|

시장보고서

상품코드

1636550

이탈리아의 이차 전지 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Italy Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

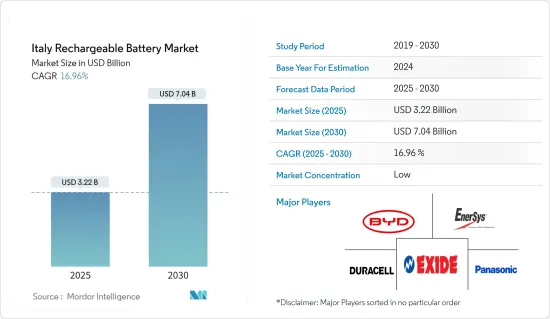

이탈리아 이차 전지 시장 규모는 2025년에 32억 2,000만 달러로 추정되고, 예측기간(2025-2030년)의 CAGR은 16.96%로 전망되며, 2030년에는 70억 4,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 전기자동차(EV) 생산량 증가와 리튬이온 배터리 가격 하락이 예측 기간 동안 이차 전지 수요를 견인할 것으로 예상됩니다.

- 한편, 원재료의 매장량 부족은 이차 전지 시장의 성장을 크게 억제할 가능성이 있습니다.

- 하지만 스마트 워치, 무선 이어폰, 스마트 밴드 등의 웨어러블 디바이스의 채용이 확대되고 있기 때문에 가까운 미래, 이차 전지 시장의 기업에게 큰 비즈니스 기회가 생길 것으로 기대되고 있습니다.

이탈리아의 이차 전지 시장 동향

리튬 이온 배터리 유형이 시장을 독점

- 리튬 이온 이차 전지는 무수한 장점으로 인해 축하되며 다양한 분야에서 광범위한 용도 분야를 찾습니다. 전기 에너지 저장을 위한 믿을 수 있는 효율적인 매체로, 그것의 상승은 주목할 만합니다. 리튬 이온 이차 전지의 두드러진 특징은 뛰어난 에너지 밀도이며 컴팩트하고 가벼운 모양에 큰 파워를 담을 수 있습니다.

- 이탈리아의 리튬 이온 이차 전지 시장은 기회와 도전 모두가 넘치는 역동적인 장소입니다. 뛰어난 용량 대 중량비 덕분에 리튬 이온 이차 전지는 다른 기술을 능가하는 인기를 자랑합니다. 리튬 이온 배터리는 일반적으로 동종의 것에 비해 비싼 가격이지만, 시장의 대기업은 연구 개발과 사업 확대에 많은 투자를 하고 있습니다. 이러한 경쟁의 격화는 전지 성능을 강화할 뿐만 아니라 리튬 이온 전지 가격의 하락 동향에도 기여하고 있습니다.

- 2023년에는 전기자동차(EV) 및 배터리 에너지 저장 시스템(BESS)에서 배터리 팩 평균 가격 상승에 견인되었으며, 배터리 가격은 현저한 하락을 보였으며, 139달러/kWh에 침착하여 13% 이상의 하락을 기록했습니다. 채굴 및 정제 능력의 증강에 따라 리튬가격은 안정되어 2026년에는 100달러/kWh의 대대를 타는 것으로 예측되고 있습니다.

- 많은 배터리 및 에너지 저장 시스템(BESS)의 중심 존재 인 리튬 이온 이차 전지는 높은 에너지 밀도, 빠른 충전 및 사이클 수명의 길이로 빛납니다. 이러한 특성은 BESS 용도에서 효율적인 에너지 저장 및 방출의 유력 후보가 되고 있습니다. 이 지역의 기업은 BESS 이니셔티브를 강화하기 위해 주요 조직과 적극적으로 협력하고 있습니다.

- 예를 들어, 2023년 12월 영국의 신재생 에너지 발전 회사인 옥토퍼스 에너지 발전은 다음 캐피탈 파트너스와 합작회사를 설립했습니다. 그들의 야심적인 목표는 150만 kW의 상업 규모의 축전지 시스템을 전국 전개하는 것입니다. 이 구상은 지역의 축전 능력을 강화해, 향후 수년간 급증하는 에너지 수요에 대응해, 그 결과, 리튬 이온 이차 전지 수요를 밀어 올리는 자세입니다.

- 이탈리아가 신재생 에너지(특히 태양광과 풍력)에 힘을 쏟고 있다는 것은 분명합니다. 리튬이온 이차 전지는 이 신재생 에너지를 이용 및 저장하고 날씨 변화에도 불구하고 안정된 전력공급을 확보하는데 매우 중요합니다. 2030년을 향해 야심찬 목표를 세우고 있기 때문에 이 나라의 신재생 에너지 부문은 투자를 확대하는 태세에 있습니다.

- 이 기세를 강조하기 위해 2023년 3월 에디슨은 신재생 에너지에 대한 50억 유로의 투자를 발표하고 2030년까지 6GW의 용량을 목표로 한다고 밝혔습니다. 마찬가지로 2023년 1월에는 솔라리그와 알란트라가 공동으로 190만kW의 태양광발전 벤처 N-산에너지를 설립하여 2025년까지 이탈리아에서 50개 발전소를 완성할 예정입니다.

- 이러한 사업은 이 지역에서 신재생 에너지 생산량의 확대를 약속할 뿐만 아니라 리튬이온 이차 전지에 대한 수요의 급증을 예측하는 것입니다.

현저한 성장을 이루는 자동차 부문

- 오랫동안 자동차는 내연 기관차(ICE)에만 의존해 왔습니다. 그러나 환경에 대한 관심이 높아짐에 따라 전기차(EV)로의 이동이 현저해지고 있습니다. EV는 주로 리튬 이온 이차 전지를 이용합니다. 리튬 이온 이차 전지는 에너지 밀도가 높고 가볍고 자기 방전이 적고 유지 보수가 필요하지 않기 때문에 선호됩니다.

- 플러그인 하이브리드 자동차와 전기자동차는 리튬 이온 이차 전지 시스템을 동력원으로 하고 있습니다. 급속 충전이 가능하고 에너지 밀도가 높기 때문에 리튬 이온 배터리는 주행 거리와 충전 시간 모두에 대한 OEM의 요구를 독자적으로 충족하고 있습니다. 대조적으로, 납 기반 트랙션 배터리는 무게가 무겁고 비 에너지가 낮기 때문에 풀 하이브리드 자동차 및 전기자동차에는 적합하지 않습니다.

- 이탈리아에서는 전기자동차의 보급이 꾸준히 진행되고 있습니다. 국제에너지기구(IEA)의 데이터에 따르면 2023년 이탈리아에서 판매된 전기차는 13만 6,000대로 2022년부터 19.3% 증가했습니다. 예측은 향후 몇 년동안 EV 판매가 크게 급증합니다.

- 이탈리아는 지속 가능한 수송을 향한 한 걸음으로 전기자동차(EV)를 지지하고 있습니다. EV의 보급을 강화하고 충전 인프라에 투자함으로써 이탈리아는 더욱 친환경적인 미래를 향한 세계의 변화에 보조를 맞추고 있습니다.

- 주목할 만한 움직임으로 이탈리아는 2024년 2월 9억 5,000만 유로(10억 달러)의 보조금 구상을 발표했습니다. 이는 보다 깨끗한 자동차(EV)로의 전환을 촉진하고 자동차 부문을 활성화하는 것을 목표로 합니다. 구체적으로 로마는 저소득자에게 최대 13,750 유로의 보조금을 제공하고 부가가치세를 제외한 가격이 최대 35,000 유로인 신형 완전 전기자동차 구매를 지원합니다.

- 또한 정부는 지역 충전 인프라에 많은 투자를 하고 있습니다. 2023년 1월 발표에서는 2026년까지 21,000개 이상의 충전소을 정비할 계획이 밝혀졌습니다. 국가 부흥 및 강인화 계획에서는 '2030년까지 약 600만 대의 EV'와, 유럽의 탈탄소화 목표에 따른 '31,500개소의 공공 급속 충전 포인트'를 상정하고 있습니다.

- 이러한 정부의 적극적인 시책은 EV의 판매를 강화하고, 충전 인프라를 확대하고, 그 결과 예측 기간에 있어서의 이차 전지 수요를 증가시킵니다.

이탈리아 이차 전지 산업 개요

이탈리아의 이차 전지는 세미플래그먼트입니다. 주요 기업(순부동)으로는 BYD Company Ltd., Duracell Inc., Exide Industries Ltd., EnerSys, Panasonic Holdings Corporation 등이 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 서문

- 시장 규모 및 수요 예측(단위 : 달러)(-2029년)

- 최근 동향 및 개발

- 정부의 규제 및 정책

- 시장 역학

- 성장 촉진요인

- 전기자동차(EV) 생산 증가

- 리튬 이온 배터리 가격 하락

- 억제요인

- 원재료의 매장량 부족

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

- 투자분석

제5장 시장 세분화

- 배터리 유형별

- 리튬 이온 배터리

- 납축전지

- 기타(NiMh, Nicd 등)

- 용도별

- 자동차용 배터리

- 산업용 배터리

- 휴대용 배터리

- 기타 용도

제6장 경쟁 구도

- M&A, 합작사업, 제휴 및 협정

- 주요 기업의 전략

- 기업 프로파일

- BYD Company Ltd

- Duracell Inc.

- EnerSys

- Panasonic Holdings Corporation

- Energizer

- Saft Groupe SA

- Exide Industries Ltd

- FIAMM Energy Technology SpA

- Amperex Technology Co. Limited

- Gotion High tech Co Ltd

- List of Other Prominent Companies

- Market Ranking/Share Analysis

제7장 시장 기회 및 향후 동향

- 웨어러블 디바이스의 채용 확대

The Italy Rechargeable Battery Market size is estimated at USD 3.22 billion in 2025, and is expected to reach USD 7.04 billion by 2030, at a CAGR of 16.96% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising electric vehicle (EV) production and declining lithium-ion battery prices are expected to drive the demand for rechargeable batteries during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the rechargeable battery market.

- Nevertheless, the growing adoption of wearable devices like smartwatches, wireless earphones, smart bands, and more are expected to create significant opportunities for rechargeable battery market players in the near future.

Italy Rechargeable Battery Market Trends

Lithium-Ion Battery Type Dominate the Market

- Lithium-ion rechargeable batteries, celebrated for their myriad advantages, find extensive applications across diverse sectors. Their ascent as a trusted and efficient medium for electrical energy storage is noteworthy. A standout feature of lithium-ion batteries is their impressive energy density, allowing them to pack substantial power into a compact, lightweight form.

- Italy's lithium-ion rechargeable battery market is a dynamic arena, brimming with both opportunities and challenges. Thanks to their superior capacity-to-weight ratio, lithium-ion batteries are outpacing other technologies in popularity. While lithium-ion batteries typically command a premium price compared to their counterparts, leading market players are heavily investing in R&D and scaling operations. This intensified competition has not only bolstered battery performance but also contributed to a downward trend in lithium-ion battery prices.

- In 2023, driven by rising average battery pack prices in electric vehicles (EVs) and battery energy storage systems (BESS), battery prices saw a notable dip, settling at USD 139/kWh, marking a decline of over 13%. With the ramp-up of extraction and refining capacities, lithium prices are projected to stabilize, aiming for the USD 100/kWh mark by 2026.

- Central to many Battery Energy Storage Systems (BESS), lithium-ion rechargeable batteries shine with their high energy density, rapid charging, and extended cycle life. These attributes make them prime candidates for efficient energy storage and release in BESS applications. Companies in the region are actively collaborating with leading organizations to bolster BESS initiatives.

- As an illustration, in December 2023, Octopus Energy Generation, a British renewable energy firm, forged a joint venture with Next Capital Partners. Their ambitious goal is to roll out 1.5 GW of commercial-scale battery storage systems nationwide. This initiative is poised to bolster regional storage capabilities, addressing the surging energy demand in the years ahead, and subsequently driving up the demand for lithium-ion rechargeable batteries.

- Italy's commitment to renewable energy sources, notably solar and wind, is evident. Lithium-ion batteries are pivotal in harnessing and storing this renewable energy, ensuring consistent power supply despite weather variances. With ambitious targets set for 2030, the country's renewable energy sector is poised for heightened investments.

- Highlighting this momentum, in March 2023, Edison unveiled a EUR 5 billion investment in renewables, aiming for a 6 GW capacity by 2030. Similarly, in January 2023, Solarig and Alantra's collaboration on the 1.9 GW solar PV venture, N-Sun Energy, underscores the focus on Southern Europe, with a significant 50 plants slated for completion in Italy by 2025.

- These undertakings not only promise to amplify renewable energy output in the region but also signal a burgeoning demand for lithium-ion rechargeable batteries in the foreseeable future.

Automobile Segment to Witness Significant Growth

- For a long time, vehicles relied solely on internal combustion engines (ICE). However, as environmental concerns grow, there's a noticeable shift towards electric vehicles (EV). Predominantly, EVs utilize lithium-ion rechargeable batteries, favored for their high energy density, lightweight nature, minimal self-discharge, and low maintenance needs.

- Plug-in hybrids and electric vehicles are powered by lithium-ion battery systems. Thanks to their rapid recharge capability and high energy density, lithium-ion batteries uniquely satisfy OEM demands for both driving range and charging time. In contrast, lead-based traction batteries fall short for full hybrids or electric vehicles, given their heavier weight and lower specific energy.

- Italy is seeing a steady uptick in electric vehicle adoption. Data from the International Energy Agency (IEA) reveals that in 2023, Italy sold 136,000 electric vehicles, marking a 19.3% increase from 2022. Projections indicate a significant surge in EV sales in the coming years.

- Italy is championing electric vehicles (EVs) as a step towards sustainable transportation. By bolstering EV adoption and investing in charging infrastructure, Italy aligns with the global shift towards a greener future.

- In a notable move, Italy unveiled in February 2024 a substantial 950 million euro (USD 1 billion) subsidy initiative. This aims to facilitate the transition to cleaner cars (EVs) and invigorate the auto sector. Specifically, Rome is offering subsidies of up to 13,750 euros to lower earners, aiding their purchase of new fully electric vehicles priced up to 35,000 euros, excluding VAT.

- Moreover, the government is making significant investments in the region's charging infrastructure. Highlighting this commitment, a January 2023 announcement detailed plans for over 21,000 charging stations by 2026. The National Recovery and Resilience Plan envisions "around 6 million EVs by 2030" and "31,500 public fast charging points" to align with European decarbonization goals.

- Such proactive government measures are poised to bolster EV sales, expand charging infrastructure, and subsequently elevate the demand for rechargeable batteries in the forecast period.

Italy Rechargeable Battery Industry Overview

The Italy rechargeable Battery is semi-fragmented. Some of the key players (not in particular order) are BYD Company Ltd, Duracell Inc., Exide Industries Ltd, EnerSys, and Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries

- 5.2.3 Portable Batteries

- 5.2.4 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Duracell Inc.

- 6.3.3 EnerSys

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Energizer

- 6.3.6 Saft Groupe SA

- 6.3.7 Exide Industries Ltd

- 6.3.8 FIAMM Energy Technology SpA

- 6.3.9 Amperex Technology Co. Limited

- 6.3.10 Gotion High tech Co Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Wearable Devices

샘플 요청 목록