|

시장보고서

상품코드

1683459

미국의 택배, 특송 및 소포(CEP) 시장 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)United States Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

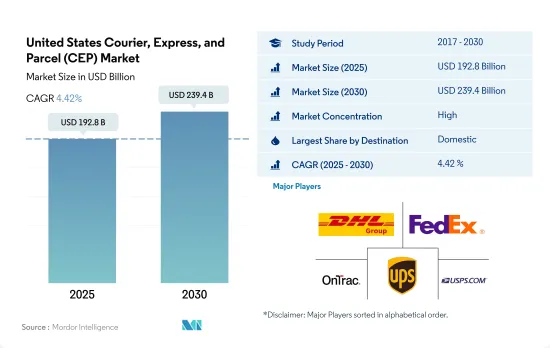

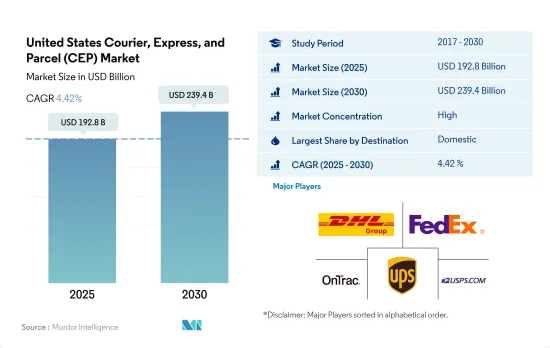

미국의 택배, 특송 및 소포(CEP) 시장 규모는 2025년에 1,928억 달러로 추정되고, 예측 기간(2025-2030년) 동안 4.42%의 CAGR로 성장하여 2030년에는 2,394억 달러에 달할 것으로 예상됩니다.

전자상거래 시장에서 택배, 특송 및 소포에 대한 국내 수요 증가가 수요를 주도

- 전자상거래의 성장과 전 세계적인 팬데믹으로 인해 소비자들이 오프라인 매장에서 구매하는 것보다 온라인 주문을 더 선호하게 되면서 소포 배송 시장이 활기를 띠었습니다. 취급량이 증가함에 따라 많은 기업들이 국내에서 기업 인수를 하고 있습니다. 2023년 10월, UPS Inc.는 PayPal Holdings Inc.에서 반품 관리 소프트웨어 회사인 Happy Returns를 인수했습니다. 이 거래를 통해 빠르게 성장하는 온라인 반품 부문에서 UPS의 입지가 강화되었습니다. 또한 이 회사는 1만 2,000개 이상의 반송 센터에서 박스 및 라벨이 필요 없는 반송 옵션을 제공할 예정입니다.

- 미국 전자상거래 시장은 끊임없이 진화하고 있습니다. 미국의 소매 전자상거래 매출은 2022년 약 9,048억 9,000만 달러에서 2025년에는 약 1조 4,788억 6,000만 달러로 성장할 것으로 예측됩니다. 이는 예측 기간 동안 국내 및 국제 택배, 특송, 소포 시장 규모에 활력을 불어넣을 것으로 예상됩니다. 전자상거래 및 엔터프라이즈 기업 중 Amazon은 미국에서 가장 인기 있는 전자 소매업체이며 시장 점유율은 37.8%입니다. 기타 eBay(시장 점유율 3.5%), Walmart(시장 점유율 6.3%), Target(시장 점유율 2.1%), Apple(시장 점유율 3.9%) 등이 성공하고 있습니다.

미국의 택배, 특송 및 소포(CEP) 시장 동향

미국은 인프라 및 공급망 투자에 힘입어 86%의 기여도로 지역 GDP를 주도

- 2024년 9월, 미국 교통부 산하 FAA는 519개 프로젝트에 19억 달러의 보조금을 배정했습니다. 이 프로젝트는 48개 주, 괌, 푸에르토리코 및 기타 영토에 걸쳐 있으며 모두 공항 개선 프로그램(AIP)의 일부입니다. 또한 2023년 추가 재량 보조금 2억 6,900만 달러는 미국 56개 공항의 62개 프로젝트에 지원될 예정입니다. 이 경쟁 이니셔티브는 공항 소유주와 운영자가 미국 공항 시스템을 개선하는 데 도움을 줍니다. 역대 최대 규모로 진행되는 이번 5차 AIP 보조금 주기에서는 공항 안전 및 지속 가능성 업그레이드부터 소음 감소에 이르기까지 다양한 프로젝트에 자금을 지원합니다. 보조금은 규모에 관계없이 전국의 공항에 지원됩니다.

- 인프라 개발과 전자상거래 붐으로 인해 운송 및 보관 부문은 고용 급증이 예상되고 있습니다. 노동통계국(BLS)은 2022-2032년까지의 연간 성장률을 0.8%로 예측하고 있으며, 이는 약 57만 명의 신규 고용에 상당합니다. 특히 택배 및 메신저 산업은 창고 및 보관업과 함께 이러한 일자리 증가의 약 80%를 주도할 것으로 예상됩니다.

미국은 2022년에도 원유 순수입국으로 남아 80개국에서 약 628만 배럴의 원유를 수입할 것으로 예상

- 미국의 휘발유 가격은 대선 직전인 2024년 10월까지 3년 만에 처음으로 갤런당 3달러 이하로 떨어질 것으로 예상됩니다. 연료 가격 하락은 주로 수요 약세와 유가 하락으로 인한 것으로, 인플레이션을 부추기는 높은 비용에 직면했던 소비자들에게 안도감을 선사할 것입니다. 이는 또한 카말라 해리스 부통령과 다른 민주당원들이 높은 유가에 대한 공화당의 비판에 대응하는 데 도움이 될 수 있습니다. 2024년 9월 일반 휘발유 평균 가격은 갤런당 3.25달러로 지난달보다 19센트, 작년보다 58센트 하락했습니다.

- 2023년에 미국이 새로운 정제 설비를 도입하면 가동 가능한 용량이 증가하여 2024년과 2025년에 석유 제품에 대한 가격 부담이 완화될 것입니다. 또한 중동, 특히 쿠웨이트에서 새로운 국제 정제 설비가 추가되어 휘발유와 경유에 대한 글로벌 가격 압력을 완화하는 데 도움이 될 것입니다. 또한 2024년 크랙 스프레드 축소는 2024년과 2025년 미국의 평균 소매 연료 가격 하락으로 이어질 것으로 예상됩니다. 휘발유 가격은 2024년 3.36달러/갤런, 2025년 3.24달러/갤런이 될 것으로 예상됩니다.

미국의 택배, 특송 및 소포(CEP) 산업 개요

미국의 택배, 특송 및 소포(CEP) 시장은 상당히 통합되어 있으며, 이 시장의 주요 기업은 DHL Group, FedEx, OnTrac, United Parcel Service of America, Inc.(UPS), USPS의 5사입니다(알파벳순).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구동태

- 경제 활동별 GDP 분포

- 경제 활동별 GDP 성장률

- 인플레이션율

- 경제성과 및 프로파일

- 전자상거래 산업의 동향

- 제조업의 동향

- 운송 및 보관업의 GDP

- 수출 동향

- 수입 동향

- 연료 가격

- 물류 실적

- 인프라

- 규제 프레임워크

- 미국

- 밸류체인과 유통채널 분석

제5장 시장 세분화(-2030년, 시장 규모 : 100만 달러)

- 수출처

- 국내

- 국제

- 배송 속도

- 특송

- 비특송

- 모델

- 기업간(B2B)

- B2C

- 소비자간(C2C)

- 출하 중량

- 중량

- 경량

- 중간 중량

- 수송 형태

- 항공편

- 도로

- 기타

- 최종 사용자

- 전자상거래

- 금융 서비스(BFSI)

- 의료

- 제조업

- 제1차 산업

- 도매 및 소매업(오프라인)

- 기타

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Amazon

- Aramex

- DHL Group

- Dropoff Inc.

- FedEx

- International Distributions Services(GLS 포함)

- OnTrac

- Spee-Dee Delivery Service, Inc.

- United Parcel Service of America, Inc.(UPS)

- USA Couriers

- USPS

- WeDo Logistics Limited(Lone Star Overnight Inc. 포함)

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 기술의 발전

- 출처 및 참고문헌

- 도표 목록

- 주요 인사이트

- 데이터 팩

- 용어집

The United States Courier, Express, and Parcel (CEP) Market size is estimated at 192.8 billion USD in 2025, and is expected to reach 239.4 billion USD by 2030, growing at a CAGR of 4.42% during the forecast period (2025-2030).

Rising domestic demand for courier, express, and parcel in ecommerce market leading the sector demand

- E-commerce growth and the global pandemic fueled the parcel shipping market, as consumers were more inclined toward ordering online compared to purchasing from physical stores. With rising volumes, many companies are undertaking acquisitions in the country. In October 2023, UPS Inc. acquired Happy Returns, a returns management software company, from PayPal Holdings Inc. The deal enhances UPS' presence in the rapidly growing online returns sector. Additionally, the company will provide box and label-free return options at over 12,000 drop-off locations across the US.

- The US e-commerce market has been constantly evolving. Retail e-commerce sales in the United States are projected to grow from around USD 904.89 billion in 2022 to around USD 1,478.86 billion in 2025. This is expected to give a boost to both domestic and international courier, express, and parcel market volumes during the forecast period. Among the e-commerce players, Amazon is the most popular e-retailer in the United States, with a market share of 37.8%. Other successful shopping websites include eBay (3.5% market share), Walmart (6.3% market share), Target (2.1% market share), and Apple (3.9% market share).

United States Courier, Express, and Parcel (CEP) Market Trends

United States leads regional GDP with 86% contribution, driven by infrastructure and supply chain investments

- In September 2024, the FAA, under the US Department of Transportation, allocated USD 1.9 billion in grants for 519 projects. These projects span 48 states, Guam, Puerto Rico, and other territories, all part of the Airport Improvement Program (AIP). Additionally, USD 269 million in Supplemental Discretionary Grants for 2023 will back 62 projects at 56 U.S. airports. This competitive initiative aids airport owners and operators in enhancing the U.S. airport system. Marking its largest round yet, this fifth AIP grant cycle funds diverse projects, from airport safety and sustainability upgrades to noise reduction. The grants cater to airports nationwide, regardless of size.

- With infrastructure development and the e-commerce boom, the transportation and storage sector is set for a job surge. The Bureau of Labor Statistics (BLS) projects a 0.8% annual growth rate from 2022 to 2032, translating to nearly 570,000 new jobs. Notably, the couriers and messengers industry, alongside warehousing and storage, is expected to drive about 80% of this job growth.

The United States remained a net crude oil importer in 2022, importing about 6.28 million bpd of crude oil from 80 countries

- Gasoline prices in the US are expected to drop below USD 3 a gallon for the first time in over three years by October 2024, just before the presidential election. Lower fuel prices are mainly due to weaker demand and falling oil prices, providing relief to consumers who have faced high costs that fueled inflation. This could also help Vice President Kamala Harris and other Democrats counter Republican criticism over high gas prices. In September 2024, the average price for regular gas was USD 3.25 a gallon, down 19 cents from last month and 58 cents from last year.

- According to US Energy Information Administration (EIA), crude oil prices will stay steady in 2024 compared to 2023, then decrease in 2025. The US' introduction of new refining capacities in 2023 will boost its operable capacity, alleviating price strain on oil products in 2024 and 2025. Furthermore, the Middle East, particularly Kuwait, will add new international refining capacities, which will help ease global price pressure on gasoline and diesel. Also, it is expected, narrowing crack spreads in 2024 are likely to lead to lower average US retail fuel prices in both 2024 and 2025. Gasoline prices are projected to USD 3.36/gal in 2024 and USD 3.24/gal in 2025.

United States Courier, Express, and Parcel (CEP) Industry Overview

The United States Courier, Express, and Parcel (CEP) Market is fairly consolidated, with the major five players in this market being DHL Group, FedEx, OnTrac, United Parcel Service of America, Inc. (UPS) and USPS (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 United States

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Amazon

- 6.4.2 Aramex

- 6.4.3 DHL Group

- 6.4.4 Dropoff Inc.

- 6.4.5 FedEx

- 6.4.6 International Distributions Services (including GLS)

- 6.4.7 OnTrac

- 6.4.8 Spee-Dee Delivery Service, Inc.

- 6.4.9 United Parcel Service of America, Inc. (UPS)

- 6.4.10 USA Couriers

- 6.4.11 USPS

- 6.4.12 WeDo Logistics Limited (including Lone Star Overnight Inc.)

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록