|

시장보고서

상품코드

1636451

프랑스의 전기자동차 배터리 제조 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)France Electric Vehicle Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

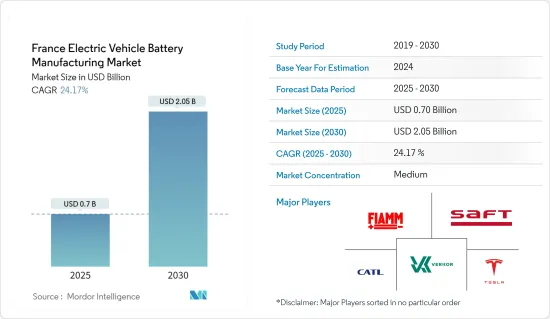

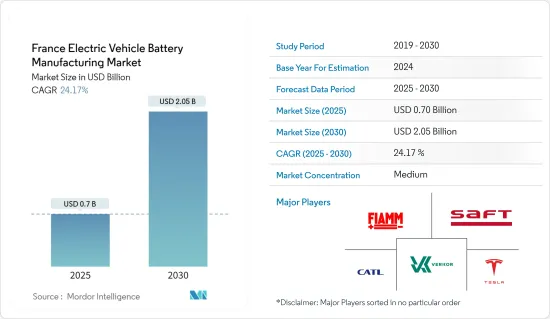

프랑스 전기자동차 배터리 제조 시장 규모는 2025년 7억 달러, 2030년 20억 5,000만 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 24.17%에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 전기자동차의 보급과 관련 전기자동차 배터리 제조 장치에 대한 투자가 시장을 견인할 것으로 보입니다.

- 반대로, 원재료의 매장량 부족은 예측 기간 동안 시장 성장을 방해할 수 있습니다.

- 그럼에도 불구하고 e-모빌리티 확대와 운송 부문의 이산화탄소 배출 억제를 위한 정부의 야심찬 목표는 예측 기간 동안 시장 기업에게 시장 기회를 가져올 가능성이 높습니다.

프랑스 전기자동차 배터리 제조 시장 동향

리튬 이온 배터리 제조가 큰 점유율을 차지

- 리튬 이온 배터리는 양극, 음극, 두 개의 전극을 분리하는 세퍼레이터로 구성됩니다. 전해액으로 적신 세퍼레이터는 촉매로서 작용하고, 충전시에는 양극으로부터 부극으로의 이온의 이동을 촉진하고, 방전시에는 그 공정을 역전시킵니다. 합리적인 가격, 높은 비에너지, 반복 충방전을 견딜 수 있는 능력으로 전기자동차에 이상적인 재료가 되고 있습니다.

- 유럽 자동차 부문이 탈탄소화를 추진하는 동안 기가팩토리(대규모 이차 전지 제조 시설)에 대한 투자는 매우 중요합니다. 2023년 9월 Macquarie Asset Management는 프랑스 배터리 제조업체인 Verkor의 주요 투자자로, 21억 7,000만 달러에 가까운 투자로 리튬 이온 배터리 생산을 확대하고 있습니다.

- 2024년 2월 프랑스 ACC는 리튬 이온 배터리 셀 생산을 전문으로 하는 3개의 기가팩토리 설립으로 44억 달러의 거액을 획득했습니다. 이러한 시설은 프랑스에 건설되고 R&D 투자로 보완됩니다. 이 부채 패키지는 Bpifrance, Euler Hermes, SACE로부터의 지원도 얻어, 유명한 상업 은행 컨소시엄(BNP Paribas, Deutsche Bank, ING, Intesa Sanpaolo)이 단독으로 지원하고 있습니다.

- 마찬가지로 프랑스의 페이 드 라 루아르에 본사를 두고 리튬 전지의 회복을 전문으로 하는 VoltR사는 최근 자금 조달의 성과를 발표했습니다. 이 회사는 C4 Ventures와 Exergon으로부터 많은 도움을 받았으며, 최초 자금 라운드에서 430만 달러를 조달했습니다. 이 자금 조달을 통해 VoltR은 향후 2년 이내에 최초의 리튬 배터리 재생 시설을 설립하는 것을 목표로 하고 있습니다. 이러한 투자는 예측 기간 동안 프랑스의 전기자동차 배터리 제조 시장을 강화할 계획입니다.

- 현재 대부분의 전기자동차는 리튬 이온 배터리를 탑재하고 있습니다. 국제에너지기구(IEA)에 따르면 프랑스의 전기차 판매량은 최근 증가세를 보이고 있습니다. 2023년에는 플러그인 하이브리드 자동차와 배터리 전기자동차를 포함한 전기자동차 판매량은 47만대에 달하고, 전년 대비 38% 증가했습니다. 이러한 전기차 판매 증가 추세는 예측 기간에 프랑스 전기자동차 배터리 제조 시장을 강화할 것으로 예상됩니다.

- 이러한 동향을 감안하면 프랑스의 전기자동차 배터리 제조 시장은 예측 기간 중에 급성장을 이룰 것으로 보입니다.

정부에 의한 E-모빌리티 도입의 중시

- 프랑스에서는 환경문제에 대한 의식이 높아지고, 특히 운송부문에서의 이산화탄소 배출을 억제하는 노력으로 배터리 제조장치 시장이 증가하는 경향이 있습니다. 그 결과, 정부의 이니셔티브는 예측 기간 동안 전기자동차 배터리 제조 시장에 이익을 가져올 것으로 예상됩니다.

- 2024년 5월 프랑스 정부는 자동차 부문과 협정을 맺고 2027년까지 전기자동차(EV)의 연간 판매 대수를 80만대로 끌어올리는 야심찬 목표를 내걸었습니다. 2024-2027년 분야별 협정의 주요 목표인 이 목표는 전기 승용차(PC)의 판매를 4년간 거의 3배로 확대해 배터리식 전기 소형차(LDV)를 대폭 강화하는 것을 강조하고 있습니다. 이러한 움직임은 향후 몇 년간 프랑스의 전기자동차 제조 시장의 성장을 견인하게 될 것으로 보입니다.

- 프랑스의 업계 각 회사는 국내 전기자동차 생산을 강화하고 있습니다. 예를 들어, Renault Group은 신사업 Renault ElectriCity를 통해 전기자동차 제조를 두에, 모부주, 루이츠에 집약했습니다. Renault의 야심적인 목표는 2025년까지 프랑스에서 연간 40만대의 전기자동차를 생산하고 경쟁력 있고 효율적인 전기자동차 생산의 유럽 선두 주거지로서 프랑스를 확립하는 것입니다. 이러한 목표를 달성함으로써 전기자동차 제조 시장은 향후 더욱 활성화될 수 있습니다.

- 정부의 새로운 보조금이 프랑스에서 전기자동차 판매를 뒷받침합니다. 2023년 9월 정부는 '그린 산업'을 강화하고 '재공업화'를 가속화하기 위한 법률안의 일부로 이러한 보조금 계획을 발표했습니다. 그 의도는 단순히 국내 생산을 강화할 뿐만 아니라, 특히 중국에서 수입 전기자동차에 대한 의존도를 줄이는 것입니다.

- 또한 프랑스의 이러한 노력은 유럽 전체의 전기자동차 판매를 밀어 올립니다. 국제에너지기구(IEA)에 따르면 2023년 유럽 전기차 판매량은 330만대로 전년대비 22% 증가했습니다. 이 증가 추세는 앞으로도 계속될 것으로 예상됩니다.

- 그 결과 프랑스의 전기자동차 제조 시장은 예측 기간 동안 크게 성장할 것으로 예측됩니다.

프랑스 전기자동차 배터리 제조 산업 개요

전기자동차 배터리 제조 장비 시장은 완만합니다. 주요 기업(순부동)은 Verkor, Contemporary Amperex Technology Co.Limited, Saft Groupe SA, Tesla Inc., FIAMM SpA 등입니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모 및 수요 예측(단위: 달러)

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 배터리 생산 능력 증강을 위한 투자

- 전지 원재료 비용의 저하

- 억제요인

- 원재료의 매장량 부족

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

- 투자 분석

제5장 시장 세분화

- 배터리별

- 리튬 이온

- 납축전지

- 니켈 수소 전지

- 기타

- 전지 형상별

- 각형

- 가방형

- 원통형

- 차량별

- 승용차

- 상용차

- 기타

- 추진별

- 배터리 전기자동차

- 하이브리드 전기자동차

- 플러그인 하이브리드 전기자동차

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- BYD Co. Ltd

- Contemporary Amperex Technology Co. Limited

- Duracell Inc

- EnerSys

- Tesla Inc.

- FIAMM SpA

- Verkor

- LG Chem Ltd

- Saft Groupe SA

- Panasonic Corporation

- List of Other Prominent Companies

- 시장 랭킹 분석

제7장 시장 기회와 앞으로의 동향

- 전기자동차의 장기적인 야심적 목표

The France Electric Vehicle Battery Manufacturing Market size is estimated at USD 0.70 billion in 2025, and is expected to reach USD 2.05 billion by 2030, at a CAGR of 24.17% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing adoption of electric vehicles and related investments in electric vehicle battery manufacturing units are likely going to drive the market.

- Conversely, the lack of raw material reserves might hinder the market's growth during the forecasted period.

- Nevertheless, the government's ambitious targets for the expansion of e-mobility and curbing carbon emissions from the transportation sector are likely to present market opportunities for the market players during the forecasted period.

France Electric Vehicle Battery Manufacturing Market Trends

Lithium-ion Battery Manufacturing to Hold Significant Share

- The lithium-ion battery comprises a cathode, an anode, and a separator that isolates the two electrodes. The separator, moistened with electrolyte, acts as a catalyst, facilitating the movement of ions from the cathode to the anode during charging and reversing the process during discharging. Its reasonable cost, high specific energy, and ability to endure numerous charge-discharge cycles render it ideal for electric vehicles.

- As Europe's automotive sector pushes towards decarbonization, investing in gigafactories-large-scale rechargeable battery manufacturing facilities-becomes crucial. In September 2023, Macquarie Asset Management, the primary investor in Verkor, a French battery manufacturer, is amplifying Lithium-ion battery production with an investment close to USD 2.17 billion.

- In February 2024, ACC, a French firm, clinched a significant USD 4.4 billion for establishing three gigafactories focused on lithium-ion battery cell production. These facilities will be constructed in France, complemented by investments in research and development. The debt package, solely supported by a consortium of prominent commercial banks-BNP Paribas, Deutsche Bank, ING, and Intesa Sanpaolo-also garners backing from Bpifrance, Euler Hermes, and SACE.

- Similarly, VoltR, a company based in Pays de la Loire, France, specializing in rejuvenating lithium batteries, recently announced a funding achievement. The firm raised USD 4.3 million in its inaugural fundraising round, with significant backing from C4 Ventures and Exergon. With this funding, VoltR aims to set up its first lithium battery reconditioning facility within the next two years. Such investments are poised to bolster France's electric vehicle battery manufacturing market during the forecast period.

- Most electric vehicles are now integrating lithium-ion batteries. According to the International Energy Agency, electric vehicle sales in France have been on the rise in recent years. In 2023, sales of electric cars, encompassing both plug-in hybrids and battery electric vehicles, reached 470,000 units, marking a 38% increase from the prior year. This upward trajectory in electric car sales is anticipated to bolster France's electric vehicle battery manufacturing market in the forecast period.

- Given these trends, France's electric vehicle battery manufacturing market is set for rapid growth in the forecast period.

Government Emphasis to Introduce E-Mobility

- In France, the market for battery manufacturing equipment is on the rise, driven by heightened awareness of environmental concerns and efforts to curb carbon dioxide emissions, especially from the transportation sector. Consequently, government initiatives are poised to benefit the electric vehicle battery manufacturing market during the forecast period.

- In May 2024, the French government sealed a deal with the automotive sector, ambitiously targeting 800,000 annual electric vehicle (EV) sales by 2027. This target, a centerpiece of the 2024-2027 sectoral agreement, emphasizes nearly tripling sales of electric passenger cars (PCs) in four years and significantly boosting battery electric light-duty vehicles (LDVs). Such moves are set to drive the growth of France's electric vehicle manufacturing market in the coming years.

- Industry players in France are ramping up the nation's electric vehicle production. For example, the Renault Group, through its new venture Renault ElectriCity, has centralized its electric vehicle manufacturing in Douai, Maubeuge, and Ruitz. Renault's ambitious goal is to produce 400,000 electric vehicles annually in France by 2025, aiming to establish the nation as Europe's leading hub for competitive and efficient electric vehicle production. Achieving such targets could further invigorate the electric vehicle manufacturing market in the years ahead.

- New government subsidies are set to boost electric vehicle sales in France. In September 2023, the government announced plans for these subsidies, part of a draft law to strengthen the "green industry" and accelerate "reindustrialization." The intent is not just to enhance domestic production but also to reduce dependence on imported electric vehicles, especially from China.

- Moreover, these initiatives in France are poised to elevate electric vehicle sales across Europe. According to the International Energy Agency, Europe recorded sales of 3.3 million electric cars in 2023, marking a 22% increase from the previous year. This upward trend is expected to persist.

- As a result, France's electric vehicle manufacturing market is projected to experience significant growth during the forecast period.

France Electric Vehicle Battery Manufacturing Industry Overview

The electric vehicle battery manufacturing equipment market is moderate. Some of the major players (not in particular order) include Verkor, Contemporary Amperex Technology Co. Limited, Saft Groupe S.A., Tesla Inc., and FIAMM SpA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Investments to Enhance the battery production capacity

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Nickel Metal Hydride Battery

- 5.1.4 Others

- 5.2 Battery Form

- 5.2.1 Prismatic

- 5.2.2 Pouch

- 5.2.3 Cylindrical

- 5.3 Vehicle

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.3.3 Others

- 5.4 Propulsion

- 5.4.1 Battery Electric Vehicle

- 5.4.2 Hybrid Electric Vehicle

- 5.4.3 Plug-in Hybrid Electric Vehicle

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 Duracell Inc

- 6.3.4 EnerSys

- 6.3.5 Tesla Inc.

- 6.3.6 FIAMM SpA

- 6.3.7 Verkor

- 6.3.8 LG Chem Ltd

- 6.3.9 Saft Groupe S.A

- 6.3.10 Panasonic Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles

샘플 요청 목록