|

시장보고서

상품코드

1683903

북미의 택배, 특송, 소포(CEP) : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)North America Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

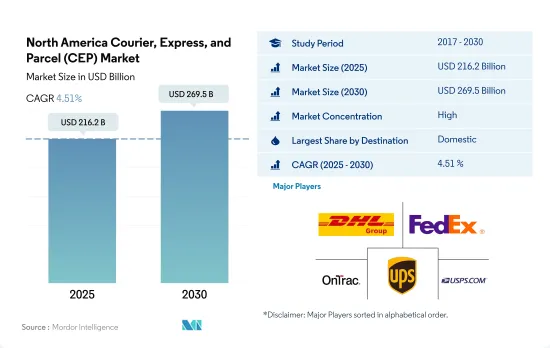

북미의 택배, 특송, 소포(CEP) 시장 규모는 2025년에 2,162억 달러가 될 것으로 추정됩니다. 2030년에는 2,695억 달러에 이르고, 예측 기간(2025-2030년)의 CAGR은 4.51%를 나타낼 것으로 예상됩니다.

전자상거래 시장 매출 증가와 무역 확대가 택배 시장 수요에 영향

- 전자상거래 성장과 세계 유행으로 북미의 택배 시장이 활성화되었습니다. 택배 취급량이 증가함에 따라 많은 기업들이 이 나라에서 기업 인수에 나서고 있습니다. 미국에서는 2023년 10월 UPS Inc.가 PayPal Holdings Inc.에서 반품 관리 소프트웨어인 Happy Returns를 인수했습니다. 이 인수로 급성장하는 온라인 리턴 분야에서 UPS의 존재가 높아졌습니다. 이 회사는 미국 내 12,000개 이상의 드롭오프 위치에서 상자 및 라벨이 없는 반품 옵션을 제공합니다.

- 멕시코에서는 2019년 농촌 인구의 11%가 온라인 구매했으며, 이는 약 140만 명에 해당하는 수치입니다. 온라인 구매를 실시한 인터넷 사용자의 비율은 2018년부터 2019년까지 약 58% 증가했으며, 이 나라에서 전자상거래 성장이 가속화되고 있음을 보여주었습니다. 수요 증가와 긍정적인 성장 패턴에 따라 멕시코 CEP 취급량은 2023년에 증가했습니다. 택배 및 소포 서비스와 관련된 일관된 성장으로 이 추세는 온라인 구매 채택을 더욱 증가시킬 것으로 예상되며, 2040년까지 멕시코에서는 구매의 95%가 온라인으로 이루어질 것으로 추정됩니다.

인프라 투자, 로봇배달차 채용, 자동창고가 지역시장을 견인

- 소포 수요가 증가함에 따라 많은 기업들이 이 지역에서 M&A를 실시했습니다. 예를 들어 2023년 10월, UPS Inc.는 리버스 로지스틱스의 주요 기업인 Happy Returns를 인수하여 가맹점과 소비자가 소포를 쉽고 빠르게 반품할 수 있도록 했습니다. 또한 2021년에는 에스타페타가 멕시코시티에 전자상거래에만 특화된 새로운 허브를 건설하는 등 물리적 및 디지털 인프라 개선에 9,750만 달러를 투자했습니다. 2023년 페덱스는 캐나다에서 페덱스 익스프레스와 그라운드 사업 통합을 발표하고 소포 배송 업무의 합리화를 도모했습니다.

- 2024년 자메이카의 전자상거래 시장은 6억 9,620만 달러의 수익을 창출했습니다. 연간 성장률은 9.28%로 2029년에는 10억 8,500만 달러로 급증할 것으로 예측되고 있습니다. 이 성장의 원동력이 되고 있는 것은 인터넷 보급률의 상승, 스마트폰 이용률의 향상, 온라인 쇼핑에의 기호 증가입니다. 사용자 수는 2029년까지 710.2만 명으로 증가할 것으로 예상됩니다. 보급률은 2024년 19.1%에서 2029년 25.8%로 상승할 것으로 예측되며 디지털 플랫폼으로의 소비자 행동의 큰 변화를 반영하고 있습니다.

북미의 택배, 특송, 소포(CEP) 시장 동향

항만과 공급망을 강화하는 인프라 계획에 힘입어 미국은 이 지역의 GDP에 가장 큰 기여를 하고 있습니다.

- 효율적이고 신뢰할 수 있는 운송 시스템은 경제에 매우 중요합니다. 캐나다 정부는 국가 무역 회랑 기금(National Trade Corridors Fund)을 통해 공급망 개선, 무역 장벽 감소, 미래 경제 기회를 위한 비즈니스 성장 촉진에 투자하고 있습니다. 2024년 5월 운수부 장관은 이 기금 하에 19개의 디지털 인프라 프로젝트에 최대 5,120만 달러를 기부할 것이라고 발표했습니다. 캐나다 정부는 혁신적인 기술로 공급망을 강화하고 캐나다 국민의 신속화와 비용 절감을 목표로 하고 있습니다. 이 이니셔티브는 운송의 병목, 취약성 및 항만의 혼잡에 효과적으로 대처하기 위한 디지털 프로젝트에 대한 전국 이해관계자와의 협력을 추진합니다.

- 미국에서는 인프라 개발과 전자상거래의 상승으로 운송 및 보관 부서의 고용이 증가할 것으로 예상됩니다. 노동통계국(BLS)에 따르면 이 부문은 2022년부터 2032년까지 매년 0.8%의 성장률로 성장하여 그 기간 동안 57만 명 가까이 고용이 증가할 것으로 예측됩니다. 택배·메신저 산업은 창고·보관업과 함께 이 부문의 예측 고용 증가의 약 80%에 크게 공헌할 것으로 예상됩니다.

중동에서의 긴장 증가는 원유 공급에 영향을 미치며 이 지역에서 급격한 가격 상승이 예상됩니다.

- 대통령 선거를 앞둔 2024년 10월까지 미국 가솔린 가격은 3년 이상 만에 갤런당 미화 3달러 미만으로 떨어졌습니다. 수요감퇴와 원유가격 하락을 주인으로 하는 이 연료가격 하락은 인플레이션의 원인이 되는 비용 상승에 시달린 소비자들에게 구원의 손을 내밀었습니다. 이러한 개발은 카말라 해리스 부통령을 비롯한 민주당이 급등하는 가솔린 가격에 관한 공화당의 비판에 대처할 때의 지지가 되었습니다고 생각됩니다. 2024년 9월 기준 레귤러 가솔린의 평균 가격은 1갤런 3.25달러로 전월보다 19센트 떨어졌으며 전년 동월 대비 58센트 떨어졌습니다.

- 2024년 캐나다 오일 샌드 플랜트의 연례 유지보수는 평소와 같이 이루어졌습니다. 그러나 노동조합 임원은 앨버타 주 2025년 턴어라운드 시즌에 두 개의 새로운 산업 프로젝트로 인한 노동력 부족이 발생한다고 경고합니다. 앨버타의 생산자는 매년 오일 샌드 업그레이드 공장, 화력 발전 프로젝트, 정유소의 중요한 유지 보수를 위해 수천 명의 숙련 노동자를 고용하고 있습니다. 세계 4위의 산유국인 캐나다는 일량 490만 배럴의 원유의 약 3분의 2를 알버타주 북부의 오일샌드로부터 조달하고 있습니다. 이 부족으로 인해 2025년에는 연료 가격이 상승할 수 있습니다.

북미의 택배, 특송, 소포(CEP) 산업 개요

북미의 택배, 특송, 소포(CEP) 시장은 상당히 통합되어 있으며, 이 시장의 주요 기업은 DHL 그룹, 페덱스, 온트랙, 유나이티드 소포 서비스 오브 아메리카(UPS), USPS 등이 있습니다(알파벳순).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구동태

- 경제 활동별 GDP 분포

- 경제 활동별 GDP 성장률

- 인플레이션율

- 경제성과 및 프로파일

- 전자상거래 산업의 동향

- 제조업의 동향

- 운수·창고업의 GDP

- 수출 동향

- 수입 동향

- 연료 가격

- 물류 실적

- 인프라

- 규제 프레임워크

- 캐나다

- 멕시코

- 미국

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 목적지

- 국내

- 국제

- 배송 속도

- 특급 배송

- 비특급 배송

- 모델

- 기업 대 기업(B2B)

- 기업 대 소비자(B2C)

- 소비자 대 소비자(C2C)

- 배송 중량

- 중량 배송

- 경량 배송

- 중간 중량 배송

- 수송 형태

- 항공편

- 도로

- 기타

- 최종 사용자

- 전자상거래

- 금융 서비스(BFSI)

- 헬스케어

- 제조업

- 제1차 산업

- 도매·소매업(오프라인)

- 기타

- 국가명

- 캐나다

- 멕시코

- 미국

- 기타 북미

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Aramex

- DHL Group

- Dropoff Inc.

- DTDC Express Limited

- Fastfrate Inc.

- Fedex

- International Distributions Services(including GLS)

- JB Hunt Transport, Inc.

- OnTrac

- Spee-Dee Delivery Service, Inc.

- TFI International Inc.

- United Parcel Service of America, Inc.(UPS)

- USPS

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 기술의 진보

- 정보원과 참고문헌

- 도표 목록

- 주요 인사이트

- 데이터 팩

- 용어집

The North America Courier, Express, and Parcel (CEP) Market size is estimated at 216.2 billion USD in 2025, and is expected to reach 269.5 billion USD by 2030, growing at a CAGR of 4.51% during the forecast period (2025-2030).

Rising e-commerce market sales along with growing trade influencing the demand for parcel delivery market

- E-commerce growth and the global pandemic fueled the parcel shipping market in the North American region, as consumers were more inclined toward ordering online compared to purchasing from physical stores. With rising volumes, many companies are undertaking acquisitions in the country. In the United States, in October 2023, UPS Inc. acquired Happy Returns, a returns management software company, from PayPal Holdings Inc. The deal enhances UPS' presence in the rapidly growing online returns sector. The company will provide box and label-free return options at over 12,000 drop-off locations across the US.

- In Mexico, 11% of the population in rural areas made online purchases in 2019, which equated to almost 1.4 million people. The percentage of internet users who made purchases online increased from 2018 to 2019 by about 58%, an indication of the accelerated growth of e-commerce in the country. With the increasing demand and positive growth pattern, the Mexican CEP volume increased in 2023. With consistent growth related to courier and parcel services, the trend is anticipated to increase further the adoption of online purchases, wherein by 2040, 95% of purchases are estimated to be made online in Mexico.

Infrastructure investments, adoption of robotic delivery cars, automated warehousing driving regional market

- With rising parcel demand, many companies are undertaking mergers and acquisitions across the region. For instance, in October 2023, UPS Inc. acquired Happy Returns, a leading reverse logistics company, to enable easy and quick returns of parcels for merchants and consumers. Also, in 2021, Estafeta invested USD 97.5 million in improving its physical and digital infrastructure, including the construction of a new hub in Mexico City focused entirely on e-commerce. In 2023, FedEx announced the merger of FedEx Express and Ground operations in Canada to streamline parcel delivery operations.

- In 2024, Jamaica's e-commerce market is set to generate a revenues of USD 696.20 million. With an annual growth rate of 9.28%, projections indicate a surge to USD 1,085.00 million by 2029. This growth is driven by increasing internet penetration, rising smartphone usage, and a growing preference for online shopping. User numbers are anticipated to climb to 710.2k by 2029, with penetration rates rising from 19.1% in 2024 to 25.8% in 2029, reflecting a significant shift in consumer behavior towards digital platforms.

North America Courier, Express, and Parcel (CEP) Market Trends

The US dominates with maximum regional GDP contribution, fueled by an infrastructure program that boosts ports and supply chains

- An efficient and reliable transportation system is crucial for the economy. Through the National Trade Corridors Fund, the Government of Canada invests in improving supply chains, reducing trade barriers, and fostering business growth for future economic opportunities. In May 2024, the Minister of Transport announced up to USD 51.2 million for 19 digital infrastructure projects under this fund. The Canadian government aims to enhance supply chains with innovative technologies to expedite and reduce costs for Canadians. This initiative will drive collaboration with stakeholders nationwide on digital projects to address transportation bottlenecks, vulnerabilities, and port congestion effectively.

- In United States, infrastructure development and the rise of e-commerce are anticipated to boost employment in the transportation and storage sector. According to the Bureau of Labor Statistics (BLS), this sector is projected to grow at a rate of 0.8% annually from 2022 to 2032, resulting in the addition of nearly 570,000 jobs during that timeframe. The couriers and messengers industry, along with warehousing and storage, are expected to contribute significantly to about 80% of the sector's projected job growth.

Rising tensions in the Middle East are expected to affect crude oil supplies and lead to sudden price hikes in the region

- By October 2024, just ahead of the presidential election, gasoline prices in the US were projected to dip below USD 3 a gallon for the first time in over 3 years. This decline in fuel prices, primarily driven by waning demand and decreasing oil prices, offered a reprieve to consumers who had been grappling with elevated costs contributing to inflation. Such a development could have bolstered Vice President Kamala Harris and other Democrats in addressing Republican critiques regarding soaring gas prices. As of September 2024, regular gas averaged USD 3.25 a gallon, marking a 19-cent drop from the previous month and a 58-cent YoY decrease.

- Annual maintenance on Canada's oil sands plants in 2024 is expected to proceed normally. However, trade union officials warn of a labor shortage in Alberta's 2025 turnaround season due to two new industrial projects. Alberta producers annually hire thousands of skilled workers for essential maintenance on oil sands upgraders, thermal projects, and refineries. As the world's fourth-largest oil producer, Canada gets about two-thirds of its 4.9 million barrels per day of crude from the northern Alberta oil sands. This shortage might raise fuel prices in 2025.

North America Courier, Express, and Parcel (CEP) Industry Overview

The North America Courier, Express, and Parcel (CEP) Market is fairly consolidated, with the major five players in this market being DHL Group, Fedex, OnTrac, United Parcel Service of America, Inc. (UPS) and USPS (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Canada

- 4.12.2 Mexico

- 4.12.3 United States

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

- 5.7 Country

- 5.7.1 Canada

- 5.7.2 Mexico

- 5.7.3 United States

- 5.7.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Aramex

- 6.4.2 DHL Group

- 6.4.3 Dropoff Inc.

- 6.4.4 DTDC Express Limited

- 6.4.5 Fastfrate Inc.

- 6.4.6 Fedex

- 6.4.7 International Distributions Services (including GLS)

- 6.4.8 J.B. Hunt Transport, Inc.

- 6.4.9 OnTrac

- 6.4.10 Spee-Dee Delivery Service, Inc.

- 6.4.11 TFI International Inc.

- 6.4.12 United Parcel Service of America, Inc. (UPS)

- 6.4.13 USPS

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록