|

시장보고서

상품코드

1693819

영국의 엔지니어링 플라스틱 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)United Kingdom Engineering Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

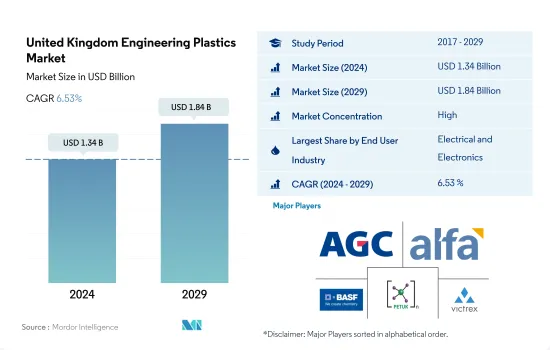

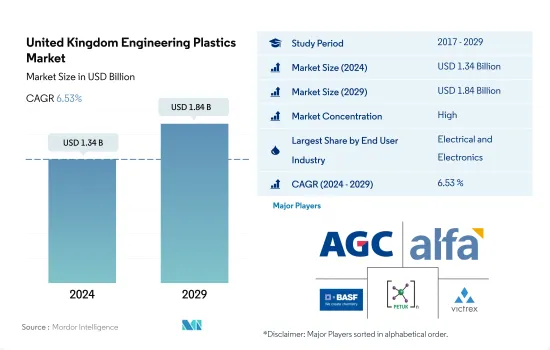

영국의 엔지니어링 플라스틱 시장 규모는 2024년에 13억 4,000만 달러에 달했고, 2029년에는 18억 4,000만 달러에 이르고, 예측 기간(2024-2029년)의 CAGR은 6.53%를 나타낼 것으로 예측됩니다.

엔지니어링 플라스틱 수요를 견인하는 첨단 재료 채용 증가

- 열가소성 폴리머로도 알려진 엔지니어링 플라스틱은 합성 수지의 일종이며, 종래의 플라스틱에 비해 고성능으로 플라스틱 특성이 향상하고 있습니다.폭넓은 온도 범위에서 안정성을 나타내, 큰 기계적 응력이나 기후의 변화에도 견딜 수 있습니다.

- 포장제조산업은 식음료, 의약품, 퍼스널케어 제품, 가정용품 등의 특정 산업으로부터의 높은 수요에 의해 연간 136억 달러 이상의 매출을 창출하고 있습니다. 2022년에는 모든 산업의 총 소비량의 약 39%를 차지했습니다. 빠르게 변화하는 라이프스타일과 플라스틱 포장의 다양성으로 인해 업계는 예측 기간 동안 매출 측면에서 5.73%의 연평균 성장률을 나타낼 것으로 예상됩니다.

- 전기 및 전자산업은 국내 제2위의 엔지니어링 플라스틱 소비산업으로, 2022년에는 전산업의 총소비량의 12%를 차지했습니다. 예를 들어, 2023년 324억 8,000만 달러의 수익을 올렸습니다. 따라서 이 산업에서 엔지니어링 플라스틱의 소비량은 예측 기간 동안 6.77 의 연평균 성장률을 나타낼 것으로 예상됩니다.

- 항공우주산업은 예측기간 중 8.27%라는 가장 높은 성장률을 보인다고 생각됩니다.

영국의 엔지니어링 플라스틱 시장 동향

기술 혁신이 소비자용 전자기기 시장을 밀어올립니다.

- 영국에서는 2020-2021년에 걸쳐 전기 및 전자기기 생산이 10.7%의 증수를 기록하였습니다.

- 지난 20년간 영국의 일렉트로닉스 산업은 변혁을 이루었으며, 하이테크와 지식 집약형의 생산 공정에 중점을 두게 되었습니다. 이 나라의 국립 마이크로전자공학연구소는 유럽 최대의 독립 반도체 설계 생산업체로, 애플리케이션별 집적 회로 설계 시장의 50%, 유럽 전체 독립 전자 설계의 40%를 점유하고 있습니다.

- 일렉트로닉스는 영국의 R&D 제조 지출 전체의 12% 이상을 차지하고 있습니다. 그러나 영국은 2019 년에 Brexit, 미국과 중국 무역 전쟁, 연구 개발 자금, 사이버 보안 문제 등의 과제에 직면했습니다.

- 이 나라에서는 스마트 디바이스 수요 증가, 아시아 시장의 확대, 의료기기 기술의 진보, 에너지 효율이 높은 기술, 사물인터넷(IoT), 5G 기술, 가상현실·증강현실의 이용, 자동화 등에 의해 전기 및 전자 기기의 생산 증가가 전망되고 있습니다.

영국의 엔지니어링 플라스틱 산업 개요

영국의 엔지니어링 플라스틱 시장은 상당히 통합되어 있으며 상위 5개 기업이 100%를 차지하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 최종 사용자 동향

- 항공우주

- 자동차

- 건축 및 건설

- 전기 및 전자

- 포장

- 수출입 동향

- 가격 동향

- 재활용 개요

- 폴리아미드(PA) 재활용 동향

- 폴리카보네이트(PC) 재활용 동향

- 폴리에틸렌 테레프탈레이트(PET) 재활용 동향

- 스티렌 공중합체(ABS 및 SAN) 재활용 동향

- 규제 프레임워크

- 영국

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 최종 사용자 산업

- 항공우주

- 자동차

- 건축 및 건설

- 전기 및 전자

- 산업 및 기계

- 포장

- 기타

- 수지 유형

- 불소수지

- 하위 수지 유형별

- 에틸렌테트라플루오로에틸렌(ETFE)

- 플루오르화 에틸렌-프로필렌(FEP)

- 폴리테트라플루오로에틸렌(PTFE)

- 폴리비닐플루오라이드(PVF)

- 폴리불화비닐리덴 플루오라이드(PVDF)

- 기타 하위 수지

- 액정 폴리머(LCP)

- 폴리아미드(PA)

- 하위 수지 유형별

- 아라미드

- 폴리아미드(PA) 6

- 폴리아미드(PA) 66

- 폴리프탈아미드

- 폴리부틸렌테레프탈레이트(PBT)

- 폴리카보네이트(PC)

- 폴리에테르에테르케톤(PEEK)

- 폴리에틸렌 테레프탈레이트(PET)

- 폴리이미드(PI)

- 폴리메틸메타크릴레이트(PMMA)

- 폴리옥시메틸렌(POM)

- 스티렌 공중합체(ABS 및 SAN)

- 불소수지

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- AGC Inc.

- Alfa SAB de CV

- Asahi Kasei Corporation

- BASF SE

- Celanese Corporation

- Covestro AG

- Domo Chemicals

- INEOS

- Mitsubishi Chemical Corporation

- Polymer Extrusion Technologies(UK) Ltd

- Radici Partecipazioni SpA

- Solvay

- Sumitomo Chemical Co., Ltd.

- Teijin Limited

- Victrex

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크(산업 매력도 분석)

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The United Kingdom Engineering Plastics Market size is estimated at 1.34 billion USD in 2024, and is expected to reach 1.84 billion USD by 2029, growing at a CAGR of 6.53% during the forecast period (2024-2029).

Rising adoption of advanced materials to drive the demand for engineering plastics

- Engineering plastics, also known as thermoplastic polymers, are a class of synthetic resins that offer high-performance capabilities and improved plastic properties compared to conventional plastics. They exhibit stability over a broad temperature range and can withstand significant mechanical stress and climatic changes.

- The packaging production industry generates annual sales of over USD 13.6 billion, driven by high demand from specific industries such as food and beverage, pharmaceuticals, and personal and household care products. The packaging industry is the largest consumer of engineering plastics in the region, accounting for approximately 39% of total consumption across all industries in 2022. With changing, fast-paced lifestyles and the versatility of plastic packaging, the industry is projected to record a CAGR of 5.73% in terms of revenue during the forecast period.

- The electrical and electronics industry is the second-largest consumer of engineering plastics in the country, representing 12% of total consumption across all industries in 2022. This industry is driven by consumer electronics such as mobile phones, computers, wearables, TVs, and similar products. For example, the consumer electronics industry is expected to generate USD 32.48 billion in revenue in 2023. Consequently, the consumption volume of engineering plastics in this industry is projected to increase at a CAGR of 6.77% during the forecast period.

- The aerospace industry is likely to exhibit the highest growth rate of 8.27% over the forecast period. The development of new technologies for lighter and faster aircraft is driving the consumption of engineering plastics.

United Kingdom Engineering Plastics Market Trends

Technological innovations to boost the consumer electronics market

- The United Kingdom witnessed a revenue increase of 10.7% in electrical and electronics production from 2020 to 2021. The electronics industry holds significant importance in UK manufacturing, accounting for 4.7% of the overall industry. In 2017, it generated EUR 8.4 billion in gross value added and EUR 19.4 billion in turnover.

- Over the past two decades, the electronics industry in the United Kingdom has undergone a transformation, focusing more on high-technology and knowledge-intensive production processes. The country's National Microelectronics Institute is the largest independent semiconductor design producer in Europe, commanding 50% of the market in application-specific integrated circuit design and 40% of Europe's independent electronics design overall. This shift has led to a transition in the UK's electronics activity from manufacturing and assembly to component design and innovation, with ARM, a major semiconductor and software design company, serving as a notable example.

- Electronics contributes more than 12% of the total R&D manufacturing expenditure in the country. The top 10 export markets consist of prominent Western economies, as well as emerging markets in Asia, including China, Hong Kong, and the United Arab Emirates. However, the United Kingdom faced challenges such as Brexit, the US-China trade war, R&D funding, and cybersecurity issues in 2019.

- The country is expected to witness an increase in the production of electrical and electronic equipment due to growing demand for smart devices, the expanding market in Asia, advancements in medical device technology, energy-efficient technologies, the Internet of Things (IoT), 5G technology, the use of virtual and augmented reality, and automation.

United Kingdom Engineering Plastics Industry Overview

The United Kingdom Engineering Plastics Market is fairly consolidated, with the top five companies occupying 100%. The major players in this market are AGC Inc., Alfa S.A.B. de C.V., BASF SE, Polymer Extrusion Technologies (UK) Ltd and Victrex (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.3 Price Trends

- 4.4 Recycling Overview

- 4.4.1 Polyamide (PA) Recycling Trends

- 4.4.2 Polycarbonate (PC) Recycling Trends

- 4.4.3 Polyethylene Terephthalate (PET) Recycling Trends

- 4.4.4 Styrene Copolymers (ABS and SAN) Recycling Trends

- 4.5 Regulatory Framework

- 4.5.1 United Kingdom

- 4.6 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Resin Type

- 5.2.1 Fluoropolymer

- 5.2.1.1 By Sub Resin Type

- 5.2.1.1.1 Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2 Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3 Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4 Polyvinylfluoride (PVF)

- 5.2.1.1.5 Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6 Other Sub Resin Types

- 5.2.2 Liquid Crystal Polymer (LCP)

- 5.2.3 Polyamide (PA)

- 5.2.3.1 By Sub Resin Type

- 5.2.3.1.1 Aramid

- 5.2.3.1.2 Polyamide (PA) 6

- 5.2.3.1.3 Polyamide (PA) 66

- 5.2.3.1.4 Polyphthalamide

- 5.2.4 Polybutylene Terephthalate (PBT)

- 5.2.5 Polycarbonate (PC)

- 5.2.6 Polyether Ether Ketone (PEEK)

- 5.2.7 Polyethylene Terephthalate (PET)

- 5.2.8 Polyimide (PI)

- 5.2.9 Polymethyl Methacrylate (PMMA)

- 5.2.10 Polyoxymethylene (POM)

- 5.2.11 Styrene Copolymers (ABS and SAN)

- 5.2.1 Fluoropolymer

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 AGC Inc.

- 6.4.2 Alfa S.A.B. de C.V.

- 6.4.3 Asahi Kasei Corporation

- 6.4.4 BASF SE

- 6.4.5 Celanese Corporation

- 6.4.6 Covestro AG

- 6.4.7 Domo Chemicals

- 6.4.8 INEOS

- 6.4.9 Mitsubishi Chemical Corporation

- 6.4.10 Polymer Extrusion Technologies (UK) Ltd

- 6.4.11 Radici Partecipazioni SpA

- 6.4.12 Solvay

- 6.4.13 Sumitomo Chemical Co., Ltd.

- 6.4.14 Teijin Limited

- 6.4.15 Victrex

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록