|

시장보고서

상품코드

1636561

중국의 이차 전지 시장 전망: 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)China Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

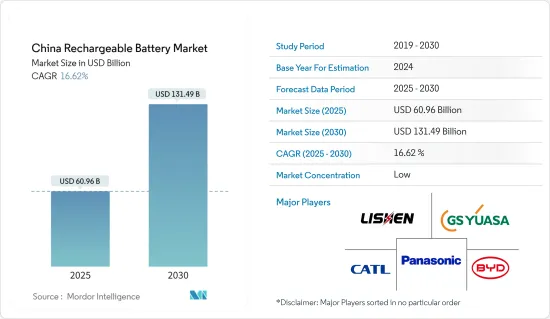

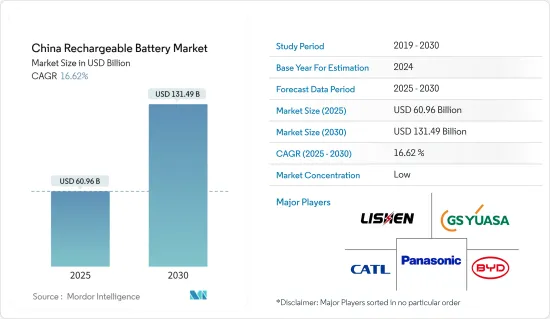

중국의 이차 전지 시장 규모는 2025년에 609억 6,000만 달러로 추정되며, 예측기간(2025-2030년)의 연평균 성장율(CAGR)은 16.62%를 나타낼 전망이며, 2030년에는 1,314억 9,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 리튬이온 전지비용 저감, 전기자동차의 급속한 보급, 신재생에너지부문에서의 에너지저장 요구의 고조, 가전 제품의 채택이 예측기간 중 중국의 이차 전지 시장을 주도할 것으로 보입니다.

- 한편, 원료의 수급 불균형이나 환경 및 안전면의 우려가 예측기간 중 시장 성장의 방해가 될 것으로 예상됩니다.

- 그럼에도 불구하고, 새로운 배터리 기술과 첨단 배터리 화학 제품의 개발이 진행됨에 따라 중국의 이차 전지 시장에는 큰 기회가 있다고 생각됩니다.

중국의 이차 전지 시장 동향

자동차 부문이 시장을 독점할 전망

- 중국에서는 자동차 부문이 이차 전지, 특히 리튬 이온 전지의 주요 용도로 시장을 지배할 것으로 예상됩니다. 중국에서는 전기자동차(EV)의 보급이 진행되어 이차 전지 산업의 성장을 크게 뒷받침할 것으로 예상됩니다.

- 기존의 자동차는 주로 납 배터리나 니켈 수소 전지에 의존하고 있었지만, EV는 리튬 이온 배터리로 전환되고 있습니다.

- 전기자동차(EV) 부문은 리튬 이온 배터리가 가전 제품에 제공하는 것과 동일한 이점을 위해 채택되었습니다. EV산업이 급속히 확대됨에 따라 EV산업은 가전 제품 부문을 추월해 이차 전지, 특히 리튬 이온 배터리의 최대 소비처가 되었습니다.

- 전 세계적으로 전기자동차는 온실가스 배출을 억제하고 화석연료에 대한 의존도를 낮출 수 있다는 점에서 주목받고 있습니다. 지속 가능한 운송 수단으로의 세계 변화에 매우 중요한 역할을하는 중국에서는 EV 수요가 지속적으로 증가하고 있습니다. 이 EV 수요 증가는 이차 전지의 큰 수요 증가에 가하고 있습니다.

- 예를 들어 국제에너지기관(IEA)의 보고에 따르면 2023년 중국의 전지식 전기자동차 판매량은 540만대에 달하고, 2022년 440만대에서 22% 증가했습니다. 이 숫자는 2023년 세계 전체의 약 56%를 차지합니다. 게다가 중국 전지 전기자동차의 재고는 2023년에 1,610만대 이상에 달하고, 전년보다 50% 가까이 증가했습니다.

- 중국은 2023년 세계 유수의 자동차 수출국으로서의 지위를 굳히고, 120만대의 EV(플러그인 하이브리드 전기자동차(PHEV)를 포함)를 포함한 400만대 이상의 자동차를 수출했습니다. 이는 전기차 수출이 전년 대비 80% 증가했으며, 자동차 수출 전반에 걸쳐 65% 증가했습니다. 유럽과 아시아태평양 국가, 특히 태국과 호주가 이러한 수출의 주요 시장으로 부상했습니다. 이러한 추세로 중국은 세계 최대의 EV 시장으로서의 지위를 유지해 당분간 이차 전지의 왕성한 수요를 보장할 것으로 보입니다.

- 배터리 제조에 대한 투자를 강화하기 위한 노력이 진행 중입니다. 예를 들어, 2024년 1월, 중국의 유명한 자동차 회사인 BYD는 중국의 서주시에서 나트륨 이온 배터리 시설을 착공했습니다. 100억 위안의 거액의 투자를 받은 이 시설에서는 EV용으로 연간 30기가와트시(GWh)의 전지를 생산할 예정입니다.

- 이러한 움직임을 감안하면, 중국의 자동차용 배터리 부문은 향후 몇년 동안 상당한 성장을 이룰 것으로 보입니다.

리튬 이온 배터리 가격 하락이 시장을 주도

- 일반적으로 리튬 이온 배터리는 다른 이차 전지보다 높은 가격입니다. 그러나 업계의 주요 기업들은 연구개발과 생산 확대에 많은 투자를 하고 경쟁을 격화시켜 리튬 이온 배터리의 가격을 인하하고 있습니다.

- 기술 발전, 제조 최적화, 원료 비용 감소로 인해 리튬 이온 배터리의 세계 수량 가중 평균 가격은 2013년 780달러/kWh에서 2023년 139달러/kWh로 급락했습니다. 2025년에는 약 113달러/kWh, 2030년에는 80달러/kWh까지 더 하락할 전망입니다. 주목할 점은 2023년 중국 전지팩 평균 가격이 126달러/kWh로 세계 최저가를 기록한 것입니다. 현지에서의 치열한 경쟁으로 중국 제조업체는 급증하는 배터리 수요를 우지하기 위해 생산량을 늘렸습니다. 이러한 비용 감소로 인해 리튬 이온 배터리는 점점 더 매력적인 선택이되었습니다.

- 최근 중국은 국내외 수요에 부응하기 위해 리튬 이온 배터리의 생산을 적극적으로 확대하고 있습니다. 국제에너지기구(IEA)에 따르면 2022년 중국의 리튬 이온 배터리 제조 능력은 약 1.20TWh로 전 세계의 76% 이상을 차지하고 있습니다. 예측에 따르면 이 생산 능력은 2025년에는 293TWh 이상, 2030년에는 465TWh로 급증하여 세계 시장에서 중국의 지배력을 공고히 할 것으로 예상됩니다. 특히 중국에서의 이 생산량의 급증은 규모의 경제를 촉진하고, 비용을 더욱 낮추고, 예측 기간 중의 보급률을 더 높일것으로 예상하고 있습니다.

- 또한 아시아태평양, 특히 중국의 배터리 제조업체는 제품 가격을 세계 평균보다 훨씬 낮게 설정합니다. 이러한 저렴한 가격의 주요 요인은 중국의 인건비 절감입니다. 휴대전화, 태블릿, 노트북 등의 가전 제품 수요가 세계적으로 급증하고 있기 때문에 특히 중국이나 인도와 같은 국가에서는 리튬 이온 배터리가 향후 10년간 배터리 시장을 독점하게 될 것으로 생각 됩니다.

- 중국의 리튬 이온 배터리 제조는 급성장하고 있으며, CATL과 같은 기업이 매출과 생산량의 증가를 주도하면서 급격한 상승세를 보이고 있습니다. 이 시장 점유율이 확대됨에 따라 리튬 이온 배터리 비용이 더욱 감소할 것으로 예상됩니다.

- 이러한 일관되고 현저한 비용 절감으로 리튬 이온 배터리는 그리드 스케일 용도에서 마이크로그리드에 이르는 모든 에너지 저장 시장에서 선호되는 옵션으로 자리매김하고 있습니다. 게다가 배터리 가격 하락이 계속되는 가운데 전기자동차(EV)는 2030년까지 주요 소형차 부문에서 가격 경쟁을 갖게 되어 EV 시장의 대폭적인 성장을 예고합니다.

- 이와 같이 리튬 이온 배터리 비용의 지속적인 감소는 리튬 이온 배터리의 보급을 뒷받침할 뿐만 아니라 예측 기간 동안 중국의 이차 배터리 시장 성장에도 박차를 가할 것으로 예상됩니다.

중국의 이차 전지 산업 개요

중국의 이차 전지 시장은 분할되어 있습니다. 이 시장의 주요 기업(무순서)은 BYD Company Ltd., Contemporary Amperex Technology Co.Ltd., GS Yuasa International Ltd., TianJin Lishen Battery Joint-Stock, Panasonic Corporation입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모와 수요 예측(단위 : 달러)

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 리튬 이온 전지 비용 저하

- 전기자동차의 보급 확대

- 재생 가능 에너지 부문의 채택 확대

- 억제요인

- 원료의 수급 불균형

- 환경과 안전에 대한 우려

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

- 투자분석

제5장 시장 세분화

- 기술

- 납 배터리

- 리튬 이온

- 기타 기술(NiMh, Nicd 등)

- 용도

- 자동차용 전지

- 산업용 전지(동력용, 거치형(텔레콤, UPS, 에너지 저장 시스템(ESS) 등))

- 휴대용 배터리(가전 제품 등)

- 기타

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Panasonic Corporation

- BYD Co.Ltd.

- GS Yuasa Corporation

- Contemporary Amperex Technology Co. Limited

- TianJin Lishen Battery Joint-Stock Co. Ltd

- East Penn Manufacturing Co.

- LG Chem Ltd.

- Samsung SDI Co. Ltd

- Exide Industries Ltd

- Leoch International Technology Limited

- 기타 저명한 기업 일람

- 시장 랭킹, 점유율 분석

제7장 시장 기회와 앞으로의 동향

- 새로운 배터리 기술과 선진 배터리 화학의 개발의 진전

The China Rechargeable Battery Market size is estimated at USD 60.96 billion in 2025, and is expected to reach USD 131.49 billion by 2030, at a CAGR of 16.62% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the declining lithium-ion battery cost, rapid adoption of electric vehicles, growing need for energy storage in renewable energy sector and the adoption of consumer electronics are likely to drive the China rechargeable battery market during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials and the environmental and safety concerns are expected to hinder the market's growth during the forecast period.

- Nevertheless, the growing progress in developing new battery technologies and advanced battery chemistries will likely hold a vast opportunities for China rechargeable battery market.

China Rechargeable Battery Market Trends

Automotive Segment is Expected to Dominate the Market

- In China, the automotive sector is poised to emerge as a primary application for rechargeable batteries, notably lithium-ion batteries. The rising adoption of electric vehicles (EVs) is set to significantly boost the growth of the rechargeable battery industry.

- Automobiles utilize batteries as secondary power sources, either to energize components or assist the engine during cranking. While conventional vehicles predominantly rely on lead-acid and nickel-metal-hydride batteries, EVs have transitioned to lithium-ion batteries.

- The electric vehicle (EV) sector embraced lithium-ion batteries for the same advantages they offer in consumer electronics. As the EV industry has rapidly expanded, it has eclipsed the consumer electronics sector, becoming the foremost consumer of rechargeable batteries, especially lithium-ion variants.

- Globally, electric vehicles are garnering attention for their promise to curtail greenhouse gas emissions and lessen reliance on fossil fuels. In China, a pivotal player in the global shift towards sustainable transportation, the demand for EVs has seen a consistent uptick. This rising demand for EVs has, in turn, spurred a heightened need for rechargeable batteries.

- For instance, the International Energy Agency (IEA) reported that in 2023, battery electric car sales in China hit 5.4 million, marking a 22% increase from 4.4 million in 2022. This figure constituted approximately 56% of the global total for 2023. Additionally, China's battery electric car stock reached over 16.10 million in 2023, nearly a 50% rise from the previous year.

- China solidified its position as the world's leading auto exporter in 2023, exporting over 4 million cars, including 1.2 million EVs (encompassing plug-in hybrid electric vehicles (PHEVs)). This marked an 80% increase in electric car exports compared to the previous year, which itself saw a 65% rise in overall car exports. Europe and Asia-Pacific nations, notably Thailand and Australia, emerged as primary markets for these exports. Given these trends, China is set to maintain its status as the largest EV market globally, ensuring a robust demand for rechargeable batteries in the foreseeable future.

- Efforts are underway to bolster investments in battery manufacturing. For example, in January 2024, BYD, a prominent Chinese automotive firm, broke ground on a sodium-ion battery facility in Xuzhou, China. With a hefty investment of CNY 10 billion, the facility is slated to produce batteries with an annual capacity of 30 gigawatt-hours (GWh), specifically for EVs.

- Given these dynamics, China's automotive battery segment is poised for substantial growth in the coming years.

Declining Lithium-ion Battery Prices to Drive the Market

- Typically, lithium-ion batteries command a higher price than other rechargeable batteries. Yet, key industry players are investing heavily in R&D and scaling up production, intensifying competition and driving down lithium-ion battery prices.

- Due to technological advancements, manufacturing optimizations, and falling raw material costs, the global volume-weighted average price of lithium-ion batteries plummeted from USD 780/kWh in 2013 to USD 139/kWh in 2023. Projections suggest a further dip to approximately USD 113/kWh in 2025 and USD 80/kWh by 2030. Notably, in 2023, average battery pack prices in China were the lowest globally, at USD 126/kWh. The intense local competition saw Chinese manufacturers boost production to capture the surging battery demand. Such declining costs position lithium-ion batteries as an increasingly attractive option.

- In recent years, China has been aggressively expanding its lithium-ion battery manufacturing to cater to both domestic and international demand. According to the International Energy Agency (IEA), in 2022, China's lithium-ion battery manufacturing capacity was approximately 1.20 TWh, accounting for over 76% of the global total. Projections indicate this capacity will soar to over 2.93 TWh by 2025 and 4.65 TWh by 2030, solidifying China's dominance in the global market. This surge in production, especially in China, is facilitating economies of scale, further driving down costs and boosting adoption rates during the forecast period.

- Moreover, battery manufacturers in the Asia-Pacific region, especially in China, are pricing their products even below the global average. A significant factor for these lower prices is China's reduced labor costs. Given the surging global demand for gadgets like mobile phones, tablets, and laptops-especially in nations like China and India-lithium-ion batteries are poised to dominate the battery market over the next decade.

- China's lithium-ion battery manufacturing is on a rapid upswing, with companies like CATL leading in both revenue and production growth. This expanding market share is anticipated to further drive down lithium-ion battery costs.

- This consistent and pronounced cost reduction positions lithium-ion batteries as the preferred choice across all energy storage markets, from grid-scale applications to microgrids. Moreover, as battery prices continue to drop, electric vehicles (EVs) are set to become price-competitive across major light-duty segments before 2030, heralding a significant growth phase for the EV market.

- Thus, the ongoing decline in lithium-ion battery costs is not only set to boost their adoption but is also expected to spur the growth of the rechargeable battery market in China during the forecast period.

China Rechargeable Battery Industry Overview

The China rechargeable battery market is fragmented. Some of the key players in the market (not in any particular order) include BYD Company Ltd., Contemporary Amperex Technology Co. Limited, GS Yuasa International Ltd, TianJin Lishen Battery Joint-Stock Co. Ltd, and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Declining Lithium-ion Battery Cost

- 4.5.1.2 Increasing Adoption of Electric Vehicles

- 4.5.1.3 Growing Adoption of Renewable Energy Sector

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.2.2 Environmental and Safety Concerns

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 BYD Co.Ltd.

- 6.3.3 GS Yuasa Corporation

- 6.3.4 Contemporary Amperex Technology Co. Limited

- 6.3.5 TianJin Lishen Battery Joint-Stock Co. Ltd

- 6.3.6 East Penn Manufacturing Co.

- 6.3.7 LG Chem Ltd.

- 6.3.8 Samsung SDI Co. Ltd

- 6.3.9 Exide Industries Ltd

- 6.3.10 Leoch International Technology Limited

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Progress in Developing New Battery Technologies and Advanced Battery Chemistries