|

시장보고서

상품코드

1628715

유럽의 에어로졸 캔 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe Aerosol Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

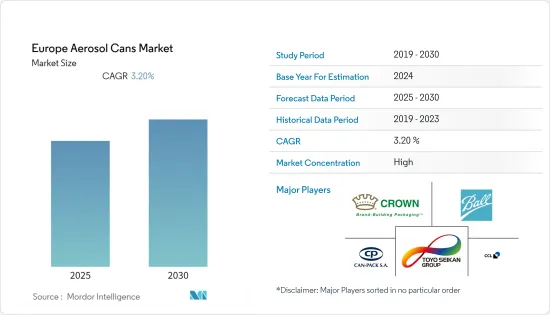

유럽의 에어로졸 캔 시장은 예측 기간 동안 CAGR 3.2%를 나타낼 것으로 예상됩니다.

주요 하이라이트

- 에어로졸은 가정용품, 화장품 등 대중적인 제품부터 산업 및 의료용에 특화된 특수 에어로졸 유형에 이르기까지 다양한 제품을 제공합니다. 에어로졸 캔은 코팅제, 세정제, 방향제, 퍼스널케어 제품, 살충제 및 기타 여러 제품에 사용되며, 1990년대 초에는 프레온 가스에 대한 우려가 커지면서 어려움에 직면했지만, 스프레이 기술의 혁신과 친환경 추진제 사용으로 여러 산업 분야에서 에어로졸 캔의 급속한 보급이 가능했습니다. 여러 산업 분야에서 에어로졸 캔의 급속한 보급이 가능해졌습니다.

- 유럽의 주요 경제 국가인 퍼스널케어 및 식품 부문 수요가 증가함에 따라 조사 대상 시장에서 유럽이 큰 비중을 차지하고 있습니다.

- 또한, 제약 부문에서는 알루미늄 에어로졸 캔의 높은 안전성과 편리한 취급으로 인해 알루미늄 에어로졸 캔에 대한 관심이 증가하고 있는 것으로 확인되었습니다. 이러한 요인들은 이 지역 수요를 촉진할 것으로 예상됩니다. 정부가 지속가능성을 장려하고 산업계가 이를 수용하는 것은 이 지역의 알루미늄 에어로졸 캔 수요에 큰 긍정적인 영향을 미치고 있습니다.

- 독일, 프랑스, 러시아의 1인당 에어로졸 소비량은 예측 기간 동안 더 많은 수요를 창출할 것으로 예상됩니다. 퍼스널케어 부문 외에도 제약 부문은 위생적이고 안전하며 정확한 제품 적용을 위해 에어로졸 시스템이 맞춤화됨에 따라 성장세를 보이고 있습니다. 또한, 많은 산업 부문과 자동차 부문이 혁신적인 포장 솔루션을 찾고 있기 때문에 이들 부문의 에어로졸 제품 소비가 빠르게 증가하고 있으며, 다양한 제품이 에어로졸 캔으로 포장되고 있습니다.

- 또한, 인프라 개발에 대한 투자 증가와 밝은 경제 동향은 예측 기간 동안 산업 수요를 더욱 촉진할 것으로 예상됩니다. 또한, 에어로졸 포장이 제공하는 편리함과 강도 덕분에 에어로졸 캔은 많은 산업에서 사용되는 표준 포장으로 자리 잡았습니다. 또한, 시장 기업들의 끊임없는 혁신과 포장 기술 개발은 시장 성장을 가속할 것으로 예상됩니다.

- 또한 2020년 9월에는 Beiersdorf, Procter & Gamble, Unilever, L'Oreal, ALPLA, enkel 등 포장 가치사슬 전반에 걸쳐 85개 이상의 기업 및 단체가 디지털 기술이 더 나은 분리수거가 가능한지 여부를 평가하기 위해 평가하기 위해 손을 잡았습니다. 또한 순환 경제를 촉진하기 위해 EU의 포장재 재활용률을 높이는 데 주력하고 있습니다.

- 최근 볼은 파리에서 열린 ADF &PCD 전시회에서 최신 캔 기술인 360도 맞춤형 성형 기술을 발표했습니다. 이 신기술은 캔의 전체 둘레에 걸쳐 좌우 대칭 또는 비대칭 맞춤 성형이 가능한 공정을 사용하여 브랜드 소유자와 최종 소비자 모두에게 이익이 되는 새로운 차원의 캔 컨투어링을 제공합니다. 또한, 법률, 지침 및 규정으로 규정된 규제로 인해 FEA(유럽의 에어로졸 연맹(FEA) 표준과 같은 업계에서 요구사항에 대한 가이드라인이 정해져 있습니다.

유럽의 에어로졸 캔 시장 동향

알루미늄이 가장 큰 시장 점유율을 차지합니다.

- 알루미늄은 에어로졸 캔의 포장 솔루션으로 가장 인기 있는 금속 중 하나입니다. 그 금속 캔버스는 광고 인쇄, 빠른 냉각, 100% 재활용 가능하고 불활성이며 불활성이기 때문에 화물의 무게를 줄이는 데 도움이되어 운송 비용을 절감하고 탄소 배출량을 줄입니다. 탈취제에 대한 선호도가 높아지고 고객의 가처분 소득이 증가함에 따라 유럽에서 알루미늄 에어로졸 캔에 대한 수요가 증가하고 있습니다.

- 또한 유럽에서는 페인트와 헤어 스프레이의 가정용 소비가 그 어느 때보다 급증하고 있으며, 2020년COVID-19 전염병과 관련된 집회 규제로 인해 살롱에서 헤어 스프레이를 사용하는 유럽인은 거의 없습니다. 가정용 스프레이에 대한 수요 증가로 영국의 캔 시트 수입량도 증가했습니다. 영국은 Ball 및 Crown과 같은 회사가 캔으로 성형한 국산 및 수입 혼합 알루미늄 헤어 스프레이 캔 시트에 의존하고 있습니다.

- 전체적으로 비용, 환경 발자국, 편의성, 다양한 포장 솔루션이 제공하는 유연성 등 많은 요인이 소비자들이 금속 캔에서 멀어지는 것을 촉진하고 있습니다. 예를 들어, 알루미늄은 보크사이트를 사용하며, 보크사이트 채굴은 매우 에너지 집약적입니다. 이 과정에는 많은 에너지가 필요하며 알루미늄으로 변환하고 캔을 만들기 위해 성형해야 합니다.

- 또한 알루미늄 캔은 재활용이 가능하고 인쇄가 용이하다는 장점이 있습니다. 또한 알루미늄 캔은 가볍고 가스에 대한 좋은 장벽 역할을합니다. 이러한 요인으로 인해 퍼스널케어 산업에서 다른 금속 캔이나 플라스틱 및 유리와 같은 다른 재료보다 알루미늄 캔의 보급률이 더 높습니다.

- 또한 탈취제 캔의 알루미늄베이스는 주로 알루미늄으로 구성되어 있지만 0.4% 철, 0.2% 실리콘, 1% 마그네슘, 1% 망간, 0.15% 구리 등 소량의 다른 금속이 포함되어 있습니다. 탈취제 캔 산업에 사용되는 알루미늄의 대부분은 재활용 재료에서 비롯됩니다. 유럽의 총 알루미늄 공급량의 약 25%는 재활용 스크랩에서 비롯되며, 퍼스널케어 캔 산업은 재활용 재료의 사용자입니다. 일부 제조업체는 알루미늄 캔 산업이 사용한 캔의 65% 이상을 재생(재활용)한다고 말합니다.

영국, 가장 큰 시장 점유율을 차지합니다.

- 영국을 포함한 유럽의 많은 국가에서는 엄격한 재활용 법규가 있어 기업들이 강철보다 알루미늄을 채택하도록 장려하고 있습니다. 알루미늄 에어로졸 캔은 유연성이 뛰어나고 밝은 포장으로 퍼스널케어 산업에서 매우 중요한 역할을 합니다. 또한, 재활용이 용이하고 재활용 가능한 재료를 쉽게 구할 수 있어 사용 편의성이 높아져 수요를 견인하고 있습니다.

- 2020년 9월, 영국 레스터시는 알루미늄 포장재 재활용 기구(Alupro)와 메탈 매터즈(Metal Matters)와 손잡고 금속 포장재 재활용을 촉진했습니다. 레스터 시의회가 시작한 Make Metals Matter 캠페인은 레스터시의 14만여 가구를 대상으로 가정에서 나오는 모든 금속 포장 폐기물을 재활용할 것을 촉구하는 것으로 보입니다.

- 또한 레스터에서는 매년 1억 6,800만 개 이상의 캔, 호일 트레이, 에어로졸 용기가 사용되는 것으로 추정되며, 이러한 금속은 무한히 재활용할 수 있습니다. 레스터 시의회에 따르면, 만약 레스터의 가정에서 사용되는 모든 금속 포장재를 재활용하기 위해 수거한다면, 연간 950대의 자동차가 지역 도로를 주행하는 것과 같은 4,500톤의 이산화탄소 배출량을 줄일 수 있다고 합니다.

- 영국 에어로졸 제조업체 협회(BAMA)에 따르면 전국적인 봉쇄와 불필요한 소매점 폐쇄로 인해 많은 사용자가 영향을 받았지만 에어로졸 산업은 상황 변화에 빠르게 적응하고 새로운 시장 요구에 부응하여 2020년전체 생산량이 여전히 15 억 개를 초과할 것으로 예상됩니다. 2019년 대비 1.3% 감소에 불과합니다.

- 또한 2020년 9월, 영국에 본사를 둔 브랜드 관리, 디지털 인쇄 및 인터랙티브 미디어 제공 업체인 Springfield Solutions는 에어로졸을 위한 새로운 디지털 환경 서비스를 출시했습니다. 지금까지 에어로졸에 스팟 바니시, 금, 은 멀티 컬러 호일, 촉감 마감, 엠보싱 효과 등 프리미엄 효과를 추가하는 것은 비용이 많이 들고 융통성이 없으며 시간이 많이 소요되는 과정이었습니다. 그러나 Springfield의 독특한 디지털 라벨 장식 서비스를 통해 이러한 상황을 바꿀 수 있습니다.

유럽의 에어로졸 캔 산업 개요

유럽의 에어로졸 캔 시장은 가격에 민감한 시장이기 때문에 소수의 주요 진입 업체로 고도로 통합되어 있습니다. 또한 시장 공급업체는 시장 점유율과 수익성을 확보하기 위해 지속가능성과 제품 강화를 위해 노력하고 있습니다. 최근 시장 개척 동향은 다음과 같습니다.

- 2021년 3월-LINDAL은 독일에서 온라인 3D 에어로졸 컨피규레이터를 출시하여 전통적인 포장 설계 프로세스를 혁신했습니다. 새로운 3D 에어로졸 컨피규레이터는 린달의 웹사이트에서 독점적으로 호스팅됩니다. 고객은 정교한 편집 및 디자인 도구에 액세스하여 3D 에어로졸 포장을 즉시 쉽게 만들 수 있습니다.

- 2020년 9월 - 스웨덴의 알루미늄 일체형 캔 제조업체인 Nussbaum Matzingen AG는 100% 포스트 소비자 재활용(PCR) 알루미늄으로 만든 에어로졸 캔을 출시했습니다. 이 제품은 1차 알루미늄을 전혀 포함하지 않는 최초의 에어로졸 캔으로, 이러한 유형의 에어로졸 캔으로는 처음입니다. 나스바움의 목표는 재활용 캔으로 에어로졸 캔을 생산하여 순환 경제의 자재 흐름을 실현하는 것입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 산업 매력 - Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 시장 성장 촉진요인

- 시장이 해결해야 할 과제

- 시장 기회

제5장 유럽의 에어로졸 캔 산업 COVID-19의 영향

제6장 시장 세분화

- 재료별

- 알루미늄

- Steel-tinplate

- 기타

- 최종사용자 산업별

- 화장품 및 퍼스널케어(데오드란트 및 제한제, 헤어 스프레이, 헤어 무스, 기타)

- 가정용

- 의약품/동물용 의약품

- 페인트/바니시

- 자동차/산업

- 기타

- 국가별

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타 유럽

제7장 경쟁 구도

- 기업 개요

- Crown Holdings inc.

- Ball Corporation

- Toyo Seikan Group Holdings

- CCL Industries

- Can-Pack SA

- Ardagh Group

- Nampak Ltd

- Mauser Packaging Solutions

- Nussbaum Matzingen AG

- Tecnocap SpA

제8장 투자 분석

제9장 시장 전망

LSH 25.01.21The Europe Aerosol Cans Market is expected to register a CAGR of 3.2% during the forecast period.

Key Highlights

- Aerosol offers a wide range of products, from mass-market goods, such as household and cosmetic products, to specific aerosol types dedicated for industrial or medical purposes. The aerosol cans are used for coatings, cleaning agents, air fresheners, personal care items, insecticides, and a host of other products. While the market faced challenges in the early 1990s due to increased concerns about CFC propellants, innovations in spray technologies and the use of eco-friendly propellants have enabled rapid adoption of aerosol cans in multiple industries.

- Europe accounts for a significant share in the market studied due to the increasing demand from the leading European economy's personal care and food segment.

- Moreover, the pharmaceutical sector has been observed to have shown a growing interest in aluminum aerosol cans owing to the can's high level of security, further complemented by its convenient handling. Such factors are expected to add to the demand in the region. The government's push for sustainability and industrial acceptance of the same has been a huge positive impact on aluminum aerosol cans demand in the region.

- The per capita consumption of aerosols in Germany, France, and Russia, is expected to provide more demand during the forecast period. Besides the personal care sector, the pharmaceutical segment is witnessing growth as the aerosol system is tailor-made for a hygienic, safe and precise application of products. Moreover, with many industrial and automotive segments looking for innovative packaging solutions, the consumption of aerosol products from these sectors has increased rapidly, with a wide range of products being packaging in aerosol cans.

- Additionally, increasing investments in infrastructure development and positive economic trends are expected further to support the industrial demand over the forecast period. Moreover, owing to the convenience and strength offered by aerosol packaging, aerosol cans have become the standard packaging used in many industries. Besides, constant innovations by the companies in the market and technological developments in packaging are expected to drive market growth.

- Further, In September 2020, over 85 companies and organizations from the complete packaging value chain, including Beiersdorf, Procter & Gamble, Unilever, L'Oreal, ALPLA, and Henkel, have joined forces to assess whether digital technology can enable better sorting. They also focus on improved recycling rates for packaging in the European Union to drive a circular economy.

- Recently, Ball Corporation unveiled its latest can technology, 360-degree custom shaping, at the ADF & PCD exhibition in Paris. The new technology brought another dimension can contouring, using a process that allows custom shaping, symmetrically or asymmetrically, up to the entire circumference of the can, benefiting both brand owners and end consumers. Furthermore, with regulations specified in laws, directives, or rules, the guidelines of the requirements are also placed in industry, e.g., FEA (European Aerosol Federation) standards.

Europe Aerosol Cans Market Trends

Aluminum Accounts For the Largest Market Share

- Aluminum is one of the most popular metals for aerosol can packaging solutions. Its metal canvas for ad printing, fast cooling, 100% recyclability, and inertness is helping for the reduction in freight weight, resulting in low transportation costs and reduced carbon emission. Its increased preference for deodorants and rise in customers' disposable income drive the demand for aluminum aerosol cans in Europe.

- Also, there was an unprecedented spike in at-home consumption of paints and hair spray in Europe. Few Europeans are using hairsprays at saloons because of gathering restrictions related to the COVID-19 pandemic in 2020. The increase in take-home sprays demand also necessitated higher UK imports of can sheets. The country relies on a mixture of domestic and imported aluminum hair sprays can sheet formed into cans by companies such as Ball and Crown.

- Overall, many factors, such as costs, environmental footprint, convenience, and flexibility offered by different packaging solutions, are driving consumers away from metal cans. For instance, Aluminum uses bauxite, and bauxite mining is very energy-intensive. The process requires a lot of energy and the conversion to Aluminum and molding to make the cans.

- Moreover, Aluminum cans offer the advantages of recyclability and ease of printing. Additionally, they are lightweight and act as excellent barriers to gases. Such factors allow a higher penetration of aluminum variants in the personal care industry than other metal cans and other materials such as plastic or glass.

- Further, The aluminum base for deodorant cans consists primarily of Aluminum, but it contains small amounts of other metals, including 0.4% iron, 0.2% silicon, 1% magnesium, 1% manganese, and 0.15% copper. A significant portion of the Aluminum used in the deodorant can industry is derived from recycled material. Approximately 25% of the total European aluminum supply comes from recycled scrap, and the personal care can industry is the user of recycled material. Some of the manufacturers stated that the aluminum can industry reclaims (recycles) more than 65% of used cans.

United Kingdom Accounts for the Largest Market Share

- Many countries in Europe, including the United Kingdom, have strict recycling laws encouraging companies to adopt aluminum over steel. Aluminum aerosol cans offer high flexibility and bright packaging, crucial aspects of the personal care industry. Moreover, the eased recyclable material availability adds to its usability, thus, driving the demand.

- In September 2020, the UK city of Leicester had partnered with the Aluminum Packaging Recycling Organisation (Alupro) and MetalMatters to promote metal packaging recycling. The Make Metals Matter campaign, launched by Leicester City Council, is likely to target over 140,000 homes in the city to remind people to recycle all of their household metal packaging waste.

- Further, it is estimated that over 168 million cans, foil trays, and aerosol containers are used in Leicester every year, and the metal they are made of is endlessly recyclable. According to Leicester City Council, if all the metal packaging used in the city's homes was collected for recycling, it may help save 4,500 metric tons in carbon emissions, equivalent to taking 950 cars off local roads for a year.

- According to British Aerosol Manufacturers' Association (BAMA), many users impacted due to the national lockdowns and the closure of non-essential retail, the aerosol industry was quick to adjust to the changing circumstances and respond to new market needs, with overall production still above 1.5 billion units in 2020, just 1.3% down on 2019.

- Further, in September 2020, UK-based brand management, digital print, and interactive media provider Springfield Solutions have launched a new digital embellishment service for aerosols. Until now, adding premium effects to aerosols, such as spot varnishes, gold, silver, and multi-colored foils, tactile finishes, and emboss effects, has been a costly, inflexible, and lengthy process. However, this is all set to change because of Springfield's unique digital label embellishment offerings.

Europe Aerosol Cans Industry Overview

The European aerosol cans market is highly consolidated with a few significant players as the market is price sensitive; hence sustaining in the market is demanding. Further, vendors in the market are driven by sustainability and product enhancements to capture the market share and profitability. Some of the recent developments in the market are:

- March 2021 - LINDAL has launched an online 3D Aerosol Configurator in Germany to transform traditional packaging design processes. The new 3D Aerosol Configurator is hosted exclusively on the company's website. Customers can gain access to a suite of sophisticated editing and design tools to instantly and easily create 3D aerosol packaging.

- September 2020 - Nussbaum Matzingen AG, a Swedish manufacturer of aluminum monobloc cans, has launched an aerosol can made from 100% postconsumer recycled (PCR) aluminum. The product is the first of its kind of aerosol can containing no primary aluminum at all. The goal for Nussbaum is to produce an aerosol can made from recycled cans, implementing a circular economy material flow.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Growing Demand from the Cosmetic Industry

- 4.4.2 Recyclability of aerosol cans

- 4.5 Market Challenges

- 4.5.1 Increasing Competition from Substitute Packaging

- 4.6 Market Opportunities

- 4.6.1 Emerging economies offer high growth potential

5 IMPACT OF COVID-19 ON THE EUROPE AEROSOL CAN INDUSTRY

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Aluminum

- 6.1.2 Steel-tinplate

- 6.1.3 Other Materials

- 6.2 By End-User Industry

- 6.2.1 Cosmetic and Personal Care (Deodorants/Antiperspirants, Hairsprays, Hair Mousse, and Others)

- 6.2.2 Household

- 6.2.3 Pharmaceutical/Veterinary

- 6.2.4 Paints and Varnishes

- 6.2.5 Automotive/Industrial

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Crown Holdings inc.

- 7.1.2 Ball Corporation

- 7.1.3 Toyo Seikan Group Holdings

- 7.1.4 CCL Industries

- 7.1.5 Can-Pack SA

- 7.1.6 Ardagh Group

- 7.1.7 Nampak Ltd

- 7.1.8 Mauser Packaging Solutions

- 7.1.9 Nussbaum Matzingen AG

- 7.1.10 Tecnocap SpA

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

샘플 요청 목록