|

시장보고서

상품코드

1692551

프랑스의 도로 화물 운송 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)France Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

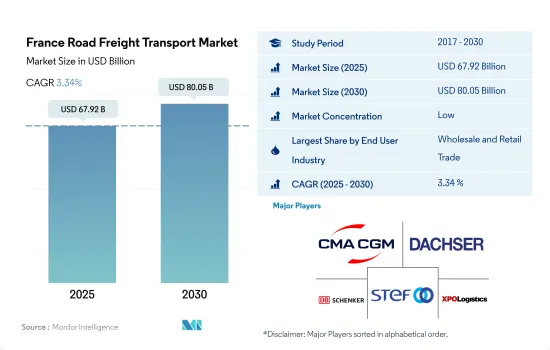

프랑스의 도로 화물 운송 시장 규모는 2025년에 679억 2,000만 달러로 추정되며, 2030년에는 800억 5,000만 달러에 이를 것으로 예측되며, 예측 기간 중(2025-2030년) CAGR 3.34%로 성장할 전망입니다.

프랑스 전자상거래 시장 급증으로 시장 성장을 가속

- 2023년 프랑스의 전자상거래 부문은 전년 대비 성장률 7% 이상을 기록했으며, 2024년 말에는 11% 이상의 성장이 예측되고 있습니다. 이 급성장하는 전자상거래 상황은 도로화물 서비스에 대한 수요 증가에 박차를 가하고 있습니다. 이러한 성장은 프랑스의 역동적인 디지털 마켓플레이스가 경제적 과제 중에서도 강인하다는 것을 뒷받침합니다. 프랑스 디지털 인프라의 지속적인 강화는 온라인 거래를 간소화하고 사용자 경험을 향상시킵니다. 주목할 점은 2023년에는 프랑스 소비자 4천만 명 가까이 온라인 쇼핑에 종사하고 매월 평균 약 5건의 주문이 있다는 것입니다.

- 향후 몇 년간 프랑스는 농업 부문에 연간 2만명의 젊은이를 채용하는 것을 목표로 하고 있으며, 이것은 현재의 1만 2000-1만 4000명으로부터 현저하게 증가합니다. 또한 야심찬 '프랑스 2030' 프로그램의 일환으로 프랑스 정부는 농업 부문에 20억 달러 이상을 투입하고 있습니다. 이 투자의 대부분은 프랑스의 아그리텍 기업과 신흥 기업으로 향하고 있습니다. 이러한 노력이 최종 사용자 시장을 전진시키는 자세입니다.

프랑스 도로화물 운송 시장 동향

프랑스는 도로 근대화에 10억 6,000만 달러, 철도 인프라에 1,060억 달러를 투자해 물류 산업을 뒷받침하고 있습니다.

- 2023년 프랑스는 2040년까지 완료 예정인 1,067억 4,000만 달러의 투자 전략을 발표했습니다. 이 계획의 중심은 파리의 유명한 RER 시스템을 본뜬 고속 통근 열차를 주요 도시에 도입하는 것입니다.

- 2024년 7월, Solaris는 프랑스 북부의 TADAO 교통망의 일부인 Artois Mobilites로부터 12미터의 Urbino 수소 버스 4대를 수주했습니다. 이 버스는 2025년 초에 납입될 예정이며, 특히 랜스와 베순 지방에서의 Artois Mobilites의 이산화탄소 배출 감축의 취급 쌍을 강화합니다. Solaris Urbino 12 수소 버스는 지붕에 70kW의 연료전지를 탑재하고 Solaris High Power 트랙션 배터리에 의해 보완되어 전력 수요의 피크시에 추가 지원을 제공합니다.

러시아 우크라이나 전쟁으로 인한 연료 부족에 대응하기 위해 러시아에서 프랑스로의 LNG 공급 증가

- 2024년 7월 12일에 끝나는 주에, 프랑스의 디젤 연료와 슈퍼 무연 연료의 가격은 소폭 상승했습니다. 2024년 들어 러시아에 6억 4,049만 달러를 넘는 가스 공급료를 지불하고 있으며, 프랑스에 구매량을 줄이도록 요구하고 있습니다.

- 2027년 EU는 새로운 탄소가격제도, 배출량거래제도2(ETS2)를 도입할 예정입니다.

프랑스 도로화물 운송 산업 개요

프랑스의 도로화물 운송 시장은 단편화되어 있으며, 이 시장의 주요 5개사는 CMA CGM Group(CEVA Logistics 포함), Dachser, Deutsche Bahn AG(DB Schenker 포함), STEF Group, XPO, Inc.입니다(알파벳순).

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 경제활동별 GDP 분포

- 경제활동별 GDP 성장률

- 경제성과 및 프로파일

- 전자상거래 산업의 동향

- 제조업의 동향

- 운수 및 창고업의 GDP

- 물류 실적

- 도로의 길이

- 수출 동향

- 수입 동향

- 연료 가격 동향

- 트럭 운송 비용

- 유형별 트럭 보유 대수

- 주요 트럭 공급업체

- 도로화물 톤수의 동향

- 도로화물 가격 동향

- 모달 점유율

- 인플레이션율

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 최종 사용자 산업

- 농업, 어업, 임업

- 건설업

- 제조업

- 석유 및 가스, 광업, 채석업

- 도소매업

- 기타

- 수출처

- 국내

- 국제

- 트럭 적재량

- Full Truckload(FTL)

- Less-than-truckload(LTL)

- 컨테이너 수송

- 컨테이너 수송

- 컨테이너 없음

- 수송 거리

- 장거리 수송

- 단거리 수송

- 상품 구성

- 유체상품

- 고체상품

- 온도 제어

- 비온도 제어

- 온도 제어

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- CMA CGM Group(including CEVA Logistics)

- Dachser

- Deutsche Bahn AG(including DB Schenker)

- DHL Group

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- Expeditors International of Washington, Inc.

- FM Logistics

- Lactalis Group(including Lactalis Logistique & Transports)

- Reyes Holdings(including Martin Brower)

- STEF Group

- XPO, Inc.

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 물류 시장 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계 밸류체인 분석

- 시장 역학(시장 성장 촉진요인, 억제요인, 기회)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

- 환율

The France Road Freight Transport Market size is estimated at 67.92 billion USD in 2025, and is expected to reach 80.05 billion USD by 2030, growing at a CAGR of 3.34% during the forecast period (2025-2030).

Surge in French e-commerce market propels the growth of the market

- In 2023, France's e-commerce sector witnessed a YoY growth exceeding 7%, with projections suggesting an uptick of over 11% by the end of 2024. This burgeoning e-commerce landscape is fueling an increased demand for road freight services. Such growth underscores a dynamic digital marketplace in France, resilient even amidst economic challenges. Continuous enhancements to France's digital infrastructure are streamlining online transactions and elevating user experiences. Notably, in 2023, close to 40 million French consumers engaged in online shopping, averaging about five orders each month.

- In the coming years, France aims to recruit 20,000 young individuals annually into its agricultural sector, marking a notable rise from the current intake of 12,000-14,000, all in a bid to enhance the industry's output. Furthermore, as part of its ambitious France 2030 program, the French government is channeling over USD 2 billion into the agricultural sector. A significant chunk of this investment is directed towards French agritech firms and startups. Such initiatives are poised to propel the end-user market forward.

France Road Freight Transport Market Trends

France is boosting its logistics industry with USD 1.06 billion investments toward road modernization and USD 106 billion towards rail infrastructure

- In 2023, France unveiled a USD 106.74 billion investment strategy slated for completion by 2040, aligning with its commitment to slash carbon emissions. The initiative, spearheaded by the government, focuses on bolstering and modernizing the nation's rail infrastructure. Central to the plan is the introduction of high-speed commuter trains, mirroring Paris's renowned RER system, in key urban centers. Collaborating on this endeavor are France's national rail entity, SNCF, alongside the European Union and regional administrations.

- In July 2024, Solaris secured an order from Artois Mobilites, part of the TADAO transport network in northern France, for four 12-meter Urbino hydrogen buses. These buses, slated for delivery in early 2025, will bolster Artois Mobilites' efforts to reduce carbon emissions, particularly in the Lens and Bethune regions. The Solaris Urbino 12 hydrogen buses will boast 70 kW fuel cells on their roofs and will be complemented by Solaris High Power traction batteries, providing additional support during peak electricity demand.

Increase in Russian LNG deliveries to France catering to fuel shortages caused by Russia-Ukraine war

- For the week ending July 12, 2024, diesel and super unleaded motor fuel prices in France saw a modest uptick. Diesel was priced at USD 1.84 per liter, inclusive of all taxes. In the first three months of 2024, Russian LNG deliveries to France increased more than to any other EU country compared to 2023. Paris has paid over USD 640.49 million to Russia for gas supplies since the start of 2024, prompting calls for France to reduce its purchases. This growing gas trade with Russia occurs as Macron aims to take a tougher stance in support of Kyiv, two years after Russia's full-scale invasion of Ukraine.

- In 2027, the EU is set to implement a new carbon pricing scheme, the Emissions Trading System 2 (ETS2), targeting CO2 emissions from buildings and road transport. Initially agreed upon in 2023, EU legislators assured that the pricing would cap at USD 48.03 per tonne of CO2, translating to an estimated 10-cent surcharge on each liter of diesel or petrol.

France Road Freight Transport Industry Overview

The France Road Freight Transport Market is fragmented, with the major five players in this market being CMA CGM Group (including CEVA Logistics), Dachser, Deutsche Bahn AG (including DB Schenker), STEF Group and XPO, Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 CMA CGM Group (including CEVA Logistics)

- 6.4.2 Dachser

- 6.4.3 Deutsche Bahn AG (including DB Schenker)

- 6.4.4 DHL Group

- 6.4.5 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.6 Expeditors International of Washington, Inc.

- 6.4.7 FM Logistics

- 6.4.8 Lactalis Group (including Lactalis Logistique & Transports)

- 6.4.9 Reyes Holdings (including Martin Brower)

- 6.4.10 STEF Group

- 6.4.11 XPO, Inc.

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

샘플 요청 목록