|

시장보고서

상품코드

1637830

아시아태평양의 에어로졸 캔 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Asia Pacific Aerosol Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

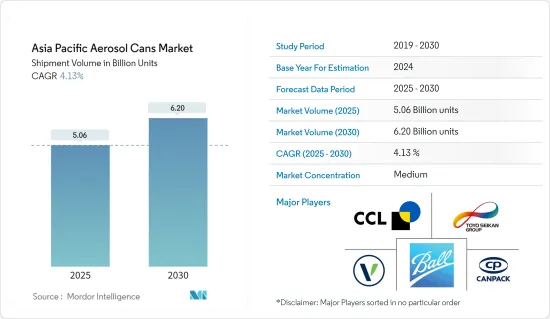

아시아태평양의 에어로졸 캔 시장 규모는 출하수량 기준으로 2025년 50억 6,000만개에서 2030년 62억개로 확대되며, 예측기간(2025-2030년)의 CAGR은 4.13%가 될 전망입니다.

에어로졸 캔은 작은 금속 캐니스터에 물질을 저장하고 미세한 안개, 거품 및 스프레이로 밀어내는 자체 완성형 디스펜싱 시스템입니다. 편의성, 정확한 투여 및 최소한의 유출 위험은 다양한 산업에서의 채택을 촉진합니다.

에어로졸 캔 시장은 예측 기간 동안 안정적인 성장이 예상됩니다. 소비자의 선호도 변화는 제품 패키지에 영향을 미치며 미관, 보관 및 운송 가치, 사용자 편의성을 강조합니다. 휴대성, 재활용성, 안전성, 탄력성, 미적 매력 향상 등의 요소가 에어로졸 캔 수요를 부추기고 있습니다.

에어로졸 캔의 재사용성과 재활용성은 시장 성장을 크게 촉진하고 있습니다. 환경 규제에 따라 만들어진 이러한 캔은 사용자에게 비용 효율적인 패키징 솔루션을 제공하는 동시에 폐기에 대한 우려를 줄일 수 있습니다. 이러한 협력은 사용자에게 이익을 가져오고 공급업체가 지속가능성 목표를 달성하는 데 도움이 됩니다.

게다가 가정용 케어 산업의 지속적인 진보가 수요를 확대하는 자세를 보이고 있습니다. 가정 청결에 대한 의식 증가는 시장의 주요 촉진요인으로 부상하고 있습니다. 특히 다양한 향기를 지닌 다양한 가정용 클리너를 사용할 수 있다는 점이 시장 성장을 더욱 뒷받침하고 있습니다.

지역 소비자의 선호도가 편리하고 지속 가능한 제품으로 이동함에 따라 에어로졸 캔 수요가 증가합니다. 퍼스널케어뿐만 아니라 제약 산업도 에어로졸 캔 수요 증가를 보여줍니다. Invest India의 예측에서 의약품 산업은 2030년까지 1,300억 달러에 달할 것으로 예상되며, 이 성장 궤도는 이 지역의 에어로졸 캔 공급업체에게 유리한 기회를 제공합니다.

업계에는 도전도 있습니다. 비용 효율적인 대체 패키지의 상승과 환경과 건강에 대한 관심 증가로 인한 에어로졸 캔의 유해 화학 물질에 대한 우려는 엄청난 장애가 되었습니다. 그러나 소프트 디스펜싱 시스템의 출현은 기존의 에어로졸 캔이 가져온 과제를 해결하고 혁신적인 패키징 솔루션의 새로운 시대의 도래를 알리는 것입니다.

아시아태평양의 에어로졸 캔 시장 동향

가정용 케어 분야가 에어로졸 캔 시장의 성장을 견인

- 조사 대상 시장의 가정용 케어 분야는 청소 및 유지보수용으로 조정된 다양한 가정용 에어로졸에 의해 성장하는 태세가 갖추어져 있습니다. 여기에는 방향제, 세정제, 연마액, 정전기 방지 스프레이, 에어로졸 접착제, 살충제, 제초제 등이 포함됩니다.

- 라이프 스타일이 진화하고 가처분 소득이 증가함에 따라 가계는 제품에 더 많은 지출을 하게 되고, 특히 에어로졸 캔과 같은 패키지 시장에 영향을 미치고 있습니다. 세계은행의 보고서에 따르면 인도 가계와 NPISH의 최종 소비 지출은 2022년 1조 8,100억 달러에서 2023년 1조 8,800억 달러로 증가합니다.

- 가정용 세제의 판매는 혁신적인 패키징, 브랜드 개발 및 광고로 급증할 것으로 예상됩니다. 또한 주요 기업은 친환경 제품 출시에 대한 투자를 늘리고 업계 매출을 더욱 강화하고 있습니다.

- 2023년 11월, 인도 소비재 부문의 유력 기업인 Dabur India Ltd는 'Odonil Exotic Room Spray'를 출시하여 Odonil 포트폴리오를 확대했습니다. 이 혁신적인 수성 에어로졸은 우수한 향기의 지속을 약속합니다. 이 스프레이는 완전 무알코올이며, 라틴아메리카의 센슈얼 달리아나 일본의 사쿠라 등, 자연으로부터 영감을 얻은 향기가 자랑합니다. 이 발매는 향기의 기준을 높이고 안목있는 인도 소비자에게 독특한 경험을 제공한다는 Dabur의 헌신을 강조합니다.

- 가정용 세제의 정세에 있어서의 새로운 개발은 업계 수요를 밀어 올리는 자세입니다. 개인의 위생 의식의 고조, 청결한 생활 공간에 대한 소망, 고급 지향이, 방향제나 세정제 시장을 견인하고 있습니다. 이 동향은 이 지역의 에어로졸 캔 시장에 큰 영향을 미칠 것으로 보입니다.

- 주택 소유자들은 장식, DIY 프로젝트 및 주택 리노베이션을 위해 에어로졸 스프레이 페인트를 사용하는 경우가 늘고 있습니다. 이러한 용도 외에도 에어로졸 스프레이는 휴일, 파티, 특별한 날 장식에도 사용되어 가정에서의 중요성이 높아지고 있습니다.

알루미늄 에어로졸 캔은 현대 포장에 적합한 선택입니다.

- 알루미늄은 강도, 내식성, 재활용성, 경량성과 같은 독특한 특성을 결합하여 제품 패키지의 최선의 선택입니다. 구체적으로 알루미늄 에어로졸은 가압된 액체와 가스를 넣는 금속 용기 역할을 합니다.

- 에어로졸 캔에 사용되는 수많은 소재 중에서 알루미늄은 뛰어난 물리적 특성으로 인해 선호되는 옵션이 되었습니다. 생산자, 소매업체 및 소비자는 경량성, 운송의 용이성, 무한한 재활용 가능성으로 알루미늄 에어로졸 캔에 끌려갑니다.

- 알루미늄에 대한 지역 접근은 에어로졸 캔 제조업체에게 생산 비용 절감을 비롯한 큰 이점을 제공합니다. 중국은 세계 1차 알루미늄 생산을 선도하고 세계 총 생산량의 55% 이상을 차지하고 있습니다. 국제알루미늄협회의 데이터에 따르면 중국의 1차 알루미늄 생산량은 증가하고 있으며, 2022년 4,040만톤에서 2023년에는 4,170만톤으로 증가하고 있습니다.

- 알루미늄 에어로졸 캔의 제조 공정에서는 하나의 금속 조각에서 작은 알루미늄 슬래그를 원통형으로 성형합니다. 제품 라벨과 설명서는 금속 캔에 오프셋 인쇄로 붙여집니다. 주목할 점은 알루미늄 에어로졸 캔과 병도 유사한 제조 공정을 거치고 있다는 것입니다.

- 알루미늄 에어로졸 캔은 휘발성 제품 및 화학 약품의 패키징 솔루션으로 자리 잡고 있습니다. 합리적인 가격, 안전성, 불침투성으로 향기나 소독제부터 헤어 스프레이 및 탈취제와 같은 고급 개인 관리 제품에 이르기까지 다양한 제품에 이상적입니다.

- 자동차, 페인트, 퍼스널케어 시장에 견인해, 알루미늄 에어로졸캔은 그 리사이클성, 사용의 용이성, 오염이나 유출에 대한 내성 덕분에 수요가 급증하고 있습니다.

아시아태평양의 에어로졸 캔 산업 개요

아시아태평양의 에어로졸 캔 시장은 가격에 민감한 것이 주된 이유로 적당히 통합되어 있으며 소수의 대기업에 의해 지배되고 있습니다. 시장의 주요 기업으로는 Ball Aerosol Packaging India Pvt. Ltd(Ball Corporation), Toyo Seikan Co. Ltd (Toyo Seikan Group Holdings), CANPACK India Private Limited(CANPACK SA), CCL Industries Inc., Trivium Packaging BV, Casablanca Industries Pvt. Ltd, Hindustan Tin Works Ltd. 등이 있습니다. 이러한 공급업체는 시장 점유율을 높이고 수익성을 높이는 것을 목표로 지속가능성과 제품 강화에 점점 더 주력하고 있습니다.

2024년 9월 - Casablanca Industries Pvt. Ltd.는 마하라슈트라주 알루미늄 모노블록 에어로졸 캔 제조 시설의 1주년을 축하했습니다. 생산성 향상과 납기 단축에 노력하고 사업 확대를 위한 적극적인 전략을 채용. 지속적인 개선을 위해 사업과 고객층의 확대를 목표로 합니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 역학

- 시장 성장 촉진요인

- 화장품 업계로부터 수요 증가

- 시장 성장 억제요인

- 대체 패키지와의 경쟁 격화

- 시장 기회

- 높은 성장 가능성을 지닌 신흥 경제국

제6장 시장 세분화

- 재료 유형별

- 알루미늄

- 스틸 주석

- 기타 재료 유형

- 최종 사용자 산업별

- 화장품 및 퍼스널케어

- 가정용 케어

- 의약품/동물용 의약품

- 도료 및 바니스

- 자동차

- 기타 최종 사용자 산업

- 국가별

- 중국

- 인도

- 일본

- 한국

제7장 경쟁 구도

- 기업 프로파일

- Ball Aerosol Packaging India Pvt. Ltd(Ball Corporation)

- Toyo Seikan Co. Ltd(Toyo Seikan Group Holdings)

- CANPACK India Private Limited(CANPACK SA)

- CCL Industries Inc.

- NCI Packaging(National Can Industries Pty Limited)

- Jamestrong Packaging

- Swan Industries(Thailand) Co. Ltd

- Trivium Packaging BV

- Euro Asia Packaging(Guangdong) Co. Ltd

- Hindustan Tin Works Ltd

- Casablanca Industries Pvt. Ltd

- ALUMATIC CANS PVT. LTD

제8장 투자 분석

제9장 시장의 미래

JHS 25.02.12The Asia Pacific Aerosol Cans Market size in terms of shipment volume is expected to grow from 5.06 billion units in 2025 to 6.20 billion units by 2030, at a CAGR of 4.13% during the forecast period (2025-2030).

An aerosol can is a self-contained dispensing system that stores a substance inside a small metal canister and pushes it out as a fine mist, a foam, or a spray. Its convenience, precise dosing, and minimal spillage risk are driving its adoption across diverse industries.

The aerosol cans market is anticipated to grow steadily during the forecast period. Shifting consumer preferences influence product packaging, emphasizing aesthetics, storage and transportation value, and user convenience. Factors like portability, recyclability, safety, resilience, and enhanced aesthetic appeal are fueling the demand for aerosol cans.

The reusability and recyclability of aerosol cans are significantly propelling the market's growth. Crafted in line with environmental regulations, these cans offer users cost-effective packaging solutions while alleviating disposal concerns. This alignment benefits users and aids vendors in achieving their sustainability objectives.

Moreover, ongoing advancements in the household care industry are poised to amplify demand. Heightened awareness about household cleanliness has emerged as a primary market driver. The availability of diverse household cleaners, especially with varied fragrances, further propels market growth.

As regional consumer preferences shift toward convenient and sustainable products, the demand for aerosol cans is set to rise. Beyond personal care, the pharmaceutical industry is also showing increased demand for these cans. With projections from Invest India estimating the pharmaceutical industry to hit USD 130 billion by 2030, this growth trajectory presents lucrative opportunities for aerosol can vendors in the region.

Challenges persist in the industry. The rise of cost-effective packaging alternatives and worries about harmful chemicals in aerosol cans, driven by heightened environmental and health concerns, present formidable obstacles. However, the advent of soft dispensing systems addresses the challenges posed by traditional aerosol cans, heralding a new era of innovative packaging solutions.

Asia Pacific Aerosol Cans Market Trends

The Household Care Segment Drives Growth in the Aerosol Cans Market

- The household care segment in the market studied is poised for growth, driven by various household aerosols tailored for cleaning and maintenance. These include air fresheners, cleaning agents, polishing solutions, anti-static sprays, aerosol starches, insecticides, and herbicides.

- As lifestyles evolve and disposable incomes rise, households spend more on products, influencing the packaging market, notably aerosol cans. The World Bank reported that India's final consumption expenditure by households and NPISHs climbed to USD 1.88 trillion in 2023, up from USD 1.81 trillion in 2022.

- Sales of household cleaning products are expected to surge, fueled by innovative packaging, brand development, and advertising. Moreover, key players are increasingly investing in eco-friendly product launches, further bolstering industry sales.

- In November 2023, Dabur India Ltd, a prominent player in India's consumer goods sector, expanded its Odonil portfolio with the debut of 'Odonil Exotic Room Spray.' This innovative, water-based aerosol promises a superior, long-lasting fragrance. The sprays are completely alcohol-free and boast nature-inspired scents, featuring flowers like the Sensual Dahlia from Latin America and Sakura from Japan. The launch underscores Dabur's commitment to enhancing fragrance standards and delivering unique experiences to discerning Indian consumers.

- New developments in the household cleaner landscape are poised to drive up industry demand. Heightened awareness about personal hygiene, the desire for pristine living spaces, and a preference for luxury are driving the market for air fresheners and cleaning products. This trend is poised to significantly influence the aerosol cans market in the region.

- Homeowners are increasingly utilizing aerosol spray paints for decorating, DIY projects, and home improvements. Beyond these uses, aerosol sprays are also used to decorate items during holidays, parties, and special occasions, underscoring their growing significance in households.

Aluminum Aerosol Cans are the Preferred Choice for Modern Packaging

- Aluminum is a top choice for product packaging, boasting a unique blend of strength, corrosion resistance, recyclability, and lightweight properties. Specifically, an aluminum aerosol can serve as a metal container to hold pressurized liquids or gases.

- Among the myriad materials used for aerosol cans, aluminum's superior physical qualities make it a favored choice. Producers, retailers, and consumers gravitate toward aluminum aerosol cans for their lightweight nature, easy shipping, and infinite recyclability.

- Regional access to aluminum provides aerosol can manufacturers with significant advantages, notably reduced production costs. Dominating the landscape, China leads global primary aluminum production, contributing over 55% to the world's total production. The data from the International Aluminium Institute highlighted a rise in China's primary aluminum production, climbing from 40.4 million metric tonnes in 2022 to 41.7 million metric tonnes in 2023.

- The manufacturing process of aluminum aerosol cans involves shaping a small aluminum slug into a cylinder from a single metal piece. Product labels and instructions are applied using offset printing on the metal cans. Notably, both aluminum aerosol cans and bottles share a similar production journey.

- Aluminum aerosol cans have become a go-to packaging solution for volatile goods and chemicals. Their affordability, security, and impermeability make them perfect for items ranging from scents and sanitizers to high-end personal care products like hair sprays and deodorants.

- Driven by the automotive, paints, and personal care markets, aluminum aerosol cans are witnessing a surge in demand thanks to their recyclability, user-friendliness, and resistance to contamination and spills

Asia Pacific Aerosol Cans Industry Overview

The Asia-Pacific aerosol cans market is moderately consolidated and dominated by a few significant players, largely due to its price-sensitive nature. The key players in the market include Ball Aerosol Packaging India Pvt. Ltd (Ball Corporation), Toyo Seikan Co. Ltd (Toyo Seikan Group Holdings), CANPACK India Private Limited (CANPACK SA), CCL Industries Inc., Trivium Packaging BV, Casablanca Industries Pvt. Ltd, and Hindustan Tin Works Ltd. These vendors are increasingly focusing on sustainability and product enhancements, aiming to capture a larger market share and boost profitability.

September 2024- Casablanca Industries Pvt. Ltd celebrated the first anniversary of its aluminum monobloc aerosol can manufacturing facility in Maharashtra. The company is dedicated to boosting productivity and reducing turnaround times, employing a proactive strategy for business expansion. Committed to continuous improvement, the company seeks to broaden its operations and clientele.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand from the Cosmetic Industry

- 5.2 Market Restraints

- 5.2.1 Increasing Competition from Substitute Packaging

- 5.3 Market Opportunities

- 5.3.1 Emerging Economies Offer High Growth Potential

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Aluminum

- 6.1.2 Steel-tinplate

- 6.1.3 Other Material Types

- 6.2 By End-user Industry

- 6.2.1 Cosmetic and Personal Care

- 6.2.2 Household Care

- 6.2.3 Pharmaceutical/Veterinary

- 6.2.4 Paints and Varnishes

- 6.2.5 Automotive

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 South Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ball Aerosol Packaging India Pvt. Ltd (Ball Corporation)

- 7.1.2 Toyo Seikan Co. Ltd (Toyo Seikan Group Holdings)

- 7.1.3 CANPACK India Private Limited (CANPACK S.A.)

- 7.1.4 CCL Industries Inc.

- 7.1.5 NCI Packaging (National Can Industries Pty Limited)

- 7.1.6 Jamestrong Packaging

- 7.1.7 Swan Industries (Thailand) Co. Ltd

- 7.1.8 Trivium Packaging BV

- 7.1.9 Euro Asia Packaging (Guangdong)Co. Ltd

- 7.1.10 Hindustan Tin Works Ltd

- 7.1.11 Casablanca Industries Pvt. Ltd

- 7.1.12 ALUMATIC CANS PVT. LTD