

- 11.2.4.1 Advancing sports analytics with virtual and fantasy sports

- 11.3 EUROPE

- 11.3.1 EUROPE: SPORTS ANALYTICS MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 Empowering data-centric engagement through strategic collaborations

- 11.3.4 GERMANY

- 11.3.4.1 Advancing competitive edge through integrated predictive analytics

- 11.3.5 FRANCE

- 11.3.5.1 Transforming tactical dynamics and academy outcomes via advanced analytics

- 11.3.6 ITALY

- 11.3.6.1 Optimizing coaching and recruitment methodologies with data-driven intelligence

- 11.3.7 SPAIN

- 11.3.7.1 Elevating tactical intelligence and fan connection through data modeling

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: SPORTS ANALYTICS MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 Leveraging analytics for optimized athlete performance and enhanced data-driven decisions

- 11.4.4 JAPAN

- 11.4.4.1 Olympic-focused investment and institutional partnerships accelerate analytics adoption across sports

- 11.4.5 INDIA

- 11.4.5.1 Real-time performance analysis accelerates team strategy and player development nationwide

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Maximizing competitive gains through data-driven decisions in esports

- 11.4.7 AUSTRALIA & NEW ZEALAND

- 11.4.7.1 Integrated analytics adoption and collaboration drive sporting excellence

- 11.4.8 SINGAPORE

- 11.4.8.1 National data exchange enhances athlete performance and institutional planning

- 11.4.9 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 SAUDI ARABIA

- 11.5.3.1 Vision 2030 and club-tech partnerships drive analytics-led sports innovation

- 11.5.4 UAE

- 11.5.4.1 Advancing talent and increasing fan engagement through targeted analytics adoption

- 11.5.5 SOUTH AFRICA

- 11.5.5.1 Digital integration and youth development propel sports analytics momentum

- 11.5.6 QATAR

- 11.5.6.1 Embedding advanced sports analytics for enhanced talent and fan experiences

- 11.5.7 TURKEY

- 11.5.7.1 Elevating sports growth through targeted club and federation analytics partnerships

- 11.5.8 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: SPORTS ANALYTICS MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 Institutional backing and club innovation accelerate data-driven athletic advancements

- 11.6.4 MEXICO

- 11.6.4.1 Sports analytics advances tactical precision and fan engagement in Mexican leagues

- 11.6.5 ARGENTINA

- 11.6.5.1 Elevating sports through tactical intelligence and federated data innovation

- 11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 PRODUCT COMPARISON

- 12.5.1 PRODUCT COMPARATIVE ANALYSIS, BY TEAM SPORTS

- 12.5.1.1 Sportscode (Hudl)

- 12.5.1.2 Catapult Pro Video (Catapult)

- 12.5.1.3 Kitman Labs Intelligence Platform (Kitman Labs)

- 12.5.1.4 Veo Analytics (Veo Technologies)

- 12.5.1.5 Sportlogiq iCE Platform (Sportlogiq)

- 12.5.2 PRODUCT COMPARATIVE ANALYSIS, BY INDIVIDUAL SPORTS

- 12.5.2.1 MoTeC i2 [MoTeC (Bosch Company)]

- 12.5.2.2 Uplift Vision (Uplift Labs)

- 12.5.2.3 Orreco Zone (Orreco)

- 12.5.2.4 BodyPro Platform (BodyPro)

- 12.5.2.5 Vekta Platform (Vekta)

- 12.5.3 PRODUCT COMPARATIVE ANALYSIS, BY ONLINE OR VIRTUAL SPORTS

- 12.5.3.1 Opta AI Studio (Stats Perform)

- 12.5.3.2 Radar360 Analytics Platform (Sportradar)

- 12.5.3.3 Esports Fantasy (Pandascore)

- 12.5.3.4 SportAI Platform (SportAI)

- 12.5.3.5 Playtest Analytics (GlobalStep)

- 12.5.1 PRODUCT COMPARATIVE ANALYSIS, BY TEAM SPORTS

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Regional footprint

- 12.7.5.3 Offering footprint

- 12.7.5.4 Sports type footprint

- 12.7.5.5 End user footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 IBM

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches and enhancements

- 13.2.1.3.2 Deals

- 13.2.1.4 MnM view

- 13.2.1.4.1 Key strengths

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 SAP

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches and enhancements

- 13.2.2.3.2 Deals

- 13.2.2.4 MnM view

- 13.2.2.4.1 Key strengths

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 SAS INSTITUTE

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Deals

- 13.2.3.4 MnM view

- 13.2.3.4.1 Key strengths

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 HCLTECH

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches and enhancements

- 13.2.4.3.2 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Key strengths

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 ZEBRA TECHNOLOGIES

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Deals

- 13.2.5.4 MnM view

- 13.2.5.4.1 Key strengths

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 GLOBALSTEP

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Product launches and enhancements

- 13.2.6.3.2 Deals

- 13.2.7 STATS PERFORM

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Product launches and enhancements

- 13.2.7.3.2 Deals

- 13.2.8 SPORTRADAR

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.3 Recent developments

- 13.2.8.3.1 Product launches and enhancements

- 13.2.8.3.2 Deals

- 13.2.9 HUDL

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Product launches and enhancements

- 13.2.9.3.2 Deals

- 13.2.10 EXL

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.11 CHYRON

- 13.2.12 CATAPULT

- 13.2.1 IBM

- 13.3 OTHER PLAYERS

- 13.3.1 MOTEC (BOSCH)

- 13.3.2 SPORTS ANALYTICS WORLD

- 13.3.3 VEKTA

- 13.3.4 BODYPRO (HEALTHCENTRAL NETWORK)

- 13.3.5 ZONE14

- 13.3.6 SPORTLOGIQ

- 13.3.7 UPLIFT LABS

- 13.3.8 KITMAN LABS

- 13.3.9 ORRECO

- 13.3.10 TRUMEDIA NETWORKS

- 13.3.11 VEO TECHNOLOGIES

- 13.3.12 SPORTANALYTICS

- 13.3.13 SPORTAI

- 13.3.14 RACE TECHNOLOGY

- 13.3.15 PANDASCORE

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 AI IN SPORTS MARKET - GLOBAL FORECAST TO 2030

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- 14.2.2.1 AI in sports market, by offering

- 14.2.2.2 AI in sports market, by end user

- 14.2.2.3 AI in sports market, by region

- 14.3 AI IN MEDIA MARKET - GLOBAL FORECAST TO 2030

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.2.1 AI in media market, by offering

- 14.3.2.2 AI in media market, by application

- 14.3.2.3 AI in media market, by end user

- 14.3.2.4 AI in media market, by region

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS