|

시장보고서

상품코드

1689977

방송 장비 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Broadcast Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

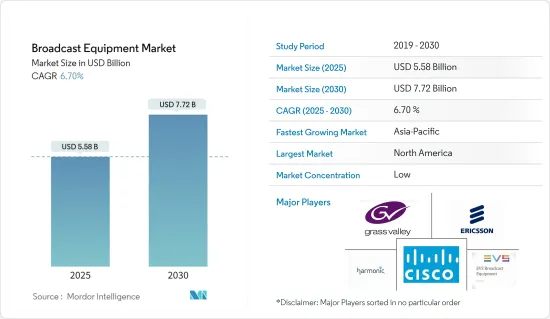

방송 장비 시장 규모는 2025년 55억 8,000만 달러로 추정되며 예측기간(2025-2030년)의 CAGR은 6.7%를 나타내 2030년에는 77억 2,000만 달러에 달할 것으로 예상됩니다.

전자 매스 커뮤니케이션을 통해 음성 및 영상 컨텐츠를 정확한 시청자에게 전달하는 것은 방송으로 알려져 있습니다. 여전히 인기있는 방송 서비스는 가장 직접적이고 신뢰할 수 있는 정보 매체를 많은 시청자에게 전달하고 있습니다.

주요 하이라이트

- 지난 수십년 동안 보다 고품질의 오디오와 비디오에 대한 소비자 수요는 방송 장비 제품과 기술을 급속히 업그레이드해 왔습니다.

- 예를 들어, 2023년 11월 ArcGIS Motion Imagery Team은 새로운 ArcGIS Video Server의 출시를 발표했습니다.

- 기술의 진보에 의해 방송국은 프리미엄 유저에게 UHD 출력을 제공하게 되어, 시장의 성장에 박차를 가하고 있습니다. 또한, 디지털 채널 증가, 스포츠 중계에서는 8K화질, 뉴스 중계에서는 4K화질을 특징으로 하는 최첨단 방송 장비의 이용 증가가 시장 성장의 가속에 기여하고 있습니다.

- 스포츠 부문은 세계 텔레비전 시청자들에게 가장 큰 시장이며, 비디오 컨텐츠를 대규모로 전달하는 방법이 발견되고 있습니다.

- 게다가 기술의 진화, 고속 인터넷 인프라에 대한 투자 증가, OTT 서비스에 의한 D2C 제공에 대한 수요 증가에 의해 시장은 진화의 기회를 목격하고 있습니다. 국제전기통신연합에 따르면 2023년 기준 소도서개발국(SIDS) 인구의 67%가 인터넷을 사용한 반면, 최빈개발국(LDC) 인구는 35%, 내륙 성장 카운티에 거주하는 인구의 인터넷 보급률은 39%에 그쳤습니다.

- 또한 소득 증가, 내구 소비재 구매 증가, 빠르고 저렴한 인터넷 가용성 증가가 시장 성장에 긍정적인 영향을 미칠 것으로 예상됩니다. 인도 IBEF에 따르면 2024년에는 텔레비전이 인도 미디어 시장의 40%를 차지했으며, 디지털 광고(12%), 인쇄 매체(13%), 영화(9%), OTT 및 게임 산업(8%)이 그 뒤를 이었습니다. 2025년에는 연결된 지능형 TV의 수가 약 4천만 대에서 5천만 대에 달할 것으로 예상됩니다.

- 디지털 음성·영상 포맷의 급속한 개척과 디지털 영상·음성을 생성·보존하기 위한 오픈, 국내, 또는 국제적인 합의 규범의 필요성이, 시장 성장의 과제가 되고 있습니다.

- COVID-19의 대유행으로 인해 방송국은 컨텐츠 제작과 배포에 대한 접근방식을 재검토해야 했고, 그 결과 인력 배치, 기술 스택, 설비가 변경되었습니다. 프로그램이 소비자용 비디오 기술을 통해 전문가의 의견을 모았습니다.방송 기술에 의해 팬데믹중의 프로그램이나 콘서트도 가능하게 되었습니다.

방송 장비 시장 동향

인코더가 큰 성장을 이룰 전망

- 인코더는 오디오 및 비디오 신호를 디지털 형식으로 변환하고 네트워크를 통해 전송함으로써 방송에서 중요한 역할을 수행합니다. 방송국은 고품질의 영상을 효율적으로 전달하기 위한 선진적인 엔코더를 필요로 하고 있습니다.

- 2024년 4월, 인터넷 인사이트은 에미상을 수상한 인터넷 미디어 트랜스포트 제품인 Nimbra 400 인코더의 기능을 강화해, 업그레이드된 Nimbra 414로, 보다 풍부하고 보다 인터랙티브한 이벤트 제작의 성장에 대응하는 것을 발표했습니다. Nimbra 414 엔코더/디코더 패밀리는 방송국이 시청자의 참여를 높이는 보다 몰입감 있는 작품을 제공하기에 최적인 위치가 되고 있습니다.

- 비디오를 인코딩하는 목적은 인터넷에서 전송되는 디지털 사본을 만드는 것입니다. 방송국은 스트림의 목적이나 예산에 따라 하드웨어 엔코더 또는 소프트웨어 엔코더 중 하나를 선택할 수 있습니다.

- 예를 들어, 2024년 4월, 미국의 캡션 회사인 Verbit Company의 VITAC와 방송 솔루션의 프로바이더인 ENCO는 방송 사업자에게 하드웨어 인코더와 클라우드 캡션의 선택지를 넓히는 것을 목적으로 한 전략적 제휴를 발표했습니다.

- 게다가 스트리밍 플랫폼의 보급에 따라, 고품질의 영상 컨텐츠를 인터넷으로 전달하기 위한 효율적인 인코딩 기술이 필요해지고 있습니다. TV나 휴대폰, LG나 Samsung의 스마트 TV, Apple TV, 웹, iOS용 최신 앱을 가동시켰습니다.

- 게다가 컨텐츠가 다양한 플랫폼과 디바이스로 전달되기 때문에 방송국은 적응 비트레이트 스트리밍과 다양한 코덱이나 프로토콜과의 호환성을 지원하는 인코더가 필요합니다.

- Meltwater에 따르면 최근 몇 년 동안 라이브 스트리밍 비디오 컨텐츠는 엔터테인먼트 및 비즈니스 목적으로 온라인에서 소비되는 가장 일반적인 비디오 컨텐츠 중 하나가 되었습니다. 2023년 넷플릭스는 미국과 캐나다에서 8,013만 명의 유료 스트리밍 가입자가 있음을 밝혔습니다.

- 엔코더의 효과는 현저하게 향상되고 있어 HDTV와 같은 최신 포맷이나 H.264와 같은 압축 규격의 성공에 중요한 역할을 하고 있습니다.

아시아태평양은 크게 성장할 것으로 예상

- 아시아태평양에는 중국과 인도 등 인구 밀도가 높은 국가들이 있습니다. 멜트워터에 따르면 2023년 3분기에는 필리핀의 16-64세 인터넷 사용자의 약 96%가 매월 Netflix 등의 정액제 비디오 온 디맨드(SVOD) 서비스를 이용하고 있었습니다.

- 또한이 지역에서는 OTT(Over the Top) 스트리밍 플랫폼의 인기가 높아지고 있으며, 고품질의 스트리밍 서비스를 지원하는 첨단 방송 장비의 요구가 높아지고 있습니다. Prasar Bharati는 2024년 5월에 독자적인 가족용 OTT 플랫폼을 출시할 계획을 발표했습니다.

- 아시아태평양은 올림픽, FIFA 월드컵, 지역대회 등 주요 스포츠 이벤트 개최지입니다.

- GSMA의 보고서에 따르면, 부탄, 이란, 방글라데시, 베트남과 같은 국가들이 모바일의 보급을 가장 두드러지게 보여줍니다. 과 비디오 수요를 촉진하고 있는 요인의 하나입니다.

- 또한 Netflix는 2023년 3월 아시아태평양 컨텐츠에 약 19억 달러를 투자할 계획을 발표했습니다. 대략 40억 달러 이상에 달했습니다. 또, ITU에 의하면, 2023년 시점에서 아시아태평양의 인구의 66%가 인터넷을 이용하고 있다고 보고되고 있어 시장의 성장을 한층 더 밀어올렸습니다.

- 현지 공급업체는 COVID-19 팬데믹이 가져온 기회를 활용하기 위해 많은 투자를 했습니다. 예를 들어, 작년 3월, Signat Inc는 임베디드 미디어 처리 소프트웨어를 제공하는 Kyno 인수를 발표했습니다. 이 인수는 SaaS 플랫폼 Software-Defined Content Exchange(SDCX)의 기능을 확장하고 미디어 자산과의 참여를 위한 도구를 통합하는 데 도움이 됩니다. 이 플랫폼은 전 세계에서 약 100만 명의 사용자를 보유하고 있으며, 50,000개가 넘는 모든 규모의 미디어 엔터테인먼트 회사를 연결합니다.

방송 장비 산업 개요

방송 장비 시장에서의 다양한 기업 간의 경쟁은 가격, 제품, 시장 점유율, 경쟁의 치열함에 의해 결정됩니다. 주요 시장 진출기업으로는 Cisco Systems Inc., Telefonaktiebolaget LM Ericsson, Harmonic Inc., EVS Broadcast Equipment SA, Grass Valley 등이 있습니다.

- 2024년 4월 : 미션 크리티컬 실시간 비디오 네트워킹 및 비주얼 협업 솔루션의 글로벌 공급업체인 하이비전 시스템즈(Haivision Systems)는 하이비전과 소니(소니)가 소니의 클라우드 프로덕션 플랫폼인 기업용 크리에이터스 클라우드로 하이비전의 업계 최고의 비디오 인코더, 디코더 및 모바일 비디오 송출기를 성공적으로 테스트했다고 발표했습니다.

- 2024년 2월 : Sony는 5G 네트워크에서 고속, 저지연 동영상 및 정지 영상 데이터 전송을 가능하게 하는 독자적인 전용 휴대용 데이터 트랜스미터 「PDT-FP1」의 발매를 발표했습니다. 이 무선 통신기는 카메라에 장착하여 뉴스와 이벤트 촬영, 방송 영상 제작 등 이미지 캡처에서 전송, 방송, 전송까지 속도가 요구되는 장면에서 활용됩니다. Wi-Fi 연결을 사용할 수 없는 실외 및 실내 환경에서 5G 네트워크를 통한 고속, 저지연, 안정적인 모바일 데이터 통신을 제공하여 효율적이고 이해하기 쉬운 워크플로우를 실현합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

- 조사 프레임워크

- 2차 조사

- 1차 조사

- 데이터의 삼각측량과 인사이트의 생성

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 밸류체인 분석

- 주요 거시 경제 동향이 시장에 미치는 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 복수 포맷 대응에 의한 엔코더 수요의 확대

- OTT 서비스를 통한 D2C 서비스 확대

- SAAS 솔루션 채용 증가

- 시장 성장 억제요인

- 방송에 사용되는 미디어 포맷과 코덱의 표준화의 부족

제6장 시장 세분화

- 기술별

- 아날로그 방송

- 디지털 방송

- 제품별

- 접시 안테나

- 스위치

- 비디오 서버

- 엔코더

- 송신기 및 리피터

- 기타

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 프로파일

- Cisco Systems Inc.

- Telefonaktiebolaget LM Ericsson

- Evs Broadcast Equipment SA

- Grass Valley

- Harmonic Inc.

- Clyde Broadcast

- Sencore Inc.

- Eletec Broadcast Telecom Sarl

- AVL Technologies Inc.

- ETL Systems Ltd

제8장 투자 분석

제9장 시장의 미래

KTH 25.05.09The Broadcast Equipment Market size is estimated at USD 5.58 billion in 2025, and is expected to reach USD 7.72 billion by 2030, at a CAGR of 6.7% during the forecast period (2025-2030).

The distribution of audio and video content to a precise audience via electronic mass communication is known as broadcasting. It is a spread of information to a large group of people. Typically, broadcasting is limited to a local spot network system. Broadcasting services, which remain popular, deliver a large audience with the most direct and reliable information mediums. The broadcast equipment market is expanding because of the increased use of smart electronic devices and improved demand for 3D and HD content.

Key Highlights

- Over the last few decades, consumers' demand for better-quality audio and video has rapidly upgraded broadcast equipment products and technology. With content being produced in 4K and UHD formats, broadcasting in the identical format for enhanced viewing quality has resulted in IP live-production technology. This is essential for live production, where a premium is placed on flexible and efficient system control.

- For instance, in November 2023, the ArcGIS Motion Imagery Team announced the release of the new ArcGIS Video Server. This new server role for ArcGIS Enterprise is designed to expand video capabilities across ArcGIS. The latest ArcGIS Video Server allows indexing, publishing, searching, and streaming video as a service with geospatial and temporal context.

- Technological advancements are driving broadcasters to provide UHD output to their premium users, fueling market growth. Moreover, the rise in digital channels and the increasing utilization of cutting-edge broadcasting devices, featuring 8K video quality for sports coverage and 4K quality for news coverage, contribute to the acceleration of market growth. According to the 8K Association, 8K TVs will become increasingly popular in the coming years. Around 2.14 million 8K TV sets were shipped in 2023, up from 800 thousand in the previous year. By 2026, this number is predicted to reach over 4.4 million units.

- The sports section is the biggest market for TV viewers worldwide, and it is finding ways to deliver video content at scale. The increasing number of devices and formats offer several challenges for service providers, content owners, broadcasters, and rights holders. The rental sports broadcast equipment sector is also a significant revenue generator in the broadcast equipment market. The increasing number of international sports tournaments is driving the rental market for broadcast equipment.

- Furthermore, the market is witnessing opportunities for evolution due to evolving technology, increased investments in high-speed internet infrastructure, and growing demand for D2C offerings via OTT services. According to the International Telecommunication Union, as of 2023, 67% of the population in small island developing states (SIDS) used the internet, compared to 35% of the population in least developed countries (LDCs), while the internet penetration rate for those living in landlocked growing counties was at 39%. The global online access rate was 67%.

- Moreover, the rising income, increasing purchases of consumer durables, and the increasing availability of fast and cheap internet are expected to impact the market's growth positively. As per IBEF, India, television is projected to constitute 40% of the Indian media market in 2024, trailed by digital advertising (12%), print media (13%), cinema (9%), and the OTT and gaming industries (8%). By 2025, it is anticipated that the number of linked intelligent televisions will reach around 40 to 50 million.

- The rapidly developing nature of digital audio and video formats and the need for open, domestic, or international agreement norms for generating and preserving digital video and audio are challenging the market's growth. Norms for digital audio and video formats and compression methods are evolving with every new advancement in digital technology.

- The COVID-19 pandemic forced broadcasters to rethink their approach to producing and delivering content - resulting in changes to staffing, technology stacks, and facilities. News broadcasting, for instance, adapted to the lockdown requirements of several nations, with several programs worldwide gathering experts' input through consumer video technology. Broadcasting technologies also enabled programs and concerts during the pandemic. For instance, Lady Gaga organized an eight-hour event involving 100 musicians playing from their living rooms, bedrooms, and gardens.

Broadcast Equipment Market Trends

Encoders are Expected to Witness Significant Growth

- Encoders play a crucial role in broadcasting by converting audio and video signals into digital format for transmission over networks. As demand for high-definition and streaming content grows, broadcasters need advanced encoders to deliver high-quality video efficiently. This drives the demand for broadcast equipment, including encoders, as broadcasters upgrade their infrastructure to meet evolving viewer preferences and technological standards.

- In April 2024, Net Insight announced a boost to the capability of its Emmy Award-winning internet media transport offering, the Nimbra 400 encoders, to meet the growth in more prosperous and more interactive events production with the upgraded Nimbra 414. The latest version of the Nimbra 414 increases channel density and support for UHD content, making the Nimbra 414 encoder/decoder family now ideally placed to help broadcasters deliver more immersive productions that enhance viewer engagement.

- The purpose of encoding a video is to create a digital copy transmitted over the internet. Broadcasters can choose between a hardware or software encoder, depending on the purpose of the stream and the budget. Most professional broadcasters use hardware encoders, but due to the high price point, most beginner-level to mid-experienced broadcasters go with live streaming encoder software.

- For instance, in April 2024, VITAC, a Verbit Company, a US-based captioning company, and ENCO, a provider of broadcasting solutions, announced a strategic partnership aimed at providing broadcasters with expanded choice for hardware encoders and cloud captioning. Through this alliance, broadcasters will access a comprehensive suite of captioning tools and services tailored to meet their specific requirements.

- Furthermore, the increasing popularity of streaming platforms necessitates efficient encoding technologies to deliver high-quality video content over the internet. For instance, in September 2023, Nordic PayTV and streaming platform Allente launched its new Allente Stream multiscreen OTT offering. As a result, the operator has gone live with the latest apps for Android TV and mobiles, LG and Samsung Smart TVs, Apple TV, web, and iOS, based on the 3SS 3Ready product platform.

- Moreover, with content being distributed across different platforms and devices, broadcasters need encoders that support adaptive bitrate streaming and compatibility with different codecs and protocols. Further, the popularity of live events, sports, and news coverage needs encoders that can efficiently encode and transmit live video streams in real time.

- According to Meltwater, in recent years, live-streaming video content has become one of the most popular types of video content consumed online for entertainment and operational purposes. During the third quarter of 2023, live streaming registered an audience reach of almost 28% among internet users worldwide. In addition, in 2023, Netflix revealed that it had 80.13 million paying streaming subscribers in the United States and Canada.

- The effectiveness of encoders has significantly improved, and they play a significant role in the success of modern formats, like HDTV, and compression standards, like H.264. Currently, the demand for encoders in broadcast settings can be categorized into three key domains: contribution, primary distribution, and home distribution.

Asia-Pacific is Expected to Witness Significant Growth Rate

- Asia-Pacific is home to some densely populated countries such as China and India. Increasing urbanization and digitization across Asia-Pacific countries fuel the demand for broadcast equipment as more people access television and digital media content. According to Meltwater, in the third quarter of 2023, about 96% of internet users aged between 16 and 64 years in the Philippines used a subscription video-on-demand (SVOD) service, such as Netflix, each month.

- Further, over-the-top (OTT) streaming platforms are gaining popularity in the region, creating a need for advanced broadcast equipment to support high-quality streaming services. For instance, in May 2024, Prasar Bharati has announced its plans to start its own OTT platform for families in August. The government's public service broadcaster will stream content that will be focused on Indian society and culture. Initially, the platform will be available for free to the public. Such developments may further propel the market's growth in the region.

- Asia-Pacific is home to major sporting events like the Olympics, FIFA World Cup, and regional tournaments. The demand for broadcast equipment surges during such events to ensure seamless coverage and transmission. At the same time, advancements in broadcasting technologies, such as 4K/UHD broadcasting, virtual reality (VR), augmented reality (AR), and immersive audio, are driving the adoption of advanced broadcast equipment in the region.

- Countries such as Bhutan, Iran, Bangladesh, and Vietnam are demonstrating the most significant mobile penetration advances, according to a GSMA report. The implementation of smart devices in the region is another factor fueling the demand for high-definition audio and videos. As per GSMA, 64% of the residents in APAC already possess smartphones, and the adoption is expected to cross 80% in 2025.

- Furthermore, in March 2023, Netflix announced plans to spend approximately USD 1.9 billion on local content in Asia-Pacific. The company was expected to register revenue growth of 12% Y-o-Y in 2023 and exceed USD 4 billion compared to 9% growth in 2022. In addition, according to ITU, 66% of the population in Asia-Pacific reported using the Internet as of 2023, further propelling the market's growth.

- Local vendors invested heavily to capitalize on the opportunities brought by the COVID-19 pandemic. For instance, in March last year, Signiant Inc. announced the acquisition of Kyno, which provides embedded media processing software. The acquisition helps Signiant Inc. extend the functionality of the Software-Defined Content Exchange (SDCX) SaaS platform, incorporating tools for engagement with media assets. With almost 1 million users globally, the platform connects more than 50,000 media and entertainment companies of all sizes.

Broadcast Equipment Industry Overview

The competitive rivalry between various firms in the broadcast equipment market depends on price, product, or market share, along with the intensity with which they compete. Some major market players include Cisco Systems Inc., Telefonaktiebolaget LM Ericsson, Harmonic Inc., EVS Broadcast Equipment SA, and Grass Valley.

- April 2024: Haivision Systems, a global provider of mission-critical, real-time video networking and visual collaboration solutions, announced that Haivision and Sony Corporation (Sony) had successfully tested Haivision's industry-leading video encoders, decoders, and mobile video transmitters with Sony's cloud production platform, Creators' Cloud for Enterprise.

- February 2024: Sony announced the launch of a unique dedicated portable data transmitter, the PDT-FP1, that allows high-speed, low-latency video and still image data transport over 5G networks. When attached to a camera, this wireless communication device will be used when speed is required, from image capture to delivery, broadcasting, and distribution, such as news or events photography and broadcast video production. It provides high-speed, low-latency, and stable mobile data communication over 5G networks in outdoor or indoor environments where a Wi-Fi connection is unavailable, enabling efficient and straightforward workflows.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Impact of Key Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Encoders due to Support for Multiple Formats

- 5.1.2 Growing D2C Offerings through OTT Services

- 5.1.3 Increased Adoption of SAAS Solutions

- 5.2 Market Restraint

- 5.2.1 Lack of Standardization of Media Formats and Codecs Used for Broadcasting

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Analog Broadcasting

- 6.1.2 Digital Broadcasting

- 6.2 By Product

- 6.2.1 Dish Antennas

- 6.2.2 Switches

- 6.2.3 Video Servers

- 6.2.4 Encoders

- 6.2.5 Transmitters and Repeaters

- 6.2.6 Other Products

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Telefonaktiebolaget LM Ericsson

- 7.1.3 Evs Broadcast Equipment SA

- 7.1.4 Grass Valley

- 7.1.5 Harmonic Inc.

- 7.1.6 Clyde Broadcast

- 7.1.7 Sencore Inc.

- 7.1.8 Eletec Broadcast Telecom Sarl

- 7.1.9 AVL Technologies Inc.

- 7.1.10 ETL Systems Ltd